Asia-Pacific Bunker Fuel Market Size, Share, and COVID-19 Impact Analysis, By Fuel Type (High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Diesel Oil (MDO), Liquefied Natural Gas (LNG)), By Vessel Type (Containers, Tankers, General Cargo, Bulk Carrier, Others), By Seller (Major Oil Companies, Leading Independent Sellers, Small Independent Sellers), By Region (India, China, Japan, and Rest of Asia-Pacific), and Asia-Pacific Bunker Fuel Market Insights Forecasts 2023 – 2033

Industry: Energy & PowerAsia-Pacific Bunker Fuel Market Insights Forecasts to 2033

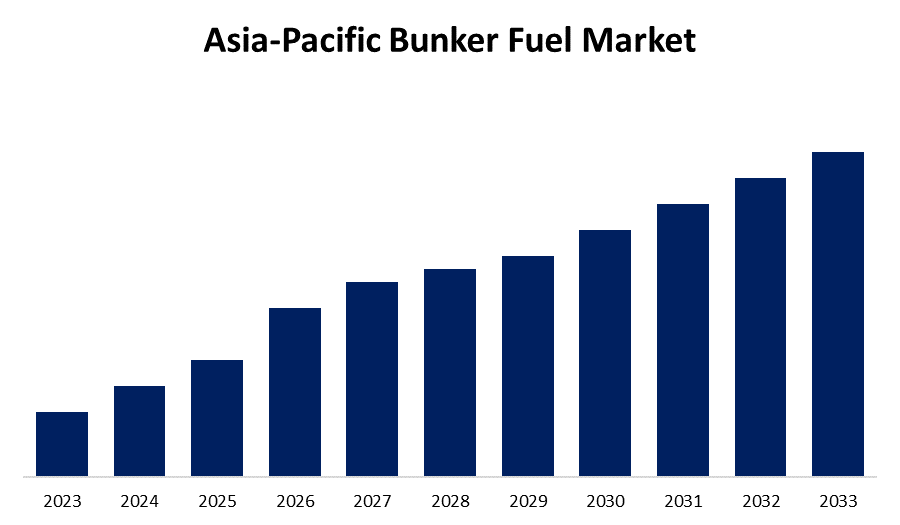

- The Market Size is Growing at a CAGR of 15.63% from 2023 to 2033.

- The Asia-Pacific Bunker Fuel Market Size Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Asia-Pacific Bunker Fuel Market size is expected to hold a significant Share by 2033, at a CAGR of 15.63% during the forecast period 2023 to 2033.

Market Overview

The term "bunker fuel" refers to any fuel delivered to ships of all nationalities engaged in international navigation. It is used by shipping companies to fuel their marine fleet and power the engines by pouring the product into the shipment's bunker. Bunker fuel is used to power engines in aircraft and ships, among other things. Bunker fuel is less expensive than other fuel options on the market. Because gasoline makes up the vast majority of the costs associated with shipping goods, businesses strive to use the cheapest fuel possible to maximize profits. Bunker fuel is typically divided into two categories: distillates and residual fuel oils. Bunker fuel is a type of fuel oil used to power maritime boats' engines. A large amount is placed in ship bunkers to keep the engines operational. The demand for bunker fuel is expected to rise as energy consumption rises, in Asia-Pacific, resulting in an increase in crude oil and natural gas trade over the projection period. The expansion of offshore oil and gas exploration operations, as well as the development of wind farms, have all contributed to the rapid growth of the Asia-Pacific bunker fuel market over the last decade.

Report Coverage

This research report categorizes the market for the Asia-Pacific bunker fuel market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia-Pacific bunker fuel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia-Pacific bunker fuel market.

Asia-Pacific Bunker Fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 15.63% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fuel Type, By Vessel Type, By Seller, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | China COSCO Holdings Company Limited, Ocean Network Express PTE Ltd, Indian Oil Corporation Limited, Chimbusco Pan Nation Petro-Chemical Co. Ltd, BP and Sinopec, Hindustan Petroleum Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Asia-Pacific's strong import and export activities, driven by the growth of industries such as manufacturing, pharmaceuticals, and automobiles, have significantly increased demand for bunker fuel. Furthermore, the Asia-Pacific government's initiatives to improve port infrastructure, such as the construction of deep-water ports and the installation of modern cargo handling facilities, have aided the growth of the Asia-pacific bunker fuel market. Rising energy consumption in Asia-Pacific, owing to population growth, urbanization, and industrial development, has increased the demand for bunker fuel for power generation in coastal areas. During forecast period, technological advancements in the maritime industry are driving Asia-Pacific bunker fuel market growth. Modern vessels are intended to be more fuel-efficient and environmentally friendly. Ships use less fuel per voyage owing to innovations such as advanced engine designs, hull optimization, and routing software. Asia-Pacific are experiencing rapid economic growth, resulting in increased production and trade activity.

Restraining Factors

The implementation of stringent environmental regulations, such as the IMO's sulfur cap, presents obstacles for the Asia-Pacific bunker fuel market. Furthermore, fluctuations in crude oil prices have a direct effect on the cost of bunker fuel. Price volatility make challenges for market participants because it affects profitability and cost competitiveness. The current price of crude oil, in addition to the rising costs associated with its transportation, may hamper market growth.

Market Segment

- In 2023, the very low sulfur fuel oil (VLSFO) segment accounted for the largest revenue share over the forecast period.

Based on fuel type, the Asia-Pacific bunker fuel market is segmented into high-sulfur fuel oil (HSFO), very low-sulfur fuel oil (VLSFO), marine diesel oil (MDO), and liquefied natural gas (LNG). Among these, the very low sulfur fuel oil (VLSFO) segment has the largest revenue share over the forecast period. The International Maritime Organization's (IMO) 2020 sulfur cap regulations required a significant reduction in sulfur content in maritime fuels. VLSFO, with a sulfur content of less than 0.5%, has emerged as the preferred choice for compliance. VLSFO provides a cleaner and more environmentally friendly alternative to high-sulfur fuel oil (HSFO) while meeting emissions standards. The VLSFO segment is expanding as shipping companies switch from HSFO to meet these regulations.

- In 2023, the tankers segment is witnessing significant growth over the forecast period.

Based on vessel type, the Asia-Pacific bunker fuel market is segmented into containers, tankers, general cargo, bulk carriers, and others. Among these, the tankers segment is witnessing significant growth over the forecast period. They come in a variety of types, including crude oil tankers, product tankers, and chemical tankers, all of which transport liquid cargo. The tanker segment has an unbreakable connection to the energy industry, as it plays an important role in the Asia-Pacific oil and gas supply chain. The demand for bunker fuel in this sector is influenced by fluctuations in oil production, crude oil prices, and the need to transport petroleum products safely and efficiently across oceans.

- In 2023, the major oil companies’ segment is witnessing the largest growth over the forecast period.

Based on seller, the Asia-Pacific bunker fuel market is segmented into major oil companies, leading independent sellers, and small independent sellers. Among these, the major oil companies’ segment is witnessing the largest growth over the forecast period. Major oil companies, also known as integrated oil and gas companies, have an important role in the energy industry. They have extensive refining and distribution networks, which enable them to produce and supply bunker fuel on a large scale. Vertical integration benefits major oil companies because it allows them to control various aspects of the supply chain, including crude oil production, refining, and distribution. This integration gives them a competitive advantage by ensuring a consistent supply of bunker fuel to meet the needs of the maritime industry.

- India is projected to have the largest share of the Asia-Pacific bunker fuel market over the forecast period.

Based on region, India is projected to have the largest share of the Asia-Pacific bunker fuel market over the forecast period. The Indian bunker fuel market encompasses the demand and supply of fuel used by ships and vessels for propulsion and power generation. Furthermore, the presence of major shipping routes, extensive shipbuilding industries, and the expansion of containerization all contribute to the market's growth. Furthermore, India is seeing advancements in cleaner and alternative bunker fuels, which are consistent with environmental sustainability goals. Strict environmental regulations are driving the transition from high-sulfur fuel oil (HSFO) to very low-sulfur fuel oil (VLSFO) and other cleaner alternatives. The commitment to reducing emissions, as well as investments in LNG bunkering infrastructure, are reshaping the Indian bunker fuel market growth during forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia-Pacific bunker fuel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China COSCO Holdings Company Limited

- Ocean Network Express PTE Ltd

- Indian Oil Corporation Limited

- Chimbusco Pan Nation Petro-Chemical Co. Ltd

- BP and Sinopec

- Hindustan Petroleum Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Asia-Pacific bunker fuel market based on the below-mentioned segments:

Asia-Pacific Bunker Fuel Market, By Fuel Type

- High Sulfur Fuel Oil (HSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

Asia-Pacific Bunker Fuel Market, By Vessel Type

- Containers

- Tankers

- General Cargo

- Bulk Carrier

- Others

Asia-Pacific Bunker Fuel Market, By Seller

- Major Oil Companies

- Leading Independent Sellers

- Small Independent Sellers

Asia-Pacific Bunker Fuel Market, By Region

- India

- China

Need help to buy this report?