Asia Pacific Specialty Oleochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fatty Acids & Derivatives, Glycerine & Derivatives, Esters, Amides, Non-Ionic Surfactants, Ionic Surfactants, and Others), By Source (Plant-Based, Animal-Based, and Microbial-Based), By Application (Personal Care & Cosmetics, Food & Beverages, Industrial & Institutional Cleaning, Oilfield & Mining, Paints & Coatings, and Others), and Asia Pacific Specialty Oleochemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAsia Pacific Specialty Oleochemicals Market Insights Forecasts to 2035

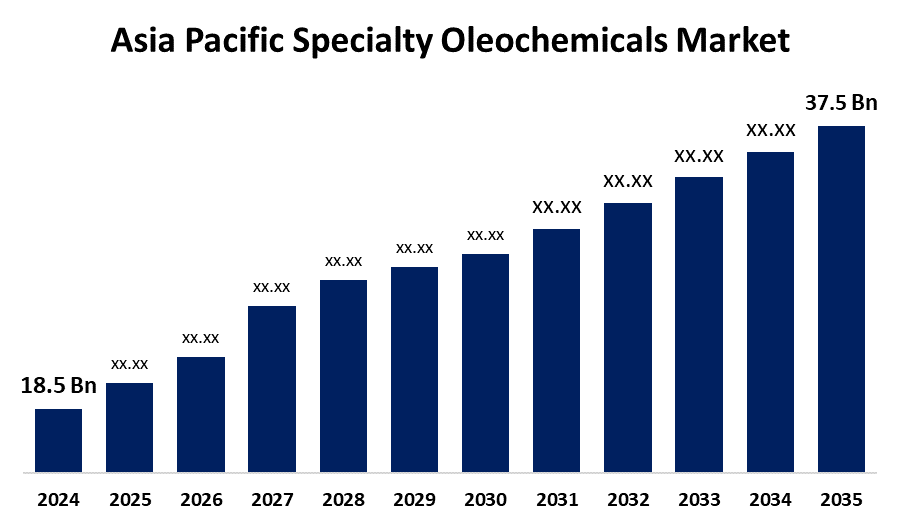

- The Asia Pacific Specialty Oleochemicals Market Size was Estimated at USD 18.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.63% from 2025 to 2035

- The Asia Pacific Specialty Oleochemicals Market Size is Expected to Reach USD 37.5 Billion by 2035

Get more details on this report -

The Asia Pacific Specialty Oleochemicals Market Size is Anticipated to Reach USD 37.5 Billion by 2035, Growing at a CAGR of 6.63% from 2025 to 2035. An increasing need for specialty oleochemicals from various end-use industries, increasing sustainability, and technological advancements in the production processes are driving the specialty oleochemicals market in the Asia Pacific region.

Market Overview

The Asia Pacific specialty oleochemicals market is the industry for chemical compounds derived from natural fats and oils (oleochemicals) that are used across applications requiring specific properties and high performance. Specialty oleochemicals are used across various applications owing to their unique properties and sustainability. Manufacturers' changing inclination towards bio-based substitutes, with an increasing environmental concern, and government support for green chemistry. Further, there is heightened demand for natural and organic ingredients and customized solutions catering to specific industry requirements. Favorable government policies that promote the use of biodegradable and renewable resources are escalating the market growth opportunities for specialty oleochemicals.

Report Coverage

This research report categorizes the market for the Asia Pacific specialty oleochemicals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific specialty oleochemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific specialty oleochemicals market.

Asia Pacific Specialty Oleochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.63% |

| 2035 Value Projection: | USD 37.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Source, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Vantage Specialty Chemicals, Emery Oleochemicals, Evonik Industries, Wilmar International, Cargill, Kao Chemicals, Croda International PLC, Sinarmas Cepsa Pte Ltd., Global Green Chemicals and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread use of oleochemicals is gaining popularity owing to their eco-friendly and sustainable characteristics, which are driving the market growth. Advances in biotechnology, enzymatic processing, and green chemistry are optimizing the oleochemical production more efficiently and cost-effectively, which is anticipated to propel the market. Government support for using eco-friendly products, along with the stringent regulations on petroleum-based products, is promoting the market growth.

Restraining Factors

The volatility in raw material prices and the availability of alternative chemicals are challenging the specialty oleochemicals market. Further, the implementation of stringent environmental regulations is restraining the specialty oleochemicals market.

Market Segmentation

The Asia Pacific specialty oleochemicals market share is classified into product type, source, and application.

- The fatty acids & derivatives segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific specialty oleochemicals market is segmented by product type into fatty acids & derivatives, glycerine & derivatives, esters, amides, non-ionic surfactants, ionic surfactants, and others. Among these, the fatty acids & derivatives segment held a major market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the personal care and cosmetic industry, fatty acid is used as emollients, surfactants, and thickeners in the skincare and haircare products.

- The plant-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific specialty oleochemicals market is segmented by source into plant-based, animal-based, and microbial-based. Among these, the plant-based segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Oleochemicals are primarily sourced from plants, including palm oil, soybean oil, and rapeseed oil. These oils produce oleochemicals and derivatives by chemical and enzymatic processes.

- The personal care & cosmetics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific specialty oleochemicals market is segmented by application into personal care & cosmetics, food & beverages, industrial & institutional cleaning, oilfield & mining, paints & coatings, and others. Among these, the personal care & cosmetics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Oleochemicals are used in cosmetics as emollients and moisturizers for enhancing the sensory experience of skincare products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific specialty oleochemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vantage Specialty Chemicals

- Emery Oleochemicals

- Evonik Industries

- Wilmar International

- Cargill

- Kao Chemicals

- Croda International PLC

- Sinarmas Cepsa Pte Ltd.

- Global Green Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Specialty Oleochemicals Market based on the below-mentioned segments:

Asia Pacific Specialty Oleochemicals Market, By Product Type

- Fatty Acids & Derivatives

- Glycerine & Derivatives

- Esters

- Amides

- Non-Ionic Surfactants

- Ionic Surfactants

- Others

Asia Pacific Specialty Oleochemicals Market, By Source

- Plant-Based

- Animal-Based

- Microbial-Based

Asia Pacific Specialty Oleochemicals Market, By Application

- Personal Care & Cosmetics

- Food & Beverages

- Industrial & Institutional Cleaning

- Oilfield & Mining

- Paints & Coatings

- Others

Need help to buy this report?