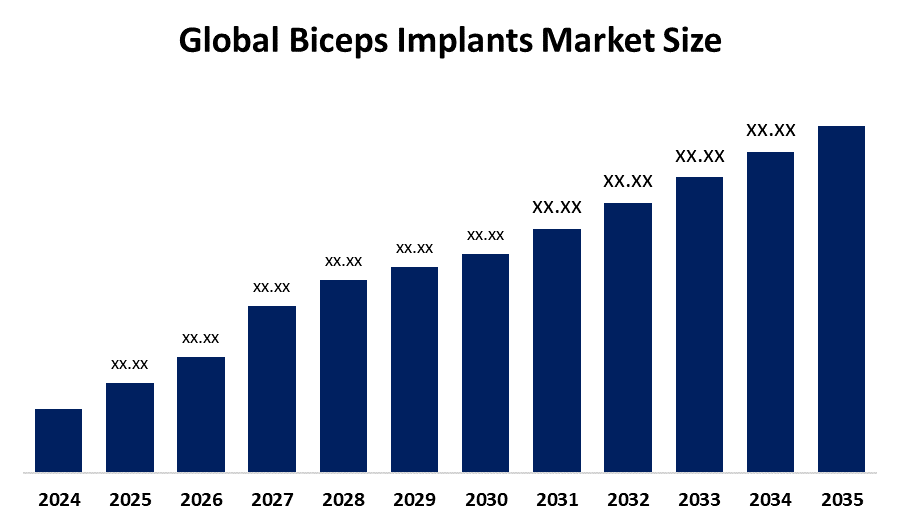

Global Biceps Implants Market Size Is Expected To Hold a Significant Share By 2035 | CAGR of 6.2%

Category: HealthcareGlobal Biceps Implants Market Size Is Expected To Hold a Significant Share By 2035

According to a research report published by Spherical Insights & Consulting, The Global Biceps Implants Market Size is expected to hold a significant share by 2035, at a CAGR of 6.2% during the forecast period 2025-2035.

Get more details on this report -

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the " Global Biceps Implants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Suture Anchors, Interference Screws, and Cortical Buttons), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), and Orthopedic Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035. "Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/biceps-implants-market

The global industry segment focused on the development, production, and marketing of prosthetic or synthetic implants, especially meant for biceps augmentation or reconstruction, is known as the "biceps implants Market." Biceps implants are medical devices intended to improve the size, form, or symmetry of the biceps muscle. To satisfy aesthetic preferences, congenital abnormalities, or post-traumatic muscle limitations, these implants are mostly employed in cosmetic and reconstructive surgeries. With a rising focus on minimally invasive surgical techniques, customized implant designs, and patient-specific solutions, the market comprises a number of stakeholders, including manufacturers, distributors, healthcare providers, and research institutions. The growing focus on physical appearance and muscle definition, as well as the expanding desire for male cosmetic modifications, are the main factors driving the biceps implants market. Technological developments in minimally invasive surgical methods and biocompatible implant materials, such as silicone and polymers, improve safety and shorten recovery times, increasing adoption. Growing medical tourism and rising disposable incomes make elective operations more accessible. Demand is further boosted by increased knowledge of reconstructive solutions for injuries, congenital abnormalities, and muscle atrophy. However, high expenses, surgical risks, strict rules, low knowledge in the area, and the availability of non-surgical options are some of the restraints.

The suture anchors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the biceps implants market is divided into suture anchors, interference screws, and cortical buttons. Among these, the suture anchors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market for suture anchors is mainly due to its extensive clinical use and excellent fixation dependability in biceps tendon and implant procedures.

Get more details on this report -

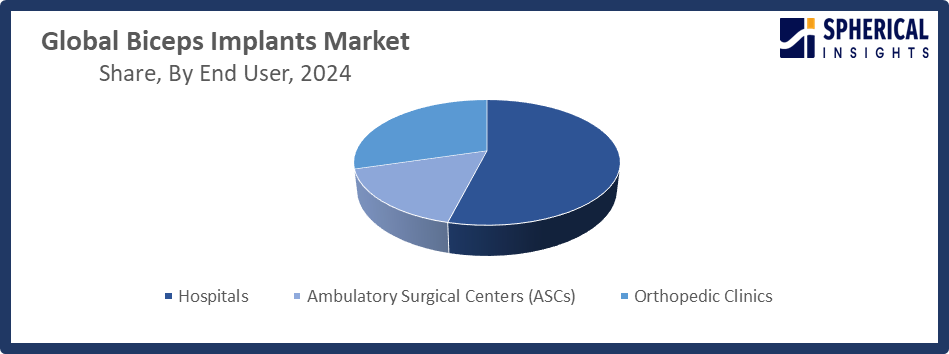

The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end user, the biceps implants market is divided into hospitals, ambulatory surgical centers (ASCs), and orthopedic Clinics. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Complex biceps implant procedures, which frequently call for interdisciplinary coordination and post-operative care, are primarily performed in hospitals.

North America is expected to hold the majority share of the global biceps implants market during the forecast period.

North America is expected to hold the majority share of the global biceps implants market during the forecast period. North America's dominance in terms of overall market share is ensured by its mature market, technical improvements, and widespread acceptance of cosmetic modifications. The region benefits from well-established healthcare infrastructure, innovative medical technologies, and the presence of key implant producers and distributors. The demand for cosmetic and reconstructive operations, such as biceps augmentation, has increased due to high disposable incomes and greater awareness of male aesthetics.

Get more details on this report -

Asia Pacific is anticipated to grow at the fastest pace in the global biceps implants market during the forecast period. The expanding disposable incomes, more urbanization, and expanding male knowledge of cosmetic and aesthetic operations are the main drivers of the Asia-Pacific region's expansion. Medical tourism has increased in the area as individuals look for high-quality, reasonably priced surgical procedures in nations like South Korea, Thailand, and India.

Major vendors in the global biceps implants market are Össur Hf., DJO Global, Aesculap, Arthrex, Inc., Acumed LLC, DePuy Synthes, Medtronic PLC, Meril Life Sciences, Stryker Corporation, BioTek Instruments, Mathys Medical Ltd, Conmed Corporation, Smith & Nephew PLC, Extremity Medical, LLC, Zimmer Biomet Holdings, Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the biceps implants market based on the below-mentioned segments:

Global Biceps Implants Market, By Product Type

- Suture Anchors

- Interference Screws

- Cortical Buttons

Global Biceps Implants Market, By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

Global Biceps Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?