Global Asphalt Additive Market Size, Share, and COVID-19 Impact Analysis, By Type (Polymeric Modifiers, Anti-strip & adhesion promoters, Emulsifiers, Chemical Modifiers, Rejuvenators, Fibers, Flux Oil, Colored Asphalt, and Others), By Application (Road Construction & Paving, Roofing, Airport Construction, and Others), By Technology (Hot Mix, Cold Mix, and Warm Mix), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal Asphalt Additive Market Insights Forecasts to 2032

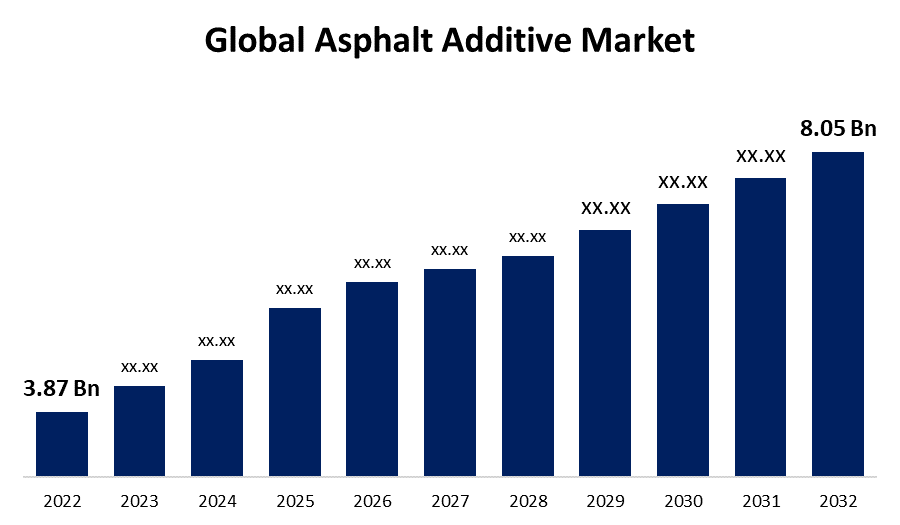

- The Global Asphalt Additive Market Size was valued at USD 3.87 Billion in 2022.

- The Market is growing at a CAGR of 7.6% from 2022 to 2032.

- The Worldwide Asphalt Additive Market Size is expected to reach USD 8.05 Billion by 2032.

- Asia-Pacific is expected to grow fastest during the forecast period.

Get more details on this report -

The Global Asphalt Additive Market Size is expected to reach USD 8.05 Billion by 2032, at a CAGR of 7.6% during the forecast period 2022 to 2032.

Market Overview

Asphalt additives are specialized substances used to enhance the performance and durability of asphalt pavements. These additives are mixed with asphalt binder to modify its properties and improve the overall quality of the road surface. Common types of asphalt additives include polymer modifiers, rejuvenators, anti-stripping agents, and fibers. Polymer modifiers enhance flexibility and resistance to cracking, while rejuvenators restore aged asphalt, extending its lifespan. Anti-stripping agents prevent moisture-induced damage by promoting better adhesion between asphalt and aggregates. Additionally, fibers add strength and reduce cracking. By incorporating asphalt additives into pavement mixtures, road engineers can create longer-lasting, more resilient road surfaces that withstand traffic loads, weather conditions, and various environmental stresses, ultimately leading to safer and more cost-effective road infrastructures.

Report Coverage

This research report categorizes the market for asphalt additive market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the asphalt additive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the asphalt additive market.

Global Asphalt Additive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.87 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 7.6% |

| 022 – 2032 Value Projection: | USD 8.05 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Application, By Technology, By Region. |

| Companies covered:: | ARKEMA Group, Akzo Nobel N.V., Evonik Industries AG, Honeywell International Inc., Huntsman International LLC, Ingevity, KAO Corporation, Nouryon, SASOL, Tri-Chem Specialty Chemicals, LLC and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The asphalt additive market is driven by several key factors, the growing demand for durable and high-performance road infrastructure fuels the market as asphalt additives enhance pavement longevity and reduce maintenance costs. Increasing government investments in road construction and rehabilitation projects worldwide create a significant demand for asphalt additives. The rising awareness about the environmental benefits of using additives to recycle and reuse old asphalt materials contributes to market growth. Additionally, advancements in additive technologies, such as polymer modifiers and anti-stripping agents, attract manufacturers and contractors seeking innovative solutions. Moreover, stringent regulations aimed at improving road quality and safety further boost the demand for high-quality asphalt additives. Overall, the escalating need for sustainable and eco-friendly construction practices encourages the adoption of asphalt additives that enhance pavement recyclability and reduce carbon footprints.

Restraining Factors

The asphalt additive market faces certain restraints that impact its growth, such as the high initial cost of incorporating additives in asphalt mixtures can deter budget-constrained projects and limit market penetration. The availability of low-cost conventional asphalt alternatives may hinder the widespread adoption of asphalt additives. The lack of standardized testing methods and regulations for asphalt additives could create uncertainty among end-users about their efficacy and performance. Moreover, the presence of substandard and counterfeit additives in the market may raise concerns about product quality and safety. Overall, the limited awareness and technical expertise among road contractors and construction companies might lead to hesitant adoption and slow market growth.

Market Segmentation

- In 2022, the polymeric modifiers segment accounted for around 54.2% market share

On the basis of the type, the global asphalt additive market is segmented into polymeric modifiers, anti-strip & adhesion promoters, emulsifiers, chemical modifiers, rejuvenators, fibers, flux oil, colored asphalt, and others. Polymeric modifiers have established themselves as a leading category within the asphalt additive market, accounting for the largest market share. This dominance can be attributed to several key factors, polymeric modifiers offer a wide range of benefits that enhance the performance and durability of asphalt pavements. These modifiers improve the elasticity and flexibility of the asphalt, making it more resistant to cracking and deformation under heavy traffic loads. This results in longer-lasting road surfaces that require less frequent maintenance and repair, reducing overall costs. The polymeric modifiers offer superior adhesion properties, which contribute to enhanced bonding between the asphalt binder and aggregates. This helps to prevent moisture-induced damage, such as stripping or raveling, ensuring the longevity and structural integrity of the pavement. The improved adhesion also leads to better resistance against environmental factors like water, UV radiation, and temperature variations. Furthermore, polymeric modifiers provide excellent resistance to rutting and fatigue, enabling the asphalt pavement to withstand repeated loading and high traffic volumes. This makes them highly desirable for high-stress areas such as highways, airports, and industrial facilities. Additionally, advancements in polymeric modifier technologies have resulted in the development of specialized formulations that cater to specific project requirements. These modifiers can be tailored to optimize various properties, such as stiffness, viscosity, and temperature susceptibility, to meet the specific needs of different climates and traffic conditions. The increasing focus on sustainable and environmentally friendly construction practices has also contributed to the growth of polymeric modifiers. They enable the recycling and reuse of old asphalt materials, reducing the need for virgin resources and minimizing environmental impact.

- In 2022, the hot mix segment dominated with more than 44.6% market share

Based on the technology, the global asphalt additive market is segmented into hot mix, cold mix, and warm mix. The hot mix segment has emerged as the dominant category within the asphalt additive market, accounting for the largest market share. Several factors contribute to the dominance of the hot mix segment. The hot mix asphalt (HMA) is the most widely used paving material in road construction due to its excellent performance and versatility. It offers superior durability, resistance to heavy traffic loads, and enhanced structural integrity, making it the preferred choice for various road projects. The hot mix segment benefits from the extensive infrastructure development and road construction activities globally. Governments and private entities invest heavily in the construction and rehabilitation of roads, highways, and airports, driving the demand for hot-mix asphalt. Moreover, the hot mix segment caters to diverse application areas, including highways, airports, parking lots, and residential roads. Its adaptability to different project requirements and traffic conditions further contributes to its market dominance. Additionally, hot mix asphalt can be customized and formulated to meet specific project specifications, taking into account factors such as climate, traffic volume, and load-bearing capacity. This flexibility allows for optimized pavement performance and ensures longevity in various environmental conditions. Furthermore, advancements in hot mix technology, such as warm mix asphalt (WMA), have expanded the application areas and benefits of the hot mix segment. WMA offers reduced energy consumption during production, lower emissions, and enhanced workability, making it an attractive option for sustainable road construction practices.

Regional Segment Analysis of the Asphalt Additive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 43.5% revenue share in 2022.

Get more details on this report -

Based on region, the Asia-Pacific region has emerged as the dominant player in the asphalt additive market, holding the largest market share. Several factors contribute to this regional dominance, the rapid urbanization and population growth in countries like China, India, and Indonesia have led to increased investments in infrastructure development, including road construction and maintenance. The government initiatives to improve transportation networks and modernize existing roadways have driven the demand for high-performance asphalt additives. Additionally, the booming industrial and commercial sectors have escalated the need for robust road infrastructure, further propelling the market. Moreover, the favorable regulatory environment and rising awareness of the benefits of asphalt additives have encouraged their adoption in the region. These combined factors have cemented Asia-Pacific's position as the frontrunner in the asphalt additive market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global asphalt additive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- ARKEMA Group

- Akzo Nobel N.V.

- Evonik Industries AG

- Honeywell International Inc.

- Huntsman International LLC

- Ingevity

- KAO Corporation

- Nouryon

- SASOL

- Tri-Chem Specialty Chemicals, LLC

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Sasol Chemicals, a division of Sasol Ltd., and mission possible partnership (MPP) have joined forces to explore potential projects for Sasol's sustainability hub in Lake Charles, Louisiana. The partnership aims to identify sustainable initiatives and innovative solutions that align with Sasol's commitment to environmental and social responsibility. Through this collaboration, Sasol seeks to foster a positive impact on the local community and the environment while advancing its sustainability goals at the lake charles facility.

- In March 2023, Kraton Corporation has announced plans to commence production of styrene-butadiene-styrene block copolymers (SBS) at its Belpre, Ohio facility starting in 2024. This move is expected to boost manufacturing capacity by an additional 24 kilotons per year by 2025. The expansion signifies Kraton's commitment to meet the growing demand for SBS and cater to various industries that utilize this versatile polymer, such as adhesives, sealants, asphalt modification, and more.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global asphalt additive market based on the below-mentioned segments:

Asphalt Additive Market, By Type

- Polymeric Modifiers

- Anti-strip & Adhesion Promoters

- Emulsifiers

- Chemical Modifiers

- Rejuvenators

- Fibers

- Flux Oil

- Colored Asphalt

- Others

Asphalt Additive Market, By Application

- Road Construction & Paving

- Roofing

- Airport Construction

- Others

Asphalt Additive Market, By Technology

- Hot Mix

- Cold Mix

- Warm Mix

Asphalt Additive Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?