Global Military Sensors Market Size To Worth USD 76.1 Billion By 2033 | CAGR Of 12.86%

Category: Aerospace & DefenseGlobal Military Sensors Market Size To Worth USD 76.1 Billion By 2033

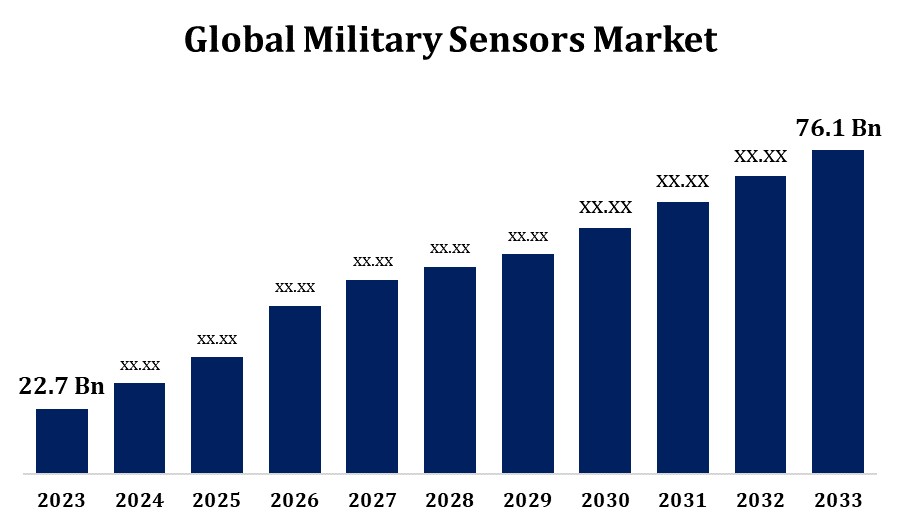

According to a research report published by Spherical Insights & Consulting, The Global Military Sensors Market Size to Grow from USD 22.7 Billion in 2023 to USD 76.1 Billion By 2033, at a Compound Annual Growth Rate (CAGR) of 12.86% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 210 pages with 120 Get Market data tables and figures & charts from the report on the "Global Military Sensors Market Size, Share, and COVID-19 Impact Analysis, By Platform (Ground, Airborne, Naval, Space), By Component (Hardware, Software), By Application (Navigation & Communication, Intelligence & Reconnaissance, Electronic Warfare, Command & Control, Monitoring & Surveillance, Target Recognition), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/military-sensors-market

The military sensors market is growing rapidly, driven by advancements in defense technology and rising global security concerns. These sensors are essential for surveillance, intelligence, reconnaissance, and combat operations, enhancing situational awareness and threat detection. Key sensor types include radar, infrared, acoustic, and biochemical, deployed across land, naval, airborne, and space-based systems. Increasing defense budgets, modernization efforts, and the expanding use of unmanned systems are fueling demand. Innovations in artificial intelligence, IoT, and miniaturization are further improving sensor capabilities. North America dominates the market due to substantial defense spending, while the Asia-Pacific region is expanding quickly due to regional conflicts and military upgrades. Leading companies include Lockheed Martin, Raytheon, and BAE Systems. The market is expected to sustain steady growth in the coming years.

Military Sensors Market Value Chain Analysis

The military sensors market value chain consists of several key stages, from raw material sourcing to end-user deployment. It starts with component suppliers providing essential materials such as semiconductors, microelectronics, and specialized alloys. Sensor manufacturers then design and develop radar, infrared, acoustic, and biochemical sensors, integrating advanced technologies like AI and IoT. These sensors are assembled into defense systems by integrators and major defense contractors such as Lockheed Martin and Raytheon. Governments and defense agencies serve as primary buyers, acquiring sensors through contracts and tenders. Regular maintenance, repairs, and upgrades ensure long-term operational efficiency. Innovation is driven by collaborations between defense firms, research institutions, and government bodies. The increasing demand for real-time battlefield intelligence and security enhancements continues to influence the military sensors market value chain.

Military Sensors Market Opportunity Analysis

The military sensors market offers substantial opportunities fueled by evolving defense requirements, technological progress, and increasing geopolitical tensions. Growing demand for advanced surveillance, intelligence, and reconnaissance systems is driving the adoption of cutting-edge sensors across land, air, naval, and space platforms. The rise of unmanned systems, including drones and autonomous vehicles, is boosting the need for miniaturized and high-performance sensors. Innovations in AI, machine learning, and IoT are enhancing sensor efficiency, enabling real-time data processing and threat detection. Expanding defense budgets and modernization programs in Asia-Pacific and the Middle East create lucrative prospects for defense contractors. Additionally, the growing focus on electronic warfare, cybersecurity, and stealth technologies is accelerating innovation. Companies prioritizing R&D and strategic collaborations will gain a competitive advantage in this expanding market.

The growing demand for military aircraft and armored vehicles is a major factor driving the expansion of the military sensors market. Modern defense forces rely on advanced sensor technologies to improve situational awareness, targeting precision, and threat detection. Fighter jets, UAVs, and transport aircraft utilize radar, infrared, and electro-optical sensors for navigation, surveillance, and combat operations. Likewise, armored vehicles are increasingly integrated with advanced sensor systems for battlefield awareness, missile defense, and communication. The shift toward next-generation warfare, along with rising defense budgets and military modernization initiatives, is accelerating the adoption of high-performance sensors. Furthermore, advancements in AI and IoT integration are enhancing sensor capabilities. As military operations become more technologically advanced, the demand for sophisticated sensor solutions is expected to continue rising.

Despite its growth potential, the military sensors market faces several challenges. High development and integration costs remain a significant hurdle, as advanced sensor technologies require substantial R&D investment. Cybersecurity threats are another major concern, with military sensor networks vulnerable to cyberattacks and data breaches. Additionally, interoperability challenges arise when integrating new sensors with existing defense systems, necessitating complex upgrades and standardization efforts. Strict regulatory requirements and export restrictions further constrain market expansion, particularly in international defense transactions. The increasing complexity of modern warfare demands real-time data processing, putting pressure on sensor performance and reliability. Furthermore, supply chain disruptions, especially in semiconductors and electronic components, can affect production timelines. Overcoming these challenges through innovation, strengthened cybersecurity measures, and policy reforms is essential for sustaining market growth.

Insights by Platform

The airborne segment accounted for the largest market share over the forecast period 2023 to 2033. The expansion of the market is driven by the increasing deployment of advanced fighter jets, unmanned aerial vehicles (UAVs), and surveillance aircraft. Modern airborne platforms rely on sophisticated sensors, including radar, infrared, electro-optical, and biochemical technologies, to enhance situational awareness, targeting precision, and threat detection. The growing demand for intelligence, surveillance, and reconnaissance (ISR) missions, along with the development of next-generation combat aircraft, is accelerating sensor adoption. Additionally, advancements in AI and IoT are enhancing sensor capabilities, enabling real-time data processing and autonomous operations. Countries are making significant investments in airborne early warning systems, electronic warfare, and missile defense technologies, further driving market growth.

Insights by Component

The hardware segment accounted for the largest market share over the forecast period 2023 to 2033. Military forces across the globe are investing in advanced sensor hardware, including radar, infrared, electro-optical, acoustic, and biochemical sensors, to enhance surveillance, targeting, and threat detection capabilities. The demand for durable and miniaturized hardware components is increasing, particularly for integration into unmanned systems, aircraft, naval vessels, and armored vehicles. Furthermore, advancements in semiconductor technology, AI-driven processing units, and sensor fusion techniques are enhancing the efficiency and durability of sensor hardware. Many countries are prioritizing domestic sensor manufacturing to reduce reliance on imports, further propelling market growth.

Insights by Application

The electronic warfare segment accounted for the largest market share over the forecast period 2023 to 2033. Electronic warfare (EW) systems utilize specialized sensors, including radar, signal intelligence (SIGINT), electronic intelligence (ELINT), and jamming technologies, to detect, disrupt, and neutralize enemy communications, radar, and missile guidance systems. The increasing demand for enhanced situational awareness, cyber defense, and electromagnetic spectrum dominance is driving investments in EW sensor technologies. Nations are upgrading their defense capabilities by integrating AI-driven and software-defined EW systems into aircraft, naval vessels, and ground-based platforms. Additionally, advancements in electronic countermeasures (ECM) and electronic counter-countermeasures (ECCM) are improving the effectiveness of EW operations. With rising defense budgets and ongoing technological advancements, the EW segment is expected to remain a key growth driver in the military sensors market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Military Sensors Market from 2023 to 2033. The United States dominates the region with significant investments in sensor-based defense systems, including radar, infrared, electro-optical, and biochemical sensors. The rising demand for intelligence, surveillance, and reconnaissance (ISR) systems, coupled with the integration of AI and IoT in military applications, continues to drive market growth. Additionally, the U.S. Department of Defense (DoD) and leading defense contractors such as Lockheed Martin, Northrop Grumman, and Raytheon play a crucial role in strengthening the market. The ongoing acquisition of advanced fighter jets, unmanned systems, and missile defense technologies further accelerates the adoption of military sensors.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The increasing demand for fighter jets, unmanned aerial vehicles (UAVs), and missile defense systems is driving the adoption of advanced sensors. Additionally, geopolitical tensions in the South China Sea and ongoing border disputes are compelling nations to strengthen their defense capabilities. Innovations in AI, IoT, and electronic warfare are further enhancing sensor efficiency. The expansion of domestic defense industries, along with collaborations with global manufacturers, is contributing to market growth. With continuous technological advancements and strategic defense initiatives, the Asia-Pacific region is poised to be a major driver of growth in the military sensors market.

Recent Market Developments

- In July 2021, QinetiQ Inc. received a USD 24 billion contract from the U.S. Army to develop three SPECTRE next-generation full-spectrum hyperspectral prototype sensors.

Major players in the market

- Honeywell International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- L3Harris Technologies; Inc.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Safran S.A.

- Textron Inc.

- Curtiss-Wright Corporation

- TE Connectivity Ltd.

- Thales Group

- General Electric Company

- Crane Aerospace & Electronics

- IMPERX; INC.

- RTX Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Military Sensors Market, Platform Analysis

- Ground

- Airborne

- Naval

- Space

Military Sensors Market, Component Analysis

- Hardware

- Software

Military Sensors Market, Application Analysis

- Navigation & Communication

- Intelligence & Reconnaissance

- Electronic Warfare

- Command & Control

- Monitoring & Surveillance

- Target Recognition

Military Sensors Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?