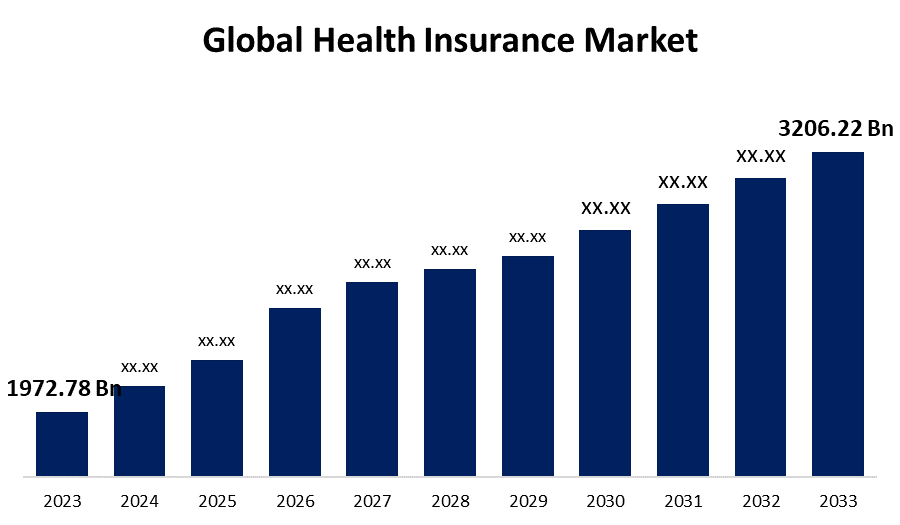

Global Health Insurance Market Size To Exceed USD 3206.22 Billion by 2033 | CAGR Of 4.98%

Category: HealthcareGlobal Health Insurance Market Size To Exceed USD 3206.22 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Health Insurance Market Size is to grow from USD 1972.78 billion in 2023 to USD 3206.22 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 4.98% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 115 Market data tables and figures & charts from the report on the "Global Health Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Provider (Public, Private, Standalone Health Insurers), By Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others), By Demographics (Minor, Adults, Senior Citizen), By Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Detailed Report Description Here: https://www.sphericalinsights.com/reports/health-insurance-market

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured. It is an agreement between the policyholder (the person who buys the insurance) and the insurance company. In exchange for regular premium payments, the insurance company agrees to provide financial protection by covering the costs of certain healthcare services and treatments. Furthermore, government agencies in many countries are actively involved in promoting awareness about the importance of health insurance. This, combined with the rising incidence of severe road accidents, which has increased surgical procedures, is having a positive impact on the market. The high cost of medical services has put patients under financial stress. However, health insurance provides financial assistance to patients by covering all medical service costs by the insurance plan's terms and conditions. As a consequence, the rising cost of medical services propels global health insurance market growth. However, Fraudulent insurance claims have resulted in stringent government verification regulations, which have hampered global health insurance growth.

The private segment is expected to grow at the largest pace in the global health insurance market during the forecast period.

Based on the insurance provider, the health insurance market has been segmented into public, private, and standalone health insurers. Among these, the private segment is expected to grow at the largest pace in the global health insurance market during the forecast period. Private insurers are known for their ability to innovate and customize insurance policies. They can adapt quickly to changing market demands and introduce new features. Furthermore, private insurers frequently maintain large networks of healthcare providers, including hospitals, clinics, and specialists.

The medical insurance segment is expected to grow at the highest pace in the global health insurance market during the anticipated period.

Based on the plan type, the global health insurance market is divided into medical insurance, critical illness insurance, family floater health insurance, and others. Among these, the medical insurance segment is expected to grow at the highest pace in the global health insurance market during the forecast period. Many medical insurance plans provide coverage for preventive services such as vaccinations, screenings, and wellness check-ups. This encourages people to prioritize preventive care, which can result in early detection and treatment of medical issues.

The adult segment is expected to grow at the largest pace in the global health insurance market during the anticipated period.

Based on the demographic, the global health insurance market is divided into minors, adults, and senior citizens. Among these, the adult segment is expected to grow at the largest pace in the global health insurance market during the forecast period. adults frequently obtain health insurance policies that cover their entire family, including children and occasionally elderly parents. In addition, insurance companies provide a variety of health insurance products tailored to adults, including individual policies, family plans, and plans with adult-specific benefits such as maternity coverage or preventive care.

The preferred provider organizations (PPOS)segment is expected to hold the largest share of the global health insurance market during the forecast period.

Based on the provider type, the global health insurance market is divided into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOS). Among these, the preferred provider organizations (PPOS) segment is expected to hold the largest share of the global health insurance market during the forecast period. PPOs give policyholders a lot of options when it comes to choosing a healthcare provider. Unlike health maintenance organizations (HMOs), which frequently require members to select a primary care physician.

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global health insurance market over the forecast period. Healthcare costs in North America rank among the highest in the world. This includes costs for medical treatments, prescription drugs, hospital stays, and specialized care. Due to these high costs, individuals and businesses seek health insurance to help alleviate the financial burden of medical expenses.

Europe is expected to grow the fastest in the global health insurance market during the anticipated forecast period. Rising public awareness of the value of insurance plans will boost market growth in this region. Furthermore, the increasing penetration of private providers in this region, and the growing number of government schemes.

Major vendors in the global Health Insurance market are Aetna Inc. (CVS Health Corporation), Cigna Corporation, International Medical Group Inc. (Sirius International Insurance Group Ltd.), Prudential Plc, United Health Group Inc., Zurich Insurance Group AG, AIA Group Limited, Allianz SE, Berkshire Hathaway, Aviva Plc, Berkshire Hathaway Inc.& Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Recent Development

- In November 2022, Berkshire Hathaway formed a partnership with Canada-based SoNomad to offer travel medical insurance. SoNomad Travel Medical Insurance policies are covered by the National Liability and Fire Insurance Company of Canada.

Market Segment

This study forecasts revenue at the global health insurance, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global health insurance market based on the below-mentioned segments:

Global Health Insurance Market, Insurance Provider Analysis

- Public

- Private

- Standalone Health Insurers

Global Health Insurance Market, Plan Type Analysis

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Global Health Insurance Market, Demographic Analysis

- Minor

- Adults

- Senior Citizen

Global Health Insurance Market, Provider Type Analysis

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Global Health Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?