Asia Pacific Meat Substitutes Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant-based Protein, Mycoprotein, Soy-based, and Others), By Distribution Channel (Foodservice and Retail), and Asia Pacific Meat Substitutes Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAsia Pacific Meat Substitutes Market Insights Forecasts to 2035

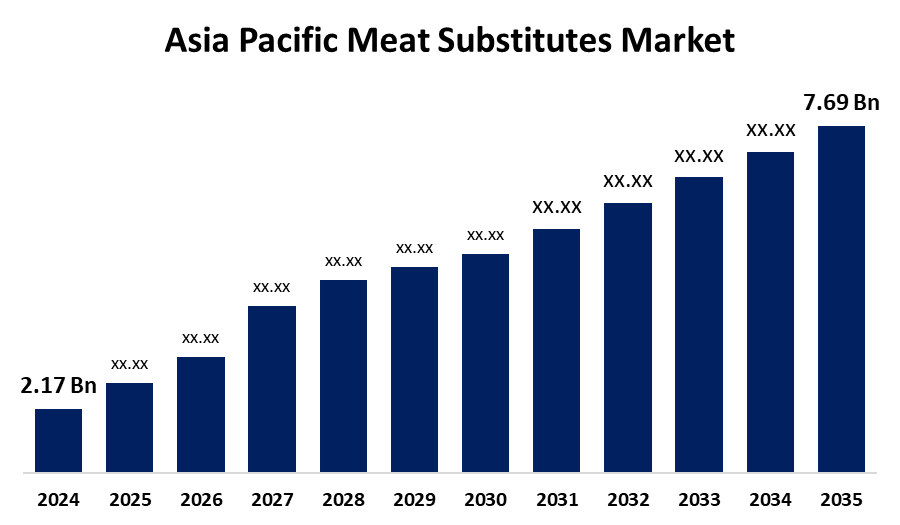

- The Asia Pacific Meat Substitutes Market Size was estimated at USD 2.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.19% from 2025 to 2035

- The Asia Pacific Meat Substitutes Market Size is Expected to Reach USD 7.69 Billion by 2035

Get more details on this report -

The Asia Pacific Meat Substitutes Market is anticipated to reach USD 7.69 billion by 2035, growing at a CAGR of 12.19% from 2025 to 2035. The growing health consciousness, environmental concerns, and shifting consume preferences are the several factors responsible for propelling the meat substitutes market in the Asia Pacific region.

Market Overview

The Asia Pacific meat substitutes market refers to the industry encompassing products designed to mimic meat in terms of taste, texture, and appearance, and are made from plant-based, fungal, or lab-grown ingredients. Meat substitutes or meat alternatives a food products made from vegetarian or vegan ingredients, consumed as a replacement for meat. The market is primarily driven by the popularity of meat substitutes among vegetarians, vegans, and individuals looking to reduce their meat consumption for health, environmental, or ethical reasons. There are growing advancements in food science and technology for realistic plant-based meat substitutes. Further, innovative products and new plant-based alternatives like jackfruit are being introduced by the manufacturers to expand their product portfolio. Technological advancements in the extrusion and processing of meat substitutes which involves the extraction of pea protein, soy protein, and wheat protein are expanding the market opportunities of meat substitutes.

Report Coverage

This research report categorizes the market for the Asia Pacific meat substitutes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific meat substitutes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific meat substitutes market.

Asia Pacific Meat Substitutes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.19% |

| 2035 Value Projection: | USD 7.69 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Source, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | China Foodstuff & Protein Group Co. Ltd, Flexitarian Foods Pty Ltd, Impossible Foods Inc., Invigorate Foods Pvt. Ltd, Kerry Group PLC, Morinaga Milk Industry Co. Ltd, Roquette Freres, Vippy Industries Ltd, Vitasoy International Holdings Ltd., Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising popularity of veganism and dietary trends among millennials is responsible for driving the meat substitutes market. An increasing demand for plant-based protein foods, including legumes, beans, and lentils among health-conscious consumers along with the adoption of proactive approach for incorporating plant-based protein products into diets is significantly driving the market demand. Further, the inclination towards cruelty free products that promote health as well as sustainability compared to real meat contributes to promoting the market growth.

Restraining Factors

The high production cost of meat substitutes as compared to traditional meat is restraining the market. Further, the perception regarding the taste of plant-based meat products limits its adoption, which is challenging the market growth.

Market Segmentation

The Asia Pacific meat substitutes market share is classified into source and distribution channel.

- The plant-based protein segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific meat substitutes market is segmented by source into plant-based protein, mycoprotein, soy-based, and others. Among these, the plant-based protein segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment include soy protein, pea protein, and wheat protein, and seeds include canola and sunflower seeds, peanuts, rice, and mung bean proteins. The inclination towards plant-based seafood and consumer interest for healthier and customized options are propelling the market in the plant-based protein segment.

- The retail segment held a major share of the meat substitutes market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific meat substitutes market is segmented by distribution channel into foodservice and retail. Among these, the retail segment held a major share of the meat substitutes market in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail channels offer a wide range of brands and types, catering to diverse dietary preferences, and benefit from promotional discounts and increased shelf life. Strategic partnerships among grocery stores for introducing and expanding product offerings contribute to driving the market growth in the retail segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific meat substitutes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China Foodstuff & Protein Group Co. Ltd

- Flexitarian Foods Pty Ltd

- Impossible Foods Inc.

- Invigorate Foods Pvt. Ltd

- Kerry Group PLC

- Morinaga Milk Industry Co. Ltd

- Roquette Freres

- Vippy Industries Ltd

- Vitasoy International Holdings Ltd.

- Others

Recent Developments:

- In January 2023, Roquette, a global leader in plant-based ingredients and a pioneer of plant proteins, announced its investment in DAIZ Inc., a Japanese food tech startup that has developed breakthrough technology utilizing germination of plant seeds combined with an extrusion process to enhance texture, flavor and the nutritional profile for plant-based foods.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Meat Substitutes Market based on the below-mentioned segments:

Asia Pacific Meat Substitutes Market, By Source

- Plant-based Protein

- Mycoprotein

- Soy-based

- Others

Asia Pacific Meat Substitutes Market, By Distribution Channel

- Foodservice

- Retail

Need help to buy this report?