Asia Pacific Liquid Chlorine Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial, Food, Water Treatment, and Other), By End-Use Industry (Chemicals, Plastics, Pulp Paper, Food Beverages, Textiles, Pharmaceuticals, and Other), By Application (Bleaching, Disinfection, Deodorization, Water treatment, Industrial synthesis, and Other), and Asia Pacific Liquid Chlorine Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsAsia Pacific Liquid Chlorine Market Insights Forecasts to 2035

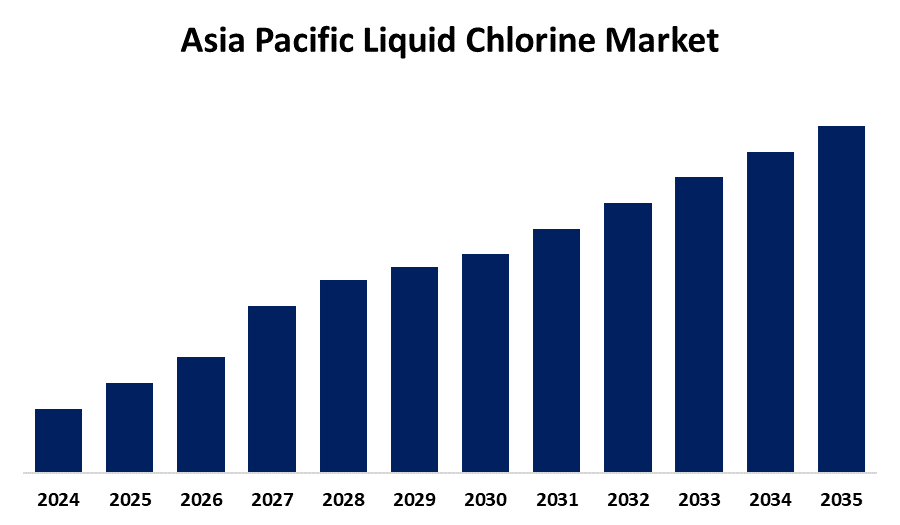

- The Market Size is Expected to Grow at a CAGR of around 4.85% from 2025 to 2035

- The Asia Pacific Liquid Chlorine Market Size is Expected to hold a significant share by 2035

Get more details on this report -

The Asia Pacific Liquid Chlorine Market Size is Anticipated to hold a significant share by 2035, Growing at a CAGR of 4.85% from 2025 to 2035. The growing emphasis on clean water access & sanitation, as well as growth in PVC & chemicals, are driving the liquid chlorine market in the Asia Pacific region.

Market Overview

The Asia Pacific liquid chlorine market refers to the production, distribution, and application of chlorine in its liquid form. Liquid chlorine is sodium hypochlorite, effectively used for destroying bacteria and preventing algae production across commercial and residential settings. Liquid chlorine has versatile applications in water purification and wastewater treatment, driving its demand across public health and safety sectors. Further, its use of water disinfection in swimming pools and industrial cooling systems is driving liquid chlorine demand in the construction and real estate industries.

Expanding water infrastructure projects, along with the upsurging emphasis on sustainable alternatives, including electrochemical technologies, are contributing to offering market growth opportunities for liquid chlorine.

Report Coverage

This research report categorizes the market for the Asia Pacific liquid chlorine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific liquid chlorine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific liquid chlorine market.

Asia Pacific Liquid Chlorine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.85% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By End-Use Industry, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Formosa Plastics Group, Tata Chemicals Ltd., Atul Ltd., AGC, Inc., Vencorex Chemicals (PTT Global Chemical), Clean Plus Chemicals Pty Ltd., DCW Limited, Vynova Belgium NV, Hamilton chemicals, Global Heavy Chemicals Ltd. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing emphasis on clean water access & sanitation with the growing urbanization, industrial growth, and climate change is anticipated to drive the market demand for liquid chlorine. The chemical industry relies on liquid chlorine as a fundamental raw material for manufacturing various chemicals, including PVC. Thus, the growth in PVC & chemicals is contributing to driving the liquid chlorine market. Further, the rising demand for liquid chlorine as disinfectant in the wastewater treatment industry, as well as in the chemical processing industry, is driving the market demand.

Restraining Factors

The strict government regulations associated with the production, transportation, and storage of liquid chlorine are challenging the market. Additionally, the availability of alternative solutions to liquid chlorine is hampering the liquid chlorine market.

Market Segmentation

The Asia Pacific liquid chlorine market share is classified into grade, end-use industry, and application.

- The industrial segment held a major revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific liquid chlorine market is segmented by grade into industrial, food, water treatment, and other. Among these, the industrial segment held a major revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. In an industrial setting, liquid chlorine is used for the production of chemicals, including hydrochloric acid, bleach, and chlorinated solvents. The widespread application of liquid chlorine in the plastics, chemicals, and textile production is driving the market in the industrial segment.

- The chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific liquid chlorine market is segmented by end-use industry into chemicals, plastics, pulp paper, food beverages, textiles, pharmaceuticals, and other. Among these, the chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Liquid chlorine has widespread application in the chemical sector for disinfection and as a bleaching agent. Further, liquid chlorine is used as a raw material and as a key component in chemical manufacturing processes.

- The bleaching segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Asia Pacific liquid chlorine market is segmented by application into bleaching, disinfection, deodorization, water treatment, industrial synthesis, and other. Among these, the bleaching segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Liquid chlorine has extensive application in the textiles, detergents, paper & pulp industries as a bleaching agent. Liquid chlorine aids in removing lignin and other impurities, resulting in brighter and higher-quality paper.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific liquid chlorine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Formosa Plastics Group

- Tata Chemicals Ltd.

- Atul Ltd.

- AGC, Inc.

- Vencorex Chemicals (PTT Global Chemical)

- Clean Plus Chemicals Pty Ltd.

- DCW Limited

- Vynova Belgium NV

- Hamilton chemicals

- Global Heavy Chemicals Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Liquid Chlorine Market based on the below-mentioned segments:

Asia Pacific Liquid Chlorine Market, By Grade

- Industrial

- Food

- Water Treatment

- Other

Asia Pacific Liquid Chlorine Market, By End-Use Industry

- Chemicals

- Plastics

- Pulp Paper

- Food Beverages

- Textiles

- Pharmaceuticals

- Other

Asia Pacific Liquid Chlorine Market, By Application

- Bleaching

- Disinfection

- Deodorization

- Water treatment

- Industrial synthesis

- Other

Need help to buy this report?