Asia Pacific Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Demand (New Demand, Aftermarket), By Product (Earthmoving & Road Building Equipment, Material Handling & Cranes, Concrete Equipment, Others), By Sales Channel (Independent Dealers/Distributors, Direct Sales to Customers, Rental Companies, Online Channel, Others), By Country (China, Japan, India, South Korea, Rest of Asia Pacific), and Asia Pacific Construction Equipment Insights Forecasts to 2032

Industry: Construction & ManufacturingAsia Pacific Construction Equipment Market Insights Forecasts to 2032

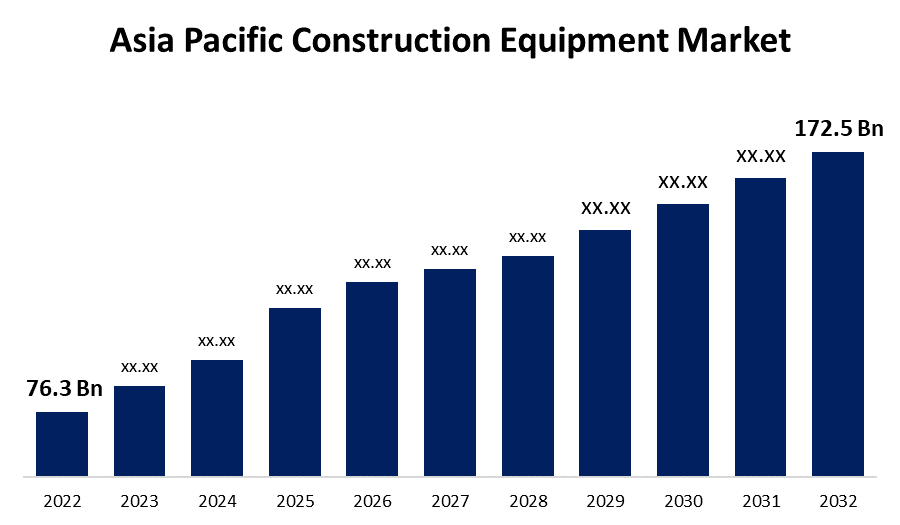

- The Asia Pacific Construction Equipment Market Size was valued at USD 76.3 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.5% from 2022 to 2032.

- The Asia Pacific Construction Equipment Market Size is expected to reach 172.5 Billion by 2032.

- India is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Asia Pacific Construction Equipment Market Size is expected to reach USD 172.5 Billion by 2032, at a CAGR of 8.5% during the forecast period 2022 to 2032.

Market Overview

Construction equipment is machinery that is specifically built to handle heavy-duty jobs in the construction and earthwork industries. Material handling, drilling, excavation, lifting, hauling, digging, paving, and grading are all examples of construction tasks that require the usage of construction equipment. There are various types of construction equipment, each with its own set of characteristics for doing specific jobs. Cranes, loaders, excavators, and dozers are among the important types of equipment. Excavators, for example, are used for excavation, cranes are used for lifting and material handling, and loaders are mostly utilized for earthmoving. Rapid urbanization, growing populations, and economic growth are accelerating the development of large-scale construction projects such as residential complexes, commercial structures, transportation networks, and energy infrastructure. Furthermore, an increasing number of favorable government programs and regulations, such as "Make in India" and the "Belt and Road Initiative," are promoting local production and global partnerships, driving demand for construction equipment even higher. Also, the introduction of new laws for the renovation and retrofitting of old building structures, fueled by continuous expenditures, will promote market growth.

Report Coverage

This research report categorizes the market for Asia Pacific Construction Equipment Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Construction Equipment Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of Asia Pacific Construction Equipment Market.

Asia Pacific Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 76.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.5% |

| 2032 Value Projection: | USD 172.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Demand, By Product, By Sales Channel, By Country and COVID-19 Impact Analysis |

| Companies covered:: | Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., J.C. Bamford Excavators Limited (JCB), Doosan Heavy Industries & Construction, Komatsu Ltd., Liebherr group, Kobe Steel, Ltd. (Kobelco), CNH Industrial, Atlas Copco, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific construction equipment market is primarily driven by the construction and infrastructure segments, which comprise residential and commercial constructions. As part of national growth and urbanization goals, the region's infrastructure is seeing government and corporate investment. Besides that, the major drivers of the market are the efforts of development projects in Asia Pacific's rural regions. Moreover, the economic stability and rising incomes of several nations have helped in the development of highways, irrigation systems, airports, and hydropower facilities in recent years, raising the demand for machinery. With the continuous expansion in those countries, the Asia Pacific construction equipment segment has developed over the years and holds a significant market share of the Asia Pacific construction equipment market. The Asia Pacific construction equipment market is being fueled by the increasing use of earthmoving machines, such as excavators and loaders, in traditional building applications due to the advantages over manual labor. These devices offer various advantages, including improved quality, better project efficiency, and cost savings.

Restraining Factors

Varying regulations and compliance standards across the region can cause difficulties in equipment deployment, influencing project timeframes and investments. Because of this disparity, specific navigation of legal frameworks may potentially slow down product demand in the Asia Pacific region. Rising oil prices and the environmental impact of carbon emissions from equipment are two main challenges that are predicted to hamper market expansion.

Market Segment

- In 2022, the aftermarket segment accounted for the largest revenue share of more than 38.5% over the forecast period.

Based on the demand, the Asia Pacific Construction Equipment Market is segmented into new demand and aftermarket. Among these, the non-flavored segment has the largest revenue share of 38.5% over the forecast period, owing to the thriving technical developments by key manufacturers. The region's rapid urbanization and infrastructure development have increased demand for construction equipment maintenance, repair, and replacement services. With construction projects growing more complicated and equipment downtime having a direct impact on project timetables, the deployment of well-maintained equipment is expanding in construction, mining, and transportation. Furthermore, the market is expected to be transformed by the paradigm shift toward digitalization and telematics technologies.

- In 2022, the earthmoving & road building equipment segment accounted for the largest revenue share over the forecast period.

On the basis of product, the Asia Pacific Construction Equipment Market is segmented into earthmoving & road building equipment, material handling & cranes, concrete equipment, and others. Among these, the earthmoving & road building equipment segment has the largest revenue share over the forecast period. The growing concern about environmental sustainability is driving the adoption of environmentally friendly equipment with lower emissions and improved fuel efficiency. Furthermore, industry participants' increasing attempts to integrate automation, GPS systems, and telematics to improve the precision and efficiency of these equipment would contribute to segment growth.

- In 2022, the direct sale to customer segment is expected to hold the largest share of the Asia Pacific set construction equipment during the forecast period.

Based on the sales channel, Asia Pacific Construction Equipment Market is classified into independent dealers/distributors, direct sales to customers, rental companies, online channels, and others. Among these, the direct sale to customer segment is expected to hold the largest share of the Asia Pacific Construction Equipment during the forecast period. The rise can be linked to an increase in the number of manufacturers selling equipment directly to end users, which helps to streamline communication, cut costs, and provide customized solutions. Furthermore, the rising emphasis on building relationships with clients has resulted in an improved awareness of their needs. The increased focus on efficiency and direct involvement will also drive segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Construction Equipment Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Caterpillar Inc.

- J.C. Bamford Excavators Limited (JCB)

- Doosan Heavy Industries & Construction

- Komatsu Ltd.

- Liebherr group

- Kobe Steel, Ltd. (Kobelco)

- CNH Industrial

- Atlas Copco

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On March 2023, Tata Hitachi, launched the new Mining Excavator ZX670H at its Kharagpur factory to meet client expectations for high durability, exceptional efficiency, easy maintenance, low operating costs, and maximum safety and comfort.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Construction Equipment based on the below-mentioned segments:

Asia Pacific Construction Equipment Market, By Demand

- New Demand

- Aftermarket

Asia Pacific Construction Equipment Market, By Product

- Earthmoving & Road Building Equipment

- Material Handling & Cranes

- Concrete Equipment

- Others

Asia Pacific Construction Equipment Market, By Sales Channel

- Independent Dealers/Distributors

- Direct Sales to Customers

- Rental Companies

- Online Channel

- Others

Asia Pacific Construction Equipment Market, By Country

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

Need help to buy this report?