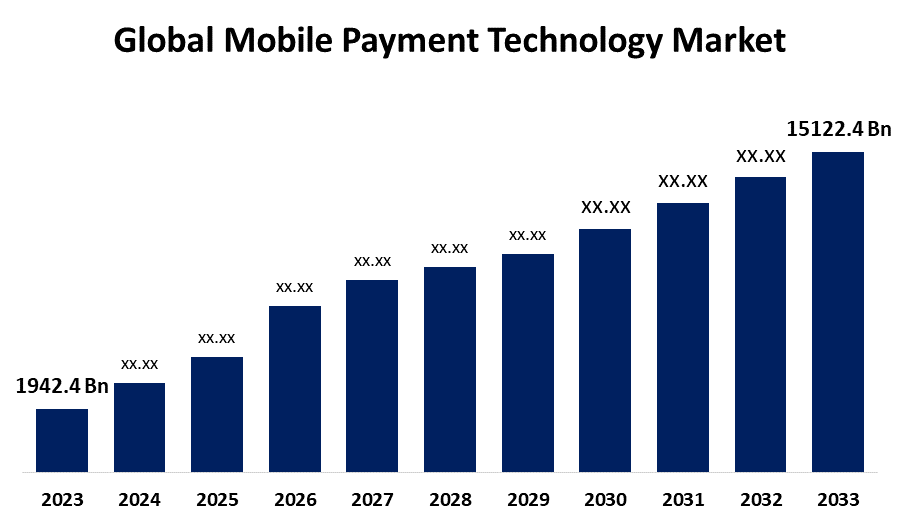

Global Mobile Payment Technology Market Size To Worth USD 15122.4 Billion by 2033 | CAGR of 22.78%

Category: Information & TechnologyGlobal Mobile Payment Technology Market Size To Worth USD 15122.4 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Mobile Payment Technology Market Size is to Grow from USD 1942.4 Billion in 2023 to USD 15122.4 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 22.78% during the projected period.

Get more details on this report -

Browse key industry insights spread across 264 pages with 120 Market data tables and figures & charts from the report on the "Global Mobile Payment Technology Market Size, Share, and COVID-19 Impact Analysis, By Mode of Transaction (SMS, NFC, and WAP), By Type of Mobile Payment (Mobile Wallet, Bank Cards, and Mobile Money), By Application (Entertainment, Energy & Utilities, Healthcare, Retail, Hospitality, and Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/mobile-payment-technology-market

Mobile payment is an alternative to traditional payment methods like cash, checks, and credit cards. Mobile Payment allows customers to purchase any goods or services using wireless devices such as smartphones and tablets. In addition, Mobile Payment uses a variety of technologies, such as NFC (Near Field Communication), SMS-based transactional payments, and direct mobile billing, to improve transaction security and convenience. Once set up, payments can be made in-store by scanning a QR code, tapping the phone against a payment terminal (using Near Field Communication, or NFC), or sending money directly to another person using peer-to-peer apps like Venmo or Cash App. Smart appliance adoption, as well as the use of mobile data, has skyrocketed in recent years. This is due to improved communication and a growing demand for convenient transactions among consumers around the globe. Smart appliances, such as tablets and smartphones, along with related applications, are essential for mobile payment technology. It enables payment without the use of traditional financial transaction channels. These factors are driving factors for the mobile payment technology market. However, due to a lack of awareness about specific mobile payment services and smartphone features. Consumers are concerned about mobile wallet security as the number of cyber-attacks on financial data grows.

The NFC segment dominates the market with the highest market share of the global mobile payment technology market during the projected period.

Based on the mode of transaction, the global mobile payment technology market is divided into SMS, NFC, and WAP. Among these, the NFC segment dominates the market with the highest market share of the mobile payment technology market during the projected period. Because of NFC-enabled smartphones, the NFC segment is driving the mobile payment market forward. Mobile payment technology is used in the BFSI, retail, healthcare, entertainment, IT and telecom, energy and utilities, hospitality and tourism industries, among others. Increased adoption of mobile payments in the banking sector is expected to increase the BFSI share within the estimated timeframe.

The mobile wallet segment is anticipated to grow at the fastest pace during the projected timeframe.

Based on the type of mobile payment, the global mobile payment technology market is categorized into mobile wallets, bank cards, and mobile money. Among these, the mobile wallet segment is anticipated to grow at the fastest pace during the projected timeframe. Mobile wallets, such as Apple Pay, Samsung Pay, and Android Pay, which are compatible with all major devices, are a relatively new payment option that will provide significant benefits as digitalization grows in popularity. Mobile wallets reduce both fraud and content within wallets.

The entertainment segment is anticipated to grow at the fastest pace during the projected timeframe.

Based on the application, the global mobile payment technology market is categorized into entertainment, energy & utilities, healthcare, retail, hospitality, and transportation. Among these, the entertainment segment is anticipated to grow at the fastest pace during the projected timeframe. The digital entertainment industry is going through a revolution. Smartphone proliferation, rapid product innovation, increased consumer connectivity, and thus the rise of social media has fueled the digital entertainment revolution. This has significantly altered the way customers purchase and consume games, movies, and music.

North America is expected to hold the largest share of the global mobile payment technology market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global mobile payment technology market over the forecast period. Due to more people in the US and Canada becoming aware of e-wallets, the market in North America is anticipated to expand. Massive market growth potential is anticipated as wearable device use and the acceptance of NFC in smartphones and wearable devices grow together.

Asia Pacific is predicted to grow at the fastest pace in the global mobile payment technology market during the projected period. The Asia Pacific market has experienced tremendous expansion in mobile payment technology, which may be ascribed to the growing trend of digitalization and the widespread usage of different technology payment options including credit/debit cards and mobile wallets. The main drivers of market expansion are emerging countries including China, Japan, South Korea, and India. The population and the quantity of mobile wallets are what are fueling the expansion of the industrial sectors.

Major vendors in the global mobile payment technology market are Bharti Airtel Limited, Econet Wireless Zimbabwe Limited, Visa, Inc., MasterCard Incorporated, Millicom International Cellular SA, MTN Group Limited, Orange S.A., PayPal Holdings Inc., HSBC USA, Safaricom Limited, Vodacom Group Limited., Microsoft Corporation, Apple, Inc., American Express, Co., Google, Inc., Boku, Inc., Others.

Recent Developments

- In March 2022, Visa announced that it acquires Tink, an open banking platform that enables financial institutions and fintech companies to build services and products while also transacting money. Tink and Visa's merger is expected to provide clients with better financial service, data, and money management.

Key Target Audience

- MarketPlayers

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global mobile payment technology market based on the below-mentioned segments:

Global Mobile Payment Technology Market, By Transaction

- SMS

- NFC

- WAP

Global Mobile Payment Technology Market, By Type of Mobile Payment

- Mobile Wallet

- Bank Cards

- Mobile Money

Global Mobile Payment Technology Market, By Application

- Entertainment

- Energy & Utilities

- Healthcare

- Retail

- Hospitality

- Transportation

Global Mobile Payment Technology Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?