Asia Pacific Veterinary Services Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Companion Animals and Production Animals), By Service Type (Medical Services and Non-Medical Services), and North America, Veterinary Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareAsia Pacific Veterinary Services Market Insights Forecasts to 2035

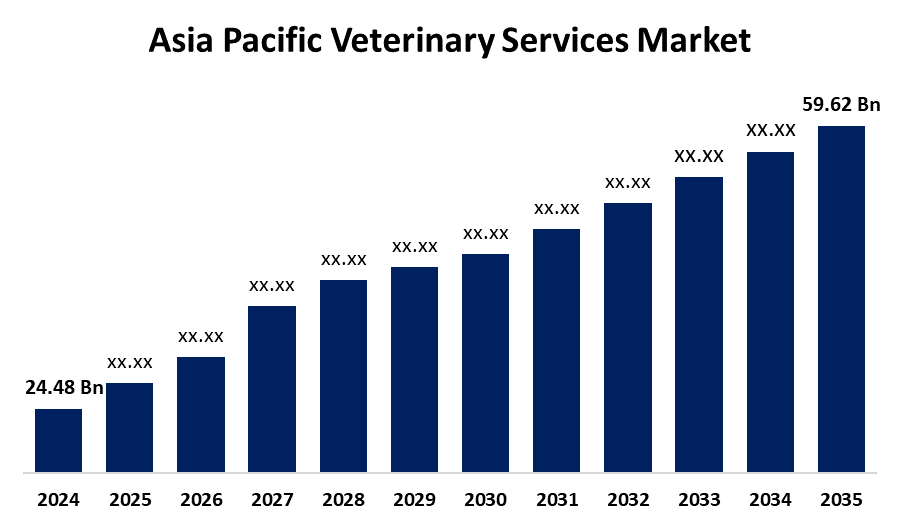

- The Asia Pacific Veterinary Services Market Size Was Estimated at USD 24.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.43% from 2025 to 2035

- The Asia Pacific Veterinary Services Market Size is Expected to Reach USD 59.62 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Veterinary Services Market is anticipated to reach USD 59.62 Billion by 2035, Growing at a CAGR of 8.43% from 2025 to 2035. The growing number of pets, greater livestock farming, improved infrastructure for animal healthcare, and growing awareness of animal welfare and preventive care are all factors driving the Asia Pacific veterinary services market's substantial growth opportunities.

Market Overview

The supply of diagnostic, therapeutic, preventative, and surgical procedures for companion and production animals in countries such as China, India, Japan, Australia, and South Korea is included in the Asia Pacific veterinary services market. In order to improve biosecurity, the National Livestock Health and Disease Control Program (2023) in India subsidizes vaccines and treatments to fight foot and mouth disease. To protect growing herds, China's Ministry of Agriculture (2024) strengthens veterinary laws and monitoring programs. Growing pet health awareness, the rise in zoonotic or animal diseases, and the need for quality medical care are some of the factors propelling the Asia Pacific veterinary services market. The market's growth element is the increasing incidence of various animal diseases. Clinical treatment digitization also improves the general caliber of veterinary imaging services, which boosts veterinary services market expansion.

Report Coverage

This research report categorizes the market for Asia Pacific veterinary services market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific veterinary services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific veterinary services market.

Asia Pacific Veterinary Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.43% |

| 2035 Value Projection: | USD 59.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Animal Type, By Service Type |

| Companies covered:: | PetSmart, Greencross Vets, CVS Group PLC, Fetch Pet Care, IVC Evidensia, Airpets International, Pets at Home Group PLC, National Veterinary Associates, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing number of animals, the widespread adoption of pets as companions, the high demand for high-end pet services, the ease of access to veterinary care, the rise in disposable income in developing nations, and the rising costs of veterinary care are all contributing to the market's notable expansion. The market is experiencing a rise in research and development, a rise in the use of pet insurance, a rise in the knowledge of animal health and health-related issues, a rise in the cost of pet care, and the introduction of cutting-edge technology such as mobile veterinary clinics.

Restraining Factors

The Asia Pacific veterinary services market faces restraining factors such as limited access to veterinary care in rural areas, high treatment costs, shortage of skilled professionals, low awareness among pet owners, and inadequate government support for animal healthcare infrastructure.

Market Segmentation

The Asia Pacific veterinary services market share is classified into animal type and service type.

- The production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Asia Pacific veterinary services market is segmented by animal type into companion animals and production animals. Among these, the production animals segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing need for food items derived from animals, growing knowledge of livestock health, and the introduction of disease prevention and control initiatives are all factors contributing to the producing animals market. Furthermore, rising expenditures in developing nations' veterinary infrastructure and services are bolstering market expansion.

- The medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific veterinary services market is segmented by service type into medical services and non-medical services. Among these, the medical services segment held a largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for sophisticated diagnostic and therapeutic techniques, the growing incidence of animal diseases, and increased awareness of animal health are the main drivers of the medical services market. The section includes services that are necessary to preserve the health and production of animals, such as surgery, diagnostics, vaccination, and therapy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific veterinary services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PetSmart

- Greencross Vets

- CVS Group PLC

- Fetch Pet Care

- IVC Evidensia

- Airpets International

- Pets at Home Group PLC

- National Veterinary Associates

- Others

Recent Developments

- In March 2024, the new DCC Animal Hospital in Japan officially launched, according to a recent announcement by the multispecialty veterinary services company A'alda Group. In 2021, the Group established the first Japanese pet care center in India in Gurugram, and it has since expanded to Delhi and Noida.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific veterinary services market based on the below-mentioned segments:

Asia Pacific Veterinary Services Market, By Animal Type

- Companion Animals

- Production Animals

Asia Pacific Veterinary Services Market, By Service Type

- Medical Services

- Non-Medical Services

Need help to buy this report?