Global Agricultural Sprayers Market Size, Share, and COVID-19 Impact Analysis, By Type (Tractor-mounted, Handheld, Self-propelled, Trailed, Aerial), By Power Source (Electric & Battery-driven, Fuel-based, Manual, Solar), By Capacity (High volume, Low volume, Ultra-low volume), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: AgricultureGlobal Agricultural Sprayers Market Insights Forecasts to 2030

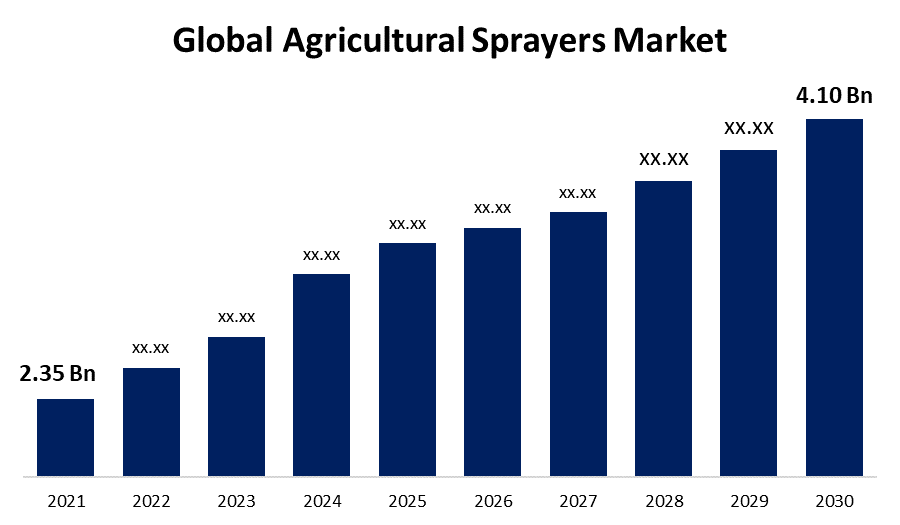

- The Global Agricultural Sprayers Market was valued at USD 2.35 Billion in 2021

- The Market is growing at a CAGR of 6.3% from 2021 to 2030

- The Worldwide Agricultural Sprayers Market size is expected to reach USD 4.10 Billion by 2030

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Agricultural Sprayers Market is anticipated to reach USD 4.10 billion by 2030, at a CAGR of 6.3% during the forecast period from 2022 to 2030. Agricultural machinery, irrigation techniques, and the ease with which finance is available to have all made important advances in agriculture over the years. In the agricultural sprayers market, demand has expanded due to increasing farmer awareness, a trend towards employing contemporary agricultural techniques, and greater production of diverse crop varieties. These are the major factor to boost the agricultural sprayers market during the forecast period.

Market Overview

Agricultural sprayers are machinery or pieces of equipment used to apply solvents to crops or plants such as fertilizers, insecticides, and herbicides. Using agricultural sprayers to apply these liquid compounds allows farmers to preserve crop health throughout the crop-growing cycle. Agricultural sprayers are available in a variety of designs, sizes, and shapes. Agricultural sprayers have evolved from simply handed sprayers to self-propelled and aerial pest control equipment in the expanding agriculture sector. Agricultural equipment is vital for increasing agricultural production and lowering labor costs. Agricultural sprayers have become increasingly crucial for farmers in recent years for spraying fertilizers as well as other chemicals such as herbicides and pesticides during harvest time as needed. Farmers can now apply chemicals more effectively due to advances in technology. As a result of changes in farming techniques and technological adoption, the market for agricultural sprayers has gained traction. Agricultural sprayer manufacturers have produced high-precision and more convenient agricultural sprayers to assist farmers in increasing the efficiency and profitability of their farming methods. As farmers grow more aware of how to protect their crops from pests, demand for improved spraying machinery is increasing. Sustainable pesticide application using agricultural sprayers raises the value of agricultural production, resulting in fueling the industry expansion.

For instance, in November 2022, John Deere has announced the imminent European introduction of C&Spray technology, which enables for the identification of weeds and the application of specialized treatments. This device detects colour changes in the environment using camera technology. Cameras and other devices are integrated into the boom or equipment frame.

Report Coverage

This research report categorizes the market for the global agricultural sprayers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural sprayers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural sprayers market.

Global Agricultural Sprayers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2.35 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.3% |

| 2030 Value Projection: | USD 4.10 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Type By Power Source, By Capacity, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | H&H Farm Machine Co., Buhler Industries Inc., AG Spray Equipment, Inc., DJI, Case IH, EXEL Industries, Bucher Industries AG, AMAZONEN-Werke, BGROUP S.p.A., Agro Chem Inc., AGCO Corporation, Boston Crop Sprayers Ltd., John Deere (US), CNH Industrial N.V., John Rhodes AS Ltd |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Farmers and growers suffer a variety of issues related to farm activities, as well as market challenges. Price fluctuations, unforeseen weather conditions, finding purchasers for their product, and a lack of natural resources are some of the market obstacles. Farmers have reaped numerous benefits from newer technology agricultural sprayers, including lower costs, increased spray efficiency, safety, and fewer crop and environmental harm. This is significantly increasing global demand for agricultural sprayers. The introduction of innovative technologies into the agricultural industry has accelerated the development of modern agricultural sprayers. The development of next-generation technology is fueling new trends in the market for innovative agricultural sprayers and spray pumps. With the use of sensors technology, leading companies in the agricultural sprayers sector are launching new spraying equipment with outstanding performance characteristics in terms of precision control and panoramic visibility.

Restraining Factors

Modern farming innovations, such as GPS, drones, and GIS to collect input data, variable rate technology, and satellite devices, are costly when compared to other non-tech equipment and necessitate a significant capital investment. Most of the farmers are small landowners or marginal farmers who cannot afford to invest in pricey equipment. This constraint is especially strong in developing countries like India, China, and Brazil. Presently, most emerging countries import farming equipment from other countries, which raises product costs and is projected to hinder the agricultural sprayer market growth in the near future.

Market Segmentation

The Global Agricultural Sprayers Market share is categorized into type, power source, and capacity.

- The tractor-mounted segment is expected to grow fastest during the forecast period.

Based on the type, the global agricultural sprayers market is differentiated into tractor-mounted, handheld, self-propelled, trailed, and aerial. Among these, the tractor-mounted segment is expected to grow the fastest during the forecast period. Tractor-mounted agricultural sprayers are estimated to grow at a faster rate throughout the projection period, owing to their ability to apply agrochemicals in large quantities. Tractor-mounted sprayers are becoming increasingly popular among both small-scale farmers and large-scale end users. In fact, major operators who previously used self-propelled sprayers are switching to tractor-mounted models, which allow for larger-scale farming operations. The operational versatility of tractor-mounted agricultural sprayers allows end users to perform pest control and fertilization tasks with a single piece of equipment.

- The fuel-based segment is estimated to grow the fastest over the predicted period.

Based on the power source, the global agricultural sprayers market is classified into electric & battery-driven, fuel-based, manual, and solar. Among these, the fuel-based segment is estimated to grow the fastest over the predicted period. The reason behind the growth is, the fuel-based sprayers are the most efficient because of their powerful engines, ability to cover wide farm areas, and less human work, but they also necessitate regular maintenance. For high-volume spraying, fuel-powered sprayers are employed. Fuel-based sprayers are dominating the global market due to increased demand and high capacity.

- The ultra-low volume segment is estimated to hold the largest market during the forecast period.

Based on the capacity, the global agricultural sprayers market is categorized into high volume, low volume, and ultra-low volume. Among these, the ultra-low volume segment is estimated to hold the largest market during the forecast period. These sprayers are used for modest jobs that do not require a lot of power machines. The capacity of agricultural sprayers is important for consistent pesticide or fertilizer application across crop leaves. Constantly changing climatic environments and water scarcity challenges drive the need for ultra-low volume sprayers, which use less water, boosting the market demand for ultra-low volume sprayers.

Regional Segment Analysis of the Agricultural Sprayers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

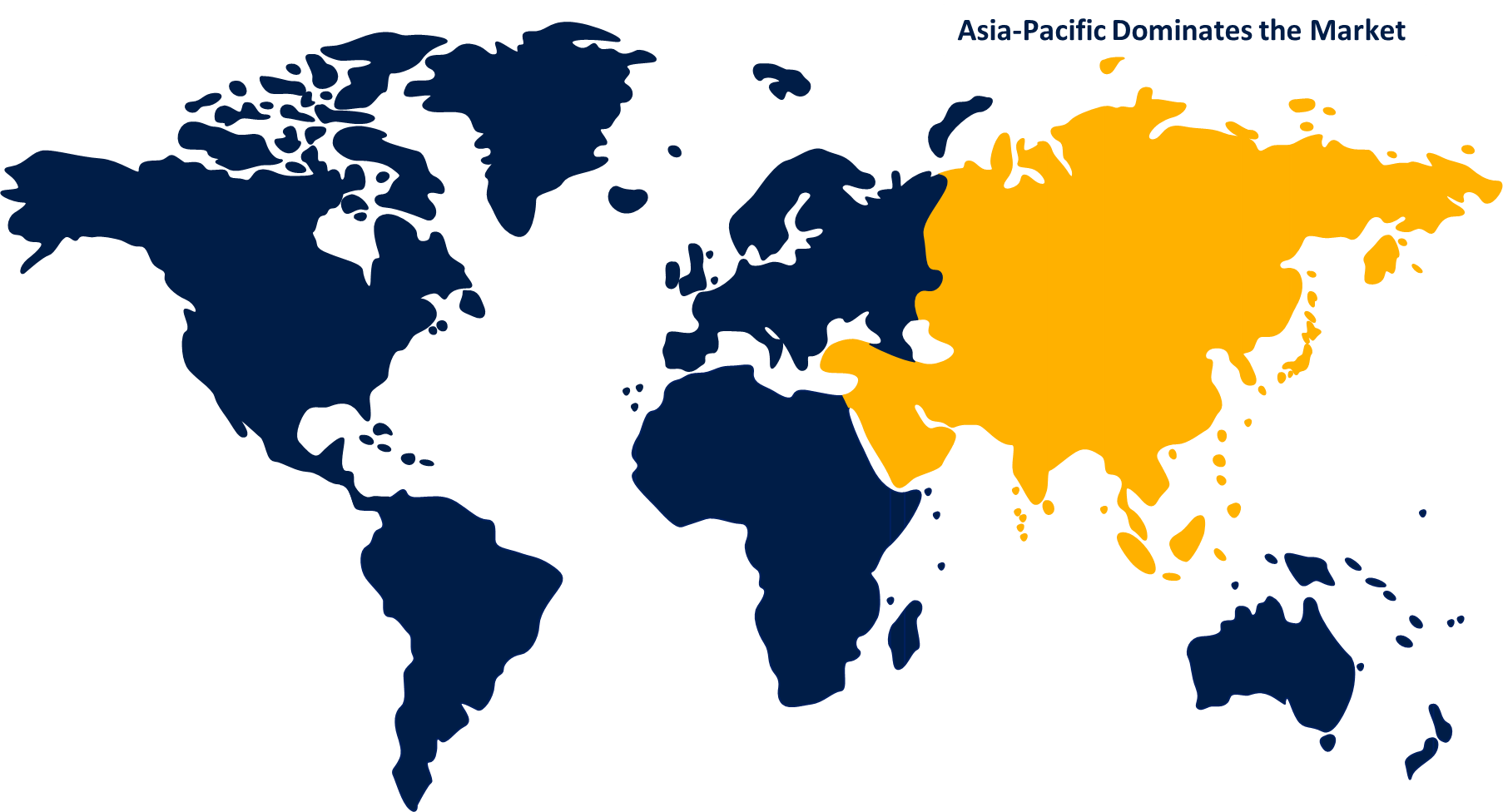

Asia Pacific is expected to hold the largest share of the market during the predicted timeframe.

Get more details on this report -

Asia Pacific is estimated to hold the largest share of the global agricultural sprayers market during the predicted timeframe. The use of unmanned aerial vehicles (UAVs) in Australia, India's high reliance on agriculture, and China's expanding export of agricultural machinery are some of the key drivers driving the Asia-Pacific agricultural sprayers market to expand in the coming years. Governments in China are also providing farmers with subsidies and loans to encourage the use of agricultural sprayers that use innovative equipment and machinery. Furthermore, self-propelled agricultural sprayer manufacturers are focused on strategic alliances with local manufacturers in order to address the growing need for customized, sustainable, and technically advanced agricultural sprayers.

North America is likely to grow fastest with a sizable portion of the global agricultural sprayer market. Product demand is expected to rise due to advancements in machinery and farm equipment productivity. Agriculture production in the region has increased significantly as a result of new technologies, process improvements, and agricultural innovations Improved farming techniques, the use of technologically advanced agricultural machinery, and the desire for high-quality agricultural produce are all predicted to drive up demand for agricultural sprayers in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural sprayers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- H&H Farm Machine Co.

- Buhler Industries Inc.

- AG Spray Equipment, Inc.

- DJI

- Case IH

- EXEL Industries

- Bucher Industries AG

- AMAZONEN-Werke

- BGROUP S.p.A.

- Agro Chem Inc.

- AGCO Corporation

- Boston Crop Sprayers Ltd.

- John Deere (US)

- CNH Industrial N.V.

- John Rhodes AS Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, AgNext Technologies has introduced the e-sprayer, an electrostatic-based pesticide sprayer that provides 360° crop coverage with no pesticide waste or leaking. Electrostatically charged atomised liquid spray is dispersed by E-spray. The e-sprayer has an Internet of Things device that allows users to track spraying operations in real time.

- In October 2022, At AirWorks, DJI revealed its updated flagship DJI AGRAS T40 for the United States and adjacent territories. Its ultra-high flow rate and Dual Atomized Spray Technology significantly improve sprayed droplet adherence on the back of fruit tree leaves. It is designed to suit the majority of users' needs in aerial crop protection for fruit trees, with a payload weight capacity of 50 kg and enhanced spreading efficiency of 1.5 tonnes per hour.

- In November 2022, Pyka, the manufacturer of the Pelican Spray, a fully autonomous and 100% electric agricultural aerial application aircraft, has gained the first regulatory licence to conduct unmanned aerial spray missions with a fixed wing aircraft at night. The Pelican Spray has been approved by Costa Rica's General Directorate of Civil Aviation (DGAC) to be utilised by Pyka's local customers to spray big commercial banana farms both day and night.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Agricultural Sprayers Market based on the below-mentioned segments:

Global Agricultural Sprayers Market, By Type

- Tractor-mounted

- Handheld

- Self-propelled

- Trailed

- Aerial

Global Agricultural Sprayers Market, By Power Source

- Electric & Battery-driven

- Fuel-based

- Manual

- Solar

Global Agricultural Sprayers Market, By Capacity

- High volume

- Low volume

- Ultra-low volume

Global Agricultural Sprayers Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?