Asia Pacific Electric Bus Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (HEV, BEV & PHEV), By Battery (Lithium Nickel Manganese Cobalt Oxide, Lithium Iron Phosphate), By Application (Intercity, Intracity), By Country (India, China, Japan, and Rest of Asia-Pacific), and the Asia Pacific Electric Bus Market Insights Forecast to 2033

Industry: Automotive & TransportationAsia Pacific Electric Bus Market Insights Forecasts to 2033

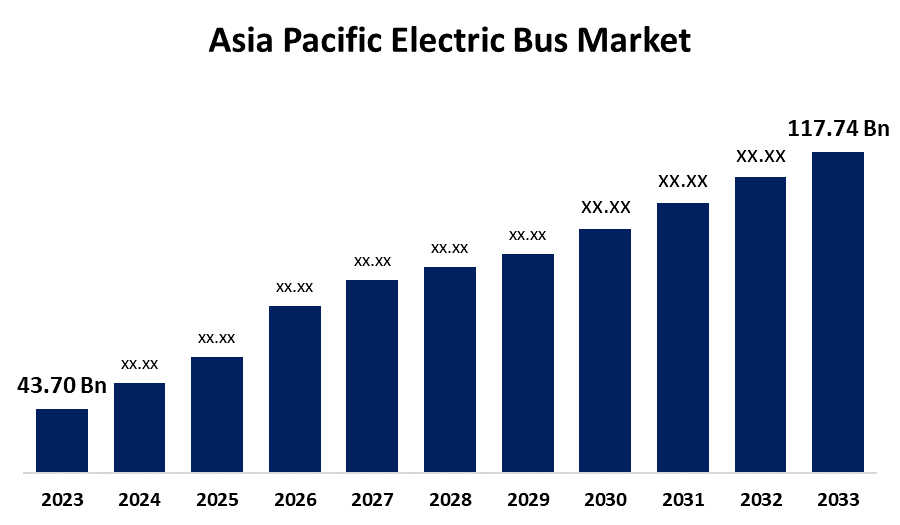

- The Asia Pacific Electric Bus Market Size was valued at USD 43.70 Billion in 2023

- The Market Size is Growing at a CAGR of 10.42% from 2023 to 2033

- The Asia Pacific Electric Bus Market Size is Expected to Reach USD 117.74 Billion by 2033

Get more details on this report -

The Asia Pacific Electric Bus Market Size is expected to reach USD 117.74 Billion by 2033, at a CAGR of 10.42% during the forecast period of 2023–2033.

Market Overview

The battery electric bus is a vehicle that is powered by electricity. In this type of vehicle, the electric motor is powered by both the onboard battery and external source stations. The process of charging electric buses is more complicated than refueling a diesel engine. The charging process must be closely monitored and attended to be optimized. It is widely used for public transportation. In contrast, an electric bus is charged at a power station by plugging it into an electric grid. The bus’s battery system stores electricity for use in the electric engine. These transportation tools require less maintenance than fuel-powered buses because their engines have fewer parts than internal combustion engines. Electric buses are regarded as sustainable solutions to the growing pollution rate because they are not only environmentally friendly but have also been proven to be more economical, especially in these unprecedented times with disruptions in the fuel supply chain. Furthermore, significant advances in battery technology have accelerated the adoption of electric buses. The development of more efficient and long-lasting batteries has alleviated range anxiety, making electric buses a viable and dependable mode of mass transportation. Furthermore, several factors have contributed to the extraordinary electric bus market growth in the Asia-Pacific region. First and foremost, robust government initiatives and policies aimed at promoting electric vehicles have laid a solid foundation for the growth of the Asia-Pacific electric bus market.

Report Coverage

This research report categorizes the market for the Asia Pacific electric bus market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific electric bus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific electric bus market.

Asia Pacific Electric Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 43.70 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.42% |

| 2033 Value Projection: | USD 117.74 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Propulsion Type, By Battery, By Application, By Country |

| Companies covered:: | Anhui Ankai Automobile Industries Co. Limited, BYD Auto Co. Limited, Tata Motors Limited, Zhongtong Bus Holding Co. Limited, King Long United Automotive Co. Limited, Volvo Group, Nanjing Jiayuan EV, Ashok Leyland Limited, Scania AB, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Environmental concerns are among the most significant drivers of the Asia-Pacific electric bus market, and government initiatives and subsidies are critical in driving it forward. As governments continue to invest in sustainable transportation solutions, the Asia-Pacific electric bus market is expected to grow, opening up opportunities for both manufacturers and operators. Furthermore, advancements in battery technology are a key driver in the Asia-Pacific electric bus market. Battery technology has advanced significantly in recent years, resulting in batteries with higher energy density, longer lifespans, and faster charging times. The Asia-Pacific region is seeing an increase in the use of electric buses due to urbanization and traffic congestion challenges. Furthermore, the cost savings associated with electric buses are propelling their adoption in the Asia-Pacific electric bus market.

Restraining Factors

These buses have a higher initial cost than conventional buses. Several governments and administrations face major obstacles in implementing e-buses in the public transportation sector. Furthermore, governments are providing subsidies for the purchase of private electric vehicles, which may have a positive impact on this market for those looking to buy commercial fleets. Furthermore, even standard e-buses cost more than twice as much as their conventional counterparts, which may hamper the Asia Pacific electric bus market growth.

Market Segment

- In 2023, the PHEV segment accounted for a significant revenue share over the forecast period.

Based on propulsion type, the Asia Pacific electric bus market is segmented into HEV, BEV, and PHEV. Among these, the PHEV segment has a significant revenue share over the forecast period. Plug-in Hybrid-Electric Vehicles (PHEVs) are hybrids that can be recharged by connecting to an electrical outlet or charging station. Under normal driving conditions, they can also store enough electricity to significantly reduce their fuel consumption. Plug-in hybrids use 30-60% less gas than traditional vehicles. Plug-in hybrids reduce oil reliance by generating electricity primarily from domestic sources.

- In 2023, the lithium iron phosphate segment is witnessing the largest growth over the forecast period.

Based on battery, the Asia Pacific electric bus market is segmented into lithium nickel manganese cobalt oxide and lithium iron phosphate. Among these, the lithium iron phosphate segment is witnessing the largest growth over the forecast period. Compared to lead-acid batteries and other lithium batteries, lithium iron manganese batteries provide several advantages, including improved discharge, charge efficiency, longer life, no maintenance, maximum safety, and lightweight design. Although LiFePO4 batteries are not the most affordable in the electric bus industry, they are a promising long-term investment in the evolving electric bus industry due to their long lifespan and low maintenance requirements.

- In 2023, the intercity segment is witnessing the largest growth over the forecast period.

Based on application, the Asia Pacific electric bus market is segmented into intercity and intracity. Among these, the lithium iron phosphate segment is witnessing the largest growth over the forecast period. The growth can be attributed to tier-I and tier-II intercity bus services account for roughly 70% of the Asia-Pacific bus market and have the highest potential for a rapid transition to electric buses. Also, high vehicle utilization, or daily km driven per bus, results in greater energy savings when switching from diesel to electric buses.

- China is projected to have the largest share of the Asia Pacific electric bus market over the forecast period.

Based on country, China is projected to have the largest share of the Asia Pacific electric bus market over the forecast period. This is because lower emissions compared to other vehicles are the primary driver of market revenue growth in this region. This is followed by rising demand for hydrogen fuel cell buses in China, which is driving market revenue growth in the country. Furthermore, advances in battery technology are increasing range and lowering costs, making electric buses more viable for public transportation, which is driving market revenue growth in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific electric bus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anhui Ankai Automobile Industries Co. Limited

- BYD Auto Co. Limited

- Tata Motors Limited

- Zhongtong Bus Holding Co. Limited

- King Long United Automotive Co. Limited

- Volvo Group

- Nanjing Jiayuan EV

- Ashok Leyland Limited

- Scania AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional and country levels from 2022 to 2033. Spherical Insights has segmented the Asia Pacific electric bus market based on the below-mentioned segments:

Asia Pacific Electric Bus Market, By Propulsion Type

- HEV

- BEV

- PHEV

Asia Pacific Electric Bus Market, By Battery

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Iron Phosphate

Asia Pacific Electric Bus Market, By Application

- Intercity

- Intracity

Asia Pacific Electric Bus Market, By Country

- India

- China

- Japan

- Rest of Asia-Pacific

Need help to buy this report?