Asia Pacific Nitrile Butadiene Rubber Latex Market Size, Share, and COVID-19 Impact Analysis, By Application (Gloves [Industrial and Medical], Cotton, Others), By End-user (Industrial, Healthcare & Cleanroom, Food, Others), By Country (China, Japan, India, South Korea, Taiwan, Rest of Asia Pacific), and Asia Pacific Nitrile Butadiene Rubber Latex Market Insights Forecasts to 2032

Industry: Chemicals & MaterialsAsia Pacific Nitrile Butadiene Rubber Latex Market Insights Forecasts to 2032

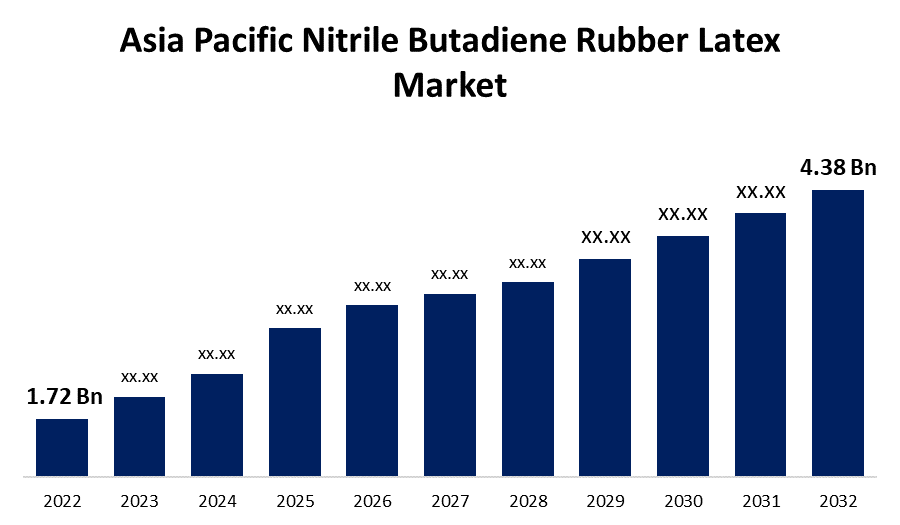

- The Asia Pacific Nitrile Butadiene Rubber Latex Market Size was valued at USD 1.72 Billion in 2022.

- The Market is Growing at a CAGR of 9.8% from 2022 to 2032.

- The Asia Pacific Nitrile Butadiene Rubber Latex Market Size is expected to reach USD 4.38 Billion by 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Asia Pacific Nitrile Butadiene Rubber Latex Market Size is expected to reach USD 4.38 Billion by 2032, at a CAGR of 9.8% during the forecast period 2022 to 2032.

Market Overview

Nitrile butadiene rubber (NBR) latex is a synthetic rubber copolymer formed by the synthesis of acrylonitrile (ACN) with butadiene. It has gained popularity in a variety of industries because of its considerable advantages over natural rubber. Nitrile butadiene rubber latex is well-known for its excellent resistance to oils, fuels, and other chemicals, making it a perfect material for a wide range of industrial applications. High tensile strength, temperature resistance, elongation, and resistance to oils and chemicals are all fundamental characteristics of nitrile butadiene rubber latex. With its resilience and versatility, nitrile butadiene rubber latex is used in a wide range of industries, including the medical industry, automotive industry, adhesives, and coatings. Today, nitrile is the most often utilized elastomer in the seal sector. Nitrile rubber is used in the manufacture of disposable non-latex gloves, automotive transmission belts, hoses, O-rings, gaskets, oil seals, V belts, static & dynamic hydraulic seals, synthetic leather, printer's form rollers, and cable jacketing. The Asia Pacific region is home to numerous prominent manufacturers and exporters of Nitrile butadiene rubber latex, including Malaysia, Thailand, China, and Indonesia. Malaysia, in particular, has been termed the 'world's glove capital' as a result of its dominance in the manufacturing of nitrile gloves. Because of the powerful industrial and manufacturing sectors, particularly in China and South Korea, there is a constant investment in technological advancement to improve the functionality of nitrile butadiene rubber latex and explore potential uses.

Report Coverage

This research report categorizes the market for Asia Pacific Nitrile Butadiene Rubber Latex Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Nitrile Butadiene Rubber Latex Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Asia Pacific Nitrile Butadiene Rubber Latex Market.

Asia Pacific Nitrile Butadiene Rubber Latex Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.72 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By End-user, By Country and COVID-19 Impact Analysis. |

| Companies covered:: | Jubilant Bhartia Group, Apcotex Industries Limited, Synthomer, Kumho Petrochemical, Emerald Performance Materials, Nantex Industry Co., Ltd., Versalis S.p.A., Zeon Chemicals, LG Chem, OMNOVA Solutions, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific region is a major contender in the market for nitrile butadiene rubber latex. The demand for products made of nitrile butadiene rubber latex has increased as a result of emerging economies' rapid industrialization, particularly in industries like construction, electronics, and the automobile industry. Additionally, the global health crisis has resulted in an extraordinary spike in demand for medical gloves manufactured mostly of nitrile butadiene rubber latex. Asian countries, particularly Malaysia and Thailand, have been crucial in meeting this spike in demand. Furthermore, the region benefits from economic advantages such as low-cost labor, ample raw material availability, and frequently favorable government policies. This confluence of factors has fuelled Asia Pacific's production capacity and market domination in the nitrile butadiene rubber latex market.

Market Segment

- In 2022, the gloves segment is expected to hold the largest share of Asia Pacific Nitrile Butadiene Rubber Latex market during the forecast period.

Based on the application, the Asia Pacific Nitrile Butadiene Rubber Latex Market is classified into gloves, cotton, and others. Among these, the gloves segment is expected to hold the largest share of the Asia Pacific Nitrile Butadiene Rubber Latex market during the forecast period. The growing demand for nitrile gloves, particularly in light of global health issues like as the COVID-19 pandemic, combined with Asia Pacific's position as a key maker and exporter of these gloves, establishes this segment's dominance. When compared to latex gloves, nitrile gloves are more resistant to chemicals and punctures. Because of their durability and protective qualities, they are frequently utilized in medical, food service, cleaning, and industrial applications. They are an important alternative to natural rubber latex gloves, especially for people who are allergic to latex.

- In 2022, the healthcare & cleanroom segment accounted for the largest revenue share of more than 62.3% over the forecast period.

On the basis of end-user, the Asia Pacific Nitrile Butadiene Rubber Latex Market is segmented into industrial, healthcare & cleanroom, food, and others. Among these, the healthcare & cleanroom segment dominates the market with the highest revenue share of 62.3% over the forecast period. This is due to the high demand for nitrile medical gloves, particularly in light of global health issues like as the COVID-19 pandemic, as well as the region's role as a major global provider of medical gloves. NBR latex is widely utilized in the manufacture of medical gloves and other protective equipment in healthcare environments. Nitrile gloves and protective clothing are favored in cleanrooms, which are regulated environments utilized in pharmaceutical, biotech, and electronics manufacturing because of their low particle and extractable levels. As a center for worldwide medical glove production, the Asia Pacific area sees a high demand for NBR latex in the healthcare industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Nitrile Butadiene Rubber Latex Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jubilant Bhartia Group

- Apcotex Industries Limited

- Synthomer

- Kumho Petrochemical

- Emerald Performance Materials

- Nantex Industry Co., Ltd.

- Versalis S.p.A.

- Zeon Chemicals

- LG Chem

- OMNOVA Solutions

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On July 2021, LG Chem Ltd. of South Korea has built a 100,000-ton nitrile butadiene latex (NBL) plant in Ningbo, China, with a 110,000-ton expansion planned for next year. The plant will serve as the chemical giant's third production base after Korea and Malaysia, responding to rising demand for the core material used in latex gloves.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Nitrile Butadiene Rubber Latex Market based on the below-mentioned segments:

Asia Pacific Nitrile Butadiene Rubber Latex Market, By Application

- Gloves

- Industrial

- Medical

- Cotton

- Others

Asia Pacific Nitrile Butadiene Rubber Latex Market, By End-user

- Industrial

- Healthcare & Cleanroom

- Food

- Others

Asia Pacific Nitrile Butadiene Rubber Latex Market, By Connectivity

- Standalone

- On-grid

Asia Pacific Nitrile Butadiene Rubber Latex Market, By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of the Asia Pacific

Need help to buy this report?