North America Fluid Handling Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Flushing, Filtration, Varnish Removal, Others), By Services (Pumping services, Valve services, Piping services, Instrumentation services), By Region (US, Canada, Mexico, Rest of North America), and North America Fluid Handling Services Market Insights Forecasts 2023 – 2033

Industry: Energy & PowerNorth America Fluid Handling Services Market Size Insights Forecasts to 2033

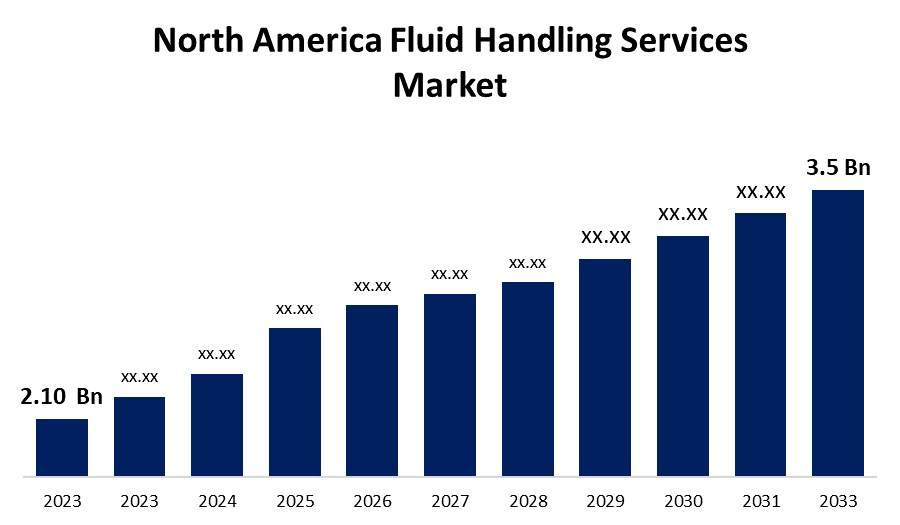

- The North America Fluid Handling Services Market Size was valued at USD 2.10 Billion in 2023

- The Market Size is Growing at a CAGR of 5.24% from 2023 to 2033.

- The North America Fluid Handling Services Market Size is Expected to Reach USD 3.5 Billion by 2033.

Get more details on this report -

The North America Fluid Handling Services Market size is expected to reach USD 3.5 Billion by 2033, at a CAGR of 5.24% during the forecast period 2023 to 2033.

Market Overview

Pharmaceutical fluid handling is an integral part of the pharmaceutical industry to ensure that fluids such as cough syrups, intravenous products, and complex active pharmaceutical ingredients are delivered in a safe and timely manner. To succeed and be reliable, businesses need to utilize the correct handling equipment and instruments. The manufacturing divisions in the biotechnology & pharmaceutical industry require fluid control systems since most processes involve the presence of a liquid such as feed media, buffer solutions, cell extracts, and product fractions. The fluid handling system consists of various equipment designs that use the mass and energy of a flowing fluid to perform work, facilitate the process of producing a product, and transfer heat. Fluid handling systems are used to direct, measure, and control the flow of various liquids or fluids throughout a facility. Fluid handling systems play an important role in a variety of end-use industries because they contribute to smoother operations throughout the facility, less waste, and longer machine life. End-use industries use fluid handling services to ensure that liquid flow in various lines runs smoothly.

Report Coverage

This research report categorizes the market for the North America fluid handling services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America fluid handling services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America fluid handling services market.

North America Fluid Handling Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 3.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Services, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Halliburton Corporation, INOXPA Group, Alexis Oil Company, RelaDyne, Inc., Gaubert Oil Company, Inc., Schlumberger Limited, Baker Hughes Company, Flowserve Corporation, Sulzer Ltd, SPX FLOW, Inc., Xylem Inc., Graco Inc., Pentair plc, ITT Inc., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased use of fluid handling systems in the chemical and oil and gas industries to handle hazardous chemicals, lubricants, and other toxic substances is a major factor driving the growth of the fluid handling systems market. The safe handling of such chemicals is required in these industries. Furthermore, the improvement in industrial equipment performance and lubricant life due to continuous filtration of lubricants accelerates market growth. Furthermore, the continuous use of these systems helps to reduce machinery repair costs and production downtime. Moreover, the increased use of fluid handling systems in the pharmaceutical industry to avoid contamination caused by inefficient chemical handling has accelerated market growth. The integration of fluid handling systems in the pharmaceutical industry has become critical due to the demand for high-quality pharmaceutical products. Additionally, rapid urbanization, lifestyle changes, increased investment, and increased consumer spending all have a positive impact on the fluid handling systems market.

Restraining Factors

Fluid handling equipment and services come with high initial investment costs. Also, there is a shortage of skilled workers and expertise in managing complex fluid handling systems. Furthermore, raw material prices fluctuate, impacting the overall cost of fluid handling services. Moreover, some industries have a slow adoption rate due to traditional practices and resistance to change.

Market Segment

- In 2023, the filtration segment accounted for the largest revenue share over the forecast period.

Based on type, the North America fluid handling services market is segmented into flushing, filtration, varnish removal, and others. Among these, the filtration segment has the largest revenue share over the forecast period. Filtration services are critical to ensuring the quality and cleanliness of fluids used in a variety of industries. With an increasing emphasis on operational efficiency and the need to ensure that fluid handling systems run smoothly, the demand for filtration services has increased significantly. Filtration services remove contaminants, particles, and impurities from fluids, improving the overall performance and longevity of equipment and processes.

- In 2023, the pumping services segment is witnessing significant growth over the forecast period.

Based on services, the North America fluid handling services market is segmented into pumping services, valve services, piping services, and instrumentation services. Among these, the pumping services segment is witnessing significant growth over the forecast period. As a pumping service are critical to the efficient movement of fluids in a variety of industries, including oil and gas, water and wastewater, chemicals, and manufacturing. Pumping services are in high demand due to the need to transport fluids from one location to another, maintain optimal flow rates, and ensure that fluid handling systems run efficiently. Pumping services are used in various industries, including water supply and distribution, oil and gas extraction and transportation, and chemical processing.

- In 2023, the United States accounted for the largest revenue share over the forecast period.

Based on region, the United States segment has the largest revenue share over the forecast period. The food processing industries in the United States have grown in response to increased demand for meat and beverages. In the processing industry, fluid handling systems are commonly used to handle a wide range of fluids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North American fluid handling services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Halliburton Corporation

- INOXPA Group

- Alexis Oil Company

- RelaDyne, Inc.

- Gaubert Oil Company, Inc.

- Schlumberger Limited

- Baker Hughes Company

- Flowserve Corporation

- Sulzer Ltd

- SPX FLOW, Inc.

- Xylem Inc.

- Graco Inc.

- Pentair plc

- ITT Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the North American fluid handling services market based on the below-mentioned segments:

North America Fluid Handling Services Market, By Type

- Flushing

- Filtration

- Varnish Removal

- Others

North America Fluid Handling Services Market, By Services

- Pumping services

- Valve services

- Piping services

- Instrumentation services

North America Fluid Handling Services Market, By Region

- US

- Canada

- Mexico

- Rest of North America

Need help to buy this report?