Global Anti-infective Agents Market Size, Share, and COVID-19 Impact Analysis, By Type (Antibacterial, Antiviral, Antifungal & Antiparasitic, and Others), By Route of Administration (Oral, Parenteral, Topical, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Anti-infective Agents Market Size Insights Forecasts to 2035

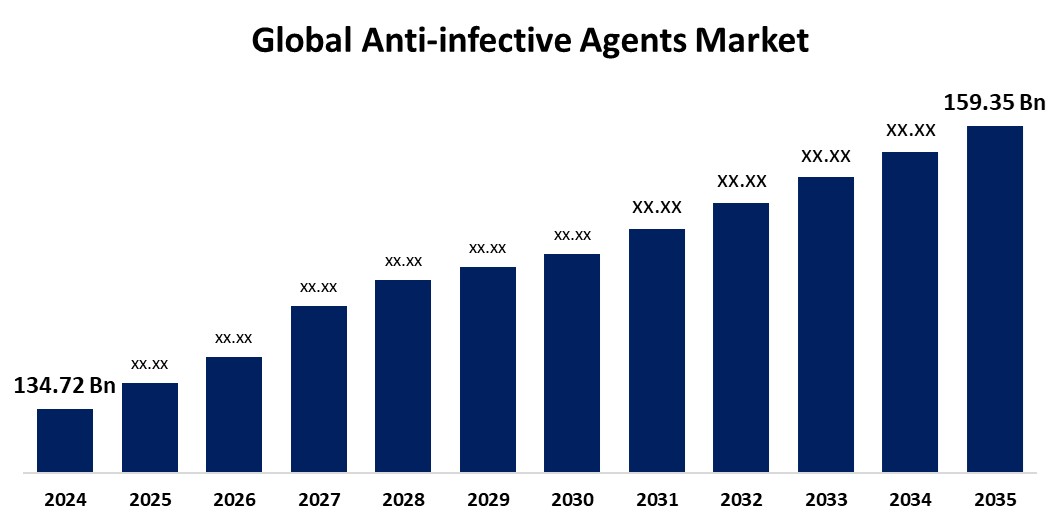

- The Global Anti-infective Agents Market Size Was Estimated at USD 134.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.54% from 2025 to 2035

- The Worldwide Anti-infective Agents Market Size is Expected to Reach USD 159.35 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Anti-Infective Agents Market Size was worth around USD 134.72 billion in 2024 and is predicted to grow to around USD 159.35 billion by 2035 with a compound annual growth rate (CAGR) of 1.54% from 2025 to 2035. The market growth is boosted by the rising health awareness, global disease burden, and advanced therapeutic innovations. Collaborative R&D, accelerated approvals, and evolving technologies like mRNA are shaping its future.

Market Overview

The Anti-Infective Agents Market Size refers to a class of medications that suppress muscular contractions. Particularly in the gastrointestinal tract, these medications aid in the promotion of smooth muscle relaxation. In general, antispasmodic drugs address symptoms including cramping and stomach pain. They are most frequently used to treat the symptoms of irritable bowel syndrome.

The market for anti-infective medications is expanding significantly as a result of leading companies' smart product releases and expanded awareness campaigns. This momentum is being driven by businesses like Pfizer and Xellia Pharmaceuticals, which are utilizing new manufacturing capabilities and awareness campaigns. The market is also being driven by an increase in infectious disease cases and a growing need for efficient treatments. Innovation and growth are also aided by regulatory approvals, such as Nabriva Therapeutics' Xenleta. Drug development is being improved by ongoing R&D investments. All things considered, it is anticipated that these variables would significantly drive the market throughout the course of the forecast year.

Report Coverage

This research report categorizes the anti-infective agents market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anti-infective agents market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anti-infective agents market.

Global Anti-infective Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 134.72 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.54% |

| 2035 Value Projection: | USD 159.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Route of Administration, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Pfizer Inc., Boehringer Ingelheim, Merck & Co., Inc., B. Braun SE, Gilead Sciences, Inc., Mankind Pharma, AbbVie, Xellia Pharmaceuticals, Bristol-Myers Squibb, Bayer AG, AstraZeneca, Sandoz International GmbH, Sanofi, Novartis AG, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the growing global health consciousness and the incidence of infectious diseases. R&D efforts are being accelerated by public-private collaborations, healthcare investments, and government backing. As a catalyst, the COVID-19 pandemic accelerated medicine approvals and spurred innovation. Demand is also increased by the continued facilitation of pathogen spread by urbanization, international travel, and climate change. The future of anti-infective treatment is being shaped by developments in therapeutic techniques, such as mRNA technology. These elements working together are setting up the market for long-term growth and innovation.

Restraining Factors

The market growth is hindered by the lack of qualified workers and unfavorable drug side effects, which could impede expansion. Drug use and market growth are further constrained by regulatory constraints. Significant growth potential is presented by continual innovations, new launches, and strategic advancements, notwithstanding these obstacles. Thorough market research is still essential for successful decision-making in the future.

Market Segmentation

The anti-infective agents market share is classified into type, route of administration, and distribution channel.

- The antiviral segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the anti-infective agents market is classified into antibacterial, antiviral, antifungal & antiparasitic, and others. Among these, the antiviral segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the antiviral medications, which are mainly employed in the treatment and prevention of viral diseases like influenza, HIV, hepatitis, and, more recently, COVID-19, and are essential parts of the market for anti-infective agents. This market has grown significantly as a result of the rise in viral infections worldwide, especially the emergence of novel strains and pandemics. As a result, demand for antiviral drugs is rising, and new therapeutic applications are emerging.

- The oral segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the route of administration, the anti-infective agents market is divided into oral, parenteral, topical, and others. Among these, the oral segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Ibrexafungerp and fluconazole are two examples of products that provide simple, focused therapy alternatives. However, certain medication interactions limit their use. Developments in this market are being driven by a robust product pipeline and ongoing innovation.

- The hospital pharmacies segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the anti-infective agents market is classified into hospital pharmacies, retail pharmacies, and others. Among these, the hospital pharmacies segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increase in hospital admissions worldwide. Patients choose hospitals because they provide complete patient treatment, timely reimbursement, and advantageous insurance coverage. Hospital pharmacies are typically found at large medical institutions with state-of-the-art medical amenities, such as critical care units or infectious disease departments, where patients with dangerous infections are treated.

Regional Segment Analysis of the Anti-infective Agents Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the anti-infective agents market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the anti-infective agents market over the predicted timeframe. This is attributed to the modern healthcare infrastructure and rising awareness among clinicians and healthcare workers. The market is anticipated to be driven by robust government initiatives to increase public health awareness, support immunization programs, encourage infection prevention, and promote responsible use of antibiotics. Further, advantageous reimbursement policies and high purchasing power for pricey drugs are supporting the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the anti-infective agents market during the forecast period. The region's growth is being driven by the significant investments in R&D due to the increased incidence of infectious diseases. To fight resistant diseases, businesses are aggressively creating new antibiotics and antivirals. This innovative tendency is emphasized by strategic partnerships, such as the Eisai-Sato agreement for fosravuconazole. It is anticipated that these initiatives would increase treatment alternatives and quicken market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the anti-infective agents market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Boehringer Ingelheim

- Merck & Co., Inc.

- B. Braun SE

- Gilead Sciences, Inc.

- Mankind Pharma

- AbbVie

- Xellia Pharmaceuticals

- Bristol-Myers Squibb

- Bayer AG

- AstraZeneca

- Sandoz International GmbH

- Sanofi

- Novartis AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Shionogi & Co. announced that the Center for Drug Evaluation in China has accepted its New Drug Application (NDA) for cefiderocol, a new siderophore cephalosporin antibiotic. Cefiderocol targets gram-negative bacteria, including multidrug-resistant ones, and has shown better efficacy in a Phase III trial than imipenem/cilastatin.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the anti-infective agents market based on the below-mentioned segments:

Global Anti-infective Agents Market, By Type

- Antibacterial

- Antiviral

- Antifungal & Antiparasitic

- Others

Global Anti-infective Agents Market, By Route Of Administration

- Oral

- Parenteral

- Topical

- Others

Global Anti-infective Agents Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Global Anti-infective Agents Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?