Global Automotive Acoustic Materials Market Size to Worth USD 5.6 billion by 2033 | CAGR of 2.68%

Category: Automotive & TransportationGlobal Automotive Acoustic Materials Market Size to Worth USD 5.6 billion by 2033

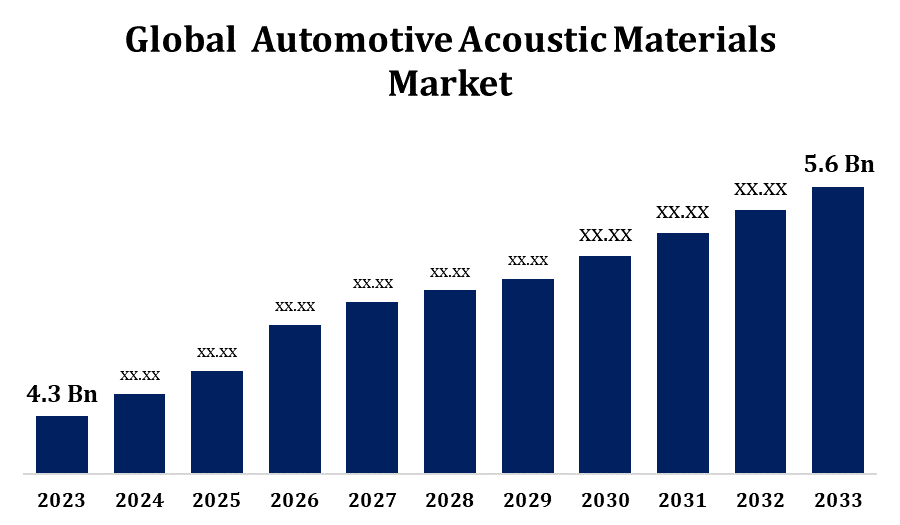

According to a research report published by Spherical Insights & Consulting, The Global Automotive Acoustic Materials Market Size to grow from USD 4.3 billion in 2023 to USD 5.6 billion by 2033, at a Compound Annual Growth Rate (CAGR) of 2.68% during the forecast period.

Get more details on this report -

Browse 107 market data Tables and 47 Figures spread through 265 Pages and in-depth TOC on the “Global Automotive Acoustic Materials Market Size, Share, and COVID-19 Impact Analysis, by Material (Polyurethane, Textile, Fiberglass, and Other Materials), Vehicle Type (Passenger Cars and Commercial Vehicles), Application (Bonnet Liner, Door Trim, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.” Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/automotive-acoustic-materials-market

The automotive acoustic materials market is witnessing consistent growth, driven by the increasing demand for quieter, more comfortable driving experiences. Materials such as foams, fabrics, and barrier mats play a vital role in minimizing noise, vibration, and harshness (NVH) in vehicles. Stricter noise pollution regulations and a growing emphasis on enhancing in-cabin comfort—particularly in electric and hybrid vehicles—are further accelerating market development. Manufacturers are prioritizing the use of lightweight, eco-friendly acoustic solutions to align with environmental and performance goals. Passenger vehicles remain key contributors to market growth, with the Asia-Pacific region leading due to its high automotive production. Ongoing advancements in material science and technology are transforming the industry, solidifying acoustic materials as essential elements in modern vehicle design and manufacturing.

Automotive Acoustic Materials Market Value Chain Analysis

The value chain of the automotive acoustic materials market comprises several critical stages, starting with raw material suppliers who provide essential inputs like polymers, foams, fibers, and composites for sound insulation applications. These materials are transformed by manufacturers into acoustic components such as damping sheets, insulation pads, and barrier mats. Component suppliers and system integrators then tailor these products to fit specific vehicle models, ensuring high performance and compatibility. Original Equipment Manufacturers (OEMs) incorporate these acoustic materials during vehicle production to meet Noise, Vibration, and Harshness (NVH) requirements. The products reach end-users through a mix of direct sales and third-party distributors across global markets. Automotive manufacturers and aftermarket service providers represent the final link in the chain. Ongoing R&D and collaboration among stakeholders continue to drive innovation, efficiency, and sustainability.

Automotive Acoustic Materials Market Opportunity Analysis

The automotive acoustic materials market offers considerable growth opportunities, largely fueled by the expanding adoption of electric and hybrid vehicles. Although these vehicles operate more quietly than traditional models, they require advanced acoustic solutions to address new noise sources such as electric motors and HVAC systems. The industry’s push for lightweight and eco-friendly materials also supports this trend, as manufacturers strive to boost fuel efficiency and cut emissions. The development of bio-based and recycled acoustic materials addresses both environmental and performance goals. In addition, the rising focus on cabin comfort and stricter noise regulations are driving demand for high-performance acoustic solutions. Rapid industrialization and growth in the automotive sector, especially across Asia-Pacific, further contribute to the market’s promising expansion potential.

The growing demand for premium and luxury vehicles is a major driver of the automotive acoustic materials market. Consumers in this segment place a high value on superior cabin comfort and low levels of noise, vibration, and harshness (NVH). In response, automakers are increasingly incorporating advanced acoustic materials to elevate the overall in-cabin experience. This trend is especially prominent in regions such as Europe, where interest in luxury vehicles continues to climb. Moreover, the transition to electric vehicles which operate more quietly than traditional cars further highlights the need for specialized acoustic solutions to manage alternative noise sources. The combination of rising luxury vehicle sales and continuous innovation in acoustic technologies is creating significant opportunities for growth within the automotive acoustic materials industry.

Volatile prices of raw materials such as acrylonitrile, ethylene, rubber, polyurethane, polypropylene, and fiberglass create considerable cost challenges for manufacturers in the automotive acoustic materials market. Incorporating advanced acoustic solutions into vehicles often involves complex processes and increased investments in design and manufacturing. Additionally, the growing use of Active Noise Control (ANC) systems which electronically minimize cabin noise may lessen reliance on traditional acoustic materials. Stricter environmental regulations also demand the development of sustainable, recyclable alternatives, further complicating production. The relatively high cost of advanced acoustic materials can be a limiting factor, particularly in cost-sensitive vehicle segments, hindering broader adoption. Overcoming these hurdles will require ongoing innovation, efficient resource management, and strategic collaboration across the value chain to ensure long-term market resilience.

Insights by Material

The polyurethane segment accounted for the largest market share over the forecast period 2023 to 2033. Polyurethane’s adaptability makes it ideal for use in a wide range of vehicle components, including seat cushions, headliners, door panels, and floor carpets, where it effectively reduces noise, vibration, and harshness (NVH). As automakers place greater emphasis on cabin comfort particularly in electric and hybrid vehicles the demand for polyurethane-based acoustic materials continues to grow. Its lightweight properties also contribute to improved fuel efficiency and align with the industry's movement toward sustainable, eco-conscious solutions. Furthermore, innovations in low-emission and recyclable polyurethane foams are accelerating its adoption. With applications across both luxury and mainstream vehicle segments, polyurethane remains a crucial material, driving advancements and performance in automotive acoustic technologies.

Insights by Vehicle Type

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the passenger car segment in the automotive acoustic materials market is largely driven by rising consumer expectations for quieter, more comfortable vehicle interiors. This demand is particularly strong in the premium and luxury segments, where top-tier acoustic performance serves as a key competitive advantage. The increasing popularity of electric vehicles further fuels this need, as their quieter drivetrains highlight other noise sources like wind and tire sounds, requiring advanced acoustic treatment. In response, manufacturers are incorporating innovative soundproofing materials to improve the in-cabin experience. Moreover, strict noise pollution regulations are pushing automakers to enhance acoustic insulation in passenger vehicles. Together, these trends highlight the pivotal role of the passenger car segment in shaping the future of the automotive acoustic materials industry.

Insights by Application

The door trim segment accounted for the largest market share over the forecast period 2023 to 2033. The growth of the door trim segment is fueled by rising consumer expectations for improved interior comfort and effective noise reduction. What was once seen as a luxury feature has now become standard in mid-range vehicles, with manufacturers increasingly using materials like ABS, polypropylene, and polyurethane to enhance both visual appeal and acoustic performance. This shift highlights the industry's dedication to tackling noise, vibration, and harshness (NVH) and enhancing the overall driving experience. The growing adoption of electric vehicles further drives demand for high-performance door trim solutions, as the quiet nature of EVs makes other noise sources more noticeable, requiring better insulation. As a result, the door trim segment continues to play a crucial role in pushing forward acoustic innovation in the automotive industry.

Insights by Region

Get more details on this report -

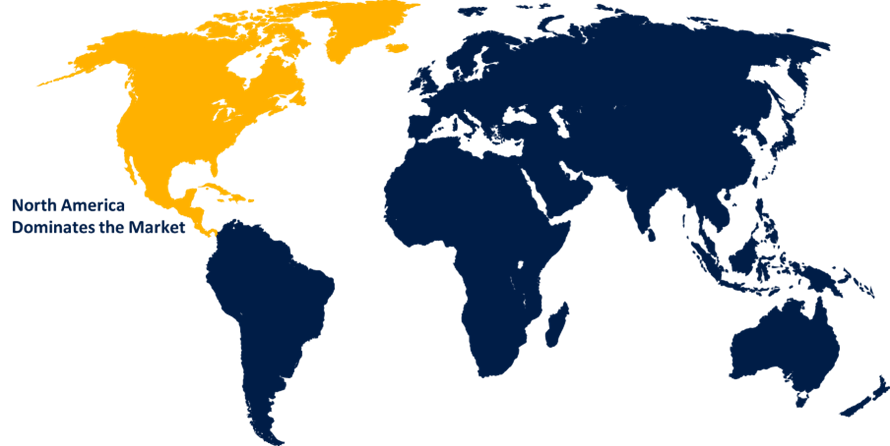

North America is anticipated to dominate the Automotive Acoustic Materials Market from 2023 to 2033. The growth of the market in North America is driven by rising consumer expectations for improved in-cabin comfort and strict noise pollution regulations. A well-established automotive sector, particularly in the United States and Canada, provides a solid foundation for the adoption of advanced acoustic technologies. The increasing popularity of electric vehicles further accelerates demand, as these vehicles require specialized noise-damping materials to address their distinct sound characteristics. Moreover, the growing preference for premium and luxury vehicles highlights the importance of high-quality acoustic performance, prompting manufacturers to incorporate superior soundproofing solutions. Ongoing collaborations between material suppliers and automotive OEMs are also spurring the development of lightweight, sustainable acoustic materials that support environmental compliance and fuel efficiency objectives.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The rapid adoption of electric vehicles, especially in China, is driving the need for advanced acoustic solutions to manage their distinct noise characteristics. Accelerating urbanization and growing consumer purchasing power have heightened expectations for in-cabin comfort, leading automakers to incorporate high-quality acoustic materials. The region also benefits from abundant raw material availability and cost-efficient manufacturing capabilities, further supporting market expansion. In addition, government efforts to curb vehicle noise pollution are reinforcing the use of acoustic materials across the automotive industry. With its booming automotive production and rising emphasis on vehicle comfort, the Asia-Pacific region is emerging as a key force in shaping the global automotive acoustic materials market.

Recent Market Developments

- In October 2021, Sumitomo Riko, in partnership with Japan's National Institute of Advanced Industrial Science and Technology (AIST), announced the completion of a joint research project that included the refurbishment of part of the vehicle testing proving ground at AIST’s Tsukuba North Site.

Major players in the market

- 3M Acoustics

- BASF SE

- Covestro

- Freudenberg Group

- Henkel Adhesive Technologies

- Huntsman

- Lyondellbasell

- Sika

- Sumitomo Riko

- Toray Industries

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Acoustic Materials Market, Material Analysis

- Polyurethane

- Textile

- Fiberglass

- Other Materials

Automotive Acoustic Materials Market, Vehicle Type Analysis

- Passenger Cars

- Commercial Vehicles

Automotive Acoustic Materials Market, Application Analysis

- Bonnet Liner

- Door Trim

- Other Applications

Automotive Acoustic Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?