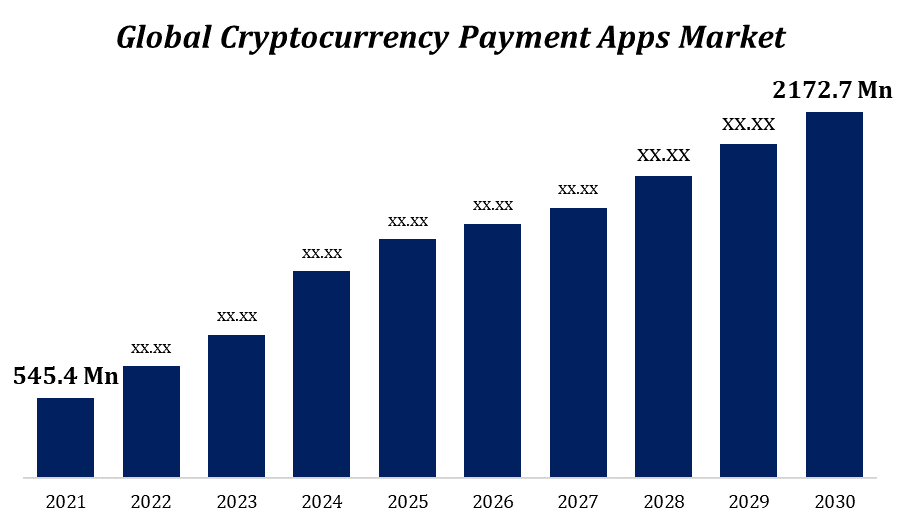

Global Cryptocurrency Payment Apps Market Size to grow USD 2172.7 Million by 2030 | CAGR of 16.6%

Category: Banking & FinancialGlobal Cryptocurrency Payment Apps Market worth $2,172.7 million by 2030

According to a research report published by Spherical Insights & Consulting, the Global Cryptocurrency Payment Apps Market Size to grow from USD 545.4 million in 2021 to USD 2,172.7 million by 2030, at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period. The industry is growing as a result of the existence of numerous illustrious businesses in the region. Additionally, it is projected that the willingness of some market players to accept bitcoin payments outright would increase the possibility for regional growth. For instance, in April 2022, Strike announced a partnership with online retailer Shopify to enable Bitcoin payments using the Lightning Network. The association seeks to simplify transactions while safeguarding bitcoin for businesses by quickly converting bitcoin payments into US dollars.

Get more details on this report -

Browse key industry insights spread across 212 pages with 160 market data tables and figures & charts from the report " Global Cryptocurrency Payment Apps Market Size, Share, and COVID-19 Impact Analysis By Cryptocurrency Type (Bitcoin, Ethereum, Litecoin, DAI, Ripple and Others), By Payment Type (In-store Payment and Online Payment), By Operating System (Android, IOS, and Others) By End User (Individuals and Businesses) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) Analysis and Forecast 2021 – 2030.” in detail along with the table of contents https://www.sphericalinsights.com/reports/cryptocurrency-payment-apps-market

View a detailed Table of Content here–

The COVID-19 pandemic has made an adverse impact on credit portfolios. There has been an unprecedented rise in unemployment and disruption in economic activity, putting a strain on the solvency of customers and companies. Central banks have taken a proactive approach by injecting liquidity into the market by lowering interest rates and asset purchase programs. Managing and monitoring credit, market, liquidity, and operational risk across financial markets were hard enough with ongoing geopolitical tensions, international trade wars, and the occasional hurricanes and earthquakes. The current pandemic situation has forced chief risk officers and their teams to recalibrate old assumptions and models used to manage and monitor risk. COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation. As a result, many governments started rushing toward identifying, evaluating, and procuring reliable solutions powered by AI.

The bitcoin segment to account for the largest market size during the forecast period

Based on the Cryptocurrency segment, the cryptocurrency payment apps market is categorized into Bitcoin, Ethereum, Litecoin, DAI, Ripple, Others. The bitcoin segment accounts for the largest market size during the forecast period. The growth of this segment can be attributed to the increasing adoption of Bitcoin applications due to the proof-of-work process supported by the decentralized bitcoin network's users, it ensures uncompromised security of the payment systems. Volunteers are required to sign hashes that employ cryptography to verify transactions over the bitcoin network in order for the blockchain-based currency to function. Due to the method's guarantee that transactions are often irreversible, bitcoin offers great data security, which is fueling the segment's expansion.

The In-store Payment segment to hold a higher CAGR during the forecast period

Based on Payment, it is categorized into In-store Payment and Online payment. The In- Store payment segment to hold higher CAGR during the forecast period. Because of digitalization and the acceptance of contactless payments, there is a growing need for digital payment methods. Retailers can accept payments by installing a QR code or NFC terminal in the POS, and cryptocurrency payment apps offer a platform for cryptocurrency transactions. Additionally, transaction costs on bitcoin payment applications are predicted to be lower than on traditional payment platforms, enticing more users to choose them.

The andriod segment to hold a higher CAGR during the forecast period

Based on the Operating system, it is categorized into Android, IOS, and Others. The android segment to hold a higher CAGR during the forecast period. The prevalence is highlighted by the accessibility and affordability of smartphones with Android operating systems. As a result, market participants are increasingly willing to create platforms for operating systems based on Android.

The businesses segment to hold a higher CAGR during the forecast period

Based on End User, It is categorized into Individuals and Businesses. The businesses segment to hold higher CAGR during the forecast period. Due to the increased size of cryptocurrency transactions completed using cryptocurrency payment apps, the dominance is explained. For instance, the American automaker Tesla declared in January 2022 that it will accept payments made in cryptocurrencies like bitcoin. Tesla is a high-end electric vehicle maker, and each transaction costs significantly more than the average person makes in a year.

Get more details on this report -

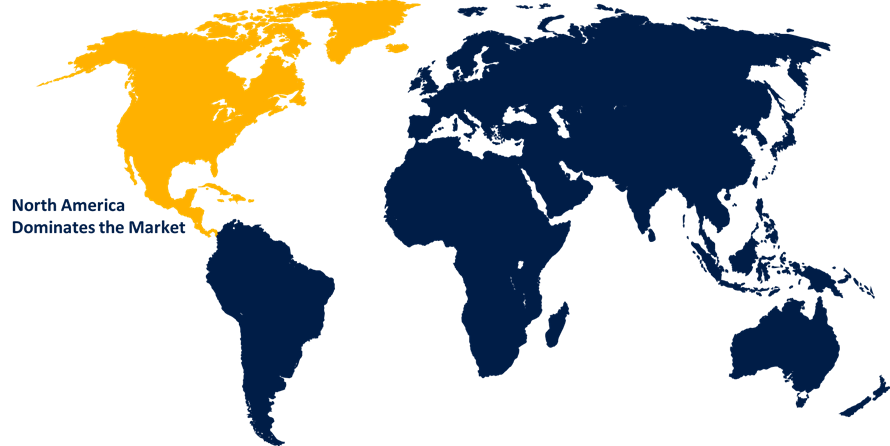

North America is estimated to account for the highest market share in 2021.

The Global Cryptocurrency Payment Apps Market has been segmented into five major regions: Asia-Pacific, Europe, APAC, Latin America, and MEA. North America is expected to be the largest market for self-supervised learning. This is mostly due to the presence of prominent market players in the regions, such as U.S.-based Meta, Google, and Microsoft. Furthermore, the presence of specialists in the cryptocurrency payment apps market in the region also propels the growth of the market. Most of the countries in the North American region have developed cryptocurrency-type infrastructure, which adds impetus to the growth of the cryptocurrency payment apps market in the region. Asia-Pacific to hold a higher CAGR during the forecast period.

Major vendors in the Global cryptocurrency Market include BitPay, Coinomi, Paytomat, Aprione OÜ , SecuX Technology, Inc , Circle Internet, Financial Limited, Binance, CoinJar UK Limited. , Crptopay Ltd.

Related Report:

Urgent Care Apps Market Share, Forecast 2030

https://www.sphericalinsights.com/reports/urgent-care-apps-market

Digital Banking Platform Market Share, Forecast 2030

https://www.sphericalinsights.com/reports/digital-banking-platform-market

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?