Global Animal Growth Promoters and Performance Enhancers Market Size, Share, and COVID-19 Impact Analysis, By Product (Non-Antibiotic {Probiotic, Prebiotic, Organic Acid, Phytogenic, Feed Enzyme, Hormonal}, Antibiotic), By Animal (Poultry, Swine, Livestock, & Aquatic), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, & Online Pharmacy), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: HealthcareGlobal Animal Growth Promoters and Performance Enhancers Market Size Insights Forecasts to 2032

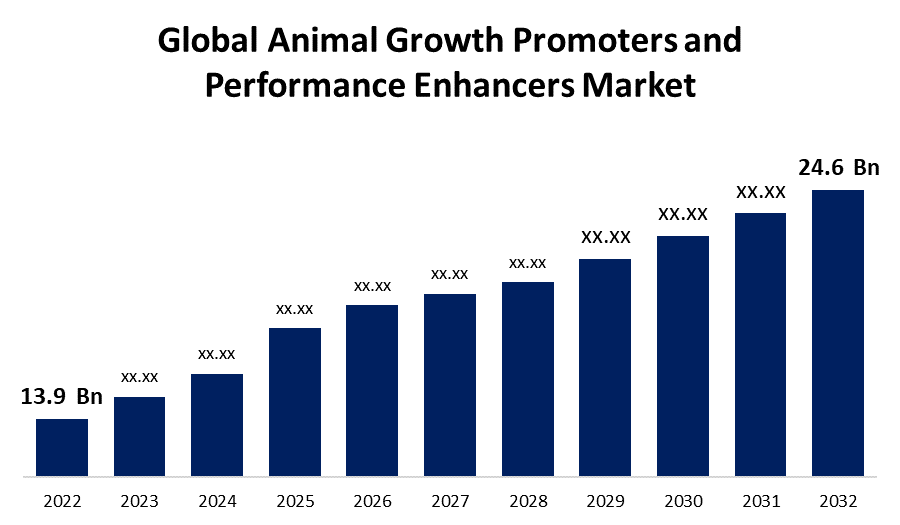

- The Global Animal Growth Promoters and Performance Enhancers Market Size was valued at USD 13.9 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.8% from 2022 to 2032.

- The Worldwide Animal Growth Promoters and Performance Enhancers Market size is expected to reach USD 24.6 Billion by 2032.

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Animal Growth Promoters and Performance Enhancers Market Size is expected to reach USD 24.6 Billion by 2032, at a CAGR of 5.8% during the forecast period 2022 to 2032.

Market Overview

Animal growth promoters and performance enhancers are supplements provided to many types of animals that aid in the functioning of their key organs and hence increase their performance. Animal growth boosters and performance enhancers help animals gain weight and expand their production. Animal growth boosters and performance enhancers are made up of natural and organic compounds that aid in the development of robust and healthy adults. In addition, the global animal growth promoters and performance enhancers market is expected to grow due to several factors such as the increasing prevalence of animal diseases leading to demand for healthier animals, rising rates of zoonotic diseases, adoption of livestock ownership, rising demand for meat and animal based products, use of animals in agriculture, and easy accessibility and affordability of animal growth promoters and performance enhancers.

Report Coverage

This research report categorizes the global animal growth promoters and performance enhancers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global animal growth promoters and performance enhancers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global animal growth promoters and performance enhancers market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Animal Growth Promoters and Performance Enhancers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 13.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.8% |

| 2032 Value Projection: | USD 24.6 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Animal, By Distribution Channel, By Region |

| Companies covered:: | Cargill Incorporated, Royal DSM N.V., Elanco Animal Health Incorporated, Boehringer Ingelheim Group, Merck & Co., Inc, Alltech Corporation, Archer-Daniels-Midland Company, Vetoquinol S.A., Bupo Animal Health Pty Ltd, Novus International, Inc., Associated British Foods plc, Erber AG, Phibro Animal Health Corporation, Kemin Industries, Inc., Zoetis Inc. (US), Nutreco N.V., Novozymes A/S, BASF SE, Evonik Industries AG, Bluestar Adisseo Company, Land O’Lakes, Inc., Biomin Holding GmbH, Guangdong VTR Bio-Tech Co., Ltd, Lallemand Inc., |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary elements encouraging the adoption of excellent husbandry methods in the animal farming business is the increased demand for organic goods. According to the Organic Trade Association, organic food is the fastest-growing segment in the US food market, with double-digit yearly growth. Similarly, the demand for organic products is growing in European countries. Factors such as multiple food scandals and greater interest in health, environmental problems, and animal welfare have raised the demand for organic food. Furthermore, the time spent traveling is minimized when animals are transported live. Breeding animals for robustness and health is becoming acknowledged as a vital component of sustainable animal production. This increased emphasis on high-welfare animal farming is propelling the natural growth promoters market.

Restraining Factors

The United States and Europe, for example, have set tight limits on the use of animal antibiotics and antimicrobials as performance enhancers. This limits the market's potential for expansion. The high cost of nutritional goods, nutritional supplements, growth boosters, and performance enhancers further threatens the market's growth pace.

Market Segmentation

- In 2022 the non-antibiotic segment is dominating the market with the largest market share over the forecast period.

Based on the product, the global animal growth promoters and performance enhancers market is segmented into non-antibiotic {probiotic, prebiotic, organic acid, phytogenic, feed enzyme, hormonal}, antibiotic. Among these segments, the non-antibiotic segment is dominating the market with the largest revenue share during the forecast period due to their economic benefits, a wide variety of products with applications in different production animals, sustainability of ecosystem, and rising laws on consumption of antibiotics and hormones. In that, non-antibiotic promoters are further subdivided into probiotic and prebiotic growth promoters, organic acid growth promoters, photogenic growth promoters, feed enzyme growth promoters, hormonal growth promoters, and others. The probiotic and prebiotic growth promoters category accounted for the biggest market share of the animal growth promoters and performance enhancers market owing to their safety, natural performance-enhancing characteristics, and great nutritional value. It also improves disease resistance and health by favorably altering the gut microbiota, reducing pathogen shedding and illness symptoms, increasing gut immunity and improving disease resistance and health.

- In 2022, the poultry segment is dominating the largest market share during the forecast period.

Based on the animal, the global animal growth promoters and performance enhancers market is bifurcated into different categories such as poultry, swine, livestock, & aquatic. Among these segments, the poultry segment is dominating the market during the forecast period. This is due to rising global demand for chicken meat and eggs, as well as novel dietary design approaches developed in poultry, which are aiding in the development of alternative growth promotion tactics.

Regional Segment Analysis of the lancets market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific led the market with the largest market revenue during the forecast period.

Get more details on this report -

Asia Pacific is influencing the significant market growth during the forecast period due to its significant growth in meat consumption. Rising disposable income levels and enormous population expansion in nations such as China, Indonesia, Malaysia, Thailand, Vietnam, and India will drive regional market growth. Brazil, Argentina, Australia, Russia, and a few African nations are expected to expand rapidly for similar reasons.

Europe is expected to experience high revenue market growth during the forecast period owing to a considerable market share in pig meat production, Spain is the world's second-largest producer of animal meat. The demand for pigs and cattle has grown, as has demand from developing countries such as Algeria, Libya, and Lebanon. The low cost of cattle feed has also aided the rising rate of cow production in recent years.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global animal growth promoters and performance enhancers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Incorporated

- Royal DSM N.V.

- Elanco Animal Health Incorporated

- Boehringer Ingelheim Group

- Merck & Co., Inc

- Alltech Corporation

- Archer-Daniels-Midland Company

- Vetoquinol S.A.

- Bupo Animal Health Pty Ltd

- Novus International, Inc.

- Associated British Foods plc

- Erber AG

- Phibro Animal Health Corporation

- Kemin Industries, Inc.

- Zoetis Inc. (US), Nutreco N.V.

- Novozymes A/S

- BASF SE

- Evonik Industries AG

- Bluestar Adisseo Company

- Land O’Lakes, Inc.

- Biomin Holding GmbH

- Guangdong VTR Bio-Tech Co., Ltd

- Lallemand Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2021, Cargill, Inc. has introduced a new feed ingredient called "Promote." The medicine is intended to promote chicken intestinal health and is projected to expand the company's worldwide product portfolio.

- In November 2022, Cargill and CARE International signed a Memorandum of Understanding (MoU) in Hanoi for a two-year program dubbed "She Thrives." The "She Thrives" program attempts to improve sustainable living circumstances for rural smallholders, notably women and members of ethnic minorities in Vietnam's Dak Lak province, by providing farmers and producers with the tools and resources they need to better their livelihoods sustainably.

- In September 2022, Zoetis announced the completion of its acquisition of Jurox, the largest manufacturer of livestock and companion animal products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Animal Growth Promoters and Performance Enhancers Market based on the below-mentioned segments:

Global Animal Growth Promoters and Performance Enhancers Market, By Product

- Non-Antibiotic {Probiotic, Prebiotic, Organic Acid, Phytogenic, Feed Enzyme, Hormonal}

- Antibiotic

Global Animal Growth Promoters and Performance Enhancers Market, By Animal

- Poultry

- Swine

- Livestock

- Aquatic

Global Animal Growth Promoters and Performance Enhancers Market, By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Animal Growth Promoters and Performance Enhancers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?