Global Armored Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Platform (Combat Vehicles, Combat Support Vehicles, Unmanned Armored Ground Vehicles), By Type (Electric, Conventional), By Mobility (Wheeled, Tracked), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Aerospace & DefenseGlobal Armored Vehicles Market Size Insights Forecasts to 2032

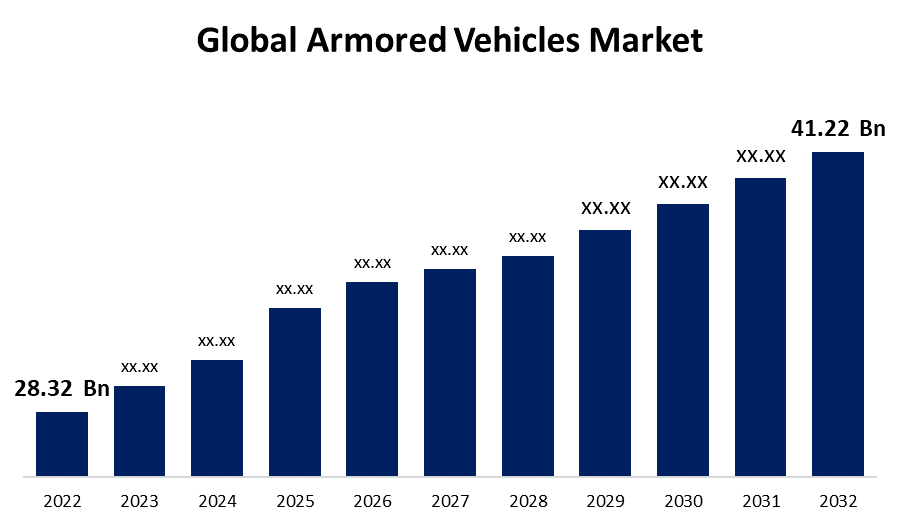

- The Global Armored Vehicles Market Size was valued at USD 28.32 Billion in 2022.

- The Market is growing at a CAGR of 3.8% from 2022 to 2032

- The Worldwide Armored Vehicles Market Size is expected to reach USD 41.22 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Armored Vehicles Market size is anticipated to exceed USD 41.22 billion by 2032, growing at a CAGR of 3.8% from 2022 to 2032. Military modernization plans around the world, the development of modular and scalable armored vehicles, and other factors are driving the market.

Market Overview

The global armored vehicle market is a dynamic and ever-changing sector of the defense and security industry. Armored vehicles, also known as military vehicles, are built to withstand a variety of threats, including ballistic, mine, and improvised explosive device (IED) attacks. These vehicles are critical in modern warfare, counter-insurgency operations, peacekeeping missions, and law enforcement operations. Several factors are driving the armored vehicle market, including geopolitical tensions, increased terrorist activity, regional conflicts, and the need to modernize defense forces. Governments around the world make significant investments in the acquisition and development of armored vehicles to ensure the safety and security of their armed forces and personnel. Technology advancements have resulted in the development of more sophisticated and versatile armored vehicles with cutting-edge materials, enhanced ballistic protection, and advanced communication systems. Furthermore, there is a growing trend toward the incorporation of unmanned systems and autonomous capabilities in armored vehicles, which provides enhanced situational awareness and operational effectiveness.

Report Coverage

This research report categorizes the market for the global armored vehicles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the armored vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the armored vehicles market.

Global Armored Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 28.32 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.8% |

| 2032 Value Projection: | USD 41.22 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Platform, By Type, By Mobility, and By Region |

| Companies covered:: | BAE Systems, BMW AG, Daimler AG (Mercedes Benz), Elbit Systems, Ford Motor Company, General Dynamics Corporation, INKAS Armored Vehicle Manufacturing, International Armored Group, IVECO, Krauss-Maffei Wegmann GmbH & Co. (KMW), Lenco Industries, Inc., Lockheed Martin Corporation, Navistar, Inc., Oshkosh Defense, LLC, Others, and Key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the armored vehicle market is global geopolitical tensions and ongoing conflicts. Increased security threats and regional insecurity force nations to strengthen their defense capabilities, resulting in increased investments in armored vehicles for their armed forces. Conflicts in the Middle East, Asia, and other regions have contributed significantly to the increased demand for armored vehicles. Defense forces strive to modernize their equipment in order to remain prepared and effective in the face of technological advancements and evolving threat scenarios. Global procurement initiatives are being driven by the need to replace aging fleets and outdated vehicles with more technologically advanced and capable armored vehicles.

Restraining Factors

Budgetary constraints faced by governments, particularly in developing countries, are one of the primary restraints for the armored vehicle market. The high costs of designing, developing, and procuring advanced armored vehicles can limit nations' ability to invest in significant fleet modernization.

Market Segmentation

The Global Armored Vehicles Market share is classified into level of platform, type, and mobility.

- The combat vehicles segment is expected to hold the largest share of the global armored vehicles market over the forecast period.

The global armored vehicles market is categorized by platform into combat vehicles, combat support vehicles, and unmanned armored ground vehicles. Among these, the combat vehicles segment is expected to hold the largest share of the global armored vehicles market over the forecast period. Many defense forces around the world rely on main battle tanks, infantry fighting vehicles, and other combat vehicles. Nations invest heavily in ground combat capabilities, ensuring that they have modern, capable, and well-equipped armored forces to defend their territories and interests.

- The conventional segment accounted for the largest share of the global armored vehicles market in 2022.

Based on the type, the global armored vehicles market is divided into electric, conventional. Among these, the conventional segment accounted for the largest share of the global armored vehicles market in 2022. Conventional armored vehicles have a long history and a proven track record on the battlefield, making them the preferred option for many defense forces. While electric armored vehicles and hybrid technologies are gaining popularity due to environmental concerns and advances in electric vehicle technology, their adoption in the armored vehicle market has been slower.

- The wheeled segment is expected to lead the global armored vehicles market during the forecast period.

Based on the mobility, the global armored vehicles market is divided into wheeled, tracked. Among these, the wheeled segment is expected to lead the global armored vehicles market during the forecast period. Wheeled armored vehicles have gained popularity in some roles, such as reconnaissance and urban warfare. Wheeled armored vehicles are preferred for scenarios requiring high speed, rapid deployment, and low logistical demands, such as peacekeeping and counter-insurgency operations.

Regional Segment Analysis of the Global Armored Vehicles Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America holds the largest share of the global armored vehicles market in 2022.

Get more details on this report -

North America holds the largest share of the global armored vehicles market in 2022. North America is a market leader in armored vehicles, owing to significant defense spending by the United States, which has one of the world's largest militaries. The demand for armored vehicles in the region is driven primarily by ongoing military modernization programs, counter-terrorism efforts, and the need to replace aging fleets. The United States Department of Defense makes significant investments in advanced combat systems such as main battle tanks, infantry fighting vehicles, and armored personnel carriers.

Asia Pacific is expected to grow at the fastest pace in the global armored vehicles market during the forecast period. The Asia-Pacific region is experiencing rapid growth in the armored vehicle market as a result of rising defense budgets, geopolitical challenges, and territorial disputes. Countries such as China, India, and South Korea are major players in the region, investing heavily in armored vehicles to improve their military capabilities. In addition, the presence of ongoing conflicts in some parts of Asia drives demand for modernized armored forces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global armored vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companie

- BAE Systems

- BMW AG

- Daimler AG (Mercedes Benz)

- Elbit Systems

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- IVECO

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

- Lockheed Martin Corporation

- Navistar, Inc.

- Oshkosh Defense, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, The US Army Contracting Command Detroit Arsenal awarded A.M. General a contract to manufacture 20,000 Joint Tactical vehicles and approximately 10,000 trailers for the US Armed Forces. The contract's total value is not stated.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Armored Vehicles Market based on the below-mentioned segments:

Global Armored Vehicles Market, By Platform

- Combat Vehicles

- Combat Support Vehicles

- Unmanned Armored Ground Vehicles

Global Armored Vehicles Market, By Type

- Electric

- Conventional

Global Armored Vehicles Market, By Mobility

- Wheeled

- Tracked

Global Armored Vehicles Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?