Asia Pacific Feed Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Type (Protease, Phytase, and Others), By Livestock (Swine, Poultry, Ruminants, Aquatic Animals, and Others), By Form (Dry, Liquid, and Others), and Asia Pacific Feed Enzymes Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureAsia Pacific Feed Enzymes Market Insights Forecasts to 2035

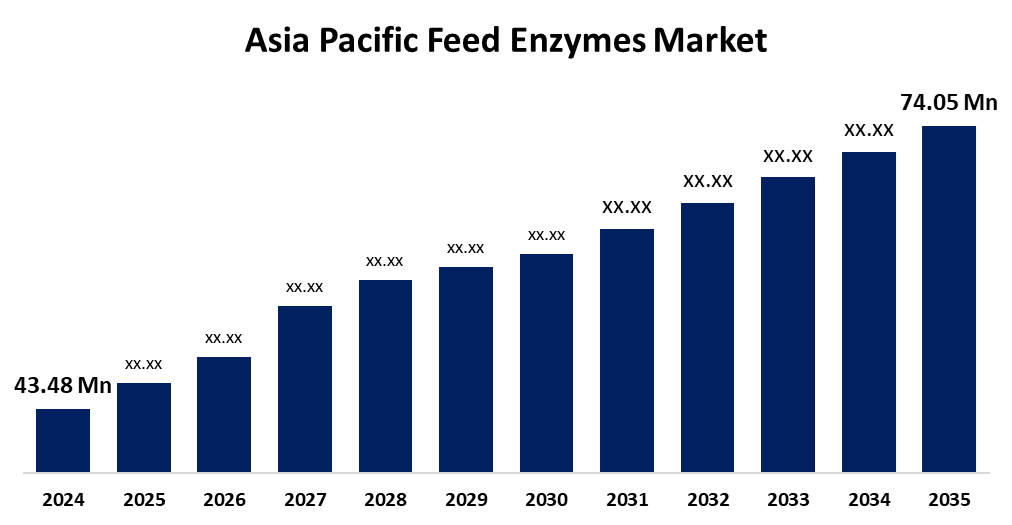

- The Asia Pacific Feed Enzymes Market Size was Estimated at USD 43.48 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.96% from 2025 to 2035

- The Asia Pacific Feed Enzymes Market Size is Expected to Reach USD 74.05 Million by 2035

Get more details on this report -

The Asia Pacific Feed Enzymes Market Size is Anticipated to Reach USD 74.05 Million by 2035, Growing at a CAGR of 4.96% from 2025 to 2035. The consumer inclination towards organic meat, along with an increasing consumption of feed additives, is driving the feed enzymes market.

Market Overview

The Asia Pacific Feed Enzymes Market Size Encompasses the enzymes used in animal feed for improving nutrient digestibility and absorption. Feed enzymes are the animal feed additives that improve the digestion and nutrient utilization, ultimately enhancing animal performance and profitability. Increasing animal health concerns and demand for an increase in the nutrient uptake of feed are both factors driving the feed enzymes market. The market expansion is further driven by an increasing demand for nutritional enhancements and digestion efficiency due to the expansion of the livestock sector. The increasing popularity of processed meat, along with growing inclination towards organic meat to enhance animal productivity, is propelling the market growth. Innovation in phytase production processes for monogastric and digastric livestock in order to enhance the nutrient uptake efficiency and livestock resistance to disease attacks is bolstering the market growth opportunities for feed enzymes.

Report Coverage

This research report categorizes the market for the Asia Pacific feed enzymes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific feed enzymes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific feed enzymes market.

Asia Pacific Feed Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 43.48 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.96% |

| 2035 Value Projection: | USD 74.05 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Livestock, By Form |

| Companies covered:: | Adisseo, Alltech Inc., BASF SE, Biovet S.A., Cargill Inc., CBS Bio Platforms Inc., DSM Nutritional Products AG, Elanco Animal Health Inc., IFF(Danisco Animal Nutrition), Kerry Group PLC, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing organic meat production for enhancing the digestion and nutrient absorption in order to improve animal health and performance aids in driving the feed enzymes market. An increasing feed additive market, owing to the demand for high-quality animal protein, contributes to the market growth. Further, the growing demand for animal protein, owing to the rising awareness about animal health and nutrition, is propelling the market demand. In addition, the increasing competition among feed mills, along with the presence of a large number of livestock driving the market demand for feed enzymes.

Restraining Factors

The increased cost of production and formulation of the feed enzymes product is challenging the market. Further, the complex biotechnological processes, precise fermentation, and stringent quality control standards in the production of feed enzymes are all contributing to restraining the market growth for feed enzymes.

Market Segmentation

The Asia Pacific feed enzymes market share is classified into type, livestock, and form.

- The phytase segment held a major share of the feed enzymes market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific feed enzymes market is segmented by type into protease, phytase, and others. Among these, the phytase segment held a major share of the feed enzymes market in 2024 and is expected to grow at a significant CAGR during the forecast period. Phytase use in animal feed allows greater phosphorus absorption in animals and reduces and aids in reducing phosphorus waste production in the environment.

- The swine segment dominated the feed enzymes market in 2024 and is expected to grow at the fastest CAGR during the forecast period.

The Asia Pacific feed enzymes market is segmented by livestock into swine, poultry, ruminants, aquatic animals, and others. Among these, the swine segment dominated the feed enzymes market in 2024 and is expected to grow at the fastest CAGR during the forecast period. Feed enzymes, including carbohydrases, proteases, and phytases, are used for swine diets to improve nutrient utilization and overall animal health.

- The dry segment dominated the feed enzymes market in 2024 and is expected to grow at the fastest CAGR during the forecast period.

The Asia Pacific feed enzymes market is segmented by form into dry, liquid, and others. Among these, the dry segment dominated the feed enzymes market in 2024 and is expected to grow at the fastest CAGR during the forecast period. Benefits of the dry form of animal feed enzymes include straightforward handling, spill-free storage, and easy transportation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific feed enzymes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adisseo

- Alltech, Inc.

- BASF SE

- Biovet S.A.

- Cargill Inc.

- CBS Bio Platforms Inc.

- DSM Nutritional Products AG

- Elanco Animal Health Inc.

- IFF(Danisco Animal Nutrition)

- Kerry Group PLC

- Others

Recent Developments:

- In February 2022, the DSM/Novozymes Feed Enzymes Alliance announced the next generation of phytase, known as HiPhorius.

- In January 2022, dsm-firmenich and CPF (Thailand) have signed an MOU to implement dsm-firmenich’s recently launched sustainability service Sustell, the first of its kind, holistic animal protein sustainability service that measures and provides real data-based, independent guidance and solutions at the farm level for profitably improving the sustainability of animal protein production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Feed Enzymes Market based on the below-mentioned segments:

Asia Pacific Feed Enzymes Market, By Type

- Protease

- Phytase

- Others

Asia Pacific Feed Enzymes Market, By Livestock

- Swine

- Poultry

- Ruminants

- Aquatic Animals

- Others

Asia Pacific Feed Enzymes Market, By Form

- Dry

- Liquid

- Others

Need help to buy this report?