Global Agricultural Fumigants Market Size, Share, and COVID-19 Impact Analysis, By Products (Chloropicrin, Dimethyl Disulfide, Phosphine, Others), By Application (Soil, Warehouses), By Form (Solid, Liquid, Gas), By Pest Control Method (Tarpaulin, Non-Tarp, Vacuum), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: AgricultureGlobal Agricultural Fumigants Market Insights Forecasts to 2030

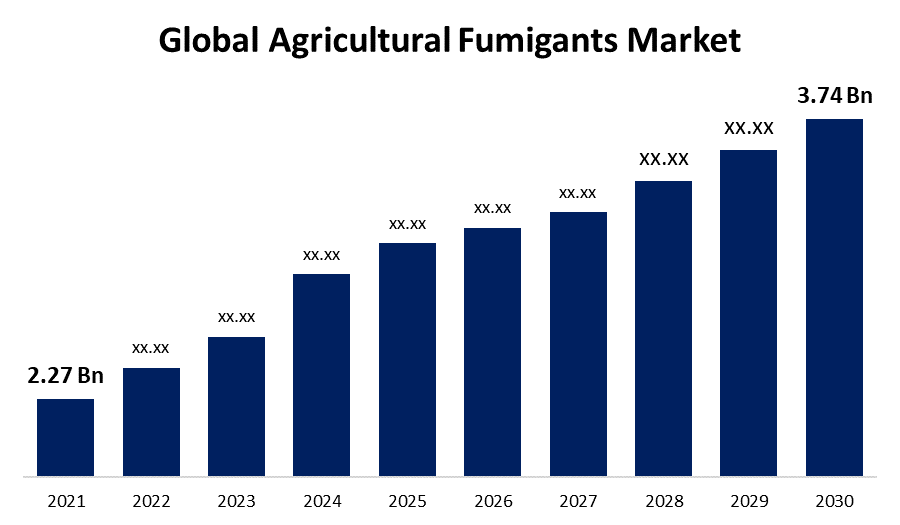

- The Global Agricultural Fumigants Market Size was valued at USD 2.27 Billion in 2021

- The Market is growing at a CAGR of 5.4% from 2021 to 2030

- The Worldwide Agricultural Fumigants Market size is expected to reach USD 3.74 Billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Fumigants Market is expected to reach USD 3.74 billion by 2030, at a CAGR of 5.4% during the forecast period 2022 to 2030. The popularisation of agricultural fumigants can be attributed to a rise in pest and insect infestations in warehouses and other crop storage rooms as a result of biotic and abiotic factors, increased awareness of crop protection chemicals, and urbanization in developing markets. Factors driving the agricultural fumigants market include rapid technological advancements in the agricultural sector, growing concerns about post-harvest losses, and a shift in advanced farming practices that have resulted in increased yields.

Market Overview

Fumigation, which involves the application of a pesticide gas into the soil or air to eliminate pests, is widely used in agriculture. Fumigation is one of the pest control methods used to kill or prevent the growth of pests. Agricultural fumigants are injected into the soil to rid it of insects, weeds, nematodes, and rodents like moles. Fumigant pesticides are used to kill small insects and fungi after harvesting grains and crops. Fumigants are used to protect crops. It removes pathogens from the soil, such as weeds, fungi, and nematodes, and promotes optimal crop development. These fumigants are useful for both pre-harvest and post-harvest applications, and they are extremely effective at reaching pests. 1, 3-Dichloropropene, phosphine, methyl bromide, chloropicrin, metam sodium, and other agricultural fumigants are commonly used. They are available in a variety of forms, including gas, solid, and liquid, and can be used in both soil and warehouses. Several factors contribute to the growth of the agricultural fumigants market, including increased consumer interest in improving agricultural output quality, changing farming methods, and highly developed storage technology. However, fumigants can cause a variety of issues, such as phytotoxicity, depending on the crop type and variety, seasonal conditions, humidity, temperature, fumigant concentration, and treatment duration. Because of its high toxicity as a respiratory poison, it is only recommended for use by professional fumigators.

Report Coverage

This research report categorizes the market for global agricultural fumigants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural fumigants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural fumigants market.

Global Agricultural Fumigants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2.27 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 5.4% |

| 2030 Value Projection: | USD 3.74 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Products, By Application, By Form, By Pest Control Method, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | AMVAC, Trinity Manufacturing Inc., Douglas products, Intertek , Nippon Chemical Industrial Co. Ltd. , MustGrow Biologics Inc , Nufarm , Solvay, Tessenderlo Kerley Inc., SGS SA , UPL, BASF SE , Syngenta ., ADAMA , ARKEMA |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Driving Factors

A rapidly growing global population has increased food demand tremendously, requiring the implementation of better overall agricultural practices. This has resulted in a major effect on agricultural fumigant demand, which provides protection for agricultural products from pests. Furthermore, the demand for fumigants has increased in conjunction with the expansion of agricultural production over the years. Fumigation has become one of the most popular methods for preventing insect infestations in farm storage and silos while avoiding pest resistance development. Reduced post-harvest food losses are an important component of ensuring food security. Agricultural products that are freshly harvested undergo transformations during handling, resulting in post-harvest losses. Post-harvest losses can be avoided by fumigating pest control. For example, ammonia gas fumigation prevents citrus fruit decay after harvest. As a result, fumigation aids in the prevention of post-harvest losses and the preservation of agricultural product quality. Fumigation also aids in the thorough cleaning of storage sites, silos, and warehouses. These are the major factors to boost the market over the study period.

Restraining Factors

Stringent regulations, as well as an increase in residue during fumigation, are expected to stymie market growth. Furthermore, a few side effects of agricultural fumigant chemical compound exposure, including loss of appetite, dizziness, headache, emphysema, and vomiting, are negatively impacting its use in agricultural applications, thereby impeding the agricultural fumigant's market growth. The use of volatile chemicals in soil fumigation is controlled by a variety of governing bodies. It is essential to determine the best fumigant for each application. Furthermore, using handheld or manual injectors to apply these fumigants incurs significant labour costs.

Market Segmentation

The Global Agricultural Fumigants Market share is segmented into products, application, form, and pest control method.

- The chloropicrin segment is expected to grow the fastest in the market during the forecast period.

Based on the products, the global agricultural fumigants market is segmented into chloropicrin, dimethyl disulfide, phosphine, and others. Among these, the chloropicrin segment is anticipated to grow the fastest in the market during the predicted period. Because of its multifunctional nature in controlling various pests such as nematodes, weeds, insects, bacteria, and soil-borne fungus diseases while leaving agricultural produce residue-free, chloropicrin is expected to grow at the fastest CAGR. It is used as a soil fumigant because it has the ability to affect both targeted and non-targeted microorganisms.

- The warehouse segment is anticipated to be the fastest growing segment in the market during the projected period.

Based on the application, the global agricultural fumigants market is segmented into soil, and warehouses. Among these, the warehouse segment is expected to be the fastest growing segment in the market during the study period. Warehouses are important because agricultural produce can be stored there if the farmer is unwilling to sell it. The effective utilisation fumigant in warehouses improves crop quality and productivity, resulting in market competitiveness. Insect, nematode, and other pests that damage infrastructure and stored food in warehouses are killed, repelled, or suppressed using pest control methods. Because of the severe pest infestation caused in warehouses, the agricultural fumigants market is gaining traction.

- The liquid segment is anticipated to hold the largest market over the predicted period.

On the basis of form, the global agricultural fumigants market is differentiated into solid, liquid, and gas. Among these, the liquid segment is expected to hold the largest market over the forecast period. Soluble products used to eliminate moulds, insects, and pests, among other things, are available in liquid form. They are typically sprayed over the desired land area with standard sprayers. The applicator determines the volume of solvent to be disbursed. When performed in either enclosed chambers or completely open outdoor areas, this type of fumigation is generally regarded as the safest.

- The tarpaulin fumigation segment is anticipated to hold the largest market over the forecast period.

On the basis of pest control method, the global agricultural fumigants market is differentiated into tarpaulin, non-tarp, vacuum. Among these, the tarpaulin fumigation segment is expected to hold the largest market over the forecast period. Tarpaulin is widely used because of its low cost, ease of application, effectiveness, availability, and ability to prevent gas leakage. Tailor-made covers are also used where sheet overlapping is inconvenient, with the assistance of trained professionals. These factors all contribute to the expansion of the tarpaulin fumigation segment.

Regional Segment Analysis of the agricultural fumigants market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America holds the largest share of the Agricultural Fumigants Market.

Get more details on this report -

North America region is expected to hold the largest market over the predicted period. North America is one of the world's largest agricultural hubs. Due to farmers growing awareness of the importance of crop protection against insects, and other pests in order to reduce agricultural commodity losses, North America holds the largest agricultural fumigants market. The cultivation of corn, strawberries, and tomatoes accounts for the majority of the country's demand for methyl bromide. The country is also a major producer and exporter of maize on a global scale. Farmers and other agricultural associations are looking for viable alternatives to methyl bromide and chloropicrin due to the stringent regulations established in recent years by multiple agencies. Because their residual leftovers are minimal, these chemicals are widely injected into the soil during strawberry production. Some alternatives, such as phosphine, carbonyl sulphide, and sulfuryl fluoride, have been tested in the United States. When compared to methyl bromide, these alternatives have a lower environmental impact.

The Asia Pacific market is expected to be the fastest-growing market during the study period due to the high potential for growth, given the increase in agricultural production and the growing demand for agricultural fumigants with rising warehouses in countries such as China and India. Furthermore, as consumer pest awareness grows, service providers and fumigant suppliers are looking to expand their market influence through joint ventures and acquisitions in the Asia Pacific region. Increasing agricultural practises in India, China, and Indonesia are projected to propel the size of the Asia Pacific Agricultural Fumigants Market during the forecast period. The size of the Latin American agricultural fumigants market is expected to grow significantly over the next few years due to Brazil's increasing capacity for adopting advanced agricultural practices and storage techniques.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural fumigants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AMVAC

- Trinity Manufacturing Inc.

- Douglas products

- Intertek

- Nippon Chemical Industrial Co. Ltd.

- MustGrow Biologics Inc

- Nufarm

- Solvay

- Tessenderlo Kerley Inc.

- SGS SA

- UPL

- BASF SE

- Syngenta

- ADAMA

- ARKEMA

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2022, Bunge Ltd has agreed to buy a 33% stake in Sinagro from UPL Ltd in order to strengthen its grain orientation strategy in Brazil.

- In August 2022, MustGrow Biologics and Sumitomo Corporation have announced the extension of their exclusive agreement and the advancement of their programme. Sumitomo Corporation has extended the option for exclusive testing with MustGrow's technology in North, Central, and South America for preplant soil fumigation, bioherbicide, postharvest, and food preservation for potatoes and bananas.

- In January 2021, United Phosphorous Limited worked in collaboration with TeleSense to introduce post-harvest commodity storage and transportation monitoring solutions to reduce food waste and increase farmer profitability.

- In January 2021, UPL and TeleSense joined forces to develop monitoring solutions for post-harvest commodity transport and storage. This helps to reduce food waste by detecting and mitigating potential issues like hotspots, excessive moisture, and pests. This adds to the company's extensive line of gas monitoring, safety, and detection devices, as well as fumigants.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global Agricultural Fumigants Market based on the below-mentioned segments:

Global Agricultural Fumigants Market, By Products

- Chloropicrin

- Dimethyl Disulfide

- Phosphine

- Others

Global Agricultural Fumigants Market, By Application

- Soil

- Warehouses

Global Agricultural Fumigants Market, By Form

- Solid

- Liquid

- Gas

Global Agricultural Fumigants Market, By Pest Control Method

- Tarpaulin

- Non-Tarp

- Vacuum

Global Agricultural Fumigants Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?