Global Agricultural Pheromones Market Size, Share, and COVID-19 Impact Analysis, By Type (Aggregation pheromones, Sex pheromones, and Others), By Crop Type (Fruits & nuts, Field crops, Vegetable crops, and Others), By Function (Mass trapping, Detection monitoring, Mating disruption, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: AgricultureGlobal Agricultural Pheromones Market Insights Forecasts to 2032

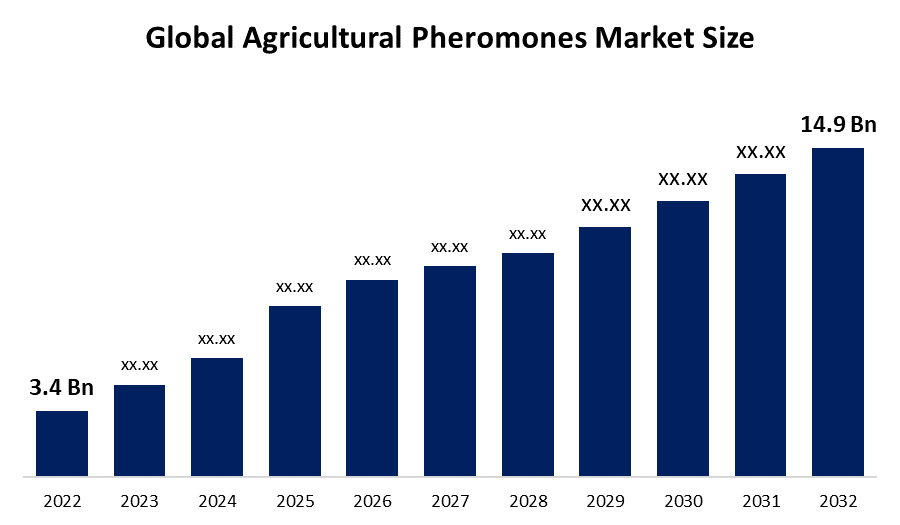

- The Global Agricultural Pheromones Market Size was valued at USD 3.4 billion in 2022.

- The Market is growing at a CAGR of 15.9% from 2022 to 2032

- The Worldwide Agricultural Pheromones Market Size is expected to reach USD 14.9 billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Agricultural Pheromones Market is projected to exceed USD 14.9 billion by 2032, growing at a CAGR of 15.9% from 2022 to 2032. Market demand is being driven by factors such as increased pest proliferation, increased sustainable agricultural activities, and growing support for government policies. Agricultural pheromones market growth is also attributed due to expanding R&D activities for developed agricultural activities, as well as increasing demand for higher production of crops.

Market Overview

The agricultural pheromones refer to the market for chemical signals or substances produced by insects and other animals to communicate with others of the same species, primarily for the purpose of attracting mates or repelling predators. In agriculture, pheromones are used to control or monitor pests and enhance crop yield by influencing insect behavior. The global agricultural pheromones market is being driven by a combination of factors, including consumer demand for sustainable agriculture practices, concerns about the harmful effects of chemical pesticides, and advances in technology that have made pheromone production more accessible and cost-effective. As these drivers continue to shape the market, the use of pheromones in agriculture is expected to grow significantly in the coming years.

The global agricultural pheromones market is highly competitive, with several key players operating in the market. Some of the major players in the market include BASF SE, Suterra LLC, Isagro Group, Shin-Etsu Chemical Co. Ltd., Trécé Inc., and Bedoukian Research Inc. These players are focusing on research and development activities to enhance their product portfolio and gain a competitive edge in the market.

For instance, in January 2023, Bayer disclosed a collaboration with the French company M2i Group to provide pheromone-based biological protection for crops to fruit and vegetable producers globally. Bayer will become the exclusive provider of select M2i products targeting lepidopteran pests in crops such as stone and pome fruits, tomatoes, as well as grapes under the terms of the agreement.

Report Coverage

This research report categorizes the market for the global agricultural pheromones market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural pheromones market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural pheromones market.

Global Agricultural Pheromones Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.4 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 15.9% |

| 2032 Value Projection: | USD 14.9 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Crop Type, By Function, By Region |

| Companies covered:: | Biobest Group NV, Shin-Etsu Chemical Co., Ltd., ISCA Technologies, Bedoukian Research, Inc., Sumi Agro France, Bioline AgroSciences Ltd., Russell IPM, Certis Europe BV, Pherobank B.V., BASF SE, Trécé Incorporated, Suterra LLC, Bio Controle, Koppert Biological Systems, Isagro Group, Others |

Get more details on this report -

Driving Factors

One of the primary driving forces behind the growth of the agricultural pheromones industry is rapid changes in environmental conditions. The rapid climate change has a direct impact on crops, as it may lead to an increase in plant pests and diseases. These ongoing changes make crops more susceptible to a variety of diseases and pests, which has a negative impact on crop production.

The use of chemical pesticides in agriculture has been linked to a range of negative effects on the environment, including water pollution and soil degradation. In addition, there are concerns about the potential health risks associated with exposure to these chemicals. As a result, many farmers are looking for alternative methods of pest control, and pheromones are seen as a safe and effective option. As consumers become more environmentally conscious, there is an increasing demand for sustainable agriculture practices that use fewer chemicals and are more eco-friendly. Pheromones are seen as a natural and sustainable alternative to chemical pesticides, and their use is growing in popularity among farmers who want to reduce their impact on the environment.

Governments around the world are becoming more supportive of sustainable agriculture practices and are providing incentives and subsidies for farmers who adopt these methods. This is driving demand for pheromones and other natural pest control methods.

Restraining Factors

While advances in technology have made pheromone production more accessible and cost-effective, it is still a relatively expensive process. This can make pheromones more expensive than chemical pesticides and other pest control methods, which can be a barrier to their adoption by some farmers. Pheromones are often produced and distributed by specialized companies, and their availability may be limited in certain regions or countries. This can make it difficult for farmers in these areas to access pheromones, which can limit their ability to use this pest control method.

Market Segmentation

The Global Agricultural Pheromones Market share is classified into type, crop type, and function.

- The sex pheromones segment is expected to hold the largest share of the global agriculture pheromones market over the forecast period.

Based on the type, the global agricultural pheromones market is divided into aggregation pheromones, sex pheromones, and others. Among these, the sex pheromones segment is expected to hold the largest share of the global agriculture pheromones market over the forecast period. The reason for the increase is due to the species-specific nature of sex pheromones, their ability to be influential even in small quantities, and their nontoxicity to humans and animals. Sex pheromones are among the most widely utilized type for pest control methods.

- The fruits & nuts segment is expected to hold the largest share of the global agricultural pheromones market during the forecast period.

Based on the crop type, the global agricultural pheromones market is divided into fruits & nuts, field crops, vegetable crops, and others. Among these, the fruits & nuts segment is expected to hold the largest share of the global agricultural pheromones market during the forecast period. The growth can be attributed due to the high demand for pheromones in controlling pests that damage these crops, as well as the high value of these crops. This segment includes crops such as apples, grapes, citrus, almonds, and walnuts. Pheromones are widely used in this segment to control pests such as codling moths, Oriental fruit moths, and navel orange worms.

- The mating disruption is expected to hold the largest share of the global agricultural pheromones market during the forecast period.

On the basis of the function, the global agricultural pheromones market is segmented into mass trapping, detection monitoring, mating disruption, and others. Among these, the mating disruption is expected to hold the largest share of the global agricultural pheromones market during the forecast period. The growth can be attributed due to the high demand for this method in controlling pests that damage crops, as well as the growing trend towards more sustainable pest management practices. This method involves the use of synthetic pheromones to disrupt the mating behavior of target pests. The goal is to prevent or reduce mating and egg-laying, which can significantly reduce the pest population. This method is typically used in crops with high-value fruits and vegetables, such as grapes and strawberries.

Regional Segment Analysis of the Global Agricultural Pheromones Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is estimated to hold the largest share of the global agricultural pheromones market over the predicted timeframe.

Get more details on this report -

North America is expected to hold the largest share of the global agricultural pheromones market during the study period. This region has the largest market for agricultural pheromones, driven by the high adoption rate of integrated pest management practices in the region's agricultural sector. The United States is the largest market for agricultural pheromones in North America, with a focus on crops such as apples, grapes, and almonds. Growers in North America are using pheromones for aimed pest control, and extensive research on developing novel semiochemicals is another factor driving the regional market growth.

The Asia Pacific region is expected to grow the fastest in the global agricultural pheromones market during the projected period. The market for agricultural pheromones in the Asia Pacific is driven by the large population and the high demand for food. The market is also driven by the increasing adoption of integrated pest management practices in the region's agricultural sector. China, India, and Japan are major markets for agricultural pheromones, with a focus on crops such as rice, corn, and tea. The regional market is also being driven by the rising incorporation of innovative and affordable active ingredients into products in order to minimize overall manufacturing costs and improve product effectiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural pheromones along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biobest Group NV

- Shin-Etsu Chemical Co., Ltd.

- ISCA Technologies

- Bedoukian Research, Inc.

- Sumi Agro France

- Bioline AgroSciences Ltd.

- Russell IPM

- Certis Europe BV

- Pherobank B.V.

- BASF SE

- Trécé Incorporated

- Suterra LLC

- Bio Controle

- Koppert Biological Systems

- Isagro Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Biobest purchased a 60% stake in Biopartner sp z o.o., one of Poland's leading manufacturers and sellers of biological plant protection products, fertilizers, as well as biopesticides. The deal will assist Biobest in expanding its presence in Poland.

- In July 2022, ATGC Biotech Pvt Ltd announced the release of its new pheromone CREMIT PBW, a mating disruption product designed specifically for the control of Pink Bollworm.

- In June 2022, PATS-C, a completely automatic IPM system designed specifically for strawberry crops, was introduced by Biobest. This novel scouting system aids in the control of moths and an expanding range of aphids.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Agricultural Pheromones Market based on the below-mentioned segments:

Global Agricultural Pheromones Market, By Type

- Aggregation pheromones

- Sex pheromones

- Others

Global Agricultural Pheromones Market, By Crop Type

- Fruits & nuts

- Field crops

- Vegetable crops

- Others

Global Agricultural Pheromones Market, By Function

- Mass trapping

- Detection Monitoring

- Mating disruption

- Others

Global Agricultural Pheromones Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?