Asia Pacific Luxury Hotel Market Size, Share, and COVID-19 Impact Analysis, By Room Type (luxury, upper-upscale, and upscale), By Category (Chain and Independent), and Asia Pacific, Luxury Hotel Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsAsia Pacific Luxury Hotel Market Insights Forecasts To 2035

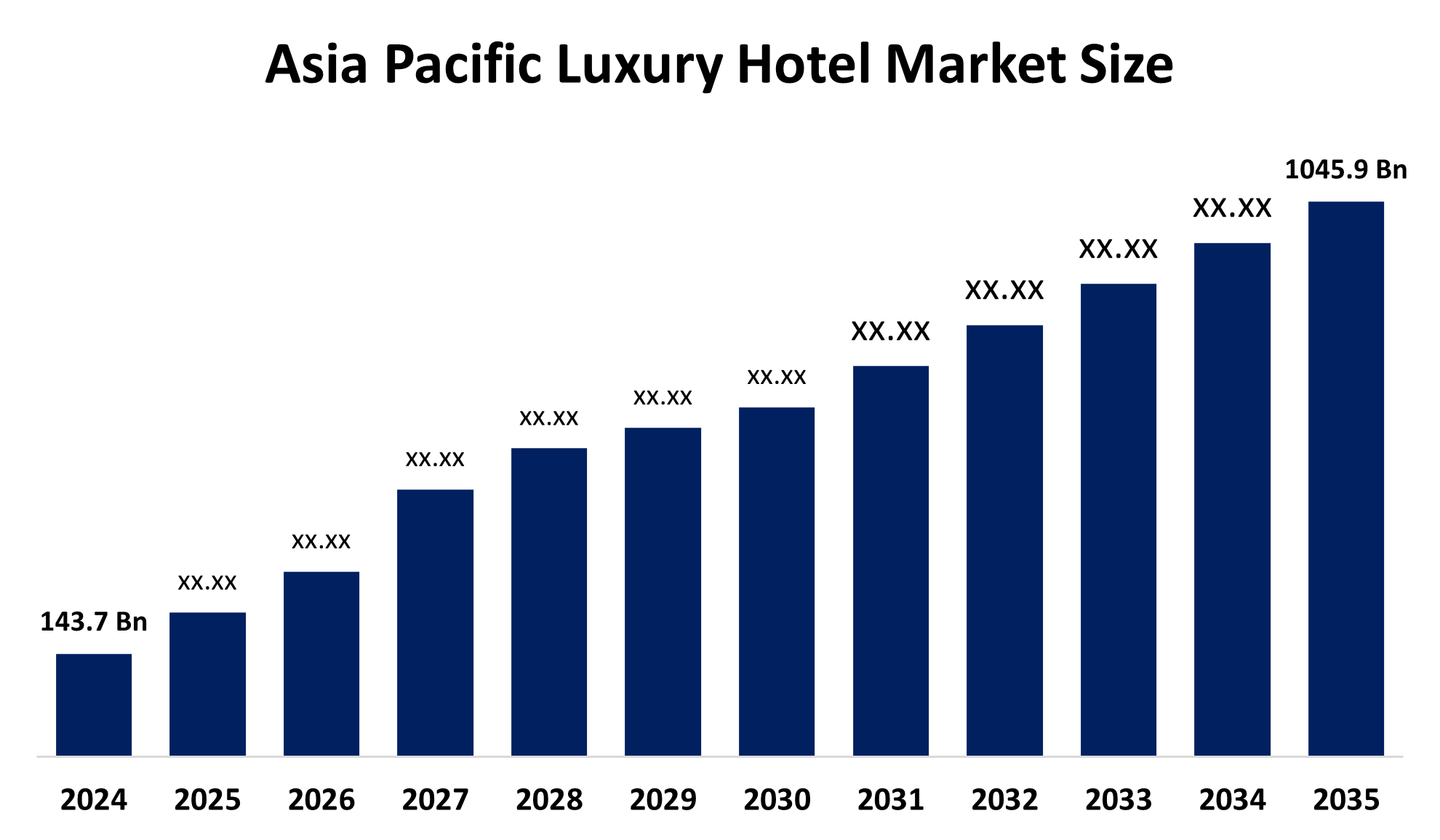

- The Asia Pacific Luxury Hotel Market Size Was Estimated at USD 143.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 19.78% from 2025 to 2035

- The Asia Pacific Luxury Hotel Market Size is Expected to Reach USD 1045.9 Billion by 2035

Get more details on this report -

According To a Research Report Published by Spherical Insights & Consulting, Asia Pacific Luxury Hotel Market Size is Anticipated To Reach USD 1045.9 Billion by 2035, Growing at a CAGR of 19.78% from 2025 to 2035. The Asia Pacific luxury hotel market Size is driven by craft luxury hotel growth, premium product innovation, sustainable brewing, digital marketing, e-commerce growth, low-alcohol alternatives, and rising consumer desire for organic and flavored luxury hotel types.

Market Overview

A luxury hotel is an upscale facility that provides guests with an unmatched experience by providing outstanding rooms, individualised services, and unique features. Globalisation, which refers to the increasingly interconnected economies, communities, and cultures, is expected to benefit the luxury hotel market in the Asia-Pacific. However, as incomes and employment opportunities increased and consumers became more confident in their spending habits, a large swathe of the consumer market that has disposable income, are acquiring luxury items now and as a habit among them, pay attention to luxury hand-pick brands. Whether they travelled to a destination on vacation, for personal reasons, or were travelling for business responsibilities, for personal or economic gain. Also, have a shoulder-to-shoulder trend in the APAC market cap at the time of the sampling is the growth in business travelling by professionals. Generally, these professionals will stay at expensive hotels compared to other lower-cost accommodation options as their travels are compensated by the corporation, hence, adding revenue to the APAC luxury hotel market cap. In 2023, there are luxury hotel projects in the Asia Pacific with a total of 3,693 projects representing 701,974 rooms in China, in India 339 projects representing 42,548 rooms in Indonesia 284 projects representing 45,359 rooms.

The government started a golden visa program that grants resident permits for five or ten years to qualified foreign individuals. This program is aimed at retirees, global talent, individual and corporate investors, and second-home buyers. Furthermore, the Ministry of Tourism has implemented extensive changes to give priority to high-end markets like wellness, culinary arts, and marine tourism, as well as to build accompanying infrastructure.

Report Coverage

This research report categorizes the market for Asia Pacific luxury hotel market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific luxury hotel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific luxury hotel market.

Asia Pacific Luxury Hotel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 143.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 19.78% |

| 2035 Value Projection: | USD 1045.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Room Type, By Category |

| Companies covered:: | Accor SA, Aman Group S.a.r.l., Choice Hotels International Inc., COMO Hotels and Resorts Asia Pte. Ltd., Four Seasons Hotels Ltd., Hilton Worldwide Holdings Inc., Hotel Okura Co. Ltd., Hyatt Hotels Corp., InterContinental Hotels Group PLC, ITC Ltd., Mandarin Oriental International Ltd, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

The Asia Pacific luxury hotel market is undergoing significant upheaval as wealthy consumers desire to employ lavish services. Furthermore, wealthy individuals usually seek upmarket and distinctive experiences when they travel. Luxury hotels cater to this need by offering luxurious accommodations, personalised services, and high-end amenities that draw in affluent travellers seeking sophistication and extravagance. As a result, both well-known and lesser-known tourism destinations in the Asia Pacific are seeing an increase in the number of luxury hotels. In addition to meeting the need for upscale accommodations, these hotels promote further expansion and investment in the region's luxury hotel sector.

Restraining Factors

The Asia Pacific luxury hotel market faces obstacles like the availability of cheaper shared accommodations sites as Airbnb, in poorer countries, and the higher cost of accommodations in more expensive hotels.

Market Segmentation

The Asia Pacific luxury hotel market share is classified into room type and category.

- The luxury segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Asia Pacific luxury hotel market is segmented by room type into luxury, upper-upscale, and upscale. Among these, the luxury segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by the rising demand for affordable luxury services. Depending on the kind of accommodation they select, visitors have a wide range of options to choose from, all of differing quality. The hotel brands were given the scores based on the degree of guest satisfaction in each of their many areas.

- The chain segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific luxury hotel market is segmented by category into chain and independent. Among these, the chain segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is supported by more well-known hotel chains; the chain category will have the largest market share. Chain stores and independent vendors compete in every market segment. Chain hotels account for a sizable portion of the industry due to their widespread presence in the region. Chain hotels are concentrating on expanding their presence and reach in profitable regions of the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific luxury hotel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accor SA

- Aman Group S.a.r.l.

- Choice Hotels International Inc.

- COMO Hotels and Resorts Asia Pte. Ltd.

- Four Seasons Hotels Ltd.

- Hilton Worldwide Holdings Inc.

- Hotel Okura Co. Ltd.

- Hyatt Hotels Corp.

- InterContinental Hotels Group PLC

- ITC Ltd.

- Mandarin Oriental International Ltd

- Others

Recent Developments

- In October 2024, TPG Angelo Gordon acquired the Grand Nikko Tokyo Daiba in a deal valued at ¥106 billion, marking one of the largest hotel transactions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific luxury hotel market based on the following segments:

Asia Pacific Luxury Hotel Market, By Room Type

- Luxury

- Upper-Upscale

- Upscale

Asia Pacific Luxury Hotel Market, By Category

- Chain

- Independent

Need help to buy this report?