Asia Pacific Set Top Box Market Size, Share, and COVID-19 Impact Analysis, By Type (Cable, Satellite, IPTV, OTT, Digital Terrestrial Television, Hybrid), By Resolution (SD, HD, UHD, 4K, Others), By End-User (Residential, Commercial), By Distribution Channel (Online, Offline), By Country (China, Japan, India, South Korea, Taiwan, Rest of Asia Pacific), and Asia Pacific Set Top Box Market Insights Forecasts to 2032

Industry: Consumer GoodsAsia Pacific Set Top Box Market Insights Forecasts to 2032

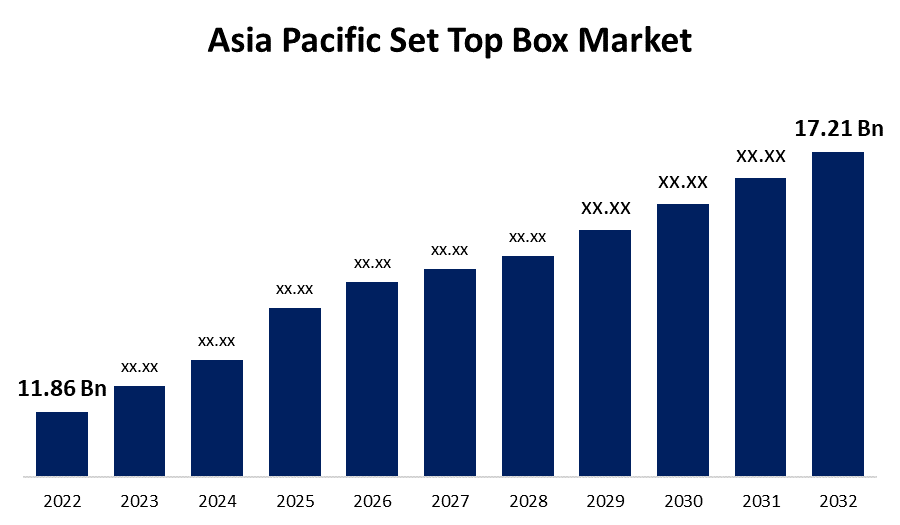

- The Asia Pacific Set Top Box Market Size was valued at USD 11.86 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.8% from 2022 to 2032.

- The Asia Pacific Set Top Box Market Size is expected to reach USD 17.21 Billion by 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Asia Pacific Set Top Box Market Size is expected to reach USD 17.21 Billion by 2032, at a CAGR of 3.8% during the forecast period 2022 to 2032.

Market Overview

A Set-Top Box (STB), often known as a cable box or digital box, is a type of gadget that receives a digital signal and turns it into material that can be viewed on a TV screen or other display device. Set-Top Boxes have progressed beyond their original function of transmitting digital TV broadcasts. They now provide a variety of features that accommodate the different entertainment preferences of their consumers, blending traditional programming with internet-based material. As the entertainment environment evolves, Set-Top Boxes play an increasingly important role by offering viewers access to a wide range of digital content and interactive services. Because of its vast population, rapid advancements in technology, and diversified entertainment preferences, the Asia Pacific region has been a major contender in the Set-Top Box (STB) market. Furthermore, comparable to global trends, there is an increasing demand in the Asia Pacific region for sophisticated features such as HD and UHD, DVR functionality, and smart STBs that provide streaming services in addition to traditional broadcasts. Many nations in the region, particularly China, have developed as STB manufacturing centers, producing low-cost units for both domestic and international usage.

Report Coverage

This research report categorizes the market for Asia Pacific Set Top Box Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Set Top Box Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Asia Pacific Set Top Box Market.

Asia Pacific Set Top Box Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.86 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.8% |

| 2032 Value Projection: | USD 17.21 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Resolution, By Distribution Channel, By Country |

| Companies covered:: | Mybox Technologies Pvt. Ltd., TechniSat Digital GmbH, Samsung Electronics, Sercomm CorporationSITI, Technicolor SA, Advanced Digital Broadcast, Altech UEC; Commscope Inc, Huawei Technologies Co., Ltd., Humax Holdings, LG CNS Co., Ltd, Kaon Media Co., Ltd., Sagemcom Broadband , SAS, Skyworth Group Co., Ltd., Technicolor SA, Zinwell Corporation, And other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific Set-Top Box market is driven by an amalgamation of challenges and opportunities, owing to economic expansion, digital transformation, and changes in consumer preferences. Set-Top Box demand is expected to continue to be high, particularly in countries with vast demographics, expanding urbanization, and continuous digitalization efforts. The shift from analog to digital broadcasting has increased the demand for STBs that can receive digital TV signals and better services. While smart TVs are becoming more popular in the region, many users still utilize STBs for updating their existing televisions and utilizing smart capabilities. Furthermore, the growing popularity of the internet has increased consumer interest in hybrid STBs that offer both traditional broadcast and online streaming content. Government measures in some nations to digitize transmission and increase television availability, on the other hand, have boosted STB demand even more.

Moreover, increased e-commerce usage contributes to more feasible for consumers to access STBs, particularly in rural areas. Customized STB content bundles featuring local TV channels, languages, and culturally relevant programming, as well as voice recognition technology and AI-driven alternatives, are increasing in widespread acceptance. Manufacturers who adapt to changing technologies, regulatory environments, and consumer needs are likely to prosper in this volatile and competitive industry.

Market Segment

- In 2022, the OTT segment is expected to hold the largest share of Asia Pacific Set Top Box market during the forecast period.

Based on the Type, the Asia Pacific Set Top Box Market is classified into cable, satellite, IPTV, OTT, digital terrestrial television, and hybrid. Among these, the OTT segment is expected to hold the largest share of the Asia Pacific Set Top Box market during the forecast period. This can be ascribed to given that, as broadband access has increased and streaming platforms have grown in popularity, the OTT category has seen tremendous growth in select metropolitan and well-connected locations. OTT boxes, also known as streaming boxes or devices, transmit television content over the Internet but are not often operated by traditional broadcasters. These devices are compatible with platforms such as Netflix, Amazon Prime, Hulu, and others. With the transition toward electronic media utilization, they are growing increasingly common.

- In 2022, the 4K segment is influencing the largest CAGR over the forecast period.

On the basis of Resolution, the Asia Pacific Set Top Box Market is segmented into SD, HD, UHD, 4K, and others. Among these segments, the 4K segment dominates the largest market share over the forecast period. The 4K market is expected to provide tremendous development, owing mostly to increased technology adoption levels and falling costs of higher-resolution screens. 4K set-top boxes are gaining popularity, thanks to decreased 4K TV prices and the readily accessible of 4K content. Economies with robust technological infrastructure, such as South Korea and Japan, are at the leading edge of this development.

- In 2022, the residential segment accounted for the largest revenue share of more than 78.3% over the forecast period.

On the basis of end-user, the Asia Pacific Set Top Box Market is segmented into residential and commercial. Among these, the residential segment dominates the market with the highest revenue share of 78.3% over the forecast period. This is partly owing to Asia Pacific countries' big populations and a considerable number of families choosing digital entertainment. Because the number of home customers greatly outnumbers commercial businesses, the residential sector is dominating. STBs are mostly utilized for household entertainment in the residential segment. They connect to home television sets, giving users access to multiple channels and streaming services. Some of the key drivers driving demand in the residential category are the increasing electronic nature of television broadcasts, rising middle-class populations with increased disposable means, and a cultural preference for family-based entertainment.

- In 2022, the offline segment is influencing the largest CAGR over the forecast period.

On the basis of distribution channel, the Asia Pacific Set Top Box Market is segmented into online and offline. Among these segments, the offline segment dominates the largest market share over the forecast period. This dominance can be attributed to established distribution channels, patron confidence in physical purchases, and direct sales by television service providers, particularly in newly introduced digital television markets. Some customers may want to make an immediate purchase rather than wait for delivery. Purchases conducted via physical retail channels such as electronics stores, hypermarkets, or direct sales through service providers are included in the offline sub-segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Set Top Box Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mybox Technologies Pvt. Ltd.

- TechniSat Digital GmbH

- Samsung Electronics

- Sercomm Corporation

- SITI

- Technicolor SA

- Advanced Digital Broadcast

- Altech UEC; Commscope Inc

- Huawei Technologies Co., Ltd.

- Humax Holdings

- LG CNS Co., Ltd

- Kaon Media Co., Ltd.

- Sagemcom Broadband SAS

- Skyworth Group Co., Ltd.

- Technicolor SA

- Zinwell Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On June 2023, ZTE Corporation and MyRepublic, an Indonesian telecom operator, have announced a groundbreaking set-top box solution. This unique set-top box, powered by Android TV, features the newest Amlogic chip solution, enables Google Assistant and AV1 decoding, and comes pre-integrated with globally popular premium content such as Netflix and YouTube. The smart set-top box solution intends to improve MyRepublic customers' user experience by giving more competitive content selections.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Set Top Box Market based on the below-mentioned segments:

Asia Pacific Set Top Box Market, By Type

- Cable

- Satellite

- Internet Protocol Television (IPTV)

- Over-The-Top (OTT)

- Digital Terrestrial Television (DTT)

- Hybrid

Asia Pacific Set Top Box Market, By Resolution

- SD (Standard Definition)

- HD (High Definition)

- UHD (Ultra-High Definition)

- 4K

- Others

Asia Pacific Set Top Box Market, By End-Users

- Residential

- Commercial

Asia Pacific Set Top Box Market, By Distribution Channel

- Online

- Offline

Asia Pacific Set Top Box Market, By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of the Asia Pacific

Need help to buy this report?