Global Aortic Valve Replacement Devices Market Size, Share, Trends Analysis, COVID-19 Impact Analysis Report, By Surgery (Open, Minimally Invasive), By Product (Transcatheter Aortic Valve, Sutureless Valve), By End-user, And Analysis and Forecast 2021 – 2030

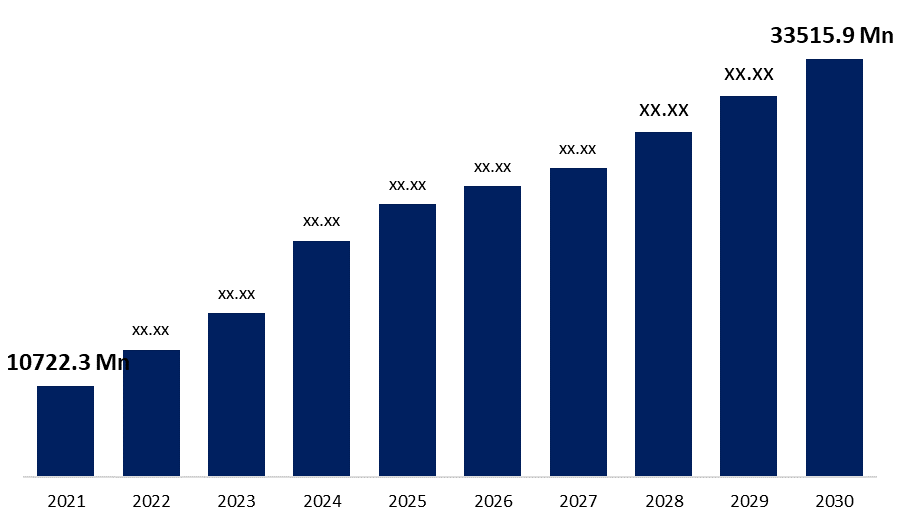

Industry: HealthcareGlobal Aortic Valve Replacement Market Size: Information By, Surgery Type, By End-Use, By Regional Analysis and Forecasts Till 2030. The Global Aortic Valve Replacement Market to grow at USD 33515.9 million by 2030 with a CAGR of 13.5% from the early figures of USD 10722.3 million in 2021.

Get more details on this report -

MARKET OVERVIEW

The aortic valve replacement market is primarily driven by the rising prevalence of valvular illnesses such as aortic stenosis and aortic regurgitation, as well as technological advances in the heart valve industry. Aortic stenosis is the most prevalent valvular disorder among the elderly people. Thus, the increasing number of older individuals is a major factor in the expansion of the aforementioned market segment.

MARKET DRIVERS FOR THE GLOBAL AORTIC VALVE REPLACEMENT MARKET –

The increased frequency of valvular disorders and measures to raise awareness of valve replacement with favourable reimbursements are the primary growth drivers for the market.

Aortic stenosis and aortic regurgitation are the most common causes of cardiac surgery and heart valve replacement. Huge number of people are at risk for aortic stenosis as a result of the increase in aortic issues. Approximately 2.5 million adults in the United States over the age of 75 have aortic stenosis, according to a report. This indicates that approximately 12.4% of the population is affected by aortic stenosis. By 2050, it is estimated that there will be 80 million older adults, which is more than double the current number.

Aortic regurgitation is an additional valve disorder requiring surgical treatment (Aortic Valve Replacement, or AVR). The prevalence of this illness increases with age. Consequently, the ageing population is a significant factor in the market's expansion. Aortic regurgitation is typically the result of rheumatic heart disease. Rheumatic heart disease is a form of persistent inflammation of the heart. According to the WHO, around 2% of patients with cardiovascular diseases (CVDs) have rheumatic heart disorders. Consequently, the increasing prevalence of rheumatic heart disease is anticipated to have a beneficial impact on the market during the next few years.

With the new procedures and treatment options available to cure or operate on a patient, more individuals are becoming aware of them and receiving referrals to specialists who can provide superior care. On the basis of Medicare and Medicaid data, the number of adults over the age of 65 with aortic stenosis has increased rapidly, from 2,500 in 1989 to over 3,200 in 2011. The increased number of aortic valve procedures performed on older patients will be one of the primary factors driving the aortic valve replacement industry over the next few years.

Global Aortic Valve Replacement Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 10722.3 Million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 13.5% |

| 2030 Value Projection: | USD 33515.9 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | COVID-19 Impact Analysis Report, Information By, Surgery Type, By End-Use, By Regional |

| Companies covered:: | Boston Scientific Corporation, Cryolife Inc., Liva Nova PLC, Medtronic, Abbott, Symetis SA, etc. |

| Growth Drivers: | The increased frequency of valvular disorders and measures to raise awareness of valve replacement with favourable reimbursements are the primary growth drivers for the market |

| Pitfalls & Challenges: | Market expansion might be inhibited by product recalls prompted by safety concerns. |

Get more details on this report -

Initiatives to raise awareness of the valve replacement process are proven to be a significant motivator.

TAVR is typically superior to surgery for replacing a heart valve than AVR. Thus, a variety of methods are employed to disseminate the news about TAVR. This registry has been approved by CMS and provides information regarding patient health and replacement and repair guidelines. Valve for Life was initiated by the European Association of Percutaneous Cardiovascular Interventions in 2015. The objective of this research was to facilitate Transcatheter valve treatments for Europeans. This effort seeks to increase knowledge of valvular illnesses, expand access to TAVR for patients, improve the education of healthcare professionals, reduce gender and age discrimination in access to care, and eliminate barriers to therapy implementation. Numerous clinical studies are being conducted by market leaders in order to broaden the spectrum of therapies, examine the safety of devices, and determine what other treatment choices are available and how long individuals live.

In addition to this, one of the most important factors anticipated to drive the market in the approaching years is the implementation of effective insurance and reimbursement policies. For instance, the Centers for Medicare & Medicaid Services (CMS) stated that the Medicare National Coverage Determination policy would cover transcatheter aortic valve replacement (TAVR). Varying insurance companies have different reimbursement rates for various procedures. Replacement of a heart valve is a serious medical condition. The amount of reimbursement depends on the amount of coverage purchased. Such advantages and other factors that raise awareness about it are unquestionably driving market growth.

GLOBAL AORTIC VALVE REPLACEMENT MARKET RESTRAINTS –

Market expansion might be inhibited by product recalls prompted by safety concerns.

This market suffers as a result of the recall of these valves. There are stringent guidelines for the approval of items. Because they are used to treat life-threatening illnesses, it is crucial that these products are safe. The Lotus line of heart valves manufactured by Boston Scientific Corporation will be removed from the market due to concerns with the way they lock. Medtronic stated that it was recalling the Medtronic 3f Enable Aortic Bio-prosthesis due to issues with the instructions on how to utilize it. In the foreseeable future, if rules change, the approval procedure could become more stringent, hence reducing product recalls.

OPPORTUNITIES IN THE GLOBAL AORTIC VALVE REPLACEMENT MARKET

The advent of sutureless valves presents enormous prospects for growth in the worldwide aortic valve replacement industry.

Transcatheter aortic valves are widely utilised since more individuals desire minimally invasive procedures. More research and development is being conducted on Transcatheter valves, and more people are learning about TAVR around the world. Numerous clinical studies have been conducted by market leaders to assess the safety, efficacy, and variety of therapies. Even though sutureless valves are not extensively used, they present a substantial growth possibility due to their many advantages.

Sutureless valves exhibit favourable hemodynamic and post-surgery outcomes, as well as reduced mortality. On the market are only three suture-free valves: the Enable 3F, the Perceval, and the Edwards Intuity Valve System. However, a number of sutureless valves are currently in development, which could contribute to the expansion of the field of sutureless valves. Tissue and mechanical valves comprise the remaining valves. There are several of these valves on the market, but their growth is constrained by the introduction of new technologies like as TAVR. Developing economies have more room for growth with mechanical and tissue heart valves, generating enormous opportunities.

SEGMENTAL ANALYSIS OF THE GLOBAL AORTIC VALVE REPLACEMENT MARKET –

The market for aortic valve replacement is categorised based on operation type and end-use.

In terms of surgery, the aforementioned market is subdivided into Minimally Invasive Surgery and Open Surgery, with Minimally Invasive Surgery holding the largest market share.

Minimally Invasive Surgery - Minimally Invasive Surgery is the largest segment in the surgery type segmentation, accounting for USD 5838 million in 2021 and predicted to reach USD 21859.5 million by 2030 at a CAGR of 15.8%.

It is a potential substitute for SAVR. Mini-thoracotomy, mini-sternotomy, and TAVR are examples of procedures that utilise minimally invasive surgery. The majority of patients choose these procedures since they inflict less harm to the body and accelerate recovery. As sutureless heart valves become more prevalent, minimally invasive procedures will undoubtedly increase. Using sutureless valves has reduced the death rate during minimally invasive aortic valve replacement surgery from 1.6% to 0.4%. A sutureless prosthesis could serve as an alternative to TAVR for individuals at high risk.

Open Surgery –

An option for replacing the aortic valve in cases of aortic valve stenosis or aortic valve regurgitation is open surgery. During this procedure, the damaged valve is removed and either a mechanical or a tissue valve is inserted in its place. Open surgery represents a substantial portion of the industry with a CAGR of 7.9%, which is an impressive development rate.

The end-user segmentation of the aforementioned market consists of hospitals and ambulatory surgery centres, with hospitals dominating.

Hospitals – The hospital segment in the by end-use category will generate a market value of USD 3,953 million in 2021, which will increase to USD 11,410 million by 2030 at a CAGR of 12.5%. The gold standard for replacing heart valves is open surgery to replace the aortic valve. Open operations are more complex and take longer to recuperate than minimally invasive surgeries. The majority of hospitals in poor nations provide primary health care. Consequently, this sector is anticipated to have the greatest market revenue share in the coming years.

Ambulatory Surgical Centres –

The number of ambulatory surgery centres is increasing in developed regions since TAVR is a new procedure that is replacing open surgery. The transcatheter aortic valve replacement (TAVR) is a minimally invasive procedure that may be performed at surgical centres since it is less difficult and requires less time to perform and recover from. Thus, the primary factor driving the market for ambulatory surgery centres is the increasing population, which contributes to the expansion of the aforementioned segment at a rate of 14%.

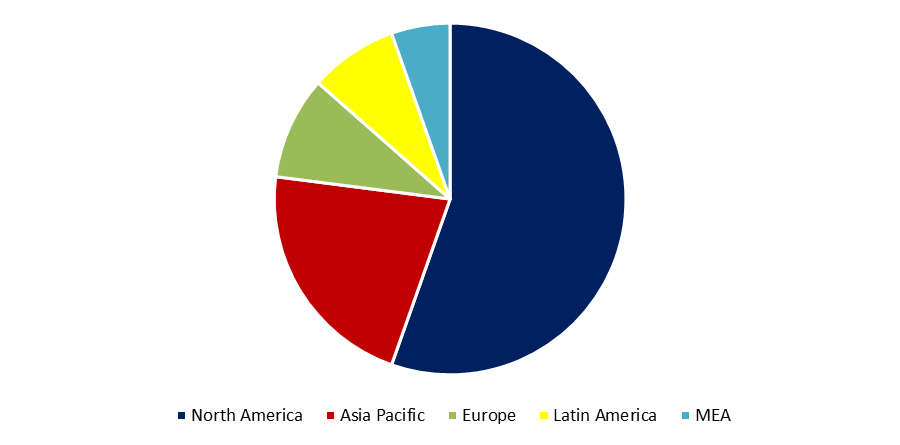

REGIONAL ANALYSIS OF THE GLOBAL AORTIC VALVE REPLACEMENT MARKET –

The global aortic valve replacement market is generally classified into three regions, namely North America, Europe, and Asia-Pacific, with Europe having the largest market share and leading the regional segmentation for this industry.

Get more details on this report -

North America — North America is the second-leading region in terms of aortic valve replacement market revenue creation, after Europe. As the region with the most modern healthcare facilities, North America is expected to experience a significant growth rate of 10.3% throughout the projection period.

Europe – Europe leads the global aortic valve replacement market with a value of USD 3,553,4 million in 2021 and is projected to reach USD 9,117,2 million by 2030, expanding at a CAGR of 11.1%. The high prevalence of aortic stenosis, the advent of viable treatments such as transcatheter aortic valve replacement (TAVR), and increased efforts to raise awareness about valve replacement surgeries are some of the primary factors contributing to the market's expansion in this region.

Asia-Pacific – The Asia-Pacific region ranks third on the list with a CAGR of 13.7% from 2021 to 2030, indicating that it has the highest growth rate of all regions. With this development rate, the Asia-Pacific region will soon dominate the global aortic valve replacement market in terms of revenue creation and assume the market leadership.

MAJOR COMPETITORS IN THE GLOBAL AORTIC VALVE REPLACEMENT MARKET –

The major key players in the global aortic valve replacement market are – Boston Scientific Corporation, Cryolife Inc., Liva Nova PLC, Medtronic, Abbott, Symetis SA, etc.

Recent developments in the market by key players–

- In February of 2022, Boston Scientific Corporation finalized its acquisition of Baylis Medical Company, a provider of innovative transseptal access technologies.

- In April 2022, Liva Nova PLC launched the Essenz Patient Monitor for Cardiopulmonary Bypass Procedures commercially.

- In May of 2022, Medtronic and DaVita announced their collaboration to form a new renal health technology firm.

SEGMENTATION OF THE GLOBAL AORTIC VALVE REPLACEMENT MARKET -

By Surgery Type –

- Minimal Invasive Surgery

- Open Surgery

By End-Use –

- Hospital

- Ambulatory Surgical Centres

By Region –

- North America

- Europe

- Asia-Pacific

Need help to buy this report?