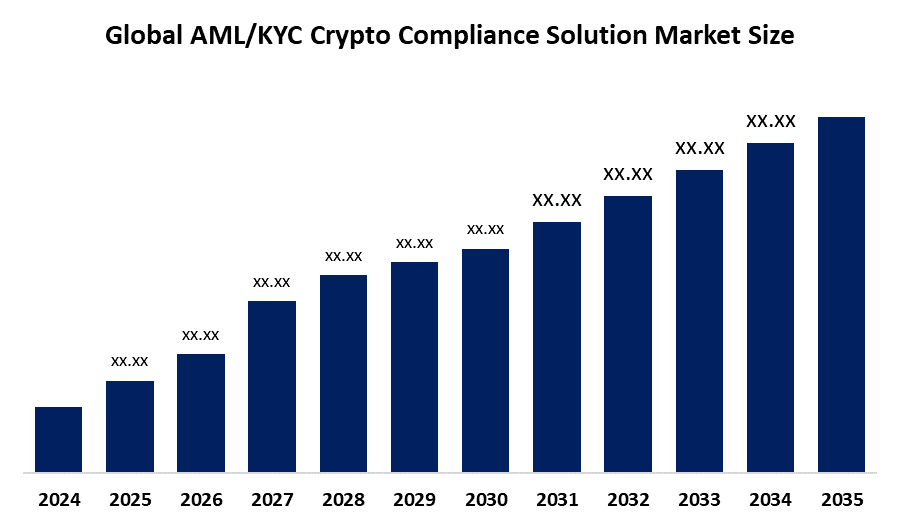

Global AML/KYC Crypto Compliance Solution Market Size Is Expected To Hold A Significant Share By 2035 | CAGR of 13.8%

Category: Banking & FinancialGlobal AML/KYC Crypto Compliance Solution Market Size Is Expected To Hold A Significant Share By 2035

According to a research report published by Spherical Insights & Consulting, The Global AML/KYC Crypto Compliance Solution Market Size is expected to hold a significant share by 2035, at a CAGR of 13.8% during the forecast period 2025-2035.

Get more details on this report -

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the" Global AML/KYC Crypto Compliance Solution Market Size, Share, and COVID-19 Impact Analysis, By Solution Type (Software Platforms (Transaction Monitoring & Risk Assessment, Identity Verification & Onboarding (KYC), Sanctions Screening (OFAC, PEPs), Wallet Screening & Risk Analysis, Case Management & Reporting), and Services (Managed Services (Outsourced monitoring and investigation), Professional Services (Consulting, integration, training)), By End-User (Crypto-Native Businesses, Traditional Financial Institutions, and Government & Regulatory Agencies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035. Get Detailed Report Description Here:https://www.sphericalinsights.com/reports/aml-kyc-crypto-compliance-solution-marke

The global industry segment dedicated to creating, offering, and implementing technologies, services, and frameworks intended to guarantee compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations within the cryptocurrency and digital asset ecosystem is known as the AML/KYC crypto compliance solution market. In order to stop illegal activities, including money laundering, financing terrorism, and fraud, these technologies make it easier to identify, verify, and continuously monitor users, transactions, and counterparties. The market includes a variety of products, such as blockchain analytics, transaction monitoring platforms, identity verification systems, and regulatory reporting software. The market for AML/KYC crypto compliance solution is being driven by factors such as expanding usage of digital assets, more regulatory scrutiny, and increased risks of financial crime. Globally, governments and regulatory agencies are enforcing strict AML/KYC regulations, forcing financial institutions, wallet providers, and cryptocurrency exchanges to build reliable compliance solutions. Technological developments improve transaction monitoring, identity verification, and risk assessment efficiency, especially in the areas of artificial intelligence (AI), machine learning (ML), and blockchain analytics. However, High costs, regulatory fragmentation, privacy concerns, and decentralized resistance hinder AML/KYC crypto compliance solution market.

The software platforms segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the solution type, the AML/KYC crypto compliance solution market is divided into software platforms (transaction monitoring & risk assessment, identity verification & onboarding (KYC), sanctions screening (OFAC, PEPS), wallet screening & risk analysis, case management & reporting), and services (managed services (outsourced monitoring and investigation), professional services (consulting, integration, training). Among these, the software platforms segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The vital role that software solutions play in automating and simplifying compliance procedures for cryptocurrency exchanges, wallet providers, and other suppliers of virtual asset services is what propels the software platforms market.

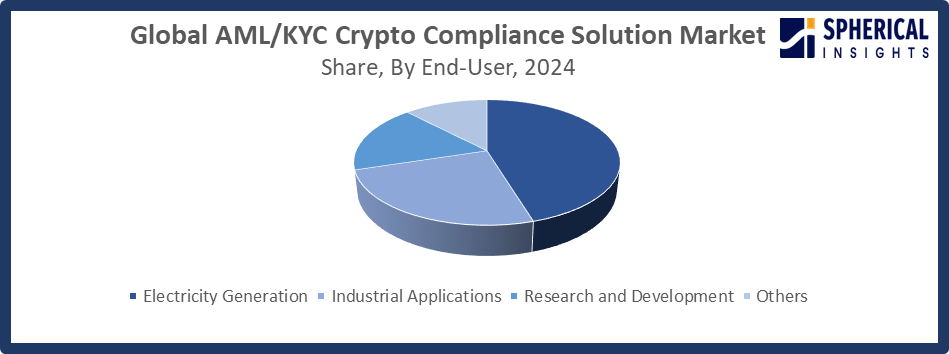

The crypto-native businesses segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the end-user, the AML/KYC crypto compliance solution market is divided into crypto-native businesses, traditional financial institutions, and government & regulatory agencies. Among these, the crypto-native businesses segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Crypto-native companies are at the vanguard of know-your-customer (KYC) and anti-money laundering (AML) responsibilities, handle large transaction volumes, and are subject to intense regulatory scrutiny.

Get more details on this report -

North America is expected to hold the majority share of the global AML/KYC crypto compliance solution market during the forecast period.

North America is expected to hold the majority share of the global AML/KYC crypto compliance solution market during the forecast period. Numerous blockchain-based startups, fintech companies, and well-established financial institutions are aggressively incorporating AML/KYC solutions into their operational architecture in North America. The creation of sophisticated compliance platforms with real-time monitoring, anomaly detection, and predictive risk assessment is made possible by the region's technological leadership, especially in artificial intelligence (AI), machine learning (ML), and blockchain analytics. Adoption rates among institutional and retail participants are also improved by raising public awareness of digital asset security and regulatory compliance.

Get more details on this report -

Asia Pacific is anticipated to grow at the fastest pace in the global AML/KYC crypto compliance solution market during the forecast period. The Asia Pacific region is gradually tightening AML/KYC regulations and imposing more stringent monitoring standards on virtual asset service providers (VASPs). Real-time transaction monitoring, identity verification, and reporting systems are required by these requirements, which significantly increases the need for sophisticated compliance solutions. Stricter monitoring requirements for virtual asset service providers (VASPs) and AML/KYC rules are being implemented by regulatory bodies throughout the Asia Pacific region.

Major vendors in the global AML/KYC crypto compliance solution market are Chainalysis, Elliptic, TRM Labs, CipherTrace, Solidus Labs, ComplyAdvantage, Scorechain, Mercury, Sum & Substance, Coinfirm, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the AML/KYC crypto compliance solution market based on the below-mentioned segments:

Global AML/KYC Crypto Compliance Solution Market, By Solution Type

- Software Platforms

- Transaction Monitoring & Risk Assessment

- Identity Verification & Onboarding (KYC)

- Sanctions Screening (OFAC, PEPs)

- Wallet Screening & Risk Analysis

- Case Management & Reporting

- Services

- Managed Services (Outsourced monitoring and investigation)

- Professional Services (Consulting, integration, training)

Global AML/KYC Crypto Compliance Solution Market, By End-User

- Crypto-Native Businesses

- Traditional Financial Institutions

- Government & Regulatory Agencies

Global AML/KYC Crypto Compliance Solution Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?