Global Anti-Corrosion Coating Market Size, Share, and COVID-19 Impact Analysis, By Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, and Others), By Technology (Solvent borne, Waterborne, Powder-based, and Others), By End-Use Industry (Marine, Oil & Gas, Industrial, Infrastructure, Power Generation, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Chemicals & MaterialsGlobal Anti-Corrosion Coating Market Insights Forecasts to 2032

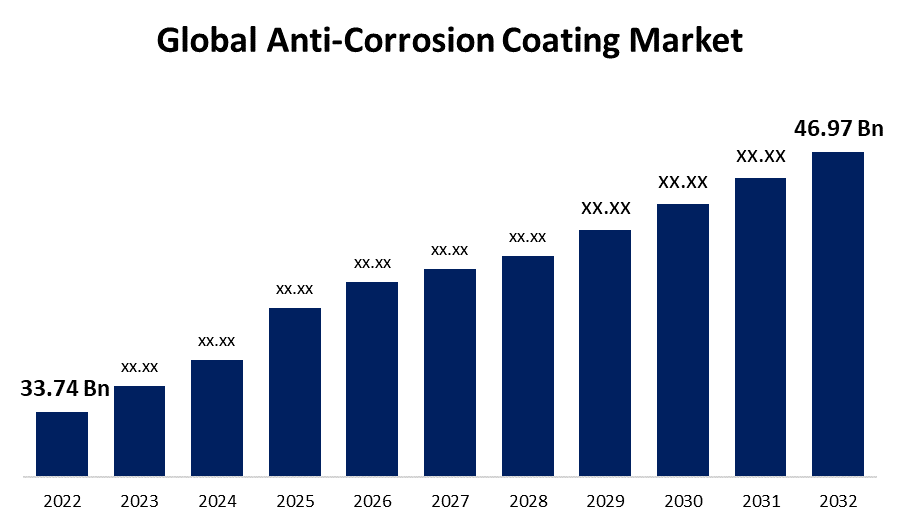

- The Global Anti-Corrosion Coating Market Size was valued at USD 33.74 Billion in 2022.

- The Market is growing at a CAGR of 3.4% from 2022 to 2032

- The Worldwide Anti-Corrosion Coating Market Size is expected to reach USD 46.97 Billion by 2032

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Anti-Corrosion Coating Market Size is anticipated to exceed USD 46.97 Billion by 2032, Growing at a CAGR of 3.4% from 2022 to 2032. The increasing losses and damage caused by corrosion is a major factor driving market growth.

Market Overview

Corrosion, a natural process caused by environmental factors and chemical reactions, causes surface, infrastructure, and equipment deterioration, resulting in significant economic losses and safety risks. The global anti-corrosion coating market is a thriving subset of the coatings and materials industry, dedicated to combating the damaging effects of corrosion on a variety of substrates. Anti-corrosion coatings, by forming a protective barrier between the substrate and the surrounding environment, play a critical role in preventing or mitigating this degradation. Anti-corrosion coatings are used in a variety of industries, including oil and gas, marine, automotive, aerospace, construction, and manufacturing. These coatings are intended to withstand the effects of moisture, chemicals, UV radiation, and other corrosive agents, extending asset life, lowering maintenance costs, and improving operational reliability. In recent years, the industry has seen significant innovation, with the development of advanced formulations that provide not only enhanced protection but also environmental sustainability. These advancements include waterborne, solvent-free, and high-performance epoxy-based coatings. Furthermore, in developing economies, the growing emphasis on regulatory compliance, health and safety standards, and the need for long-lasting infrastructure drives demand for anti-corrosion solutions.

Report Coverage

This research report categorizes the market for the global anti-corrosion coating market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the anti-corrosion coating market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the anti-corrosion coating market.

Global Anti-Corrosion Coating Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 33.74 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.4% |

| 2032 Value Projection: | USD 46.97 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Technology, By End-Use Industry, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Akzo Nobel N.V., Ashland, Axalta Coating Systems, LLC, BASF SE, Hempel A/S, Jotun, Kansai Paint Co., Ltd., PPG Industries, Inc., RPM INTERNATIONAL INC., The Sherwin-Williams Company and other market Players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of global infrastructure projects, such as transportation, energy, and utilities, fuels demand for anti-corrosion coatings. As governments and private entities invest in the construction and maintenance of critical infrastructure, the need to extend the lifespan of these assets becomes increasingly important, driving the adoption of effective corrosion protection solutions. Oil and gas, petrochemicals, and manufacturing industries all rely heavily on corrosive equipment and facilities. The growth of these industries, particularly in emerging economies, increases demand for anti-corrosion coatings to ensure operational integrity, reduce downtime, and avoid costly repairs or replacements. Continuous R&D efforts result in the development of novel coating formulations with improved performance characteristics. Coatings with higher chemical resistance, improved adhesion, superior durability, and adaptability to extreme environmental conditions are among the advancements driving market growth.

Restraining Factors

Investing in advanced anti-corrosion coatings is frequently more expensive than investing in traditional coatings. Businesses may be hesitant to implement these coatings due to concerns about upfront costs, particularly if budget constraints are a factor. Certain anti-corrosion coatings necessitate the use of specialized application techniques and equipment. This complexity can result in higher labor costs, longer application times, and potential coating errors, discouraging adoption, especially in industries with limited expertise or resources.

Market Segmentation

The Global Anti-Corrosion Coating Market share is classified into type, technology, and end-use industry.

- The epoxy segment is expected to hold the largest share of the global anti-corrosion coating market during the forecast period.

The global anti-corrosion coating market is categorized by type into epoxy, polyurethane, acrylic, alkyd, zinc, and others. Among these, the epoxy segment is expected to hold the largest share of the global anti-corrosion coating market during the forecast period. Epoxy coatings are well known for their outstanding adhesion, chemical resistance, and durability. They form a strong bond with a variety of substrates, making them ideal for use in industries such as marine, oil and gas, and infrastructure. Because of their excellent corrosion resistance, epoxy coatings are commonly used as primers, and they can be combined with other topcoats for added protection.

- The waterborne segment accounted for the significant share of the global anti-corrosion coating market in 2022.

Based on the technology, the global anti-corrosion coating market is divided into solvent borne, waterborne, powder-based, and others. Among these, the waterborne segment accounted for the significant share of the global anti-corrosion coating market in 2022. Waterborne coatings have grown in popularity because they contain fewer VOCs and have a lower environmental impact than solvent-borne coatings. Water is the primary solvent in these coatings, making them less harmful to both human health and the environment.

- The oil & gas segment is expected to hold the largest share of the global anti-corrosion coating market during the forecast period.

Based on the end-use industry, the global anti-corrosion coating market is divided into marine, oil & gas, industrial, infrastructure, power generation, and others. Among these, the oil & gas segment is expected to hold the largest share of the global anti-corrosion coating market during the forecast period. Anti-corrosion coatings are critical in the oil and gas industry for protecting pipelines, drilling rigs, refineries, storage tanks, and other equipment. Corrosion risks are increased by harsh chemical exposure, corrosive fluids, and extreme weather conditions. Chemical, moisture, and temperature resistance coatings are critical for preventing leaks, structural degradation, and costly downtime.

Regional Segment Analysis of the Global Anti-Corrosion Coating Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

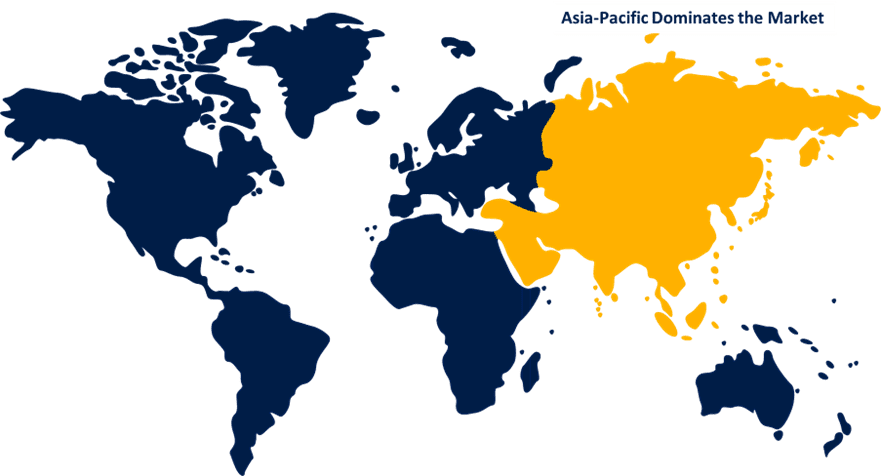

Asia Pacific is anticipated to hold the largest share of the global anti-corrosion coating market over the predicted timeframe.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global anti-corrosion coating market over the predicted years. Because of its rapid industrialization and infrastructure development, the Asia-Pacific region is one of the largest-growing markets for anti-corrosion coatings. This region's key players include China, India, Japan, and South Korea. The growing automotive, construction, and manufacturing industries, as well as increased maritime activity, all contribute to the high demand for corrosion protection solutions.

Europe is expected to grow at the fastest pace in the global anti-corrosion coating market during the forecast period. The anti-corrosion coating market in Europe is distinguished by a strong focus on environmental regulations and sustainable practices. Germany, the United Kingdom, and France all have well-established industrial sectors that require advanced corrosion protection solutions. Demand for anti-corrosion coatings is influenced by the push for energy efficiency and green technologies in manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global anti-corrosion coating along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel N.V.

- Ashland

- Axalta Coating Systems, LLC

- BASF SE

- Hempel A/S

- Jotun

- Kansai Paint Co., Ltd.

- PPG Industries, Inc.

- RPM INTERNATIONAL INC.

- The Sherwin-Williams Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, PPG has introduced AMERLOCK 600, a multipurpose epoxy coating designed for applicators seeking maximum versatility. The AMERLOCK coatings family is well-known for its superior corrosion resistance in harsh environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Anti-Corrosion Coating Market based on the below-mentioned segments:

Global Anti-Corrosion Coating Market, By Type

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Others

Global Anti-Corrosion Coating Market, By Technology

- Solvent borne

- Waterborne

- Powder-based

- Others

Global Anti-Corrosion Coating Market, By End-Use Industry

- Marine

- Oil & Gas

- Industrial

- Infrastructure

- Power Generation

- Others

Global Anti-Corrosion Coating Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?