Global Aircraft Leasing Market Size By Lease (Dry Lease, Wet Lease), By Application (Wide Body, Narrow Body), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Leasing Market Size Insights Forecasts to 2033

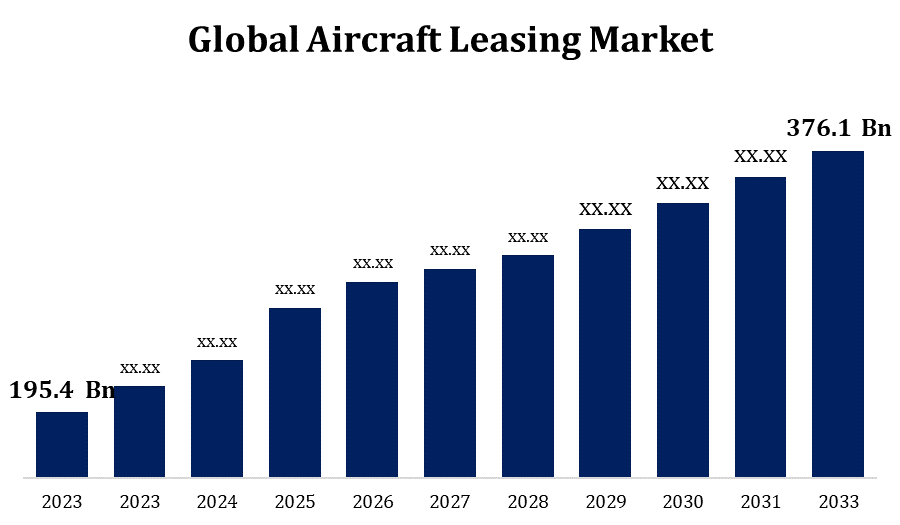

- The Global Aircraft Leasing Market Size was valued at USD 195.4 Billion in 2023.

- The Market is Growing at a CAGR of 6.77% from 2023 to 2033

- The Worldwide Aircraft Leasing Market is Expected to reach USD 376.1 Billion by 2033

- Asia Pacific is Expected to Grow the Fastest during the Forecast period

Get more details on this report -

The Global Aircraft Leasing Market is Expected to reach USD 376.1 billion by 2033, at a CAGR of 6.77% during the Forecast period 2023 to 2033.

Airlines can acquire aircraft without having to pay the high upfront expenses involved with owning them by leasing them for a predetermined amount of time. The necessity for fuel-efficient aircraft, an increase in low-cost carriers, and rising air travel demand have all contributed to the market's notable expansion in recent years for aircraft leasing. In order to comply with environmental standards and save operational costs, airlines frequently lease newer, more fuel-efficient aircraft. Lessors are now concentrating on updating their fleets as a result of this trend. The COVID-19 pandemic had a major effect on the aviation sector, lowering demand for air travel and posing difficulties for lessors of aircraft. As air traffic resumed, hopes were raised for a recovery.

Aircraft Leasing Market Value Chain Analysis

The companies that design, manufacture, and deliver aircraft, like Boeing and Airbus, are at the beginning of the value chain. New aircraft are frequently purchased directly from manufacturers by leasing companies. In this value chain, airlines are the lessees. Rather than buying aircraft altogether, they lease them from lessors. This lowers initial capital costs and gives airlines greater flexibility in managing their fleets. Leasing companies are in charge of providing maintenance and repair for leased aircraft. In order to guarantee that the aircraft is kept in excellent operating condition for the duration of the lease, lessors frequently enter into agreements with MRO firms. A vital link in the aircraft leasing value chain is insurance. In order to shield their assets from potential hazards like accidents, damage, or loss, lessors usually get insurance coverage. Banks and financing organisations contribute to the funds that aviation leasing firms need to buy aircraft. To help lessors grow their fleets, they could provide loans or other financial instruments. Lessors may decide to sell or retire an aircraft when its operating life or lease term is up.

Aircraft Leasing Market Opportunity Analysis

Analyse past and future patterns in the demand for air travel worldwide. Aircraft leasing may become more viable as a result of airlines looking to expand their fleets in order to meet the rising demand, particularly in emerging economies. Think about the need for more recent, fuel-efficient aircraft. In order to save operating expenses and adhere to environmental requirements, airlines are frequently attracted to lease contemporary aircraft. Lessors with aircraft of this type in their fleets can have opportunities. Evaluate prospects in developing nations where air travel is expanding quickly. Take into account the demand from low-cost airlines as well, as they frequently favour leasing over purchasing an aircraft due to the high upfront expenditures involved. Examine regional differences in the regulatory landscape and demand. Lessors can customise their offers by having a better understanding of the unique requirements and difficulties in various regions.

Global Aircraft Leasing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 195.4 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.77% |

| 2033 Value Projection: | USD 376.1 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Lease, By Application, By Region, By Geographic, |

| Companies covered:: | SAAB Aircraft Leasing, GE Capital Aviation Service, CIT Commercial Air, Boeing Capital Corporation, ALAFCO Aviation Lease and Finance Company K.S.C.P, AerCap, AerCap Holdings N.V., BOC Aviation, SMBC Aviation Capital, Ansett Worldwide Aviation Services, and |

| Growth Drivers: | Increasing demand for air travel worldwide |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Leasing Market Dynamics

Increasing demand for air travel worldwide

In many emerging economies, the growing middle class has raised disposable money and heightened air travel inclinations. Travel by air is in high demand due to this demographic transition. The growth of metropolitan areas and urbanisation both contribute to the demand for convenient and effective transportation. The increasing preference for air travel, particularly for lengthy distances, has led to a rise in the demand for aircraft. More people are travelling for work and pleasure, which has resulted in a major growth in the worldwide tourism industry. The demand for air transport services has increased as a direct result of this tourism boom. Travelling abroad for business has become more common as a result of the globalisation of commerce. As companies grow internationally, so does the need for air travel.

Restraints & Challenges

The market is susceptible to changes in the economy and in world politics. Economic downturns or uncertainty can have an influence on lessors by affecting airline profitability and, in turn, their capacity to fulfil lease agreements. The state of the airline sector as a whole is strongly correlated with the state of the aircraft leasing market. Leasing decisions made by airlines can have an influence on lessors due to factors like high fuel prices, labour strikes, or regulatory changes. The airline sector experiences upswings and downswings in its cyclical expansion. This cyclical nature may have an effect on the demand for leasing, resulting in oversupply during recessions and difficulties satisfying demand during booms. Lessors may incur losses in the event of airline bankruptcies or defaults on lease payments.

Regional Forecasts

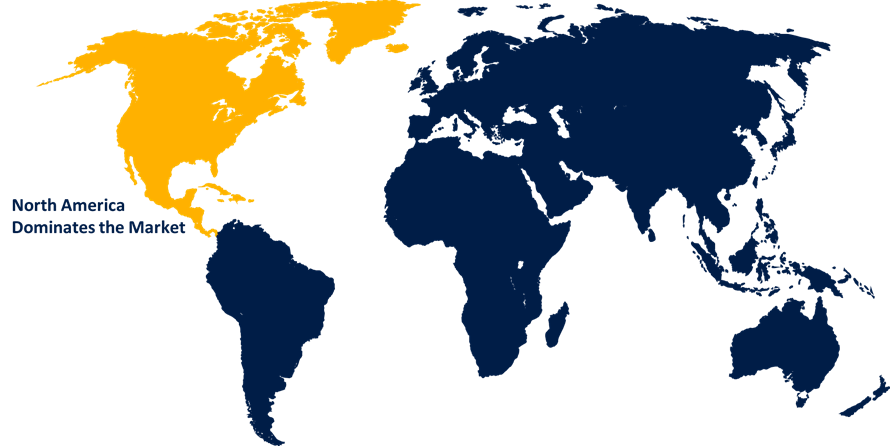

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Leasing Market from 2023 to 2033. The market for leasing aircraft in North America is large and has grown steadily. The necessity for new, fuel-efficient aircraft, the region's thriving aviation sector, and rising air travel demand all have an impact on the market's growth. Leasing aircraft is a strategic strategy to fleet management used by both legacy and low-cost airlines in North America. Leasing gives you the freedom to modify fleet sizes in response to shifting demand and market conditions. A number of North American cities function as important hubs for the leasing of aircraft. These include the major aeroplane leasing hubs of New York, Chicago, and Los Angeles, which are home to financial institutions, leasing businesses, and legal and consultancy services.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The aircraft leasing sector has expanded due in part to the Asia-Pacific area being one of the fastest-growing air transport markets. The need for air travel has been driven by rapid economic expansion, the emergence of a middle class, and growing urbanisation. The Asia-Pacific area is home to a number of significant aeroplane leasing businesses. This include lessors including ICBC Leasing, SMBC Aviation Capital, BOC Aviation (Bank of China Aviation), and numerous others. The demand for air travel on both domestic and international routes has increased in the Asia-Pacific area. Airlines are looking to expand their fleets in order to handle more passengers, which has increased demand for aircraft leasing. The market for aircraft leasing has been significantly fueled by the emergence of low-cost carriers in the Asia-Pacific area.

Segmentation Analysis

Insights by Lease

The wet lease segment accounted for the largest market share over the forecast period 2023 to 2033. Wet leasing gives airlines operating flexibility so they may respond swiftly to unanticipated events or shifts in demand. In order to fulfil high travel seasons or take care of maintenance difficulties in their own fleets, airlines can temporarily lease aircraft with crews. The wet leasing model is especially advantageous for airlines that experience demand swings during certain seasons. Airlines may decide to wet lease extra aircraft to accommodate higher passenger numbers during peak seasons or special events, or they may decide to run charter flights. Airlines can grow their fleets through wet leasing without having to make a sizable upfront financial commitment. Because it frees them from long-term ownership commitments and allows them to satisfy short-term capacity needs, this is particularly appealing to airlines that are dealing with financial difficulties or uncertainties.

Insights by Application

The narrow body segment accounted for the largest market share over the forecast period 2023 to 2033. The need for narrow-body aircraft has been fueled by the expansion of low-cost airlines (LCCs) and the rising demand for short-haul flights. These aircraft are ideal for flights with comparatively small destination distances. Narrow-body aircraft are more popular with low-cost carriers because of their efficiency on shorter itineraries and cheaper operational costs. The need for leased narrow-body aircraft has increased dramatically as a result of LCCs' global expansion. Worldwide airlines are updating their fleets with newer models to replace their older, less fuel-efficient planes. Airlines may modernise their fleets affordably and without having to make a sizable upfront capital expenditure by using leasing. Leasing narrow-body aircraft gives airlines the freedom to modify capacity to meet fluctuating demand. They can adjust their operations to reflect changes in the market or in response to seasonal fluctuations by leasing.

Recent Market Developments

- In December 2022, Goshawk Management Limited and the corporate assets connected with it were purchased by SMBC Aviation Capital.

Competitive Landscape

Major players in the market

- SAAB Aircraft Leasing

- GE Capital Aviation Service

- CIT Commercial Air

- Boeing Capital Corporation

- ALAFCO Aviation Lease and Finance Company K.S.C.P

- AerCap

- AerCap Holdings N.V.

- BOC Aviation

- SMBC Aviation Capital

- Ansett Worldwide Aviation Services

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Leasing Market, Lease Analysis

- Dry Lease

- Wet Lease

Aircraft Leasing Market, Application Analysis

- Wide Body

- Narrow Body

Aircraft Leasing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?