Asia Pacific Hydrogen Generation Market Size, Share, and COVID-19 Impact Analysis, By Source (Natural Gas, Coal, Biomass, Water), By Process (Steam Methane Reforming, Coal Gasification, Electrolysis, Others), By Application (Methanol Production, Ammonia Production, Petroleum Refining, Transportation, Power Generation, Others), By Country (China, Japan, India, South Korea, Taiwan, Rest of Asia Pacific), and Asia Pacific Hydrogen Generation Market Insights Forecasts to 2032

Industry: Energy & PowerAsia Pacific Hydrogen Generation Market Insights Forecasts to 2032

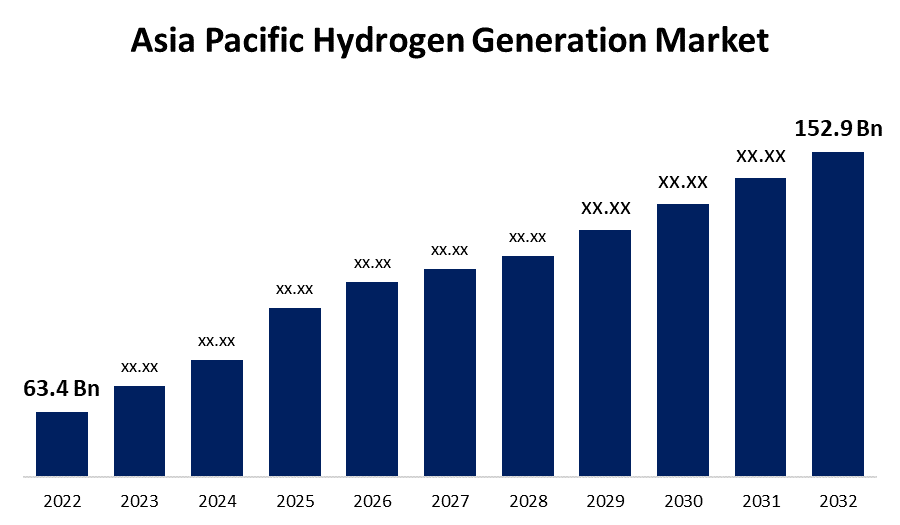

- The Asia Pacific Hydrogen Generation Market Size was valued at USD 63.4 Billion in 2022.

- The Market is Growing at a CAGR of 9.2% from 2022 to 2032.

- The Asia Pacific Hydrogen Generation Market Size is expected to reach 152.9 Billion by 2032.

- Canada is expected to grow the fastest during the forecast period.

Get more details on this report -

The Asia Pacific Hydrogen Generation Market Size is expected to reach USD 152.9 Billion by 2032, at a CAGR of 9.2% during the forecast period 2022 to 2032.

Market Overview

As a form of energy, hydrogen is a viable substitute for carbon-free fuel that is reliable, readily available, secure, and cost-effective. It can provide significant solutions for the expanding energy demands of the twenty-first century while also addressing the challenges of global warming and the effects of climate change. Hydrogen can be generated from fossil fuels and biomass, water, or a combination of the two. Natural gas is the dominant source of hydrogen generation at the moment, accounting for almost three-quarters of the annual global commercial hydrogen production of around 70 million tonnes. The Asia Pacific area has enormous low-carbon hydrogen generation potential and is likely to play a crucial role in the worldwide transition to renewable energy. More Asia-Pacific countries are turning to hydrogen as an energy source as part of the worldwide net-zero drive to reduce reliance on fossil fuels and seek cleaner energy alternatives. China unveiled its first long-term plan for establishing a national hydrogen economy for the period 2021-2035 in March. Because of its fast-developing renewables capacity, China is already the world's top hydrogen producer and consumer. Furthermore, Japan and South Korea were among the first in the Asia-Pacific region to establish a domestic hydrogen market, adopting national road plans to increase hydrogen capabilities. Moreover, Asia Pacific generates about 40% of global hydrogen demand, with China accounting for 26% of global demand.

Report Coverage

This research report categorizes the market for Asia Pacific Hydrogen Generation Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Hydrogen Generation Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Asia Pacific Hydrogen Generation Market.

Asia Pacific Hydrogen Generation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 63.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.2% |

| 2032 Value Projection: | USD 152.9 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Process, By Application, By Country, and COVID-19 Impact Analysis. |

| Companies covered:: | Air Liquide, Air Products, INPEX Corporation, Iwatani Corporation, AMEA Power, Fuji Electric Co Ltd, Linde, Showa Denko K.K., Ally Hi-Tech Co. Ltd., Shanghai Electric Power, Tokyo Gas Chemicals Co., Ltd., Epoch Energy Technology Corporation, Mitsubishi Hitachi Power Systems Ltd., Toshiba Fuel Cell Power Systems Corporation, Neom Green Hydrogen Company, Beijing Hypower Energy Technology Ltd. and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen generation market in Asia Pacific is growing as a result of increased investments in expanding existing refining facilities and rising crude oil consumption. The government's higher expenditure on multiple technologies aimed at boosting the productivity of hydrogen extraction is expected to drive market expansion. The development of the market is expected to be boosted by increasing emphasis on distributed power and utility projects. Over the predicted period, regional electricity demand is expected to increase by approximately two-thirds of its current level. Additionally, the fast-growing demand for fuel cell electric vehicles (FCEVs) such as passenger vehicles, buses, trucks, and other heavy-duty vehicles is expected to drive demand for this industry. Furthermore, the implementation of various incentive programs aimed at reducing the levels of sulfur in engine oil, diesel-fueled vehicles, and gasoline will contribute to the automotive sector's demand.

Market Segment

- In 2022, the natural gas segment accounted for the largest revenue share of more than 67.3% over the forecast period.

Based on the source, the Asia Pacific Hydrogen Generation Market is segmented into natural gas, coal, biomass, and water. Among these, the natural gas segment has the largest revenue share of 67.3% over the forecast period. Hydrogen is generated through the reforming of natural gas, which creates hydrogen, carbon monoxide, and carbon dioxide. The cheapest technique for producing hydrogen is through the use of natural gas. Steam methane reforming (SMR) is a method used to generate hydrogen from methane-rich natural gas. It is currently the most affordable source of industrial hydrogen. Natural gas-derived hydrogen generation is expected to maintain its competitive edge in the Asia-Pacific hydrogen generation market over the forecast period.

- In 2022, the steam methane reforming segment is witnessing a higher growth rate over the forecast period.

Based on the process, the Asia Pacific Hydrogen Generation Market is segmented into steam methane reforming, coal gasification, electrolysis, and others. Among these, the steam methane reforming segment is witnessing a higher growth rate over the forecast period. The steam methane reforming technique is a developed and efficient hydrogen generating technology. The region's expanding demand for hydrogen generation is a major contributing driver for steam methane reformer technology, as steam methane reforming is the most cost-effective method of producing hydrogen. The additional drivers driving expansion incorporate operational advantages such as the high productivity of conversion of the steam methane reforming process. During the projected period, the steam methane reforming segment is expected to continue to hold its market position.

- In 2022, the ammonia production segment accounted for the largest revenue share of more than 32.8% over the forecast period.

On the basis of application, the Asia Pacific Hydrogen Generation Market is segmented into air methanol production, ammonia production, petroleum refining, transportation, power generation, and others. Among these, the ammonia production segment has the largest revenue share of 32.8% over the forecast period, because of their capacity to use various technologies, increase technical skills, and synthesize ammonia in major quantities. The efficacy of ammonia as a carbon-free fuel, hydrogen carrier, and energy storage provides the potential for renewable hydrogen technologies to be applied on a wider scope. In general, hydrogen is manufactured on-site in ammonia facilities from a fossil fuel feedstock. Natural gas is the most typical feedstock for a steam methane reforming (SMR) plant. A partial oxidation (POX) technique can also be utilized to create ammonia from coal. Moreover, the upsurge in market demand for various ammonia fertilizers throughout the region is a major factor driving hydrogen growth in this industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Hydrogen Generation Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- Air Products

- INPEX Corporation

- Iwatani Corporation

- AMEA Power

- Fuji Electric Co Ltd

- Linde

- Showa Denko K.K.

- Ally Hi-Tech Co. Ltd.

- Shanghai Electric Power

- Tokyo Gas Chemicals Co., Ltd.

- Epoch Energy Technology Corporation

- Mitsubishi Hitachi Power Systems Ltd.

- Toshiba Fuel Cell Power Systems Corporation

- Neom Green Hydrogen Company

- Beijing Hypower Energy Technology Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On April 2023, ExxonMobil Asia Pacific and Keppel Infrastructure have signed a Memorandum of Understanding (MOU) aimed at providing access to low-carbon hydrogen and ammonia for scalable commercial and industrial uses in Singapore. This MOU follows the Singapore government's October 2022 launch of its National Hydrogen Strategy, which anticipates hydrogen meeting up to half of Singapore's electricity demands by 2050.

- On May 2023, Graforce and Worley have joined forces to scale up methane electrolysis (plasmalysis) technology in APAC countries in order to convert natural gas, LNG, flare gas, and other hydrocarbons into hydrogen. Gas customers will be able to switch to clean-burning hydrogen without changing their energy supplier or mode of transportation thanks to this technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Hydrogen Generation Market based on the below-mentioned segments:

Asia Pacific Hydrogen Generation Market, By Source

- Natural Gas

- Coal

- Biomass

- Water

Asia Pacific Hydrogen Generation Market, By Process

- Steam Methane Reforming

- Coal Gasification

- Electrolysis

- Others

Asia Pacific Hydrogen Generation Market, By Application

- Methanol Production

- Ammonia Production

- Petroleum Refining

- Transportation

- Power Generation

- Others

Asia Pacific Hydrogen Generation Market, By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of the Asia Pacific

Need help to buy this report?