Global Algorithmic Trading Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Component (Solution, Services), By Deployment (On-premise, Cloud-based), By Type (Stock Markets, FOREX, Exchange-Traded Fund (ETF), Bonds, Cryptocurrencies & Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Information & TechnologyALGORITHMIC TRADING MARKET: OVERVIEW

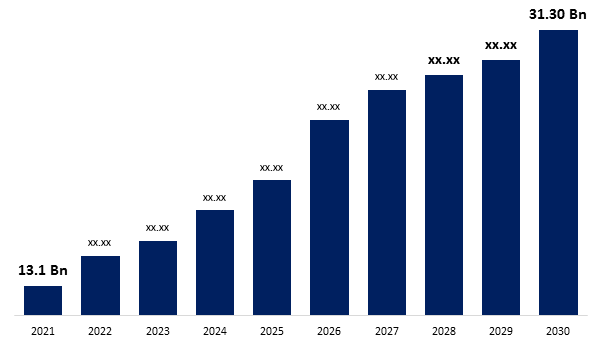

The Global Algorithmic Trading Market was valued at USD 13.02 billion in 2021 and is expected to reach USD 31.30 billion by 2030, growing at a CAGR of 13.6% during 2021-2030

Get more details on this report -

Algorithmic trading, often known as "algo-trading," is the process of managing a trading activity using computer programs with a pre-defined set of instructions. The instructions are based on a mathematical model's pricing, timing, quantity, and many other aspects. It promises to make money, lower transaction costs, and provide investors computer-based control over the trading process. Aside from this, by removing all human effects, algorithmic trading makes the market more flexible and systematic. High-frequency trading (HFT), which includes putting sizable trade orders across several marketplaces, also makes quick decisions possible.

COVID-19 ANALYSIS

The COVID-19 epidemic has had a favorable effect on the growing rate of the market. Algorithmic trading allows for more quick decision-making while minimizing human errors. The Covid-19 outbreak, for instance, may have merely accelerated the industry's shift toward computerized trading, according to a recent paper by the Reserve Bank of Australia. Additionally, the pandemic has increased the appeal of high-frequency traders (HFT), which has fueled market expansion. As an illustration, Virtu Financial, one of the top high-speed traders, recorded net trading revenue of $784.5 million for the first quarter of 2020.

ALGORITHMIC TRADING MARKET: TREND

Increasing API-driven Trading in Developing Regions

The increasing adoption of API-based trading offers faster order execution and investors may execute trades based on insights and analytics while keeping customers in the analytics app and fostering greater customer loyalty. The API-based trading platform enhances digital wealth management solutions to connect with capital markets in order to offer rea-time trading and market data.

Global Algorithmic Trading Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 13.02 billion |

| Forecast Period: | 2022 to 2030 |

| Forecast Period CAGR 2022 to 2030 : | 13.6% |

| 2030 Value Projection: | USD 31.30 billion |

| Historical Data for: | 2017 to 2021 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Component, By Deployment, By Type, By Region |

| Companies covered:: | 63 moons technologies limited, AlgoTrader, Argo Software Engineering, Citadel LLC, Hudson River Trading, InfoReach, Inc., Lime Trading Corp., MetaQuotes Ltd, Refinitiv Limited, Software AG, and others. |

| Growth Drivers: | Opportunities and Challenges that influence the Market. |

| Pitfalls & Challenges: | Expansion, Product Launch and Development, Partnership, Merger, and Acquisition |

Get more details on this report -

ALGORITHMIC TRADING MARKET: DRIVERS

Increasing Implementation of Cloud-based Services

The market for algorithmic trading will see significant potential due to the rising adoption of cloud-based services, cloud computing, and cloud-based trading solutions. When placing trades, traders employ cloud services for back testing, run-time series analysis, and trading techniques. To improve efficiency, enhanced security, better data management, improved sustainability, etc.

Introduction of ML, AI and Other Technologies to Improve Efficiency

The financial services industry's adoption of AI, ML, and big data is anticipated to play a significant role in the market growth for algorithmic trading. Because of the advancements in technology, regulators are also beginning to pay attention to the ways that people engage with the market. Some of the biggest institutions in the world began implementing such technologies to advance algorithmic trading.

ALGORITHMIC TRADING MARKET: RESTRAIN

Concerns Pertaining to Inadequate Risks Valuation

Lack of observation and weak risk valuation skills could limit market growth during the forecasted timeframe. Moreover, the life span of algorithms is short which may hamper the market growth. The skilled professional is required to operate the platforms.

MARKET SEGMENTATION

The Global Algorithmic Trading Market is segmented by Component, Deployment, Type, and Region. Based on the Component, the market is categorized Solution, Services. Based on Deployment, the market is categorized into On-Premise, Cloud-Based. Based on Type, the market is categorized into Stock Markets, Forex, Exchange-Traded Fund (ETF), Bonds, Cryptocurrencies and Others. Based on the Region, the market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Component Insights

Based on the component segment, the global algorithmic trading market is categorized into solution, services. The solution segment has dominated the market share in 2020 of global algorithmic trading market owing to advantages of algorithmic trading solutions, such as lower transaction costs owing to the absence of human intervention and quick and precise trade order placement, are what primarily fuel the demand for these solutions. In addition, market participants are providing sophisticated algorithmic trading systems to meet a range of customer needs.

Deployment Insights

Based on the deployment segment, the global algorithmic trading market is categorized into on-premise, cloud-based. The cloud-based segment has dominated the market share in 2020 of global algorithmic trading market owing to because financial firms are increasingly using cloud-based solutions to boost productivity and efficiency. Additionally, cloud-based algorithmic trading solutions are becoming more and more popular among traders since they guarantee efficient process automation, data preservation, and cost-effective management.

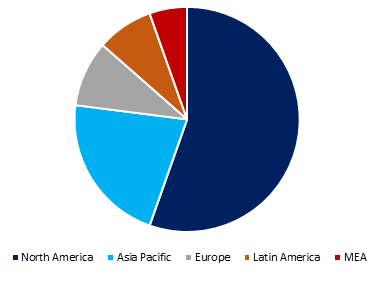

MARKET SEGMENTATION: BY REGION

Based on the Region, the Global Algorithmic Trading Market is categorized into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Get more details on this report -

North America region is dominating the market share of global algorithmic trading market owing to a variety of variables, such as significant expenditures in trading technology and rising government backing for international trade. Additionally, the region's dense concentration of vendors offering algorithmic trading contributes to the market's expansion. However, Asia Pacific region is anticipated to grow over the next few years of global algorithmic trading market owing to significant public and private sector investments in advancing their trading technologies, which are fueling demand for algorithmic trading solutions to automate trading procedures, Asia-Pacific is predicted to experience the fastest growth rate throughout the projected period.

ALGORITHMIC TRADING MARKET: COMPETITIVE LANDSCAPE

The major key players operating in the global algorithmic trading market are 63 moons technologies limited, AlgoTrader, Argo Software Engineering, Citadel LLC, Hudson River Trading, InfoReach, Inc., Lime Trading Corp., MetaQuotes Ltd, Refinitiv Limited, Software AG, and others.

May 2022- Argo Software Engineering announced a new release of Argo Trading Platform which will enhance the scalability improvements and performance.

ALGORITHMIC TRADING MARKET: KEY PLAYERS

• 63 moons technologies limited

• AlgoTrader

• Argo Software Engineering

• Citadel LLC

• FlexTrade Systems, Inc.

• Hudson River Trading

• InfoReach, Inc.

• Lime Trading Corp.

• MetaQuotes Ltd

• Refinitiv Limited

• Software AG

• Symphony

• Tata Consultancy Services Limited

• Tethys Technology, Inc.

• Tower Research Capital LLC

• Trading Technologies International, Inc.

• Virtu Financial

ALGORITHMIC TRADING MARKET: RECENT DEVELOPMENT

- June 2022- Alexbank has announced to adopt Electronic Trading solution (ET) provided by Refinitiv to empower their business in Egypt and strengthen its presence in both the local and international Foreign Exchange (FX) markets.

- August 2021- Tethys Technology integrates MSCI index data with tethysalgo trade execution algorithms that will enable clients to achieve superior trading performance for their funds.

ALGORITHMIC TRADING MARKET: REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Algorithmic Trading Market. The Global Algorithmic Trading Market is segmented by Component, Deployment, Type, and Region. It reveals the market situation and future forecast. The study also covers the significant data presented with the help of graphs and tables. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Algorithmic Trading Market.

Need help to buy this report?