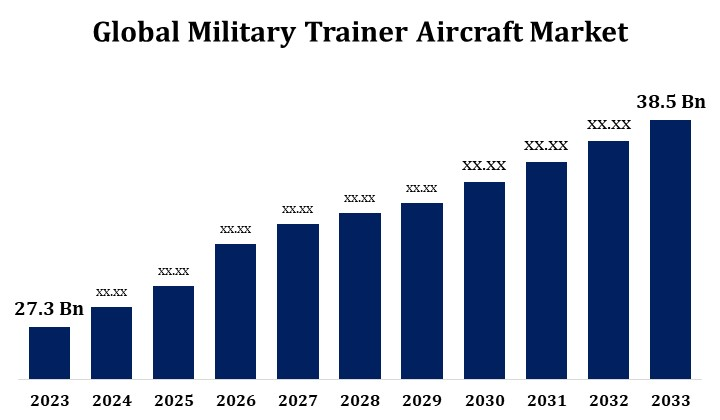

Global Military Trainer Aircraft Market Size to Worth USD 38.5 Billion by 2033 | CAGR of 3.50%

Category: Aerospace & DefenseGlobal Military Trainer Aircraft Market Size to Worth USD 38.5 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Military Trainer Aircraft Market Size to grow from USD 27.3 Billion in 2023 to USD 38.5 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 3.50% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Military Trainer Aircraft Market Size By Type (Fixed Wing, Rotary Wing), By Solution (OEM, Aftermarket), By End User (Air Forces, Naval Forces, Land Forces), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/military-trainer-aircraft-market

Military trainer aircraft are designed to mimic the flight characteristics and capabilities of other military aircraft, such as advanced fighter jets. They provide future aviators with hands-on experience in emergency scenarios, armament system operation, tactical manoeuvres, and flight manoeuvres. A multitude of factors, including as geopolitical tensions, defence budgets, procurement programmes, and technological advancements, influence the market for military trainer aircraft. The government's military departments and the armed services are the primary users, driving demand with projects for fleet modernization and training requirements. There is a market for military trainer aircraft as a result of global investments in training initiatives to maintain military preparedness and capabilities. Emerging markets are particularly active in acquiring new trainer aircraft to bolster their defence capabilities.

Military Trainer Aircraft Market Value Chain Analysis

Aerospace companies and defence contractors invest in research and development to produce new trainer aircraft models with state-of-the-art features and technology in response to evolving training requirements. Manufacturers and suppliers produce the airframes, engines, avionics systems, and other subsystems required for the building of trainer aircraft. These components need to meet strict military specifications and performance requirements. Original equipment manufacturers (OEMs) assemble training aircraft using parts purchased from suppliers. Manufacturers of aircraft integrate avionics, propulsion, flight control, and other subsystems to produce completed aircraft that are ready for delivery and testing. System integrators are crucial to the integration of multiple subsystems and components into fully functional training aircraft. After certification, military customers can purchase trainer aircraft directly from manufacturers or through government procurement programmes. Defence firms, government agencies, and military divisions are among the end users of trainer aircraft. They use trainer aircraft for pilot training, competency building, mission rehearsal, and operational preparedness for a range of training programmes and exercises.

Military Trainer Aircraft Market Opportunity Analysis

International military academies are modernising their training fleets in order to adapt to shifting operational requirements and technological advancements. This presents an opportunity for OEMs and defence contractors to supply next-generation trainer aircraft equipped with state-of-the-art avionics, training features, and simulation tools. Several countries are retiring their antiquated trainer aircraft and replacing them with more contemporary models in an effort to increase training effectiveness, safety, and efficiency. This leads to an increasing need for modern trainer aircraft that offer superior performance, reliability, and maintainability over legacy platforms. The increasing demand for military pilots due to factors including fleet growth, pilot attrition, and retiring personnel might be advantageous for manufacturers of trainer aircraft. Military divisions are investing in expanding their training capacity in order to meet the increasing demand for pilot training.

By conducting modernization initiatives, military services can extend the operational life of their current fleets of trainer aircraft. Long-term use of trainers is made possible by upgrades to avionics, propulsion systems, and other critical components that enhance aircraft performance, safety, and dependability. By equipping training aircraft with state-of-the-art avionics and systems, military departments can optimise aircraft performance and mission capabilities. Upgrades that can improve aircraft responsiveness, handling, and mission readiness include better flight control systems, more efficient engines, and advanced instruments. The aviation industry, defence contractors, and aftermarket service providers stand to gain from the expanding market for military trainer aircraft upgrading services.

Budgetary restrictions on the armed forces in many countries may prevent the purchase and modernization of new trainer aircraft. Programmes that use trainer aircraft may not receive as much funding as they once did because of competing financial objectives or declining defence budgets. Buying trainer aircraft sometimes involves lengthy and intricate procurement processes, including government contracts, budget clearances, and regulatory compliance. Bureaucratic roadblocks and procurement delays can make acquisition processes longer and affect market demand. It could be challenging to integrate new technology and systems into the trainer aircraft that are currently in use. In order to avoid incompatibilities and system failures, careful design, testing, and validation are required to assure smooth integration with modern avionics, sensors, and simulation systems.

Insights by Type

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces worldwide are devoting money to modernising their fleets of trainer aircraft in order to adapt to evolving training requirements and technological advancements. Purchasing brand-new fixed-wing trainer aircraft models equipped with the newest avionics, training features, and simulation systems is required for this. Many countries are retiring its fixture-wing trainer aircraft and replacing them with more contemporary, higher-performing models. Upgrading to modern fixed-wing trainers increases training effectiveness, safety, and efficiency and ensures that aspiring pilots receive the training needed to operate cutting-edge combat aircraft. Due to retirements, fleet expansion, and pilot attrition, there is a severe shortage of military pilots, which has led to a strong demand for fixed-wing trainer aircraft.

Insights by Solution

The aftermarket segment accounted for the largest market share over the forecast period 2023 to 2033. As many military trainer aircraft near the end of their initial service lives, extensive maintenance and repairs are being performed to extend their operational longevity. In addition to offering structural repairs, component replacements, and system upgrades, aftermarket service businesses often offer additional solutions to ageing aircraft issues. By utilising aftermarket services, military operators can enhance the capabilities and performance of their trainer aircraft. Enhancements such as avionics modernization, engine improvements, and aerodynamics improvements enhance aircraft performance, reliability, and mission effectiveness. Modern systems and technology are integrated into trainer aircraft with the help of aftermarket services including sensor installations, avionics upgrades, and mission equipment modifications. These technology connections increase training efficacy, enable new mission profiles, and increase the capabilities of trainer aircraft.

Insights by End User

The fixed wing segment accounted for the largest market share over the forecast period 2023 to 2033. Air forces worldwide are investing in modernising their training capabilities to meet evolving operational objectives. This entails investing in state-of-the-art trainer aircraft that are furnished with avionics, simulation software, and training technology. The air force is growing its fleets as a result of growing operational demands and geopolitical tensions, which calls for matching investments in pilot training. Trainer aircraft are essential for skill development and maintenance so that air force pilots are ready for a range of jobs. Combat aircraft with upgraded avionics and systems are being used by air forces. By deploying sophisticated training aircraft with equivalent capabilities, pilots can transition to front-line fighter aircraft faster and at a lower cost.

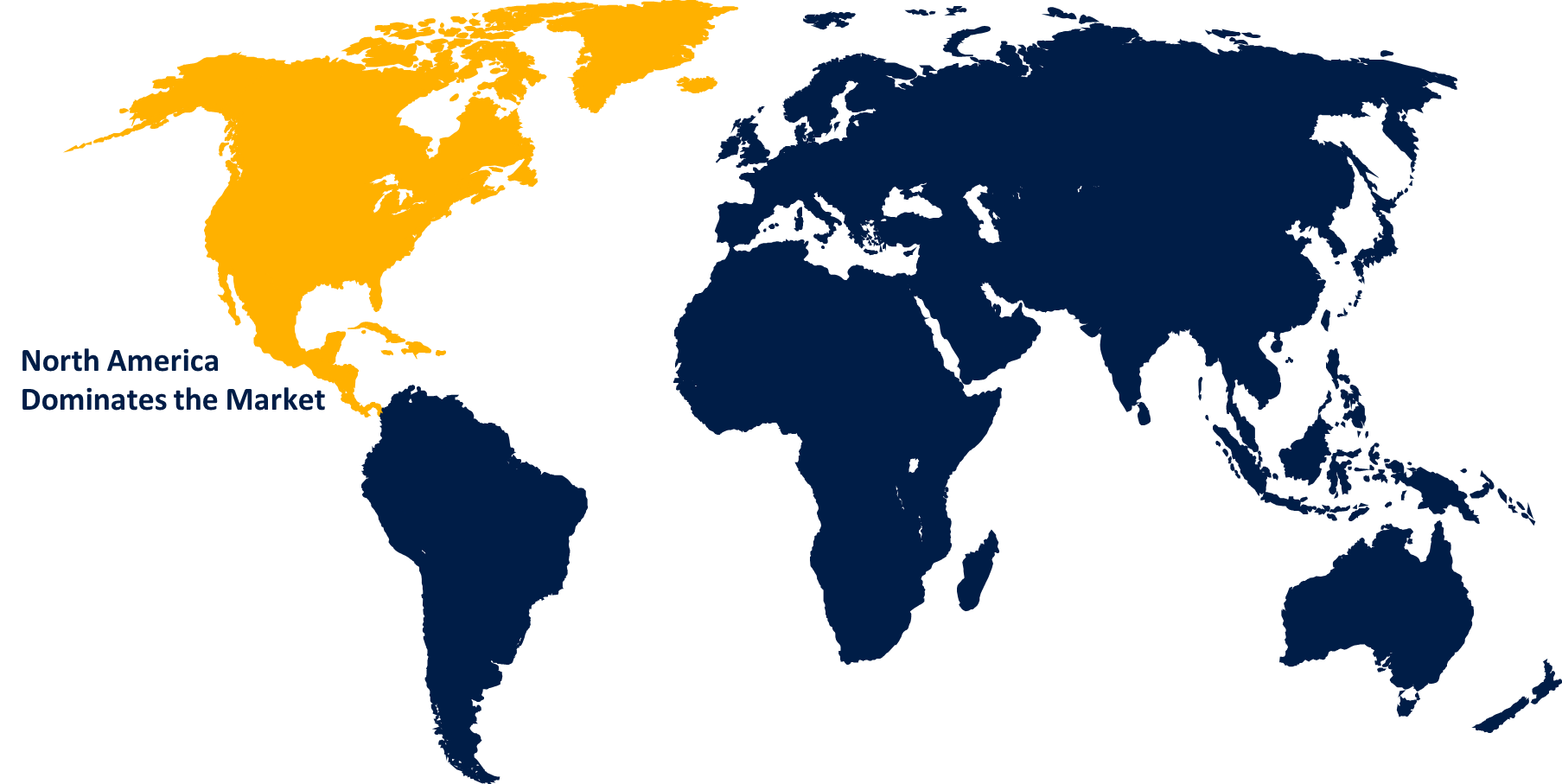

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Military Trainer Aircraft Market from 2023 to 2033. North American countries show their dedication to enhanced training capabilities, for example, by purchasing state-of-the-art trainer aircraft equipped with the newest avionics, simulation systems, and training technologies. Military pilots are guaranteed top-notch training to prepare them for operational missions because of these cutting-edge skills. North American aerospace companies utilise export opportunities to provide military training planes to allies worldwide. Exports of trainer aircraft not only improve the economy but also support international security alliances and collaborations. North America offers excellent training facilities and infrastructure to support military pilot training activities. These facilities include military locations, flight schools, training ranges, and simulation centres furnished with state-of-the-art teaching aids.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. In order to strengthen their armed forces and address security concerns, many of the countries in the Asia-Pacific area are increasing their defence budget. The rising defence budget, which notably includes funding for military training projects, is driving the need for trainer aircraft. Many countries in the Asia-Pacific region are modernising their armed forces, other armaments, and their fleets of training aircraft. The replacement of antiquated trainer aircraft with more contemporary models equipped with cutting-edge avionics and training apparatus is the aim of modernization initiatives.

Recent Market Developments

- In December 2021, a Memorandum of Cooperation (MoC) has been signed by Turkish Aerospace and the Universiti Kuala Lumpur Malaysian Institute of Aviation Technology (UniKL MIAT) to streamline the delivery of aerospace education, technical training, and applied research programmes in Malaysia.

Major players in the market

- Rostec

- Hindustan

- Aeronautics Ltd

- Diamond Aircraft Industries

- Embraer SA

- Northrop Grumman Corporation

- The Boeing Company

- BAE Systems PLC

- Pilatus Aircraft Ltd

- Textron Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Calidus LLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Trainer Aircraft Market, Type Analysis

- Fixed Wing

- Rotary Wing

Military Trainer Aircraft Market, Solution Analysis

- OEM

- Aftermarket

Military Trainer Aircraft Market, End User Analysis

- Air Forces

- Naval Forces

- Land Forces

Military Trainer Aircraft Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?