Global 1,4 Butanediol Market Size, Share, and COVID-19 Impact By Technology (Reppe Process, Davy Process, Propylene Oxide Process & Others), By Application (Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethanes (PU), Tetrahydrofuran (THF)), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Chemicals & MaterialsGlobal 1,4 Butanediol Market Size Insights Forecasts to 2032

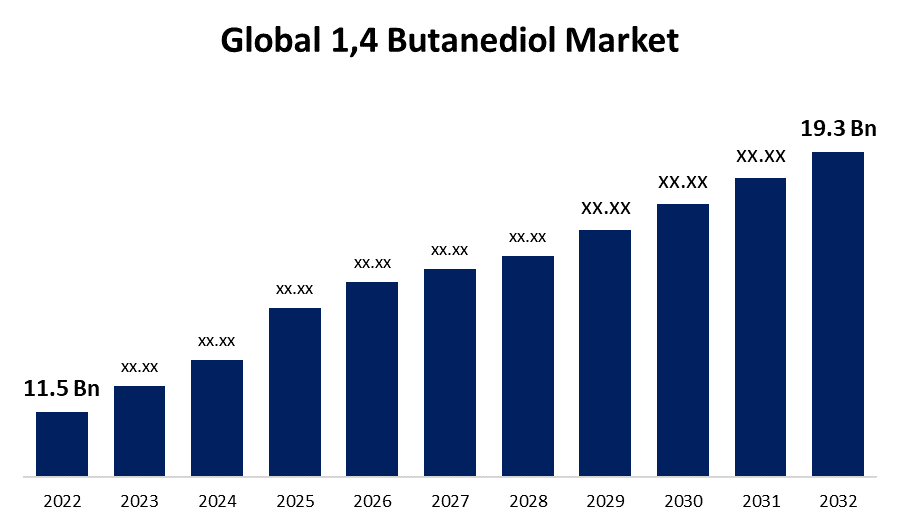

- The 1,4 Butanediol Market Size was valued at USD 11.5 Billion in 2022.

- The Market Size is Growing at a CAGR of 10.4% from 2022 to 2032

- The Worldwide 1,4 Butanediol Market Size is expected to reach USD 19.3 Billion by 2032.

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global 1,4 Butanediol Market Size is expected to reach USD 19.3 Billion by 2032, at a CAGR of 10.4% during the forecast period 2022 to 2032.

The chemical compound 1,4-butanediol, also known as 1,4-BDO or just BDO, has the molecular formula C4H10O2. At room temperature, it is a colourless and odourless liquid. Due to the presence of two hydroxyl (OH) groups on nearby carbon atoms, 1,4-butanediol is categorised as a diol or glycol. Due to its application in the creation of numerous chemicals and products, the BDO market has grown consistently over time. The automobile, textile, and electronics industries, among others, are frequently the drivers of growth. The BDO market is divided into regional and worldwide segments. BDO's largest producers are frequently confined to a few geographical areas. As an illustration, certain manufacturing facilities are situated in Asia, particularly China, which has grown to be a prominent player in the worldwide BDO industry. Growing attention has been paid in recent years to the creation of bio-based BDO, which is made from sustainable feedstocks. This movement fits in with the greater drive towards ecologically friendly and sustainable chemicals.

Impact of COVID 19 On Global 1,4-butanediol Market

Global supply systems, particularly those in the chemical sector, were disrupted by the pandemic. Production and distribution of BDO and its raw materials may have been hampered by lockdowns, transit restrictions, and regional industrial closures. The demand for BDO decreased noticeably during the pandemic in many sectors where it is used as a raw material, including textiles, construction, and the automobile industries. The BDO market would have been impacted by this decline in demand. During the epidemic, some chemical producers changed their production emphasis to necessary goods like hand sanitizers and medical supplies. The accessibility of BDO for other applications may have been impacted by this change. The pandemic sped up digital transformation initiatives across numerous businesses. The chemical industry's supply chain and business strategies may be affected by this change, which could have an effect on the BDO market.

Global 1,4 Butanediol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 10.4% |

| 2032 Value Projection: | USD 19.3 Billion |

| Historical Data for: | 2019-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application, By Region, and COVID-19 Impact. |

| Companies covered:: | BASF SE, Ashland Inc., Dairen Chemical Corporation, Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, SK Global Chemical Co., Ltd., Bioamber Inc., Mitsui Co. & Ltd., Chongqing Jian Feng Chemical Industry Co. Ltd, Chemtura Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Key Market Drivers

For the creation of polymers like polybutylene terephthalate (PBT) and polyurethane (PU), BDO is a crucial basic ingredient. Increased demand for these polymers may be sparked by the expansion of sectors including the automobile, building, and textile industries, which would increase BDO consumption. BDO is used in the manufacture of materials and parts for automobiles, including seat covers, tyres, and parts for the fuel system. The BDO market may benefit from the expansion of the automobile industry, which is being fueled by things like electric cars and lightweight materials. BDO is used in the production of connectors and printed circuit boards (PCBs) for the electronics sector. The booming telecommunications and consumer electronics industries may support the expansion of the BDO market. For producers of BDO, emerging economies with expanding manufacturing sectors may present new prospects. The demand for BDO and its derivatives may rise in certain regions.

Key Market Challenges

The price and supply of raw materials used to produce BDO, like butadiene or acetylene, might fluctuate depending on the state of the world's commodity markets. The profitability of BDO manufacturers may be impacted by these pricing changes. Multiple manufacturers may be fighting for market share in the BDO industry, which can be very competitive. Innovation and price competition are important components in keeping a competitive edge. Various sectors can have varied levels of demand for BDO and its derivatives. Demand fluctuations may be caused by economic downturns, modifications in consumer behaviour, or difficulties unique to a given industry. Although it can be difficult, decreasing reliance on a particular market or application is crucial for long-term viability. Manufacturers may need to look for new BDO markets and applications.

Market Segmentation

Technology Insights

Davy process holds the largest market share over the forecast period

On the basis of technology, the global 1,4-Butanediol Market is segmented into Reppe Process, Davy Process, Propylene Oxide Process & Others. Among these, the davy process holds the largest market share over the forecast period. Capacity increases and the adoption of this technology by new production facilities may be the driving forces behind the Davy Process segment's growth. This might be a reaction to the growing demand for BDO across a range of applications. The Davy Process category may experience higher acceptance if general demand for BDO continues to rise across sectors including the automotive, textiles, and construction. As it penetrates new markets and geographic areas, the Davy Process may see expansion. Opportunities for BDO manufacture via this method can arise as the economies of emerging markets develop their sectors.

Application Insights

Tetrahydrofuran segment is dominating the market over the forecast period

Based on the application, the global 1,4-Butanediol Market is segmented into Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), Polyurethanes (PU), Tetrahydrofuran (THF), and Others. Among these, the Tetrahydrofuran segment is dominating the market over the forecast period. THF is a crucial raw material used to create polymers like PTMEG and polyurethane, which are used in a variety of sectors, including construction, automotive, and textiles. The expansion of these sectors may result in higher THF consumption. The manufacture of elastane fibres, also known as spandex, and other speciality materials depends heavily on PTMEG. PTMEG production and, in turn, THF demand may be influenced by the expansion of the textile and garment industries as well as the desire for flexible and high-performance materials. The creation and exploitation of THF derived from renewable and biological sources may aid in the expansion of this market. The sourcing of THF can be environmentally and legally compliant. Producers of THF may spend money enhancing the competitiveness of their goods.

Regional Insights

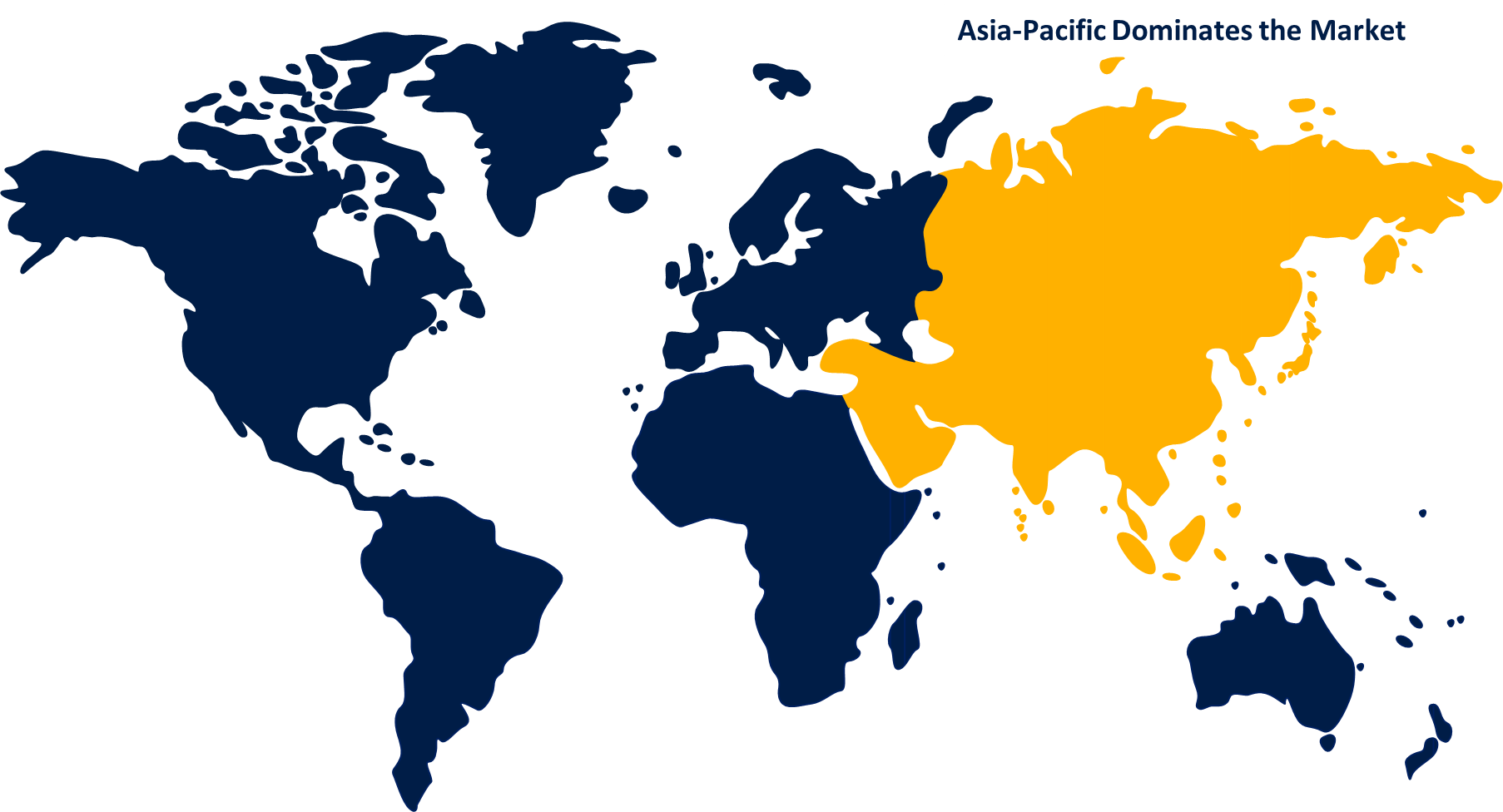

Asia Pacific is dominating the market over the forecast period

Get more details on this report -

Among all regions, Asia Pacific is dominating the market with the largest market share over the forecast period. The Asia-Pacific region has a number of nations that are significant BDO producers. Particularly in terms of use and manufacturing of BDO, China is a major participant. There are important BDO production facilities in other nations as too, including Japan, South Korea, and India. BDO and its derivatives are used by a wide range of industries in the APAC region. These sectors include the production of automobiles, textiles, electronics, building materials, and chemicals. The expansion of these sectors helps to meet the region's demand for BDO. One of the biggest users of BDO in APAC is the automotive sector, primarily for the manufacture of polyurethane-based materials, coatings, and adhesives used in the construction of vehicles. The industrialization and population growth of the region have both contributed to the BDO market's consistent rise in APAC.

North America, on the other hand is witnessing the fastest market growth over the forecast period. There are multiple BDO production plants in North America, with the United States being a significant producer. Numerous areas in the United States are home to manufacturing facilities. In North America, the automotive sector is a significant consumer of BDO. Foams and coatings made of polyurethane are produced using BDO, and both the inside and exterior of vehicles use these materials. For the construction business, BDO is used to make sealants, coatings, and adhesives. The demand for BDO may rise as infrastructure and building projects expand in North America. The industrialization, population expansion, and demand for goods containing BDO and its derivatives have all contributed to the BDO market's continuous growth in North America.

Recent Market Developments

- In April 2021, Mitsubishi Chemical Corporation and Dymon Co., Ltd., the first private firm to ever explore the moon, have established a partnership agreement. Dymon Co., Ltd. is a robot and space development enterprise.

List of Key Companies

- BASF SE

- Ashland Inc.

- Dairen Chemical Corporation

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- SK Global Chemical Co., Ltd.

- Bioamber Inc.

- Mitsui Co. & Ltd.

- Chongqing Jian Feng Chemical Industry Co. Ltd

- Chemtura Corporation

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global 1,4 Butanediol Market based on the below-mentioned segments:

1,4 Butanediol Market, Technology Analysis

- Reppe Process

- Davy Process

- Propylene Oxide Process

- Others

1,4 Butanediol Market, Application Analysis

- Gamma-Butyrolactone (GBL)

- Polybutylene Terephthalate (PBT)

- Polyurethanes (PU)

- Tetrahydrofuran (THF)

- Others

1,4 Butanediol Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?