Global Aerospace Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber (Carbon Fiber Aerospace Composites, Ceramic Fiber Aerospace Composites, Glass Fiber Aerospace Composites), By Matrix (Polymer Matrix, Ceramic Matrix, Metal Matrix), By Application (Aerospace Composites for Interiors, Aerospace Composites for Exteriors), By Manufacturing Process ( AFP (Automated Fiber Placement)/ATL (Automated Tape Layup), Layup, Resin Transfer Molding, Filament Winding), By Aircraft ( Aerospace Composites for Commercial Aircraft, Aerospace Composites for Business & General Aviation, Aerospace Composites for Civil Helicopters, Aerospace Composites for Military Aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030.

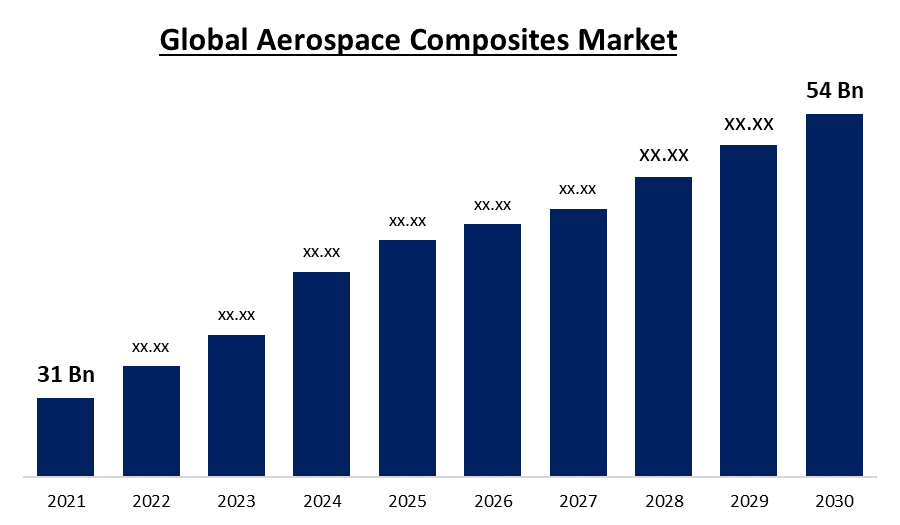

Industry: Aerospace & DefenseThe Global Aerospace Composites Market is expected to grow from USD 31 billion in 2021 to USD 54 Billion by 2030 at a CAGR of over 7.5% over the forecast period.

Get more details on this report -

The report aims to provide an overview of the global aerospace composites market with detailed market segmentation by Fibre, Matrix, Application, Manufacturing Process, Aircraft, and Region. The global aerospace composites market is expected to witness significant growth during the forecast period.

Global Aerospace Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 31 billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 7.5 % |

| 2030 Value Projection: | USD 54 billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Fibre, By Matrix, By Application, By Manufacturing Process, By Aircraft, By Region |

| Companies covered:: | Materion Corporation, Royal Ten Cate, Hexcel Corporation, Owen Corning, Solvay, Teijin, SGL Group, Mitsubishi Rayon Co., Renegade Materials Corporation, and Toray Industries. |

| Growth Drivers: | Demand for composite materials will be boosted by improvements in manufacturing methods and easy machinability. |

| Pitfalls & Challenges: | The COVID-19 outbreak and the Boeing 737 MAXs forced grounding have had a negative effect on the aviation industry in 2020. |

Get more details on this report -

Aerospace Composites Market: Overview

Composites are frequently used in the aviation sector. They are utilized in the construction of aircraft parts such as wings, ribs, spars, frames, longeron, and fuselage stiffeners. A composite is created from two or more materials that, when mixed together, create a new material with superior properties that are very different from those of the base materials alone. Historically, materials such as metals, aluminum alloys, polymers, and others were utilized to create aircraft. with enhanced knowledge and technology.

The aerospace sector saw a substantial surge in the use of composites. Wings and fuselages are two common basic forms in which composites are used nowadays. Manufacturing composite aeronautical parts have a complicated supply chain. Nevertheless, despite several challenges, composite manufacturers guarantee a constant supply of these materials in various regions of the world. The demand for lightweight and durable components in military and commercial aircraft is increasing the use of aerospace composites, which will accelerate market expansion.

Weight reduction and excellent impact resistance are two factors that will help the aerospace composites market grow. The widespread use of both interior and exterior applications will also increase the penetration of the product overall. Commercial and defense industry expansion is anticipated to experience rapid growth during the anticipated time range. Additionally, rising defense spending will have an impact on how the industry develops in the upcoming years.

Aerospace Composites Market- Growth Factors

Demand for composite materials will be boosted by improvements in manufacturing methods and easy machinability. Composites can be produced in a variety of intricate shapes that reduce material waste and provide corrosion resistance, which in turn helps products penetrate the market more deeply. The market for the product will be boosted by the high quality of the composites used in exterior airframe components including wings, undercarriages, and fuel components. The expansion of the sector will be accelerated by strong product penetration in aircraft construction. Players in the aerospace composites market are concentrating on recycling composites so they may be used again in the MRO sector, which will increase product penetration.

By 2028, 65% of the revenue share in the aerospace composites market would go to the carbon sector. High-quality precision components made from carbon are frequently used to manufacture and treat high-quality components such as machine plates, nuts, bolts, and posts. The primary elements propelling the market expansion of graphite in aircraft applications are its superior durability, hardness, and flexibility. Additionally, the material is frequently utilized in engine components like impellers and rotors to provide safety from sparks. The main characteristics promoting the industry's development are lightness, resilience to high temperatures, and improved strength.

Graphite also has the ability to self-lubricate, which results in steady behaviour and less upkeep. In 2021, the commercial aerospace composites market was worth USD 6.5 billion. The number of air travellers has increased in recent years due to flights' rising affordability. The market revenue will rise even more if the aggregate number of passengers rises. More than 50% of the market is made up of composites. The industry's growth will be fuelled by the increasing benefits of product use, such as weight reduction and an improvement in the aircraft's overall efficiency. Additionally, the competitive edge over rivals in manufacturing and melding processes will enhance the entire market value.

COVID-19 Analysis

The COVID-19 outbreak and the Boeing 737 MAX's forced grounding have had a negative effect on the aviation industry in 2020. The aerospace composites industry is severely impacted by the complete ban on international travel in numerous economies in Europe and APAC during the first half of FY2020. A number of airlines have abandoned and/or delayed their intentions to buy new aircraft. Leaders in the sector have also reported a negative effect on revenue growth in FY 2020.

Aerospace Composites Market – Market Trends

- After North America, the market with the highest growth rate is Asia-Pacific. The need for aerospace composites is rising along with the demand for aeroplanes and helicopters. The largest APAC demand came from China. It is anticipated that aircraft composites would soon show potential growth in other nations including Japan, Singapore, and India.

- Commercial aircraft along with military and defense activity dominated the market. For example, passenger and cargo floor panels, ceiling panels, kitchens, air ducts, cabin linings, plenums, upper compartments, ceiling panels, toilets, bars, partitions, cupboards, seats, fins and ailerons, trailing edges, supports, and landing gear doors are just a few examples of the many uses for aerospace composites.

- In 2019, Europe accounted for the second-largest share of aerospace composites. Due to the enormous demand for military and defense activities, Western Europe had the largest demand in this region. But in the near future, Central Europe and Russia will hold a larger market share.

Aerospace Composites Market – Segmentation

By Fibre:

- Carbon Fibre Aerospace Composites

- Ceramic Fibre Aerospace Composites

- Glass Fibre Aerospace Composites

By Matrix:

- Polymer Matrix

- Ceramic Matrix

- Metal Matrix

By Application:

- Aerospace Composites for Interiors

- Aerospace Composites for Exteriors

By Manufacturing Process:

- AFP (Automated Fibre Placement)/ATL (Automated Tape Layup)

- Layup

- Resin Transfer Moulding

- Filament Winding

By Aircraft:

- Aerospace Composites for Commercial Aircraft

- Aerospace Composites for Business & General Aviation

- Aerospace Composites for Civil Helicopters

- Aerospace Composites for Military Aircraft

Aerospace Composites Market –Regional Analysis

Due to rising demand from the defense industry, expanding trade operations in the region, and the presence of key players, North America currently controls the majority of the aerospace composites market. Asia-Pacific is predicted to have the greatest CAGR due to an increase in research and development activities, rising tourist numbers in nations like China and India, rapid economic expansion in emerging markets, and a plentiful supply of raw resources, to name a few of the region's key driving forces.

Get more details on this report -

In addition, consumers' growing demand for air travel and the vigorous expansion of the aviation industry in these nations are projected to fuel regional market expansion. Due to the expansion of the tourism industry in the area, Europe anticipates having a substantial part. In the upcoming years, market growth may be further boosted by the growing demand for commercial aircraft with high load-carrying capacities.

Aerospace Composites Market – Key Market players

Materion Corporation

Royal Ten Cate

Hexcel Corporation

Owen Corning, Solvay

Teijin, SGL Group

Mitsubishi Rayon Co.

Renegade Materials Corporation

Toray Industries

Need help to buy this report?