Asia Pacific Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Almond, and Others), By Product (Milk, Yogurt, and Others), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores, and Others), and Asia Pacific Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesAsia Pacific Dairy Alternatives Market Insights Forecasts to 2035

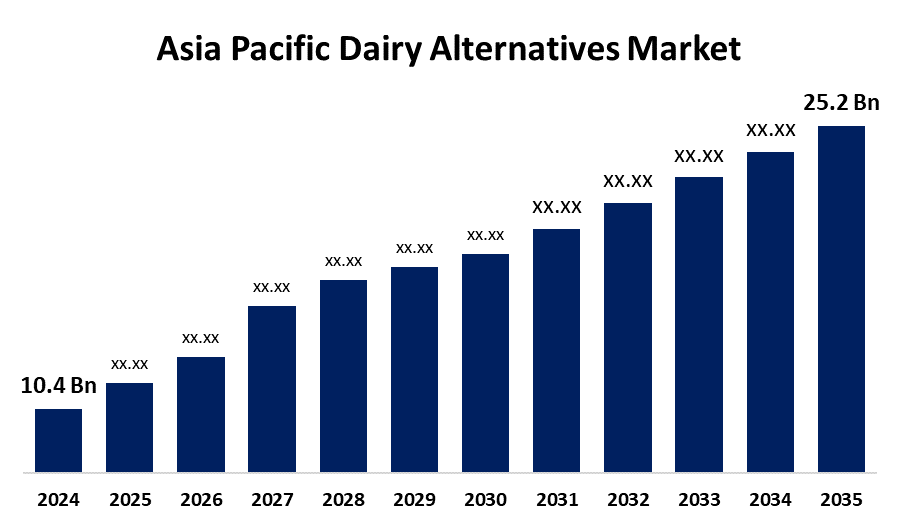

- The Asia Pacific Dairy Alternatives Market Size was estimated at USD 10.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.38% from 2025 to 2035

- The Asia Pacific Dairy Alternatives Market Size is Expected to Reach USD 25.2 Billion by 2035

Get more details on this report -

The Asia Pacific Dairy Alternatives Market is anticipated to reach USD 25.2 billion by 2035, growing at a CAGR of 8.38% from 2025 to 2035. The growing prevalence of lactose intolerance, milk allergies, and increasing vegan & flexitarian populations, along with growing awareness about animal welfare & environmental issues, are driving the dairy alternatives market in the Asia Pacific region.

Market Overview

The Asia Pacific dairy alternatives market refers to the industry of plant-based foods that substitute traditional dairy products such as milk, butter, cheese, yogurt, and ice cream, which caters to various dietary needs and preferences. Dairy alternatives are plant-based dairy that offer a wide range of options for those who are lactose intolerant, have dairy allergies, or prefer a vegan diet. The dairy alternatives market is driven by a surging trend reflecting the changing consumer attitudes towards health, sustainability, and ethical considerations. Changing consumer lifestyles, as well as people gravitating towards nutritious and healthier food options, are providing market growth opportunities for dairy alternatives.

Report Coverage

This research report categorizes the market for the Asia Pacific dairy alternatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific dairy alternatives market.

Asia Pacific Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.38% |

| 2035 Value Projection: | USD 25.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Source, By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Blue Diamond Growers, Campbell Soup Company, Coconut Palm Group Co. Ltd, Danone SA, Hebei Yangyuan Zhihui Beverage Co. Ltd, Kikkoman Corporation, Nestle SA, Oatly Group AB, Sanitarium Health and Wellbeing Company, The Hershey Company, Vitasoy International Holdings Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing prevalence of intestinal ailments, including celiac disease, carcinoid syndrome, Crohn’s disease, etc., damaging the lactase-generating cells, is driving the dairy alternatives market. The growing awareness about lactose intolerance and demand for dairy substitutes are propelling the dairy alternatives market. The growing flexitarian population, owing to the awareness of health and environmental sustainability, is contributing to driving the market for dairy alternatives. In addition, the rising awareness about animal welfare and environmental issues is significantly responsible for driving the market.

Restraining Factors

The issues associated with soy food allergies are restraining the market. Further, the limited availability of raw materials and supply chain disruptions are challenging the dairy alternatives market.

Market Segmentation

The Asia Pacific dairy alternatives market share is classified into source, product, and distribution channel.

- The soy segment dominated the market with a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific dairy alternatives market is segmented by source into soy, almond, and others. Among these, the soy segment dominated the market with a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Soy milk is a popular dairy alternative made from soybeans, often used as a substitute for cow’s milk. It is also used for making dairy-free products such as yogurt, crema, kafir, and cheese. Environmental concerns and preference for sustainable and plant-based options are contributing to driving the market in the soy segment.

- The milk segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific dairy alternatives market is segmented by product into milk, yogurt, and others. Among these, the milk segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. It includes plant-based options such as soy milk, almond milk, and oat milk, which are suitable for various dietary needs and preferences, including lactose intolerance and veganism. Health, environmental, and ethical factors are responsible for driving the dairy alternatives market in the milk segment.

- The supermarket & hypermarkets segment held a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific dairy alternatives market is segmented by distribution channel into supermarket & hypermarkets, convenience stores, and others. Among these, the supermarket & hypermarkets segment held a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Supermarket & hypermarkets are big-box stores combining a supermarket and a departmental store to offer a vast array of goods under one roof. The growing investment by international retailers in establishing a presence in the rapidly expanding market with the expanding consumer base is driving the market in the supermarket & hypermarkets segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Diamond Growers

- Campbell Soup Company

- Coconut Palm Group Co. Ltd

- Danone SA

- Hebei Yangyuan Zhihui Beverage Co. Ltd

- Kikkoman Corporation

- Nestlé SA

- Oatly Group AB

- Sanitarium Health and Wellbeing Company

- The Hershey Company

- Vitasoy International Holdings Ltd.

- Others

Recent Developments:

- In October 2022, Australia’s Bega Cheese, the dairy-to-Vegemite manufacturer, announced it had to sell its stake in the local Vitasoy Australia plant-based beverages joint venture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Asia Pacific Dairy Alternatives Market based on the below-mentioned segments:

Asia Pacific Dairy Alternatives Market, By Source

- Soy

- Almond

- Others

Asia Pacific Dairy Alternatives Market, By Product

- Milk

- Yogurt

- Others

Asia Pacific Dairy Alternatives Market, By Distribution Channel

- Supermarket & Hypermarkets

- Convenience Stores

- Others

Need help to buy this report?