Global Abutment Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Stock Abutments, Custom Abutments, & Abutments Fixation Screws), By Material (Titanium and Zirconium), By End-use (Hospitals and Dental Clinics), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Abutment Implants Market Insights Forecasts to 2032

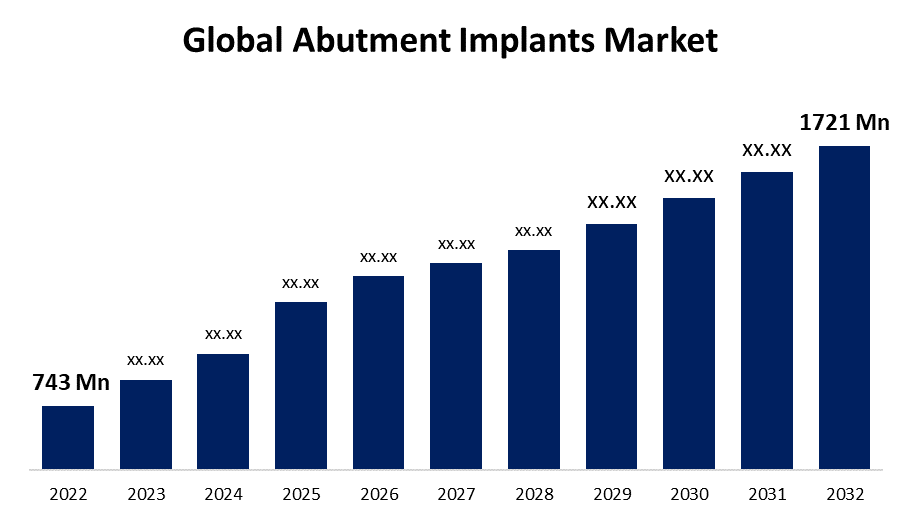

- The Global Abutment Implants Market Size was valued at USD 743 Million in 2022.

- The Market Size is Growing at a CAGR of 8.7% from 2022 to 2032.

- The Worldwide Abutment Implants Market size is expected to reach USD 1721 Million by 2032.

- Europe is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Abutment Implants Market Size is expected to reach USD 1721 Million by 2032, at a CAGR of 8.7% during the forecast period 2022 to 2032.

Market Overview

An abutment is a metal piece that serves as a foundation for the crown when a dentist places a dental implant. Its function is to serve as a connection, with one end connecting to the jawbone and the other end attached to the crown. Titanium is commonly used to make implant abutments. Sometimes zirconia and goal are used. However, zirconia is chosen since it has a similar tint to one's teeth. In comparison to titanium, this makes it unobtrusive inside the mouth. In addition, the frequency of dental ailments such as edentulism and periodontal disease is increasing. Furthermore, the growing desire for cosmetic dentistry and dental aesthetics in emerging nations is expected to drive the global use of abutment implants. According to the latest WHO figures, almost 3.5 billion people worldwide are impacted by oral illnesses. Moreover, according to the State of Oral Health in Europe study, more than half of the European population has some type of periodontitis, with about 10% having severe cases. The large proportion of the population suffering from problems such as tooth loss as a result of various oral issues such as gum disease, tooth decay, or other traumas will have a favorable influence on product uptake.

Report Coverage

This research report categorizes the global abutment implants market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global abutment implants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global abutment implants market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Abutment Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 743 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.7% |

| 2032 Value Projection: | USD 1721 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Material, By End-use, By Region. |

| Companies covered:: | Dentsply Sirona, A.B. Dental Devices Ltd., Adin Dental Implant Systems Ltd., Bicon, LLC., Cortex, Envista Holdings Corporation, Henry Schein, Institut Straumann AG, Osstem Implant Co., Ltd, ZimVie Inc., Biotem, Dentium USA, Ziacom, Dynamic Abutment Solutions, Keystone Dental Group, BHI Implants, Dentalpoint AG, Cowellmedi Co. Ltd., TAV Medical Ltd., and National Dentex Labs |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Initially, abutments were composed of titanium, which reflected when a person opened their lips. However, because zirconia was utilized for the implant, patients were more inclined to undergo the implant abutments. They are extremely adaptable and may be developed totally with CAD/CAM technology. They offer exceptional mechanical strength and dependability. In addition, it collects less bacterial plaque than titanium. This eliminates the need for the patient to return for maintenance regularly. It also mixes in with the color of human teeth, making it less obvious to the naked eye. Also, Abutments are being made accessible to enable adaptability to particular patient demands. Custom abutments guarantee that the crown is a perfect fit. This results in fewer dental clinic visits and modifications for the patient. It also assists physicians in developing an optimum profile that supports healthy tissue growth. This allows margins to be applied consistently and painlessly. The digitalization of the process has shown to be beneficial to the worldwide implant abutments market share.

Restraining Factors

Several variables might have an impact on the worldwide implant abutment market's growth. The number of failures rises as a result of late implant abutments. According to a report published on PubMed Central, dental implant failure is caused by a variety of factors. The mechanism may fail at any point throughout the operation. Failures can arise immediately after surgery. As a result, patients avoid undergoing the operations. As long as people visit a clinic on time, the risks of failure are eliminated.

Market Segmentation

- In 2022, the stock abutments segment is influencing the market with the largest market share during the forecast period.

On the basis of product, the global abutment implants market is segmented into stock abutments, custom abutments, & abutments fixation screws. Among these segments, the stock abutments segment is dominating the market with the largest revenue share during the forecast period due to the cost-effectiveness and ease of use of these technologies are important contributors to segmental expansion. Furthermore, these abutment systems provide pre-fabricated, conventional sizes with angulation correction while maintaining a cheap aesthetic profile. As a result, the aforementioned aspects are expected to bolster segment expansion.

- In 2022, the titanium segment is dominating the largest market share over the forecast period.

Based on the material, the global abutment implants market is bifurcated into different categories such as titanium and zirconium. Among these segments, the titanium segment is dominating the market during the forecast period due to its biocompatibility and growing utilization in abutment system construction. Titanium abutment implants are corrosion resistant, have high mechanical strength, and are ductile, resulting in increased demand for titanium material throughout the forecast period. Furthermore, these abutment systems are much more durable and long-lasting than previous abutment systems.

- In 2022, the dental clinics segment is dominating the market with the largest market share during the forecast period.

Based on end use, the global abutment implants market is segmented into hospitals and dental clinics. Among these segments, the dental clinics segment is expected to have significant development potential over the analysis period due to the rising frequency of periodontal diseases, together with the availability of specialized dentists in this healthcare environment to provide diverse and innovative therapies, which will drive the segment revenue. Furthermore, growth in the dental workforce and services that provide cheap dental treatment will accelerate sector trends.

Regional Segment Analysis of the abutment implants market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

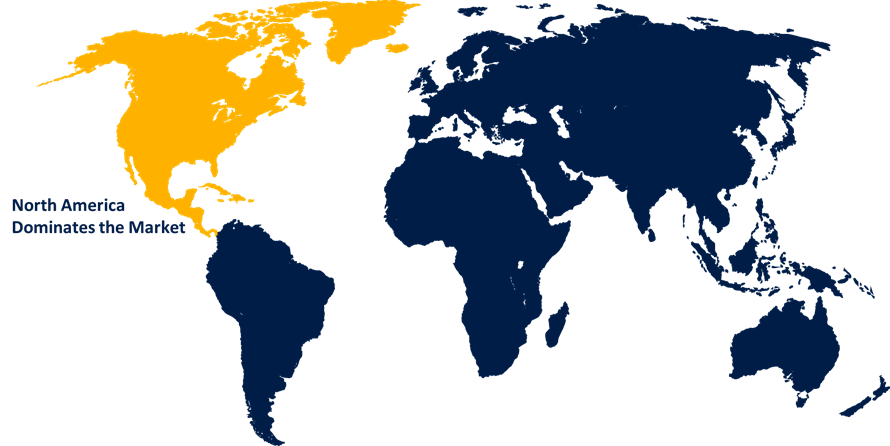

North America influenced the market with the largest market share during the forecast period

Get more details on this report -

North America is influencing significant market growth during the forecast period owing to the increasing frequency of dental disorders coupled with the increased demand for dental treatment and the cosmetic sector. Furthermore, the growing elderly population suffering from oral cavity disorders like toothaches or gum disease is driving demand for the abutment implants market in this area. In addition, the presence of significant market players, as well as the development of novel goods to satisfy the industry's expanding demand, is contributed to the market's expansion. For example, Bobel Biocare released Xeal and TiUltra Implant and Abutment Surfaces in the United States in January 2021.

Europe is expected to experience high revenue market growth during the forecast period. The basic materials necessary for construction abutments are plentiful, due to industrialization. The digitalization of current operations across Europe has helped Europe being the market's largest consumer.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global abutment implants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsply Sirona

- A.B. Dental Devices Ltd.

- Adin Dental Implant Systems Ltd.

- Bicon, LLC.

- Cortex

- Envista Holdings Corporation

- Henry Schein

- Institut Straumann AG

- Osstem Implant Co., Ltd

- ZimVie Inc.

- Biotem

- Dentium USA

- Ziacom

- Dynamic Abutment Solutions

- Keystone Dental Group

- BHI Implants

- Dentalpoint AG

- Cowellmedi Co. Ltd.

- TAV Medical Ltd.

- National Dentex Labs

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, ZimVie Inc. announced the arrival in the United States of the FDA-approved T3 PRO Tapered Implant and Encode Emergence Healing Abutment. This has enabled the corporation to broaden its product offering in a key area.

- In June 2022, Henry Schein agreed to buy Condor Dental Research Company. Condor Dental Research Company is a dental distributor that sells to specialists, general practitioners, and laboratories. As a result, this purchase aided the corporation in increasing its business revenue and geographical reach.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Abutment Implants Market based on the below-mentioned segments:

Global Abutment Implants Market, Product

- Stock Abutments

- Custom Abutments

- Abutments Fixation Screws

Global Abutment Implants Market, By Material

- Titanium

- Zirconium

Global Abutment Implants Market, By End Use

- Hospitals

- Dental Clinics

Abutment Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?