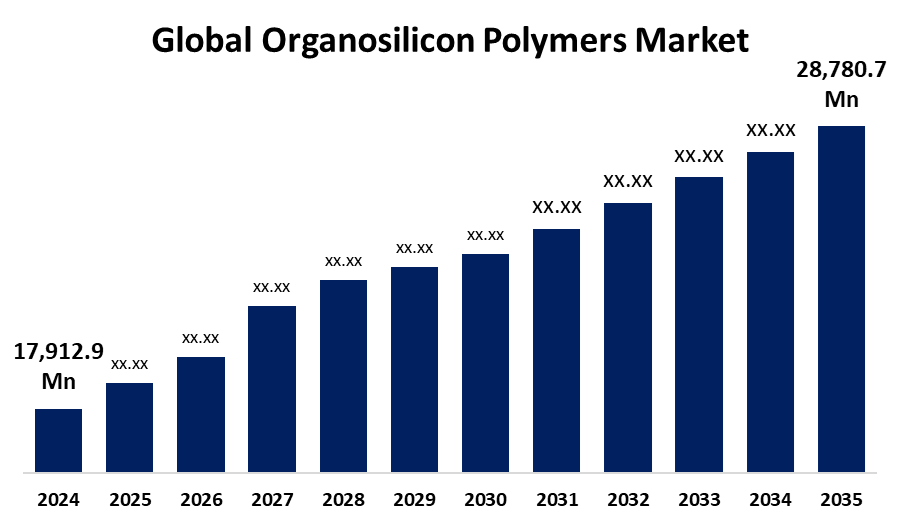

Global Organosilicon Polymers Market Insights Forecasts To 2035

- The Global Organosilicon Polymers Market Size Was Estimated at USD 17,912.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.41% from 2025 to 2035

- The Worldwide Organosilicon Polymers Market Size is Expected to Reach USD 28,780.7 Million by 2035

- North America is Expected to Grow significantly during the forecast period.

Organosilicon Polymers Market

The global organosilicon polymers market is a key sector in the chemicals industry, encompassing a wide range of products that combine silicon with organic groups. These polymers are highly valued for their exceptional properties, including heat resistance, flexibility, electrical insulation, and durability in harsh environments. They find applications across various industries such as automotive, construction, electronics, and healthcare. Organosilicon polymers are commonly used in the production of sealants, adhesives, coatings, and elastomers, owing to their ability to perform in extreme conditions. The versatility of these materials makes them essential for modern manufacturing processes, where longevity and performance are crucial. As industries continue to seek reliable and high-performance materials, the demand for organosilicon polymers is expected to grow. Additionally, ongoing advancements in polymer technology are expanding the range of applications, further solidifying their importance in sectors that require innovative and durable material solutions.

Attractive Opportunities in the Organosilicon Polymers Market

- Organosilicon polymers offer significant potential in biomedical devices due to their biocompatibility and flexibility, especially in applications like responsive drug delivery systems and bioelectronic implants.

- As sustainability becomes a top priority, there is a growing demand for eco-friendly organosilicon products. Advances in silicone recycling technologies and closed-loop manufacturing systems provide long-term environmental and cost benefits.

- The rise of electric vehicles and renewable energy projects creates a strong demand for thermal management, encapsulation materials, and high-performance silicones in areas like EV batteries and solar panel technology.

Global Organosilicon Polymers Market Dynamics

DRIVER: Rising demand for high-performance materials across industries

Rising demand for high-performance materials across industries such as automotive, aerospace, electronics, and healthcare is a major growth driver, as organosilicon polymers offer exceptional thermal stability, flexibility, and weather resistance. Technological advancements and increased R&D investments are enabling the development of innovative products like self-healing silicones, thermally conductive elastomers, and bio-based alternatives, further expanding their application scope. The growing renewable energy and electronics sectors, particularly in solar and 5G infrastructure, are boosting the need for advanced encapsulants and thermal interface materials. Additionally, environmental regulations and a shift toward sustainable and low-VOC materials are prompting manufacturers to adopt eco-friendly organosilicon formulations. Rapid industrialization and infrastructure development, especially in emerging economies across Asia-Pacific, are also contributing to increased consumption of silicone-based sealants, coatings, and lubricants.

RESTRAINT: Limited availability of raw materials and dependence on specific suppliers

One major challenge is the high production cost of organosilicon polymers, driven by complex synthesis processes and expensive raw materials like silicon and specialty catalysts. These costs can limit affordability and adoption, especially in price-sensitive industries or emerging markets. Additionally, limited availability of raw materials and dependence on specific suppliers, particularly in Asia, can disrupt supply chains and affect production stability. Stringent environmental regulations related to the use and disposal of silicones, particularly in Europe and North America, also pose hurdles, requiring manufacturers to invest in costly compliance and reformulation efforts. Moreover, competition from alternative materials, such as thermoplastics and conventional polymers that offer similar performance at lower costs, may further restrict market penetration. Lastly, low awareness and adoption of advanced organosilicon technologies in certain regions can slow market expansion, especially in developing countries with limited technological infrastructure.

OPPORTUNITY: Growing integration of silicones in next-generation biomedical devices

Beyond traditional growth drivers, the organosilicon polymers market is poised to capitalize on several untapped and emerging opportunities. One such potential lies in the growing integration of silicones in next-generation biomedical devices, including responsive drug delivery systems and bioelectronic implants, where their flexibility and biocompatibility offer clear advantages. Another unique opportunity is the surge in demand for soft robotics and stretchable electronics, which rely on organosilicon materials for durability and adaptability in dynamic environments. Furthermore, as sustainability becomes a strategic priority, advancements in silicone recycling technologies and the development of closed-loop manufacturing systems are gaining attention, offering long-term cost and environmental benefits. The expansion of space exploration and satellite technologies also opens doors for high-performance silicones used in thermal and radiation-resistant components. Lastly, government-backed localization initiatives in specialty chemical production, particularly in emerging economies, are creating new market entry points for organosilicon manufacturers seeking regional diversification and reduced import dependency.

CHALLENGES: Difficulty in achieving consistent product performance across diverse applications

A key issue is the difficulty in achieving consistent product performance across diverse application environments, such as extreme temperatures, high-pressure systems, or chemically aggressive settings, which demand highly tailored formulations. Moreover, the fragmented supply chain for specialized additives and crosslinking agents can disrupt production continuity and affect final product reliability. The absence of globally harmonized certification standards for organosilicon-based materials further complicates international trade and regulatory approval, particularly in the medical, aerospace, and food packaging sectors. Another emerging challenge is the integration of organosilicon materials with rapidly evolving technologies, such as nano-electronics or hybrid composites, where compatibility and long-term stability remain uncertain. Additionally, limited academic-industry collaboration in developing application-specific innovations slows the commercialization of cutting-edge solutions. These nuanced challenges collectively hinder the pace at which organosilicon polymers can achieve deeper penetration in advanced and high-value markets.

Global Organosilicon Polymers Market Ecosystem Analysis

The global organosilicon polymers market ecosystem includes raw material suppliers, manufacturers, distributors, end-use industries, and regulatory bodies. Key manufacturers and sellers include major players like Dow Inc., Wacker Chemie AG, Shin-Etsu Chemical, Momentive, Evonik Industries, Elkem Silicones, and regional companies such as Elkay Chemicals and Supreme Silicones. These companies produce a wide range of silicone products used in industries like automotive, construction, electronics, healthcare, and energy. Distributors and logistics providers ensure smooth global supply, while R&D centers and technology partners focus on innovation. Asia-Pacific is a major production and consumption hub, supported by growing industrialization and government initiatives.

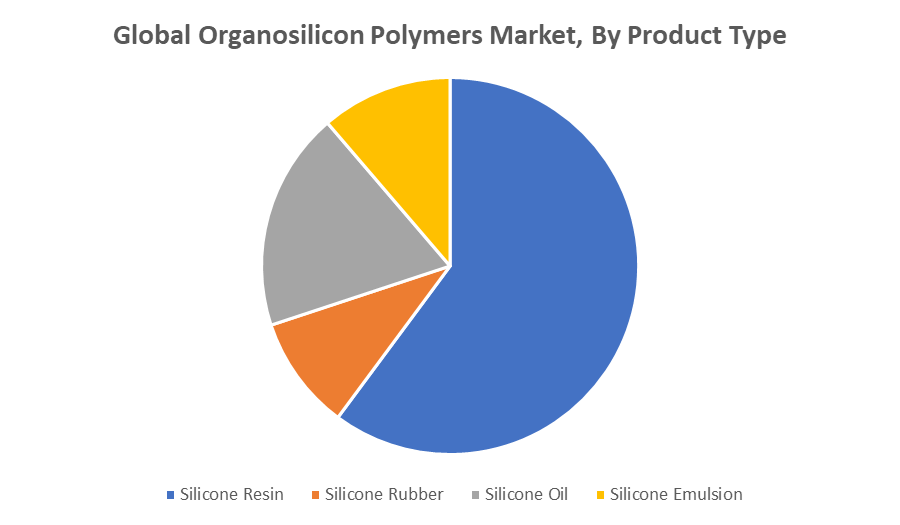

Based on the product type, the silicone resin dominated the organosilicon polymers market and is expected to grow at a remarkable CAGR over the forecast period

Silicone resins are widely used in applications like protective coatings, electrical insulation, and construction materials. Their ability to withstand harsh environmental conditions makes them suitable for both industrial and consumer uses. As demand for long-lasting and high-performance materials continues to rise, especially in construction and electronics, the market for silicone resins is expected to see steady growth.

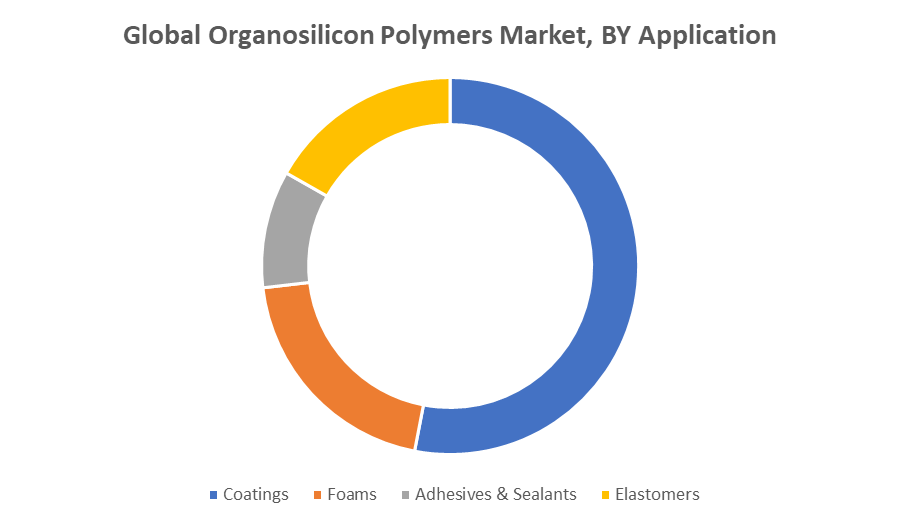

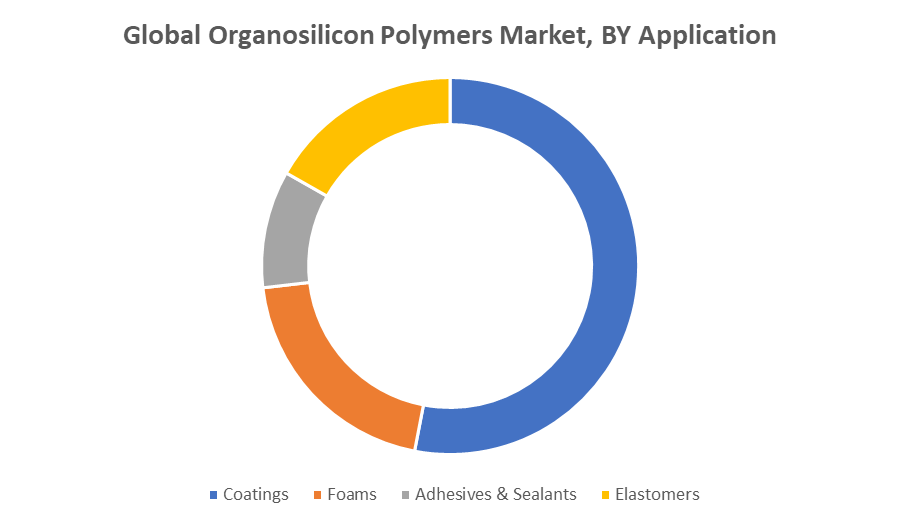

Based on the application, the coatings dominated the organosilicon polymers market and is expected to grow at a significant CAGR over the forecast period

The segment dominance is attributed to the superior properties of organosilicon-based coatings, such as high thermal stability, water resistance, UV protection, and chemical durability. These coatings are widely used in industries like automotive, construction, electronics, and aerospace to protect surfaces and enhance performance under harsh conditions. As demand for long-lasting, weather-resistant coatings increases across various sectors, the use of organosilicon polymers in coating applications is set to expand steadily in the coming years.

Asia Pacific is anticipated to hold the largest share of the organosilicon polymers market during the forecast period

Asia Pacific is anticipated to hold the largest share of the organosilicon polymers market during the forecast period. This growth is driven by rapid industrialization, expanding construction and automotive sectors, and rising demand for consumer electronics in countries like China, India, Japan, and South Korea. The region also benefits from a strong manufacturing base, availability of raw materials, and supportive government initiatives promoting domestic chemical production. Additionally, increasing investments in infrastructure and renewable energy projects further contribute to the growing demand for high-performance organosilicon materials. These factors position Asia Pacific as the leading market for organosilicon polymers globally.

North America is expected to grow at a significant CAGR in the organosilicon polymers market during the forecast period

North America is expected to grow at a significant CAGR in the organosilicon polymers market during the forecast period. This growth is driven by rising demand across industries such as healthcare, electronics, automotive, and construction. The region’s strong focus on technological innovation and advanced manufacturing processes supports the adoption of high-performance silicone-based materials. Additionally, increasing investment in renewable energy and electric vehicles is boosting the use of organosilicon polymers in insulation, sealing, and thermal management applications. Favorable regulatory support and a growing emphasis on sustainable, low-VOC materials are also contributing to the market's expansion in North America.

Recent Development

- In January 2025, Evonik announced the launch of its new business line, Smart Effects, which resulted from the merger of its Silica and Silanes divisions, effective January 1, 2025. This strategic move aimed to enhance innovation and sustainability by combining the strengths of molecular silane chemistry and silica particle design. Smart Effects focused on delivering advanced solutions across industries such as green mobility, electronics, and carbon capture, emphasizing eco-friendly products with high value and performance.

- In May 2024, The EU Commission announced new restrictions on the use of D4, D5, and D6 (siloxanes) under the REACH regulation due to environmental and health concerns. These chemicals, commonly used in cosmetics, cleaning products, and industrial applications, were classified as persistent, bioaccumulative, and toxic (PBT). The restrictions aimed to limit their release into the environment, with specific concentration limits set for products. Businesses were given a transition period to comply with the new rules.

Key Market Players

KEY PLAYERS IN THE ORGANOSILICON POLYMERS MARKET INCLUDE

- Dow Inc.

- Wacker Chemie AG

- Shin-Etsu Chemical Co., Ltd.

- Momentive Performance Materials Inc.

- Evonik Industries AG

- Elkem ASA

- BASF SE

- KCC Corporation

- Hoshine Silicon Industry Co., Ltd.

- Supreme Silicones

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the organosilicon polymers market based on the below-mentioned segments:

Global Organosilicon Polymers Market, By Product Type

- Silicone Resin

- Silicone Rubber

- Silicone Oil

- Silicone Emulsion

Global Organosilicon Polymers Market, By Application

- Coatings

- Foams

- Adhesives & Sealants

- Elastomers

Global Organosilicon Polymers Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa