Global Aircraft Cabin Interior Market Size By Material (Alloy, Composites, Others), By Type (Aircraft and Seating, Entertainment and Connectivity, Cabin Lighting), By End User (OEM, Aftermarket), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aircraft Cabin Interior Market Insights Forecasts to 2033

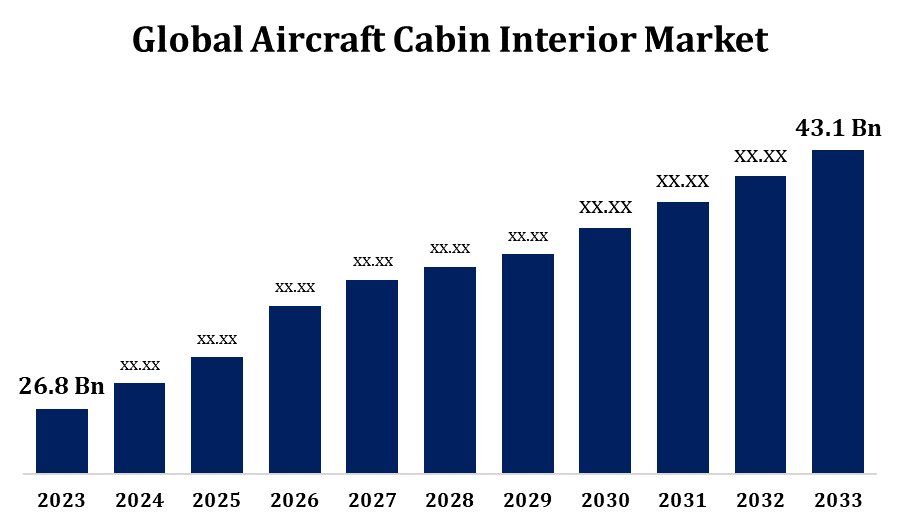

- The Global Aircraft Cabin Interior Market Size was valued at USD 26.8 Billion in 2023

- The Market Size is growing at a CAGR of 4.87% from 2023 to 2033

- The Worldwide Aircraft Cabin Interior Market Size is expected to reach USD 43.1 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aircraft Cabin Interior Market Size is expected to reach USD 43.1 Billion by 2033, at a CAGR of 4.87% during the forecast period 2023 to 2033.

Comfort, weight reduction, and space efficiency are the main priorities for manufacturers while designing and producing aircraft seats. The kind of aircraft and the needs of the carrier determine the different seating arrangements. Passengers can enjoy screens, audio systems, and connectivity features using these systems while in flight. The industry has witnessed developments in satellite-based internet services and wireless streaming due to the growing demand for connectivity. Not only may creative lighting solutions improve the cabin's aesthetic attractiveness, but they also contribute to making passengers feel more at ease and at ease. In particular, LED lighting has grown in favour because of its versatility and energy economy. As the need for in-flight Wi-Fi and connectivity grows, businesses are coming up with ways to give travellers dependable internet access.

Aircraft Cabin Interior Market Value Chain Analysis

The extraction or production of raw materials, such as metals, composites, textiles, and other materials required in the fabrication of cabin interior components, is the first step in the process. Using raw materials, companies at this stage manufacture specific parts for the aircraft cabin, including seats, lighting, galleys, restrooms, and other interior features. Sub-assembly is the process of joining smaller parts to form bigger sub-assemblies, and systems integration is the process of integrating different cabin systems to form coherent units, such lighting and in-flight entertainment (IFE) systems. In order to assemble the entire cabin interior, manufacturers now combine subassemblies and integrated systems. Installing seats, galleys, restrooms, and other parts falls under this category. After that, the cabin interiors are shipped to the producers of the aircraft, where they are integrated into the final assembly stage of the aircraft. The aircraft is delivered to airlines and aircraft operators after it has been constructed and cleared by all required inspections.

Aircraft Cabin Interior Market Opportunity Analysis

Lightweight materials for cabin interiors present potential for companies who can leverage the aviation industry's focus on sustainability and fuel efficiency. This includes the creation of cutting-edge materials, alloys, and composites that help reduce overall weight and increase fuel efficiency. Airlines are searching more and more for distinctive and customisable interiors for their cabins that will set them apart from the competition and enhance the traveller experience. Businesses who can provide adaptable and bespoke solutions, such as customised interior designs and seating arrangements, may discover substantial growth prospects. There is pressure on the aviation sector to embrace more environmentally friendly procedures. Businesses that can supply recyclable parts, eco-friendly materials, and energy-saving technologies for aircraft interiors may be able to capitalise on the aviation industry's rising need for sustainability.

Global Aircraft Cabin Interior Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.87% |

| 2033 Value Projection: | USD 43.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End User, By Region, By Geographic Scope |

| Companies covered:: | Acro Aircraft Seating Astronics Corporation, Aviointeriors S.p.A., Diehl Stiftung & Co. KG, GAL Aerospace, Hong Kong Aircraft Engineering Company Limited, Jamco Corporation, Raytheon Technologies Corporation, Safran S.A., Thales Group, and Other Key Vendors. |

| Growth Drivers: | Increasing global preference for air travel |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aircraft Cabin Interior Market Dynamics

Increasing global preference for air travel

The number of middle-class people worldwide has increased, which has raised discretionary income. The need for better cabin interiors is being driven by the growing demand for comfortable and enjoyable in-flight experiences as more people are able to afford to travel by air. The advent of urbanisation and enhanced intercity connection has rendered air travel a convenient and expedient means of transportation. Air travel is becoming more and more popular among passengers, both for business and pleasure, due to its efficiency and speed. With more people travelling to new places, the tourism sector is expanding rapidly. Travel by air is becoming more and more popular, and airlines are looking for appealing and competitive cabin interiors to meet the needs of a wide range of passenger demographics.

Restraints & Challenges

There are significant expenses and stringent testing procedures involved in designing and certifying new cabin interiors. The large initial cost may hinder smaller businesses and slow down the rate of innovation. The aviation sector is susceptible to changes in the economy and world events. Manufacturing and delivery delays of cabin interior components may result from supply chain disruptions brought on by natural catastrophes, pandemics, or geopolitical tensions. Innovation in technology is happening quite quickly in the aviation sector. It can be difficult for manufacturers to stay on top of the latest developments in in-flight entertainment, connectivity, and materials; this calls for constant R&D.

Regional Forecasts

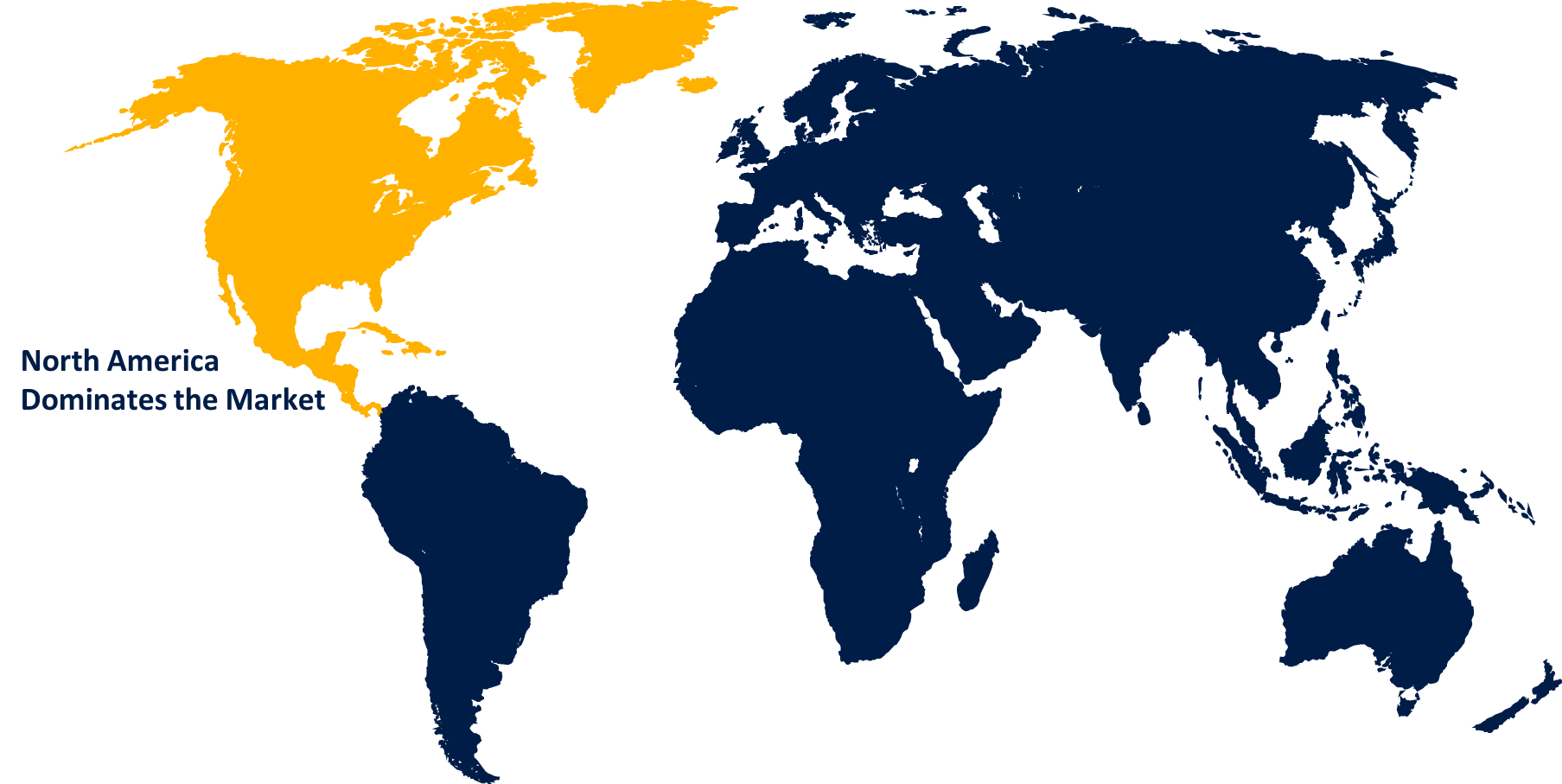

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aircraft Cabin Interior Market from 2023 to 2033. With so many airlines and a well-established aviation industry, North America is a major player in the worldwide aircraft cabin interior market. Major aircraft manufacturers, airlines, and suppliers of cabin interior components are based in the region. Modern and creative cabin decor are in demand as North American airlines continuously work to improve the traveller experience. The need for newer interior features is fueled in part by fleet modernization initiatives, which also include the launch of new aircraft models. Corporate jet interiors that are upscale and specially designed are in great demand because to the thriving business and private aviation sectors in North America. This market involves the need for high-end items like sophisticated entertainment systems and plush chairs.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific area has experienced a notable increase in demand for air travel as a result of growing middle-class demographics, increased disposable income, and urbanisation. As a result, in order to accommodate the increasing number of passengers, modern and cosy cabin interiors are required. To accommodate the rising demand for air travel, airlines in the Asia-Pacific area, especially in emerging nations, have been extending their fleets. This growth opens doors for suppliers of cabin interiors to offer creative, personalised solutions. More people are choosing to travel by air as a result of economic expansion in nations like China and India. This directly affects the market for cutting-edge, contemporary cabin interior design.

Segmentation Analysis

Insights by Type

The entertainment and connectivity segment accounted for the largest market share over the forecast period 2023 to 2033. Both business and leisure travellers in the modern day have high standards for connectivity while flying. Increased spending on onboard connectivity solutions is a result of the growing demand for Wi-Fi access and in-flight internet services. Real-time streaming services for entertainment content are being adopted by airlines, giving customers access to a wide range of media on their own devices. This method offers a larger content library and greater flexibility. In order to remain productive during flights, business travellers are depending more and more on in-flight connection. Airlines are realising how important it is to provide dependable internet access for work-related tasks like video conferences and email.

Insights by Material

The alloy segment accounted for the largest market share over the forecast period 2023 to 2033. Materials made of alloys are selected for their strength and longevity. They give parts like seat frames, overhead bins, and structural components inside the cabin their structural integrity. This guarantees the cabin interiors' dependability and safety for the duration of the aircraft's operating life. The ability of many alloy materials to withstand corrosion is essential for cabin components that are subjected to a variety of environmental factors during flight. The endurance and dependability of cabin interiors are increased by corrosion-resistant alloys, which also lower maintenance needs. The ability of some alloy materials to withstand fire is a deciding factor in achieving aviation safety regulations. Cabin interior safety is enhanced by alloys that can tolerate high temperatures without losing their structural integrity.

Insights by End User

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. In the market for aircraft cabin interior, the aftermarket sector is dynamic, adapting to changing consumer demands and industry dynamics. The aircraft aftermarket sector is expected to remain vital as airlines seek to preserve contemporary, secure, and reasonably priced cabin interiors. Certain cabin components may become outdated due to rapid technology improvements. To keep their fleets competitive, airlines may look for aftermarket services to replace antiquated technology with cutting-edge alternatives.

Recent Market Developments

- In June 2023, a unique digital experience within the cabin is introduced with "The Smart View Concept," which will be unveiled at AIX 2023 by AERQ, a provider of digital cabin solutions in collaboration with EnCore Corporate, Inc.

Competitive Landscape

Major players in the market

- Acro Aircraft Seating Astronics Corporation

- Aviointeriors S.p.A.

- Diehl Stiftung & Co. KG

- GAL Aerospace

- Hong Kong Aircraft Engineering Company Limited

- Jamco Corporation

- Raytheon Technologies Corporation

- Safran S.A.

- Thales Group

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aircraft Cabin Interior Market, Material Analysis

- Alloy

- Composites

- Others

Aircraft Cabin Interior Market, Type Analysis

- Aircraft and Seating

- Entertainment and Connectivity

- Cabin Lighting

Aircraft Cabin Interior Market, End User Analysis

- Aftermarket

- OEM

Aircraft Cabin Interior Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?