Asia Pacific Seed Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Insecticides, Fungicides, Chemicals, and Non-chemicals), By Crop (Corn, Wheat, Soybean, and Others), and Asia Pacific Seed Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureAsia Pacific Seed Treatment Market Insights Forecasts to 2035

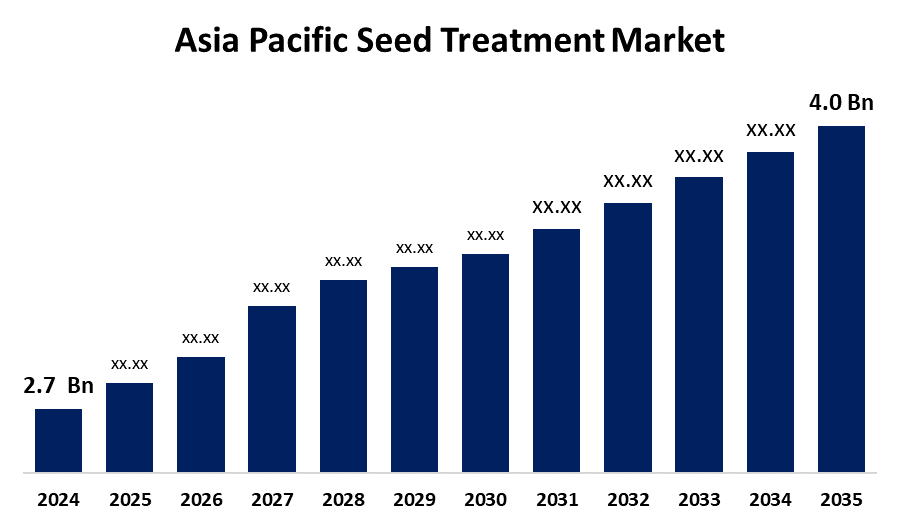

- The Asia Pacific Seed Treatment Market Size was estimated at USD 2.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.64% from 2025 to 2035

- The Asia Pacific Seed Treatment Market Size is Expected to Reach USD 4.0 Billion by 2035

Get more details on this report -

The Asia Pacific Seed Treatment Market is anticipated to reach USD 4.0 Billion by 2035, Growing at a CAGR of 3.64% from 2025 to 2035. The growing application of seed treatment therapy in crop production along with the increasing health concerns regarding crops and fruits yield are contributing to drive the seed treatment market in the Asia Pacific region.

Market Overview

The Asia Pacific seed treatment market refers to the industry encompassing the application of chemical, biological, or physical agents to seeds before planting. Seed treatment aids in protecting seeds from various pests, diseases, and environmental stresses to enhance plant health and productivity. There is an increasing demand for seed treatment in agricultural practices due to its crucial role in preventing seed and soil-borne infections and diseases, as well as in improving the overall productivity and crop yield. Advanced seed treatment technologies are adopted to enable more targeted and effective protection and optimization of resource utilization. Development of a sustainable solution by the seed treatment manufacturers, including the polymer-based synthetic coatings, is escalating the growth opportunity in the seed treatment market.

Report Coverage

This research report categorizes the market for the Asia Pacific seed treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific seed treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific seed treatment market.

Asia Pacific Seed Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.64% |

| 2035 Value Projection: | USD 4.0 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Crop and COVID-19 Impact Analysis |

| Companies covered:: | ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, Corteva Agriscience, Crystal Crop Protection Ltd, FMC Corporation, Nufarm Ltd, PI Industries, Syngenta Group, UPL Limited, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing application of seed treatment therapy for protection against diseases & pests and enhanced germination rates is driving the market. The awareness about the crucial role of seed treatment in sustainable agriculture is significantly contributing to promoting the market growth. The rising health concerns in the increased crop yield owing to the use of pesticides, soil degradation, and alteration in food diet, which may impact human health and the environment, are expected to propel the market demand for seed treatment.

Restraining Factors

The strict regulatory requirements mandating the rigorous testing and compliances measures for seed treatment products are challenging the market growth. The emergence of biological solutions as an alternative to chemical seed treatment are hindering the market.

Market Segmentation

The Asia Pacific seed treatment market share is classified into type and crop.

- The insecticides segment dominated the market with a maximum share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific seed treatment market is segmented by type into insecticides, fungicides, chemicals, and non-chemicals. Among these, the insecticides segment dominated the market with a maximum share in 2024 and is expected to grow at a significant CAGR during the forecast period. It involves the application of insecticides to seeds before planting to protect them and emerging seedlings from insect pests.

- The corn segment held a major share of the seed treatment market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific seed treatment market is segmented by crop into corn, wheat, soybean, and others. Among these, the corn segment held a major share of the seed treatment market in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in demand from crop protection activities contributing to drive the seed treatment market. There is increased adoption of advanced seed treatment technologies for enhancing crop resilience and yield potential.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific seed treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- Crystal Crop Protection Ltd

- FMC Corporation

- Nufarm Ltd

- PI Industries

- Syngenta Group

- UPL Limited

- Others

Recent Developments:

- In January 2023, Bayer launched a new collaboration with Oerth Bio, seeking to develop the next generation of more sustainable crop protection products. The unique protein degradation technology used by Oerth Bio has the potential to generate products that support Bayer’s sustainability objective to reduce the environmental impact of agriculture, via lower application rates and favorable safety profiles.

- In December 2022, ADAMA Ltd., a leading global crop protection company, announced the acquisition of AgriNova New Zealand, Ltd. known as Grochem New Zealand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Seed Treatment Market based on the below-mentioned segments:

Asia Pacific Seed Treatment Market, By Type

- Insecticides

- Fungicides

- Chemicals

- Non-chemicals

Asia Pacific Seed Treatment Market, By Crop

- Corn

- Wheat

- Soybean

- Others

Need help to buy this report?