Global Aero Wing Market Size by Platform (Military, Commercial), by Type of Build (Conventional Skin Fabrication, Composite Skin Fabrication) and by Material (Alloys, Metals, Composite), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aero Wing Market Size Insights Forecasts to 2033

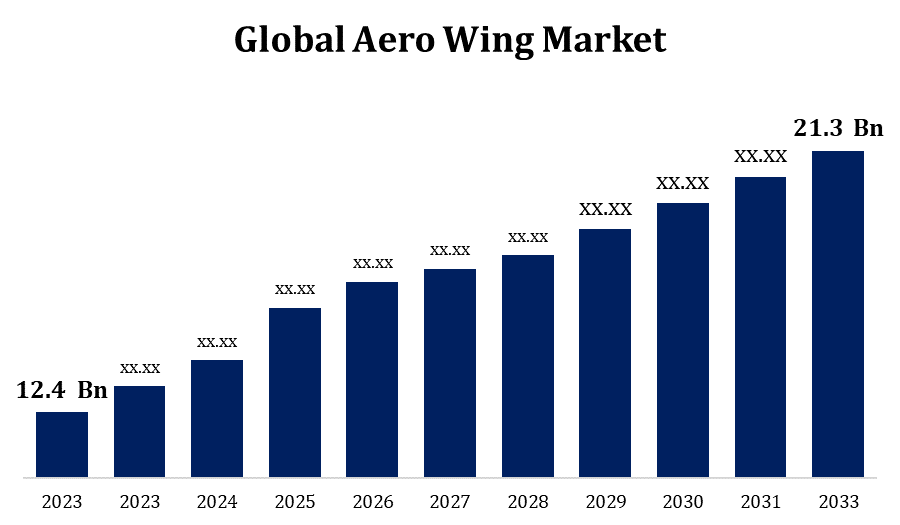

- The Global Aero Wing Market was valued at USD 12.4 Billion in 2023.

- The Market is Growing at a CAGR of 5.56% from 2023 to 2033

- The Worldwide Aero Wing Market is Expected to reach USD 21.3 Billion by 2033

- Asia Pacific is Expected to Grow the Fastest during the Forecast Period

Get more details on this report -

The Global Aero Wing Market is Expected to reach USD 21.3 Billion by 2033, at a CAGR of 5.56% during the Forecast period 2023 to 2033.

In commercial aviation, wings are critical components that provide lift and stability to an aircraft. Factors influencing the commercial aircraft wing market include airline fleet expansions, fuel economy standards, and innovations in wing design and materials. Military aircraft also require innovative wing technology to improve manoeuvrability and mission-specific capabilities. Defence expenditures, geopolitical circumstances, and technological improvements all have an impact on the military aircraft wing market. The aerospace sector depends on a complicated worldwide supply network. Companies that specialise in the production of aircraft wings, both large OEMs (Original Equipment Manufacturers) and smaller suppliers, contribute to the overall market dynamics.

Aero Wing Market Value Chain Analysis

The value chain begins with the acquisition of raw materials, such as advanced composites, aluminium alloys, and other materials required in wing manufacturing. Suppliers play an important role in providing high-quality supplies to manufacturers. Their efficiency and dependability can influence the overall quality and cost-effectiveness of aero wings. The manufacturing process comprises transforming basic materials into aero wings. This stage involves cutting, shaping, and assembling numerous components. OEMs are key participants in the aerospace industry who design and build whole aircraft, including aero wings. Aero wing manufacturers work with OEMs to meet aircraft design specifications, performance standards, and regulatory approvals. Aero wings require rigorous testing and quality control procedures to assure their safety and reliability. After production and testing, aero wings are transported to assembly lines or final aircraft assembly facilities. The logistics network is critical to delivering goods on time and efficiently. The last stage of the value chain is to deliver the completed aircraft to airlines or other end customers. Aero wings improve the overall performance and efficiency of the aircraft.

Aero Wing Market Opportunity Analysis

There are opportunities in the development and application of new materials, like as carbon fibre composites, to make aero wings lighter, more fuel-efficient, and ecologically benign. The growing emphasis on fuel efficiency and environmental sustainability creates prospects for aero wings that help to reduce aircraft emissions while enhancing overall efficiency. Participation in next-generation aircraft programmes allows aero-wing producers to become involved in cutting-edge aviation initiatives. Opportunities may arise to meet the specialised needs of regional and business aviation. Designing wings for smaller aircraft or those with unique performance needs might be a niche sector. As airlines and operators look to extend the life of their existing fleets, providing aftermarket services such as maintenance, repair, and upgrades to aero wings can be a profitable option.

Global Aero Wing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.4 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.56% |

| 2033 Value Projection: | USD 21.3 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | by Type, by Material, By Region, By Geographic, |

| Companies covered:: | Airbus Group, United Technologies Corporation (UTC), General Dynamics Corporation, Lockheed Martin, Northrop Grumman, Embraer Executive Jets, Raytheon Company, The Boeing Company, Mitsubishi Aircraft, Bombardier Aerospace, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aero Wing Market Dynamics

Rising use of composite components to procure aircraft wings

Composite materials are recognised for their high strength-to-weight ratio. Manufacturers can reduce aircraft weight significantly by employing composites in the wings. Lighter wings improve fuel efficiency, which lowers airline operational expenses. Composites are frequently more fatigue-resistant and durable than traditional materials. This can lead to aircraft wings having a longer operating life and requiring less maintenance, saving operators money. Composite materials provide increased design flexibility, enabling new and complicated wing designs. This flexibility can result in increased aerodynamics and overall aircraft performance. Composite materials can help to reduce the noise levels created by aircraft. Quieter aircraft are becoming more significant in meeting environmental rules and resolving community concerns, particularly in densely populated regions.

Restraints & Challenges

Developing and producing sophisticated composite wings can be expensive. The initial investment in materials and technology may provide difficulties for both manufacturers and airlines, reducing the overall cost-effectiveness of the solution. The aerospace business is built on complicated worldwide supply chains. Disruptions such as geopolitical conflicts, natural disasters, or global events (e.g., pandemics) can all have an impact on raw material and component supply, influencing production schedules and delivery deadlines. Weight reduction through the use of innovative materials is crucial to fuel economy. Weight reduction, however, frequently comes at the expense of durability and structural integrity. Finding the correct balance is difficult for designers. The aerospace sector is vulnerable to economic downturns, geopolitical events, and global crises.

Regional Forecasts

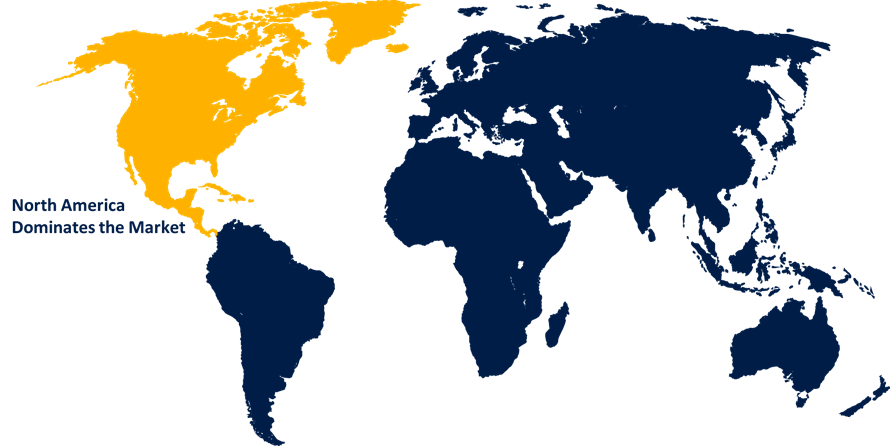

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aero Wing Market from 2023 to 2033. North America is home to some of the world's largest and most powerful aerospace businesses, including Boeing (headquartered in the United States), a significant producer of commercial and military aircraft wings. The aerospace sector in North America is known for its emphasis on sophisticated technology and innovation. This covers the creation and application of innovative materials, manufacturing techniques, and design concepts in the manufacture of aircraft wings. North America has a strong commercial aviation industry, with major airlines operating significant fleets. Demand for new aircraft, including those with advanced wing technologies, is being driven by considerations such as fleet modernization, fuel efficiency, and increasing passenger capacity.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Increasing air travel demand, expanding middle-class populations, and economic development have all contributed to increased demand for commercial aircraft, which has an impact on the Aerowing market. Countries such as China and India are emerging as key players in the aerospace industry. Both countries have made significant investments in the development and manufacture of aeroplane components, such as wings. The Asia-Pacific area has experienced a growth in low-cost carriers (LCCs), which has created demand for more fuel-efficient and cost-effective aircraft. This trend has the potential to affect aero-wing design and specifications. Some Asia-Pacific countries, particularly China, have emerged as major aerospace component production hubs. This encompasses the manufacturing of wings for many types of aircraft.

Segmentation Analysis

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. The overall increase in air travel demand, fueled by factors such as population growth, urbanisation, and rising disposable income, is critical to the commercial aviation sector's expansion. More passengers require more commercial aircraft, increasing demand for Aero Wings. The demand for long-haul flights has been increasing, prompting the purchase of wide-body aircraft. These aircraft often have longer wings to accommodate their long-range capability. The increase in long-haul routes boosts demand for commercial Aero Wings. The growth of low-cost carriers in several locations has boosted demand for narrow-body aircraft. These aircraft, which are often operated by low-cost carriers, may have unique Aero Wing requirements for short to medium-haul flights.

Insights by Type of Build

The conventional skin fabrication segment accounted for the largest market share over the forecast period 2023 to 2033. Advances in conventional materials and production processes, such as advancements in aluminium alloys and traditional assembly methods, can help to drive growth in the conventional skin fabrication sector. Adherence to industry standards and certification criteria is critical in the aircraft business. Manufacturers' ability to fulfil and surpass these criteria may have an impact on growth in the traditional skin fabrication industry. The requirement for upgrading existing aircraft fleets could propel expansion in the conventional skin manufacturing industry. Upgrading older aeroplanes with better skin materials or designs can increase their operating life and performance. The distribution of aircraft fleets around the world, notably the prevalence of older models with conventional skin construction, can influence demand for replacement parts and components, driving growth in this market.

Insights by Material

The metals segment accounted for the largest market share over the forecast period 2023 to 2033. Metallic wings are manufactured using well-established technologies that have been improved over decades. This expertise with procedures improves the efficiency and cost-effectiveness of fabricating metal wings. Metals, particularly aluminium, are generally less expensive than modern composite materials. This cost issue is critical for both aircraft manufacturers and airlines, particularly for commercial aircraft with high manufacturing volumes. The metals industry may expand due to the demand for modifying current aircraft fleets. Upgrading vintage aeroplanes with metallic wings can be a cost-effective way to extend their lifespan. Metallic wings are commonly required for military aircraft due to their longevity and strength. The expansion of the military aerospace sector may impact demand for metallic wing components.

Recent Market Developments

- In January 2024, Airbus Helicopters to expand its unmanned aerial system portfolio with the acquisition of Aerovel.

Competitive Landscape

Major players in the market

- Airbus Group

- United Technologies Corporation (UTC)

- General Dynamics Corporation

- Lockheed Martin

- Northrop Grumman

- Embraer Executive Jets

- Raytheon Company

- The Boeing Company

- Mitsubishi Aircraft

- Bombardier Aerospace

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aero Wing Market, Platform Analysis

- Military

- Commercial

Aero Wing Market, Type of Build Analysis

- Conventional Skin Fabrication

- Composite Skin Fabrication

Aero Wing Market, Material Analysis

- Alloys

- Metals

- Composite

Aero Wing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Need help to buy this report?