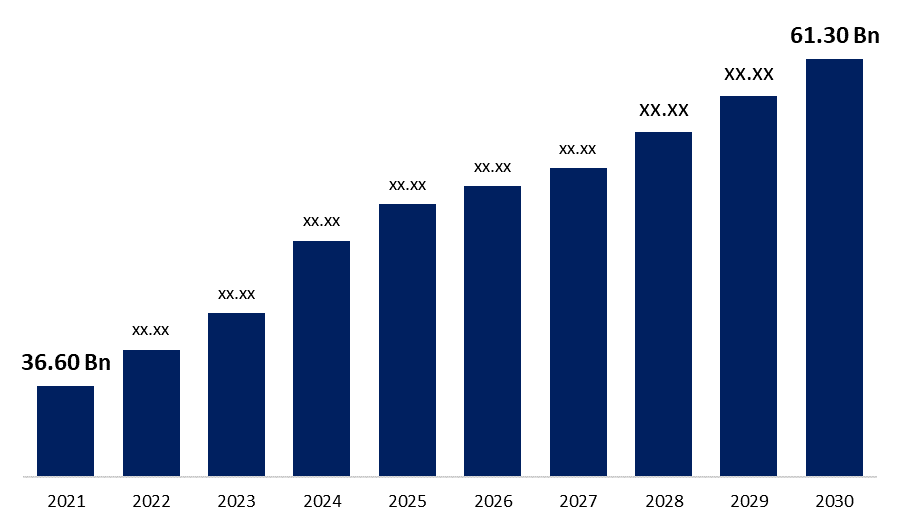

Global Crop Insurance Market Size to grow USD 61.30 Billion by 2030 | CAGR of 5.90%

Category: Banking & FinancialThe Crop Insurance Market was valued at USD 36.60 Billion in 2021, the market is projected to grow USD 61.30 Billion in 2030, at a CAGR of 5.90 %. as per the latest research report by Spherical Insights & Consulting.

Get more details on this report -

Varying insurers provide different types of coverage and policy limits, so it makes sense to look around for the most appropriate cover as per the need. Agriculture is subjected to a variety of climatic and market variables. Extreme weather events, such as drought, are expected to become more common as a result of climate change. Farmers must continuously handle the dangers of shifting global market conditions as well as volatile domestic growing conditions. Farmers, like any other business, want to maximize revenues while minimizing risks. There are numerous potential sources of risk, and different risk management strategies may be suitable depending on the situation. Revenue risk and input cost risk are two types of risks affecting farmer profits. Agricultural insurance is better suited to extreme and rare events. Claims against insurance policies frequently increase the cost of insurance by increasing loss adjustment expenses. Insurance costs must also be weighed against the costs of alternative risk management strategies. Less substantial risks, in particular, can be addressed more cost-effectively through savings or borrowing.

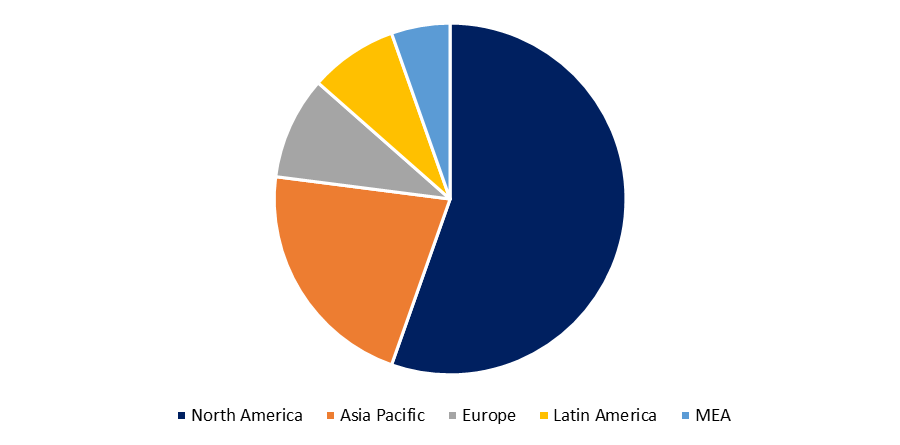

Browse key industry insights spread across 190 pages with 73 market data tables and figures & charts from the report Global Crop Insurance Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage), By Coverage (Localized Calamities, Sowing/Planting/Germination Risk, Standing Crop Loss, and Post-harvest Losses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030 in detail along with the table of contents https://www.sphericalinsights.com/reports/crop-insurance-market

Agricultural weather insurance assists farmers in risk management by compensating them for production losses caused by bad weather. This is especially essential, where agricultural production is among the world's most variable. Climate change is predicted to enhance this volatility. Insurance must benefit both farmers and insurers in order for a crop insurance market to be sustainable. Farmers grow a diverse range of food crops, including grains, fruits, and vegetables, enough to feed 600 people each farmer. Cotton and sugar are among the industrial crops they cultivate.

The agriculture land area is increasing in the many countries. Despite the fact that a substantial amount of the production area is devoted to vast grazing in low-yield arid areas, total output is high in comparison to population food demand, resulting in a considerable proportion of agricultural output being exported. In 2015/2016, agricultural products accounted for 15% of overall export value. China, the United States, Japan, the Republic of Korea, and Indonesia were the top five agricultural export destinations in that year. The bulk of intense production, cropping, and overall output by value occurs in the continent's temperate and relatively high rainfall southern and eastern perimeters, with minimal production occurring in the continent's desert center and tropical north. Over three decades ago, agricultural policy began to support free-market adaptability and market orientation. Agriculture has largely adjusted and developed production adaptability, resulting in agricultural returns on capital that are comparable to those seen in other economic sectors.

Farmers must safeguard their farm from a variety of dangers depending on the season and year, which means they must have a variety of risk management plans on hand at all times. They must be prepared to deal with 'climate shocks,' which occur when the weather abruptly changes, and the frequency of these incidents is likely to rise over time. For farmers, agricultural insurance is an important aspect of risk management. Farm income fluctuates dramatically from year to year, owing in part to changing weather patterns.

Crop insurance is usually divided into sections that protect certain grain types, such as broadacre or viticulture. Policies are often just designed to cover one or two potential hazards and are meant to cover the most common risks impacting the specific crops. Named danger crop insurance is the most common type of crop insurance in Australia, accounting for about 75% of all policies. Broadacre farms are the most common, followed by industrial crops and viticulture.

Get more details on this report -

Adapting to rising climate unpredictability will necessitate new approaches to risk management on the part of farmers. Farmers are encouraged to adopt improved risk management strategies by government policy, which focuses on establishing an atmosphere of self-reliance. While agriculture has a higher amount of revenue risk than other industries, insurance is best for managing yield risk from unusual and extreme catastrophes. Traditional insurance products, which are meant to protect against yield losses on a single farm, are compared to newer index-based plans, which employ indirect proxies for yield losses, such as rainfall at a nearby weather station or shire-level yields, for yield losses on a farm.

Related Report

Extended Warranty Market Size, Trends & Forecast 2021-2030

https://www.sphericalinsights.com/reports/extended-warranty-market

Contract or Temporary Staffing Market Size, Forecast 2030

https://www.sphericalinsights.com/reports/contract-or-temporary-staffing-market

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?