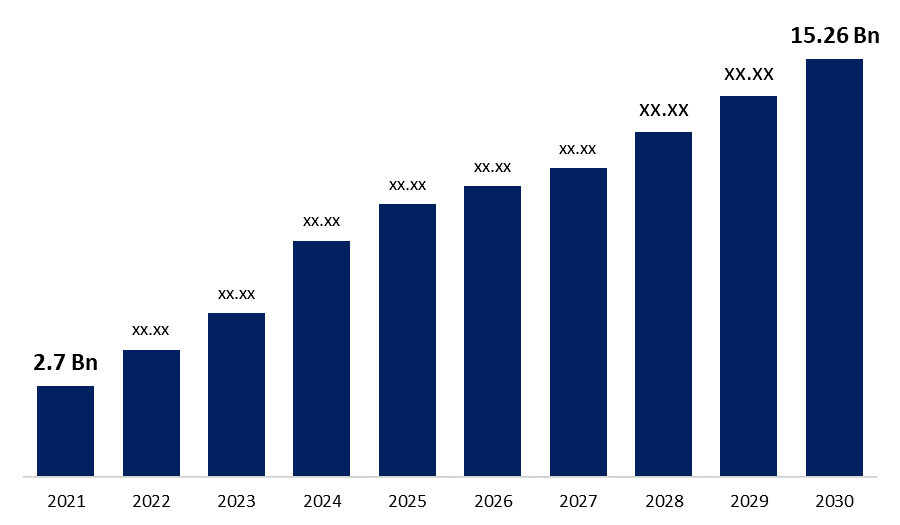

Global English Proficiency Test Market Size to Worth USD 15.26 Billion by 2030 | CAGR of 8.90 %

Category: Electronics, ICT & MediaGlobal English Proficiency Test Market Size to Worth USD 15.26 Billion by 2030

The Global English Proficiency Test Market was valued at USD 2.7 Billion in 2021 and is expected to reach USD 15.26 Billion by 2030, growing at a CAGR of 8.90 % during 2021-2030.as per the latest research report by Spherical Insights & Consulting.

Get more details on this report -

English proficiency is viewed as a vital to improving personal work and advancement possibilities, significant impediments exist for individuals who wish to study. English is typically seen positively by younger people because of the social status it confers and the access it provides to popular culture. English proficiency is clearly viewed as a key for national progress and a skill required for the country to interact with the globalized economy and allow the world community to invest in their country by many countries' governments and business sectors. Given the recent need for internationalization and globalization of the world, a cross-border student mobility around the world has resulted in a considerable increase in the inflow of international students in the United States. The majority of international students come from Asian countries such as China, India, South Korea, and Taiwan are increasing.

Browse key industry insights spread across 225 pages with 117 market data tables and figures & charts from the report "Global English Proficiency Test Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Application (Graduates/ Undergraduates, Employers, and Others), By Test (IELTS, TOEFL, CAE, CPE, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa), Analysis and Forecast 2021 – 2030"

in detail along with the table of contents https://www.sphericalinsights.com/reports/english-proficiency-test-market

Those who had studied English, 65 percent had done so at the secondary level and 61 percent had done so at the undergraduate level, with the two percentages totaling more than 100 percent to indicate classes completed at more than one academic level. Approximately 43 percent had attended a private English language school, while 38 percent had studied it in primary school. These four groupings accounted for the great majority of students. According to the British Council poll, the top motives for beginner-level English students were to enhance their work chances (26 percent), to improve their quality of life (16 percent), and to go overseas (16 percent).

In nations where English is not a native or official language, there is a wide variety of English needs, with 7 percent of employment duties requiring native-level English, 49 percent requiring advanced English, 33 percent requiring intermediate English, and 8 percent requiring basic English. Business areas with the greatest English language requirements include banking, finance, and law, where business publications tend to utilize complicated and technical English. Language requirements are lower in the Travel, Leisure, Hospitality, Transportation, Distribution, and Utilities industries, presumably because customer-facing professions use more daily English and understanding concerns can be managed with relatively easy English. There is a misalignment between the English language skills necessary and the skills that are really available in every industry. Surprisingly, there is little distinction between large, medium, and small employers. There is at least a 40% skills gap across all corporate sizes. When it comes to hiring, 98.5 percent of businesses use at least one way to assess English language proficiency.

Over the last five years, international student enrolment in intensive English and undergraduate degree programs has increased by double digits, with top-sending countries such as China leading the way. As they design their enrolment targets and carefully balance the needs of international students, teachers, and administrators, US admissions offices face competing priorities and tremendous budgetary strain.

DuoLingo, a shorter computer-adaptive test combined with a video interview, is a fast-growing competitor. This not only integrates testing and identification verification, but it also offers information about how well the student performs on open-ended questions in a conversational English situation. Because each administration of the test is unique, the computer-adaptive aspect of the test also aids in the prevention of fraud. The test is significantly less expensive than the TOEFL and IELTS tests and has a lot faster turnaround time for test results. DuoLingo test results and TOEFL/IELTS test scores have a good association. DuoLingo has iPhone, Android, and web-based apps.

Get more details on this report -

Furthermore, English-speaking destinations like the United States, the United Kingdom, Australia, Canada, New Zealand, and South Africa dominate the global market. According to the application, graduates/undergraduates lead the English proficiency test market, with employers coming in second.

With the increasing number of English proficiency tests, more participants are entering the fray. Berlitz Corporation (United States), McGraw-Hill Education (United States), Pearson ELT (United Kingdom), SANAKO (Finland), Duolingo (United States), and Inlingua International Ltd. (Switzerland) have, nevertheless, acquired the lion's share of the market. The market has enormous potential, and several new companies are predicted to emerge throughout the projected time due to improved profitability.

ENGLISH PROFICIENCY TEST MARKET: RECENT DEVELOPMENT

- May 2021 – ETS announced the launch of a brand-new English-language proficiency test, the TOEFL Essentials. The TOEFL Essentials exam replaces the TOEFL Family of Assessments' second high-stakes English-language proficiency test.

SCOPE OF THE REPORT

The reports also assist in understanding the dynamic and structure of the English Proficiency Test market. The study serves as an investor's guide with its clear representation of competitive analysis of key competitors by product, price, financial condition, product portfolio, growth plans, and regional presence in the market for English Proficiency Test. The report covers the Global English Proficiency Test market segmented by application, test, and by region. It reveals the market situation and future forecast. The study also covers the significant data presented with the help of graphs and tables.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?