Global Aquaculture Disinfectants Market Size, Share, and COVID-19 Impact Analysis, By Type (Oxidizing Disinfectants, Non-Oxidizing Disinfectants, Aldehyde Disinfectants, Halogen Disinfectants, and Others), By Application (Fish Farming, Shrimp Farming, Mollusk Farming, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Aquaculture Disinfectants Market Insights Forecasts to 2035

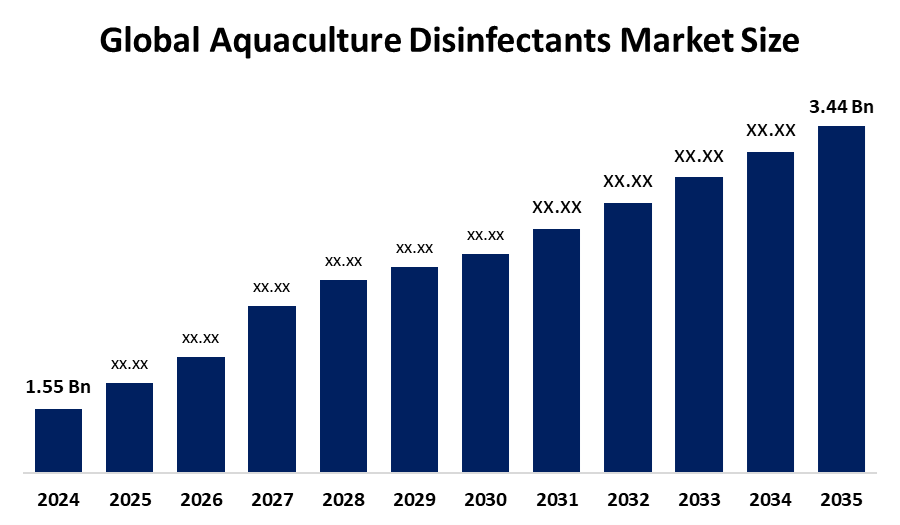

- The Global Aquaculture Disinfectants Market Size Was Estimated at USD 1.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.52 % from 2025 to 2035

- The Worldwide Aquaculture Disinfectants Market Size is Expected to Reach USD 3.44 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global aquaculture disinfectants market size was worth around USD 1.55 billion in 2024 and is predicted to grow to around USD 3.44 billion by 2035 with a compound annual growth rate (CAGR) of 7.52 % from 2025 to 2035. The aquaculture disinfectants market offers potential through expanding fish farming activities, rising biosecurity awareness, technological breakthroughs in eco-friendly formulations, and increasing regulatory focus on disease prevention to enhance production efficiency and sustainability.

Market Overview

The aquaculture disinfectants industry is a worldwide market that deals with the production, distribution, and usage of agents (chemical, biological, and eco-friendly) to help the aquaculture environments stay clean and safe. The disinfectants used for controlling, preventing big and microscopic organisms that are harmful to the totally geeky aquatic species, i.e., fish and the like, grown in aquafarms, hatcheries, lakes, and other water systems are the worst. This market supports biosecurity in intensive aquaculture operations and is the reason why so much sustainable production still goes on in times when the diseases are on the rise. The National Aquaculture Development Plan (December 2024) underscores disease prevention as key to food security, while the Marine Aquaculture Research for America Act (MARA Act, August 2025) funds new biosecurity technologies. Among recent advances, an eco-friendly chlorine-based disinfectant compliant with USDA and included in NOAA’s 2025 Strategic Plan has been launched, promising safer, sustainable marine farming. One of the key growth factors driving the aquaculture disinfectants market is the development of aquaculture output to suit the increasing worldwide demand for seafood. Regulatory organizations and industry associations have also developed severe biosecurity rules, further promoting the adoption of aquaculture disinfectants.

Report Coverage

This research report categorizes the aquaculture disinfectants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Aquaculture Disinfectants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Aquaculture Disinfectants market.

Global Aquaculture Disinfectants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.55 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.52% |

| 2035 Value Projection: | USD 3.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Bayer AG CID Lines NV Evonik Industries AG Kemin Industries, Inc. LANXESS AG Merck Animal Health Neogen Corporation Sanosil AG Shandong Huayang Technology Co., Ltd. Solvay S.A. Stepan Company Taminco Corporation Thermo Fisher Scientific Inc. Zoetis Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for seafood worldwide, the intensification of aquaculture operations, and the growing regulatory requirements for upholding hygienic farming conditions are the primary factors driving this market's growth. The remarkable growth is supported by growing awareness of the vital role that disease prevention and water quality management play, as well as the quick adoption of cutting-edge aquaculture technology in both developed and developing countries. Technological developments and product innovation are also essential in defining the growth trajectory of the aquaculture disinfectants market. Additionally, the proliferation of commercial aquaculture operations, notably in Asia Pacific and Latin America, is producing increasing demand for aquaculture disinfectants.

Restraining Factors

High product costs, low awareness in developing nations, possible environmental effects of chemical residues, strict regulatory approvals, and the availability of alternative disease-control techniques that lessen reliance on traditional disinfectant formulations are some of the primary challenges facing the aquaculture disinfectants market.

Market Segmentation

The aquaculture disinfectants market share is classified into type and application

- The oxidizing disinfectants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the aquaculture disinfectants market is divided into oxidizing disinfectants, non-oxidizing disinfectants, aldehyde disinfectants, halogen disinfectants, and others. Among these, the oxidizing disinfectants segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Aquaculture systems utilize oxidizing disinfectants such as hydrogen peroxide and peracetic acid extensively for water, sanitation, and equipment sterilization. These oxidizing disinfectants are the operators' choice in aquaculture due to their capability to rapidly decompose organic matter and to prevent the buildup of residues.

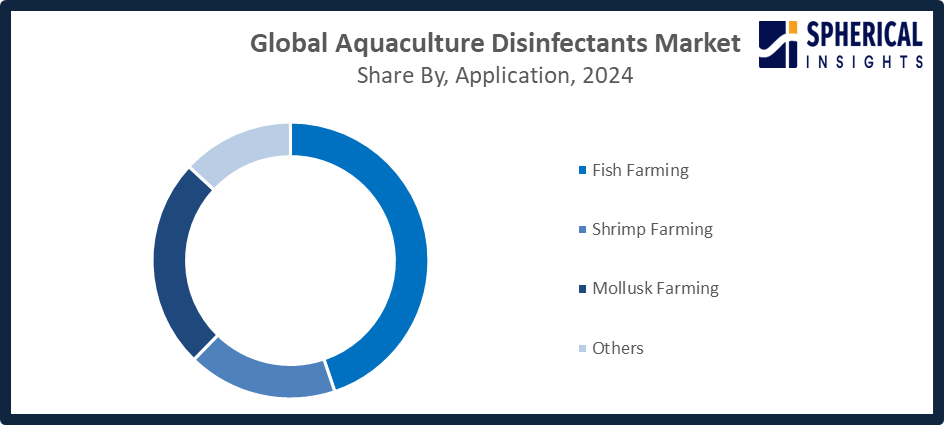

- The fish farming segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the aquaculture disinfectants market is divided into fish farming, shrimp farming, mollusk farming, and others. Among these, the fish farming segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The fish farming industry, which benefits from finfish production's supremacy in the global aquaculture market, is the major consumer of disinfectants within the aquaculture industry. The market for new disinfection solutions is expected to be bolstered by the trend towards intensive and super-intensive fish farming operations, thus driving the demand.

Get more details on this report -

Regional Segment Analysis of the Aquaculture Disinfectants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the aquaculture disinfectants market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the aquaculture disinfectants market over the predicted timeframe. The Asia Pacific region is largely identified with its extensive aquaculture production, which is mainly concentrated in China, India, Vietnam, and Indonesia. The fast growth of the commercial fish and shrimp farming sector, along with the modern aquaculture infrastructure investment, is creating a future more resilient through advanced disinfectants, is the trend resulting in high demand for sophisticated disinfectants. The production of this area is foreseen to be around 177 million tonnes in 2025, while the total aquaculture output of the world is predicted to be 197 million tonnes. The latest innovations are characterized by raising the bar for disinfection by presenting biodegradable, iodine-based disinfectants that comply with ASEAN standards, supported by the Chinese government's aquaculture USD 1.2 million subsidy in 2025, as per the Ministry of Agriculture data, and fostering resilience to the disease and thus growing the export.

North America is expected to grow at a rapid CAGR in the aquaculture disinfectants market during the forecast period. The increasing emphasis on biosecurity, sustainability, and regulation compliance in aquaculture has been the driving force behind North America's development. The United States and Canada are investing heavily in the renovation of aquaculture facilities with the federal government’s strong support that promotes the adoption of disease prevention technology and the use of environmentally friendly cultivation practices.US government initiatives include NOAA's Aquaculture Strategic Plan update (April 2025), which invests USD 30 million in sustainable practices, and USDA Agricultural Research Service's Aquaculture National Program Action Plan 2025-2029, which allots USD 50 million for biosecurity technologies. Canada's 2025 Budget offers C$80.5 million for modernization via a new Strategic Exports Office.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aquaculture disinfectants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- CID Lines NV

- Evonik Industries AG

- Kemin Industries, Inc.

- LANXESS AG

- Merck Animal Health

- Neogen Corporation

- Sanosil AG

- Shandong Huayang Technology Co., Ltd.

- Solvay S.A.

- Stepan Company

- Taminco Corporation

- Thermo Fisher Scientific Inc.

- Zoetis Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, the U.S. government launched key aquaculture initiatives, including the USDA’s National Program 108 Food Safety Retrospective and Minnesota’s State Aquaculture Plan , promoting pathogen control and 20% production growth.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aquaculture disinfectants market based on the below-mentioned segments:

Global Aquaculture Disinfectants Market, By Type

- Oxidizing Disinfectants

- Non-Oxidizing Disinfectants

- Aldehyde Disinfectants

- Halogen Disinfectants

- Others

Global Aquaculture Disinfectants Market, By Application

- Fish Farming

- Shrimp Farming

- Mollusk Farming

- Others

Global Aquaculture Disinfectants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?