Global Blind Spot Solutions Market Size To Worth USD 17.8 Billion By 2033 | CAGR of 6.15%

Category: Automotive & TransportationGlobal Blind Spot Solutions Market Size To Worth USD 17.8 Billion By 2033

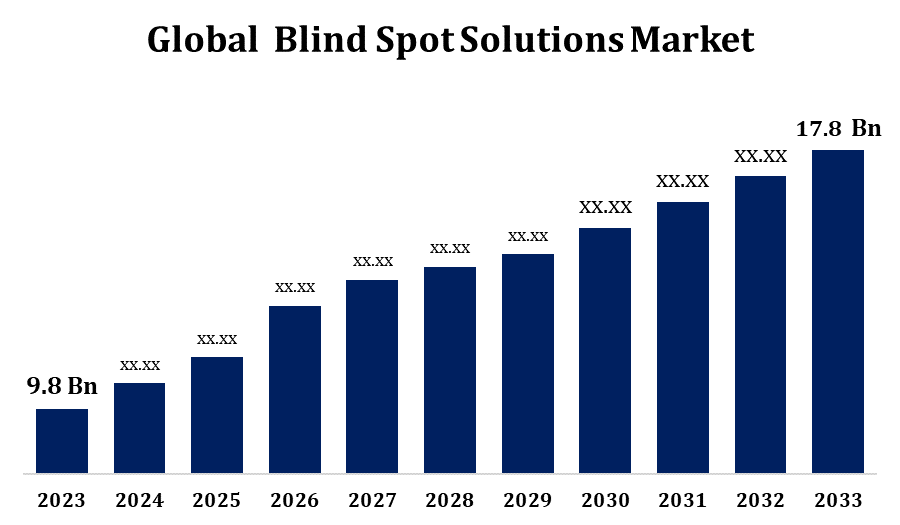

According to a research report published by Spherical Insights & Consulting, the Global Blind Spot Solutions Market Size to Grow from USD 9.8 Billion in 2023 to USD 17.8 Billion by 2033, at a Compound Annual Growth Rate CAGR of 6.15% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 250 pages with 110 Market data tables and figures & charts from the report on the "Global Blind Spot Solutions Market Size, Share, and COVID-19 Impact Analysis, By Technology (Camera-based system, Radar-based system, Ultrasonic-based system), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Truck, Bus), By Sales Channel (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023-2033 " Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/blind-spot-solutions-market

The global Blind Spot Solutions market is experiencing consistent growth, fueled by the increasing demand for enhanced vehicle safety and advanced driver-assistance systems (ADAS). As awareness of road safety rises, more automakers are incorporating technologies like radar, cameras, and ultrasonic sensors to detect vehicles and obstacles in blind spots. The market is further bolstered by stricter government regulations requiring the inclusion of safety features in vehicles. North America and Europe lead the market, thanks to early adoption of safety technologies and favorable regulatory frameworks. Meanwhile, the Asia-Pacific region is rapidly gaining traction, driven by rising vehicle production and urbanization. While challenges such as high installation costs and limited consumer awareness persist in certain regions, ongoing technological advancements and a growing focus on vehicle safety are expected to sustain the market's growth in the coming years.

Blind Spot Solutions Market Value Chain Analysis

The value chain of the Blind Spot Solutions market comprises several key stages, beginning with raw material suppliers who provide components such as sensors, cameras, and control units. These are followed by technology developers who design and engineer blind spot detection systems using radar, ultrasonic, or camera-based technologies. System integrators and manufacturers then incorporate these solutions into vehicles, often collaborating with automotive OEMs. Tier-1 suppliers play a vital role in customizing and assembling systems for various vehicle models. Distribution channels include direct sales to automakers and aftermarket suppliers for retrofitting purposes. Aftermarket service providers manage the installation, maintenance, and upgrades of these systems. The final stage involves end-users, including individual consumers and commercial fleet operators. Regulatory bodies and industry standards guide compliance and safety requirements throughout product development and deployment.

Blind Spot Solutions Market Opportunity Analysis

The Blind Spot Solutions market offers substantial opportunities, driven by the global push for improved road safety and the increasing adoption of advanced driver-assistance systems (ADAS). Stricter safety regulations in regions like North America and Europe are pushing automakers to incorporate blind spot detection technologies into a wider variety of vehicles, including mid-range and economy models. In emerging markets, particularly Asia-Pacific, rapid growth is being fueled by urbanization, rising vehicle ownership, and growing consumer awareness of vehicle safety. Technological advancements, including the integration of artificial intelligence and machine learning, are improving the accuracy and effectiveness of these systems. Additionally, the rise of electric and autonomous vehicles is driving the need for advanced safety features, such as blind spot monitoring. Collaborations between automotive manufacturers and tech companies are facilitating the development of innovative, integrated safety solutions.

The Blind Spot Solutions market is experiencing strong growth, driven by the increasing consumer demand for advanced vehicle safety technologies. As drivers become more aware of the dangers associated with blind spots, the need for systems that improve situational awareness and prevent accidents is rising. Automakers are progressively incorporating blind spot detection and monitoring systems into a wide range of vehicles, including compact and mid-range models. Technological innovations such as AI-based detection, sensor fusion, and real-time alerts are enhancing the accuracy and reliability of these systems. Moreover, the rise in road accidents and stricter government regulations requiring safety features are prompting manufacturers to adopt these solutions. The growth of the electric and autonomous vehicle markets also presents new opportunities, as these vehicles require sophisticated safety systems. This growing focus on safety is expected to drive continued market expansion worldwide.

The Blind Spot Solutions market encounters several challenges that could hinder its growth. The high costs of implementing advanced sensors and radar technologies limit adoption, particularly in price-sensitive segments. Integrating these solutions into existing vehicle architectures, especially older models, presents technical challenges that require substantial modifications. Adverse weather conditions can also affect sensor performance, compromising system reliability. Rapid technological advancements demand continuous investment in research and development, putting pressure on smaller manufacturers. Additionally, navigating varied regulatory requirements across different regions adds complexity and could delay product launches. Supply chain issues, such as semiconductor shortages, can disrupt production and raise costs. Furthermore, consumer awareness and understanding of blind spot technologies remain low in some markets, which may impact demand. Overcoming these challenges is essential for the continued growth of the market.

Insights by Technology

The radar-based system segment accounted for the largest market share over the forecast period 2023 to 2033. Radar systems surpass camera and ultrasonic technologies by effectively detecting objects in low visibility conditions such as fog, rain, or darkness. This reliability has driven their widespread adoption in both passenger and commercial vehicles, with radar becoming the dominant technology in the global blind spot detection system market. Advances in technology, such as the development of 77GHz sensors, have improved detection capabilities, making radar systems more efficient and cost-effective. Moreover, the integration of radar-based systems with other advanced driver-assistance systems (ADAS) like adaptive cruise control and lane-keeping assist is further enhancing vehicle safety. The increasing focus on vehicle safety, along with regulatory requirements for advanced safety features, is further fueling the demand for radar-based blind spot detection systems.

Insights by Vehicle Type

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of this segment is fueled by increasing consumer awareness of road safety and a growing preference for vehicles equipped with advanced driver-assistance systems (ADAS). In response, automakers are incorporating blind spot detection systems across a broader range of passenger vehicles, including mid-range models, to meet evolving consumer expectations and stand out in a competitive market. Furthermore, regulatory mandates requiring the integration of safety features in vehicles are accelerating the adoption of blind spot detection technologies within the passenger car segment. As a result, this segment is expected to see sustained growth, playing a key role in driving the overall expansion of the Blind Spot Solutions market.

Insights by Sales Channel

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Automakers are increasingly equipping vehicles with blind spot detection systems either as standard or optional features to align with rising consumer demand for enhanced safety and to meet regulatory requirements. As road safety awareness continues to grow, OEMs are expanding the integration of these systems across a broader spectrum of vehicles, including mid-range and economy models. The growing presence of autonomous and semi-autonomous vehicles is also accelerating the adoption of blind spot monitoring technologies. In addition, regulatory mandates that call for the inclusion of advanced driver-assistance systems (ADAS) are compelling OEMs to incorporate these safety features more widely. Together, these factors are driving significant growth within the OEM segment of the Blind Spot Solutions market.

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Blind Spot Solutions Market from 2023 to 2033. In the U.S. and Canada, growing awareness of road safety and a strong preference for premium vehicles with advanced safety features are driving the expansion of the Blind Spot Solutions market. Government regulations in the U.S. mandating the inclusion of advanced safety technologies in new vehicles are further increasing demand for blind spot detection systems. Radar-based technologies lead the market, thanks to their reliability in diverse driving conditions. The commercial vehicle sector especially heavy trucks is also seeing rising adoption of these systems to improve safety and meet regulatory requirements. Additionally, advancements in technology, such as AI-powered detection systems, are enhancing vehicle safety and playing a key role in supporting market growth across the region.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, and Japan are leading the way in the growing demand for advanced driver-assistance systems (ADAS) across both passenger and commercial vehicle segments. Radar-based technologies hold a dominant position in the market, valued for their dependable performance in varying driving conditions. The rapid expansion of electric vehicles (EVs) is also driving the need for advanced safety features, such as blind spot detection systems. Original Equipment Manufacturers (OEMs) are at the forefront, incorporating these technologies into new vehicle models to align with evolving regulatory requirements and meet rising consumer expectations for enhanced safety.

Recent Market Developments

- In January 2022, GILLIG LLC has partnered with RR.AI to jointly develop next-generation Advanced Driver Assistance Systems (ADAS) and SAE Level 4 Autonomous Vehicle (AV) technology for GILLIG transit buses throughout North America.

Major players in the market

- Autoliv Inc.

- Continental AG

- Delphi Automotive LLP

- Denso Corporation

- Robert Bosch GmbH

- Magna International Inc.

- Hella KGaA Hueck & Co.

- Valeo SA

- Samvardhana Motherson Reflected

- Ficosa International S.A.

- Gentex Corporation

- ZF Friedrichshafen AG

- Mobileye N.V.

- Stoneridge, Inc.

- Quanergy Systems, Inc.

- Hitachi Automotive Systems Ltd.

- Muth Mirror Systems, LLC

- WABCO Holdings Inc.

- Preco Electronics, Inc.

- Aptiv PLC

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Blind Spot Solutions Market, Technology Analysis

- Camera-based system

- Radar-based system

- Ultrasonic-based system

Blind Spot Solutions Market, Vehicle Type Analysis

- Passenger Cars

- Light Commercial Vehicles

- Truck

- Bus

Blind Spot Solutions Market, Sales Channel Analysis

- OEM

- Aftermarket

Blind Spot Solutions Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?