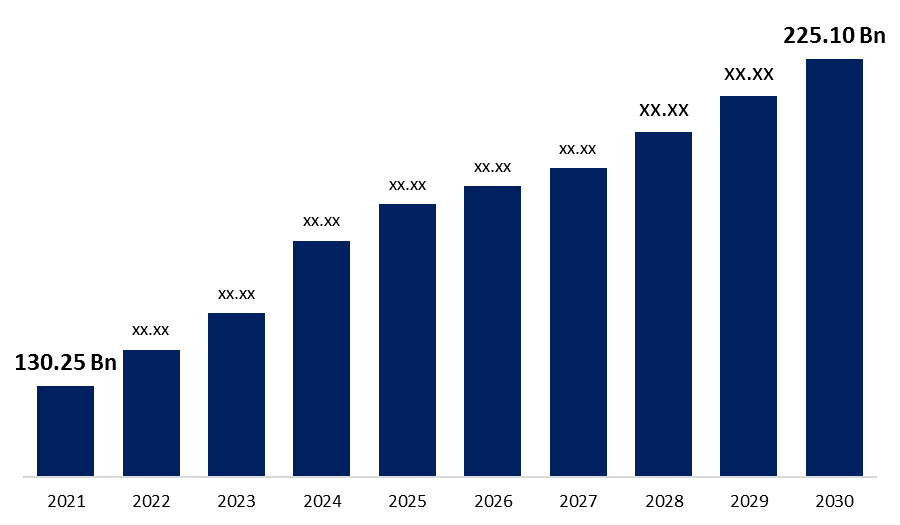

Global Operational Technology Market Size to grow USD 225.10 Billion in 2030 | CAGR 6.11%

Category: Information & TechnologyThe Global Operational Technology Market Size was valued at USD 130.25 Billion in 2020, the market is projected to grow USD 225.10 Billion in 2029, at a CAGR of 6.11%. Operational technology combines hardware and software to manage and keep an eye on physical processes, equipment, and infrastructure. Operational technology is used to perform a number of duties in a variety of asset-intensive businesses, from managing robots in a manufacturing plant to monitoring crucial infrastructure.

Get more details on this report -

The primary drivers of the market are the rising adoption of Industry 4.0, the increasing emphasis on automation technology in manufacturing processes, the growing government support for industrial automation, the increasing significance of regulatory compliances, the increasing complexity of the supply chain, and the rising demand for software systems that save time and money.

Impact of COVID-19 on the operational technology market

COVID-19 has had a significant impact on the global operational technology market and economy. The significant decline in product demand has hurt economies all throughout the world. Production across all industries has been slowed down as a result of the pandemic-related shortage of raw materials. The loss in exports and supply chain disruptions are the key reasons for the output decrease. At this period, when the major objective of the businesses was to maintain operations despite having a limited staff and resource pool, operational technology was essential to a company's capacity to operate effectively.

Drivers: Strategic initiatives by governments to promote adoption of operational technologies

Governments all across the globe are supporting and funding R&D for technologies like the IIoT and industrial 3D printing as they become more aware of the enormous potential of operational technology. Numerous governments are funding IIoT breakthroughs because they see themselves as prospective users of the technology. To create and manage smart cities in the future, they are financially sponsoring new IoT research projects and implementations. In addition, the market is expected to grow at the highest CAGR during the forecast period due to the operational technology performing several tasks using a variety of technologies, including Distributed Control Systems (DCS), and Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA), and others.

For further information on this analysis, please click here https://www.sphericalinsights.com/reports/operational-technology-market

The operational technology market is dominated by the machine manufacturing industry, which also holds the largest market share and is anticipated to expand at the highest CAGR during the projected period. The need for operational technologies in the machine manufacturing business is anticipated to rise as a result of rising industrial machine demand in emerging nations, technical advancements, and intensifying market rivalry. As energy-saving practices, high productivity, and sustainability become more essential, this trend is anticipated to continue. Operational technologies are being used by the machine manufacturing sector as a result of factors such the expanding aftermarket for spare parts, rising degrees of machine customization, and the growing requirement to guarantee the availability of diverse manufacturing parts.

Opportunities: Rapid industrial growth in emerging economies

Key market developments for operational technology are included in the studies, along with both organic and inorganic growth tactics. For many businesses, organic growth tactics are increasingly crucial. These initiatives include new product launches, product approvals, and others like patents and events. Acquisitions, partnerships, and collaborations are a few examples of inorganic growth tactics that have been used in the market. These initiatives have allowed market participants to grow their consumer bases and commercial operations. Market participants can anticipate having favorable growth possibilities in the future due to the industry's increasing demand for operational technology.

Organic growth strategies, such as new product releases, product approvals, and others like patents and events, are becoming important to many firms. Examples of inorganic growth strategies that were seen in the market were acquisitions, partnerships, and collaborations. These actions have made it possible for market participants to increase their clientele and business. With the increasing demand for operational technology in the global market, market players from the operational technology market are projected to enjoy attractive growth prospects in the future. Some of the key players in the market includes, ABB, Siemens, Schneider Electric, Rockwell Automation, Honeywell International Inc., Emerson Electric Co, IBM Corporation, General Electric, Accenture, Advantech Co., Ltd., Cognizant, and others.

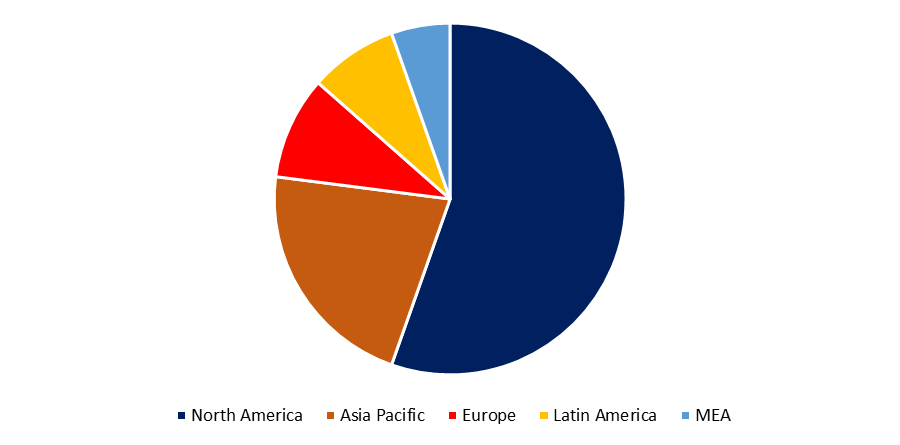

Operational Technology market in APAC to grow at the highest CAGR

Get more details on this report -

North America is anticipated to hold the major market share in the global operational technology security market throughout the period of forecasting. Many governments have enacted legislative compliances to safeguard data from cyber-attacks, which has increased the use of operational technology (OT) security solutions. To ensure and enforce reliability standards and national security across the critical infrastructures of the countries in North America, governments have established regulations and associations like the United States Department of Homeland Security, the Department of Defense Information Assurance Certification and Accreditation Process (DIACAP), and The National Strategy and Action Plan released by Public Safety Canada. These organizations contribute to improving the safety and resiliency of both physical and digital infrastructures. The operational technology security market in APAC was valued at USD 49,195 million in 2021 and is projected to reach USD 73,523 million by 2030; it is anticipated to grow at the highest CAGR of 7.1% from 2021 to 2030.

Competitive Landscape and Operational Technology Market

Some of the key players in the market includes, ABB, Siemens, Schneider Electric, Rockwell Automation, Honeywell International Inc., Emerson Electric Co, IBM Corporation, General Electric, Accenture, Advantech Co., Ltd., Cognizant, and others.

TABLE OF CONTENTS

Chapter 1. Executive Summary

Chapter 2. Research Methodology

Chapter 3. Market Outlook

Chapter 4. COVID-19 Impact On Global Operational Technology Market Size

Chapter 5. Global Operational Technology Market Size Overview, By Offering, 2017 - 2030 (USD Billion)

Chapter 6. Global Operational Technology Market Size Overview, By Product, 2017 - 2030 (USD Billion)

Chapter 7. Global Operational Technology Market Size Overview, By Type, 2017 - 2030 (USD Billion)

Chapter 8. Global Operational Technology Market Size Overview, By Currency Type, 2017 - 2030 (USD Billion)

Chapter 9. Global Operational Technology Market Size Overview, By Geography, 2017 - 2030 (USD Billion)

Chapter 10. North America Global Operational Technology Market Size Overview, By Countries, 2017 - 2030 (USD Billion)

Chapter 11. Europe Global Operational Technology Market Size Overview, By Countries, 2017 - 2030 (USD Billion)

Chapter 12. Asia Pacific Global Operational Technology Market Size Overview, By Countries, 2017 - 2030 (USD Billion)

Chapter 13. Middle East & Africa Global Operational Technology Market Size Overview, By Countries, 2017 - 2030 (USD Billion)

Chapter 14. South America Global Operational Technology Market Size Overview, By Countries, 2017 - 2030 (USD Billion)

Chapter 15. Competitive Landscape

Chapter 16. Key Vendor Analysis

Chapter 17. Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 18. Marketing Strategy Analysis, Distributors/Traders

Chapter 19. Market Effect Factors Analysis

Chapter 20. Future Outlook of the Market

Disclaimer

List of Figures

List of Tables

OPERATIONAL TECHNOLOGY MARKET: KEY PLAYERS

- ABB

- Siemens

- Schneider Electric

- Rockwell Automation

- Honeywell International Inc.

- Emerson Electric Co

- IBM Corporation

- General Electric

- Accenture

- Advantech Co., Ltd.

- Cognizant

- Others

OPERATIONAL TECHNOLOGY MARKET: RECENT DEVELOPMENT

- October 2021- EcoStruxure Automation Expert Version 21.2, which manages the automation lifecycle for the water and wastewater sector, was introduced by Schneider Electric.

OPERATIONAL TECHNOLOGY MARKET: REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Operational Technology Market. The Global Operational Technology Market is segmented by Component, Networking Technology, End-user, and Region. It discloses the state of the market and the outlook. The study also discusses the important information that is displayed in tables and graphs. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Operational Technology Market.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?