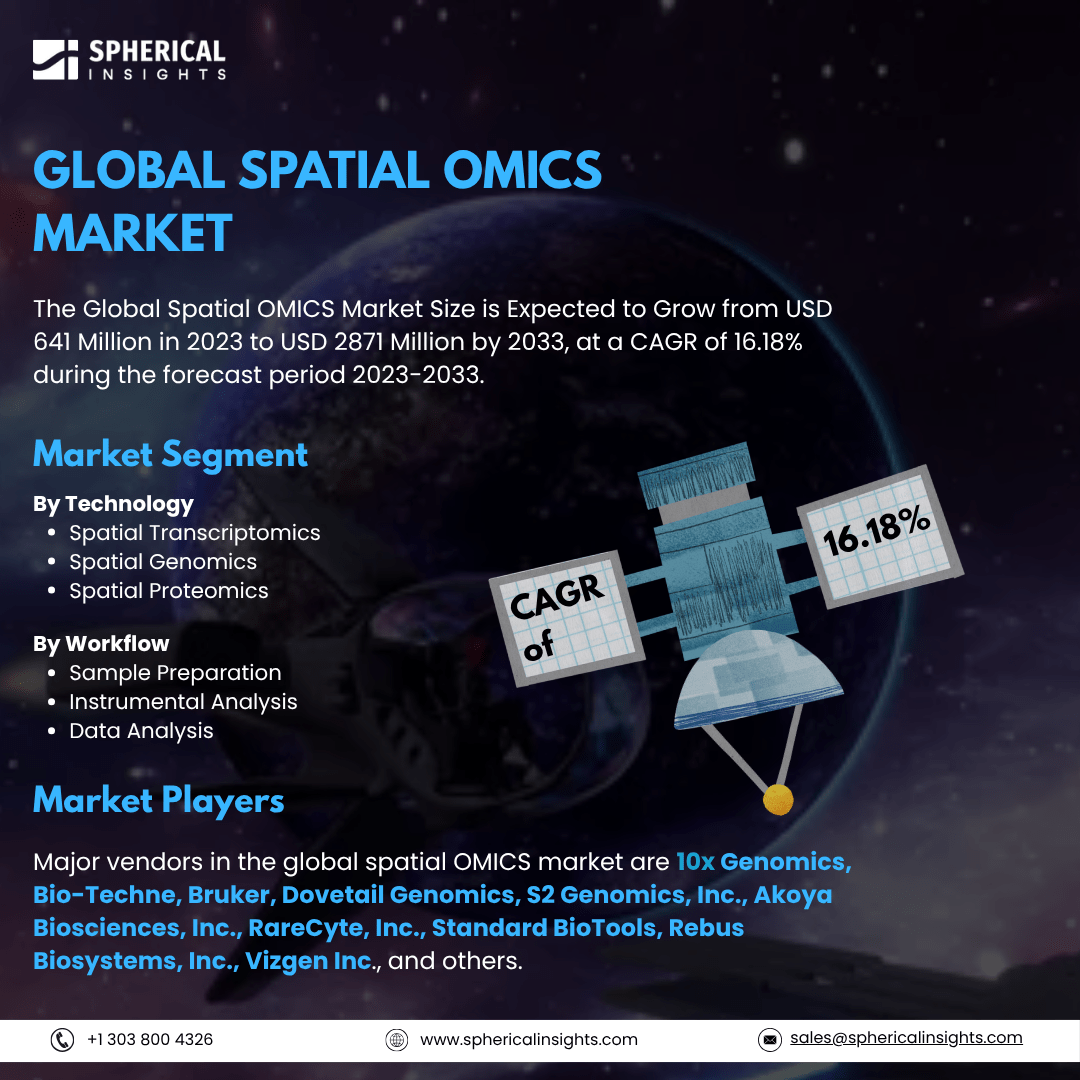

Global Spatial OMICS Market Size To Exceed USD 2871 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Spatial OMICS Market Size is Expected to Grow from USD 641 Million in 2023 to USD 2871 Million by 2033, at a CAGR of 16.18% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Spatial OMICS Market Size, Share, and COVID-19 Impact Analysis, By Technology (Spatial Transcriptomics, Spatial Genomics, and Spatial Proteomics), By Product (Instruments {By Mode [Automated, Semi-automated, and Manual]} {By Type [Sequencing Platforms, IHC, Microscopy, Flow Cytometry, Mass Spectrometry, and Others]}, Consumables, and Software {Bioinformatics Tools, Imaging Tools, and Storage & Management Databases}), By Workflow (Sample Preparation, Instrumental Analysis, and Data Analysis), By Sample Type (FFPE and Fresh Frozen), By End-Use (Academic & Translational Research Institutes and Pharmaceutical & Biotechnology Companies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The spatial OMICS market is the marketplace for technologies and solutions that evaluate biological molecules like DNA, RNA, and proteins in their spatial context in tissue or cells. It integrates genomics, transcriptomics, proteomics, and spatial information such that researchers can study cellular interactions, disease mechanisms, and biomarker discovery with excellent accuracy. This market encompasses instruments, reagents, software, and services applied in spatial transcriptomics, spatial proteomics, and other associated research applications, propelling drug discovery, personalized medicine, and pathology. Furthermore, the worldwide spatial omics market is propelled by the development of imaging and sequencing technologies, increasing demand for personalized medicine, and expanding uses in cancer research. Increased investments in genomics, growing biotechnology and pharmaceutical industries, and government support for omics research also drive growth. The demand for high-resolution cellular mapping and biomarker discovery drives market growth. However, the high costs of instruments and consumables, complex data analysis, lack of standardized protocols, limited skilled professionals, regulatory challenges, and slow adoption in developing regions are key restraints for the growth of the market.

The spatial transcriptomics segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the technology, the global spatial OMICS market is divided into spatial transcriptomics, spatial genomics, and spatial proteomics. Among these, the spatial transcriptomics segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its ability to provide high-resolution gene expression insights while preserving spatial context. Growing demand for single-cell analysis, advancements in sequencing technologies, and rising applications in disease research and drug discovery drive growth. Increasing adoption in oncology and neuroscience further supports its significant CAGR.

The consumables segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period.

On the basis of the product, the global spatial OMICS market is classified into instruments, consumables, and software. The instruments are divided into mode and type. The mode segments are divided into automated, semi-automated, and manual. The type segment is divided into sequencing platforms, IHC, microscopy, flow cytometry, mass spectrometry, and others. Among these, the consumables segment accounted for the greatest share in 2023 and is anticipated to grow at a substantial CAGR over the forecast period. The segmental growth is attributed to the high and recurring demand for reagents, assays, and kits in spatial omics research. Increasing R&D activities, advancements in sequencing technologies, and growing applications in disease mapping and biomarker discovery drive growth. Continuous innovation and expanding adoption in personalized medicine further support its substantial CAGR.

The instrumental analysis segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period.

On the basis of the workflow, the global spatial OMICS market is segmented into sample preparation, instrumental analysis, and data analysis. Among these, the instrumental analysis segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period. The segmental growth is attributed to the increasing adoption of advanced imaging and sequencing technologies for spatial omics research. Rising demand for high-resolution molecular analysis, technological advancements in microscopy and mass spectrometry, and expanding applications in oncology and neuroscience drive growth, supporting its remarkable CAGR during the forecast period.

The FFPE segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period.

On the basis of the sample type, the global spatial OMICS market is classified into FFPE and fresh frozen. Among these, the FFPE segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR throughout the forecast period. The segmental growth is attributed to its widespread use in preserving tissue samples for long-term molecular analysis. Increasing demand for retrospective studies, biomarker discovery, and cancer research drives growth. Advancements in spatial omics technologies and expanding applications in translational research further support its remarkable CAGR during the forecast period.

The academic & translational research institutes segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR over the forecast period.

On the basis of the end-user, the global spatial OMICS market is divided into academic & translational research institutes and pharmaceutical & biotechnology companies. Among these, the academic & translational research institutes segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR over the forecast period. The segmental growth is attributed to increasing investments in spatial omics research, rising collaborations with biotech firms, and a growing focus on disease mechanisms. Advancements in molecular profiling, expanding genomics programs, and the need for biomarker discovery drive growth, supporting its significant CAGR during the forecast period.

North America is projected to hold the largest share of the global spatial OMICS market over the forecast period.

North America is projected to hold the largest share of the global spatial OMICS market over the forecast period. The regional growth is attributed to advanced research infrastructure, high R&D investments, and the strong presence of key market players. Increasing adoption of spatial transcriptomics, government funding for genomics research, and rising applications in oncology and neuroscience drive growth. Expanding collaborations between academia and biotech firms further support market expansion.

Asia Pacific is expected to grow at the fastest CAGR growth of the global spatial OMICS market during the forecast period. The regional growth is attributed to increasing investments in life sciences research, rising adoption of advanced omics technologies, and expanding healthcare infrastructure. Government initiatives supporting genomics, growing demand for precision medicine, and collaborations with global biotech firms drive market growth. A large patient pool further accelerates research and development activities.

Major vendors in the global spatial OMICS market are 10x Genomics, Bio-Techne, Bruker, Dovetail Genomics, S2 Genomics, Inc., Akoya Biosciences, Inc., RareCyte, Inc., Standard BioTools, Rebus Biosystems, Inc., Vizgen Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, the revolutionary fluorescence signal removal technology EpicIF, which Bruker Corporation has unveiled, greatly improves its CellScape Spatial Proteomics platform. In addition to doubling throughput and simplifying assay development, EpicIF preserves tissue integrity and avoids cross-reactivity while nearly tenfold increasing the range of compatible fluorophore-conjugated antibodies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global spatial OMICS market based on the below-mentioned segments:

Global Spatial OMICS Market, By Technology

- Spatial Transcriptomics

- Spatial Genomics

- Spatial Proteomics

Global Spatial OMICS Market, By Product

- Instruments

- By Mode

- Automated

- Semi-automated

- Manual

- By Type

- Sequencing Platforms

- IHC

- Microscopy

- Flow Cytometry

- Mass Spectrometry

- Others

- Consumables

- Software

- Bioinformatics Tools

- Imaging Tools

- Storage & Management Databases

Global Spatial OMICS Market, By Workflow

- Sample Preparation

- Instrumental Analysis

- Data Analysis

Global Spatial OMICS Market, By Sample Type

Global Spatial OMICS Market, By End-Use

- Academic & Translational Research Institutes

- Pharmaceutical & Biotechnology Companies

Global Spatial OMICS Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa