Asia Pacific Ultrafiltration Market Size, Share, and COVID-19 Impact Analysis, By Type (Polymeric and Ceramic), By Module (Hollow Fiber, Plate & Frame, and Tubular), By Application (Municipal Treatment and Industrial Treatment), and Asia Pacific Ultrafiltration Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsAsia Pacific Ultrafiltration Market Insights Forecasts to 2035

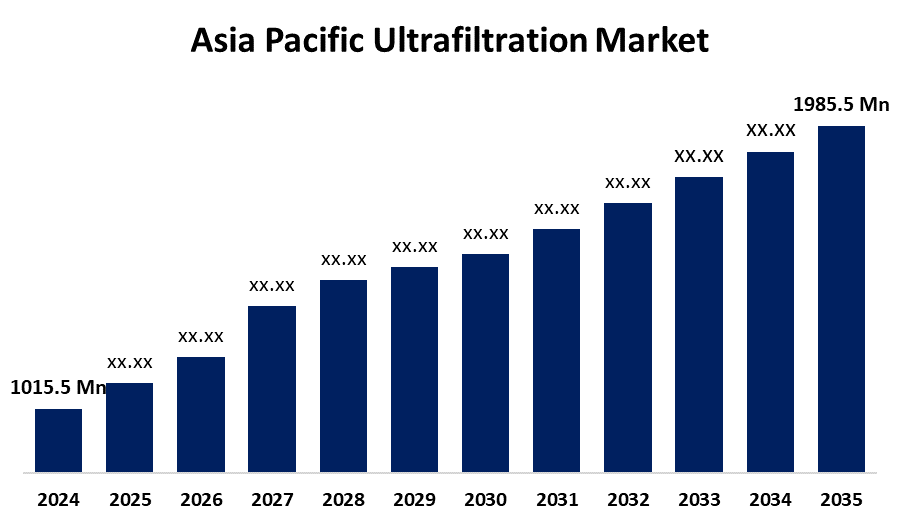

- The Asia Pacific Ultrafiltration Market Size was estimated at USD 1015.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.28% from 2025 to 2035

- The Asia Pacific Ultrafiltration Market Size is Expected to Reach USD 1985.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Asia Pacific Ultrafiltration Market Size is anticipated to reach USD 1985.5 Million by 2035, growing at a CAGR of 6.28% from 2025 to 2035. The growing demand for clean water and concerns over water scarcity are driving the ultrafiltration market in the Asia Pacific region.

Market Overview

The Asia Pacific ultrafiltration market is an industry emphasizing the use of ultrafiltration membranes and systems for various applications, like water and wastewater treatment, food & beverage processing, and pharmaceuticals. The separation process of ultrafiltration is used in industry and research for the purification and concentration of protein solutions. The growing demand for efficient water treatment and separation processes across industries is driving the market demand for ultrafiltration. Ongoing technological advancement, including membrane materials and system designs for improving the filtration efficiency, reducing fouling, and lowering operational costs. An increasing adoption of automated and IoT-enabled systems, use of nanotechnology, and emphasis on sustainable & energy-efficient solutions are providing market growth opportunities.

Report Coverage

This research report categorizes the market for the Asia Pacific ultrafiltration market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific ultrafiltration market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific ultrafiltration market.

Asia Pacific Ultrafiltration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1015.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.28% |

| 2035 Value Projection: | USD 1985.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Module, By Application |

| Companies covered:: | Mitsui Chemicals, Inc., JGC Catalysts and Chemicals Ltd., Tosoh Corporation, Sumitomo Chemical Co., Ltd., Kuraray Co., Ltd., Showa Denko K.K., Hitachi Chemical Co., Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for Asia Pacific ultrafiltration is primarily driven by the growing demand for clean water and concerns over water scarcity. Further, the stringent environmental regulations and standards for ultrafiltration are anticipated to drive the market demand. Rapid urbanization, industrialization, and climate change are driving the issues of freshwater scarcity, resulting in the market demand for ultrafiltration. Adoption of advanced water treatment solutions for ensuring a stable water supply is propelling the ultrafiltration market growth.

Restraining Factors

Membrane fouling issues that lead to reduced filtration efficiency and maintenance costs may hamper the market of ultrafiltration. Increased initial and operational costs, and supply chain volatility are challenging the market growth.

Market Segmentation

The Asia Pacific ultrafiltration market share is classified into type, module, and application.

- The polymeric segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ultrafiltration market is segmented by type into polymeric and ceramic. Among these, the polymeric segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polymeric spiral wound technology, including polyethersulfone and polysulfone, is most commonly used in ultrafiltration. The use of these membranes in water treatment, food & beverage processing, and pharmaceuticals is driving the market expansion.

- The tubular segment held a major market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ultrafiltration market is segmented by module into hollow fiber, plate & frame, and tubular. Among these, the tubular segment held a major market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Tubular membrane system is designed for high solid content and high SS liquid, having characteristics of more convenient cleaning, maintenance, independent closed pipeline operation, and overall system robustness.

- The industrial treatment segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific ultrafiltration market is segmented by application into municipal treatment and industrial treatment. Among these, the industrial treatment segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Industrial applications of ultrafiltration include food & beverage, pharmaceuticals, and chemical manufacturing for improving product quality.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific ultrafiltration market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals, Inc.

- JGC Catalysts and Chemicals Ltd.

- Tosoh Corporation

- Sumitomo Chemical Co., Ltd.

- Kuraray Co., Ltd.

- Showa Denko K.K.

- Hitachi Chemical Co., Ltd.

- Others

Recent Developments:

- In March 2024, Ecolab opened a wastewater treatment plant on Shell Jurong Island. The plant utilizes Ecolab's ultrafiltration and reverse osmosis (RO) membrane system and is almost 100% automated.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Ultrafiltration Market based on the below-mentioned segments:

Asia Pacific Ultrafiltration Market, By Type

- Polymeric

- Ceramic

Asia Pacific Ultrafiltration Market, By Module

- Hollow Fiber

- Plate & Frame

- Tubular

Asia Pacific Ultrafiltration Market, By Application

- Municipal Treatment

- Industrial Treatment

Need help to buy this report?