Logistics Robot Market Summary

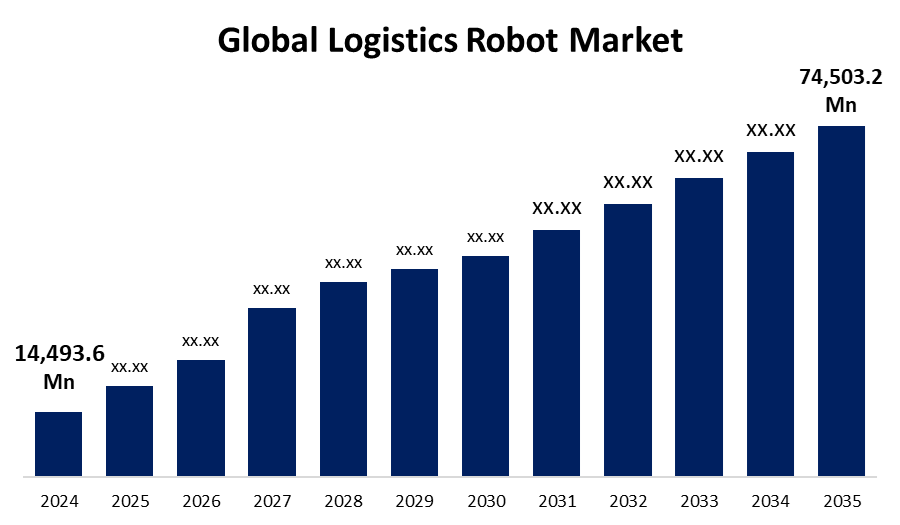

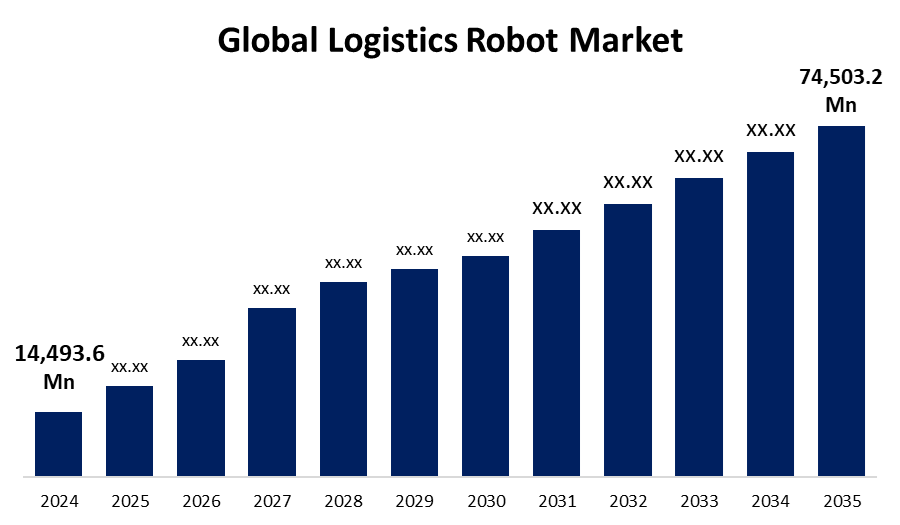

The Global Logistics Robot Market Size was Estimated at USD 14,493.6 Million in 2024 and is projected to Reach USD 74,503.2 Million by 2035, Growing at a CAGR of 16.05% from 2025 to 2035. The growing need for automation in e-commerce, growing labor costs, and developments in robotics technology are the main factors propelling the logistics robot market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific region dominated the market with the highest revenue of 35.4%.

- From 2025 to 2035, China is anticipated to have the greatest CAGR among all countries.

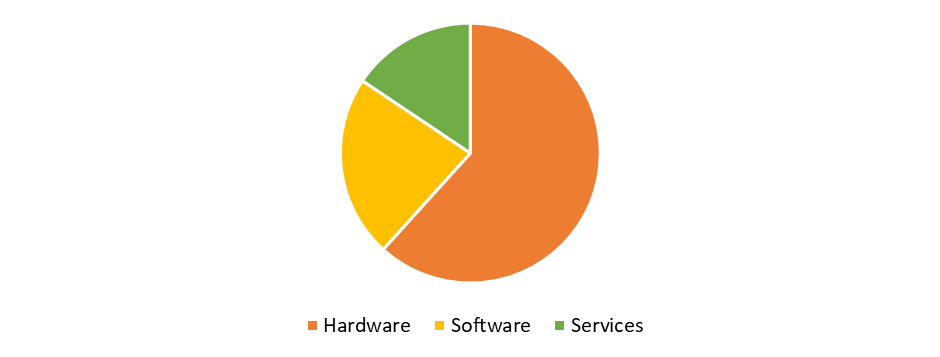

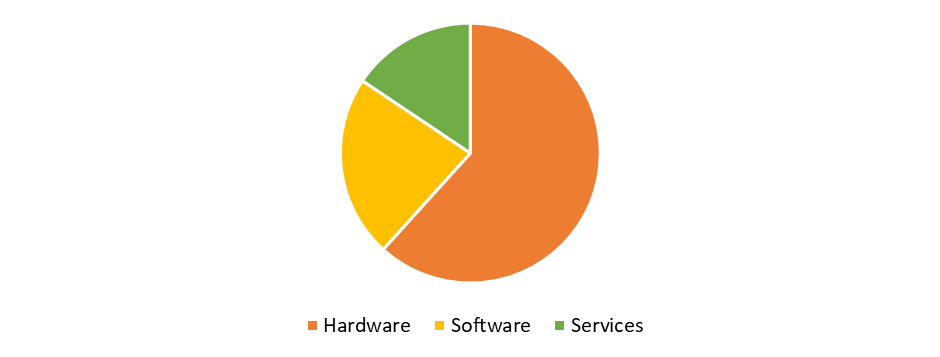

- In 2024, the hardware segment dominated the global market with the largest share of 61.4% based on component.

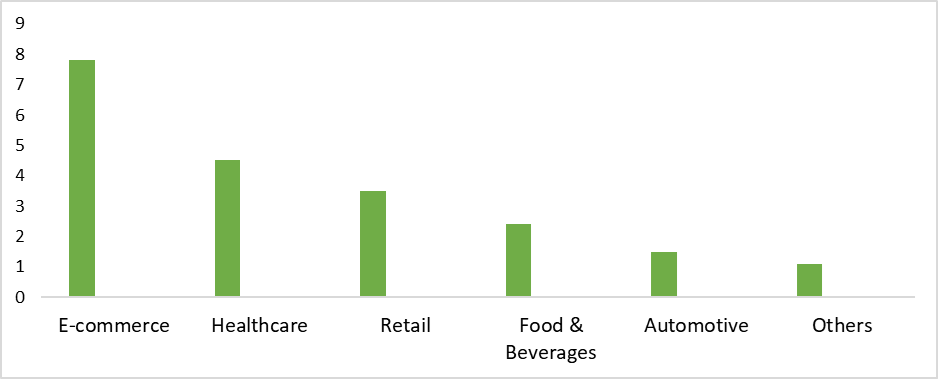

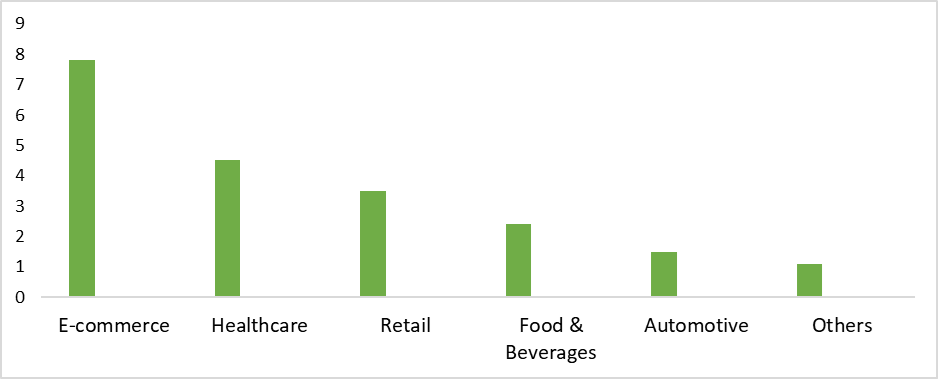

- In 2024, the E-commerce category dominated the global market with the largest share based on industry.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 14,493.6 Million

- 2035 Projected Market Size: USD 74,503.2 Million

- CAGR (2025-2035): 16.05%

- Asia Pacific: Largest market in 2024

The logistics robotics market is defined as the domain encompassing automated devices and systems designed to maximize and make efficient various operations, logistics tasks such as fulfillment, transport, and warehousing. At warehouses and distribution facilities, robots perform a range of functions, including, but not limited to, picking, sorting, packing, and transporting goods. These robots often operate autonomously or alongside people. In the end, this sector is growing rapidly, driven by increased labor costs and demand for supply chain optimization. Additionally, advances in robotics technology, including better sensors and cooperative, or multi-agent, capabilities, have positively impacted the market. Recent significant advancements in computer vision, machine learning, and artificial intelligence have propelled the capabilities of logistics robots. AI-powered robots can now navigate in complex layouts without the need for human intervention, avoiding obstacles, and optimizing the tasks of picking and placing.

Large companies are investing in research and development (R&D) initiatives to create robotics technology, such as hardware, software, sensors, and artificial intelligence (AI) algorithms. More companies, especially those trying to reinvent their businesses, are considering the logistics robots sector. The need for flexible and adaptive robotics platforms that can perform a range of tasks and operate in will become increasingly necessary as supply chains grow worldwide and functions of logistics networks become more complex. Along with the push to promote automation through government programs, funding incentives, and regulation enhancements will be critical in developing the widespread adoption of robotics technology in the logistics sector to promote additional efficiency and safety. The logistics robots market has a bright future with a growing demand of increased safety and reliability. Furthermore, the increasing demand for green logistic methods should also help spur market growth.

Component Insights

In 2024, hardware captured a global sales share of 61.4%, and is in overall control of the robot logistics market, with the rapid adoption of AMRs and AGVs in warehouse and fulfillment centers impacting the hardware category's dominance. These robots help streamline logistics operations by reducing manual labor, improving accuracy, and increasing operational efficiency. Essentially, the hardware components refer to the actual tools and machinery needed to operate logistics robots. Actuators, consisting of motors and pneumatic systems, allow the robot to move, perform tasks, and do work such as pushing, lifting, and grasping. As well as advancements in the hardware and sensors, which encompass actuator technology and edge computing, are other contributors perpetuating the hardware category's dominance. Modern logistics robots have advanced sensors, but not limited to LiDAR sensors, ultrasonic sensors, and 3D vision systems, allowing them to accurately assess the environment around them and identify obstacles, including doors and other items, in any order.

Services will be the fastest-growing sector throughout the forecast period. The increase can be attributed to the rise of robot deployment, maintenance, training, integration, and support services. Logistics automation will continue to expand and become more popular; as it becomes more mainstream, it will require specialized knowledge to help companies successfully adopt and manage robotic systems. One of the biggest drivers of this market's growth is the rapid adoption of the Robotics-as-a-Service (RaaS) model. Many companies, especially small and medium-sized enterprises (SMEs), prefer to subscribe to robotic systems rather than invest in large capital expenditures. Additionally, the need for seamless integration into existing supply chain infrastructures and the ever-increasing complexity of robotic technology have contributed to exceptional growth in service-based offerings.

Industry Insights

The e-commerce market dominated the market in 2024. The rapid growth of shopping online and the subsequent need for reliable and fast order fulfillment is the principal factors driving a marketplace's dominance. E-commerce companies have adopted innovative logistics technologies to meet their customers' demands for faster delivery and increasing order quantities. To capitalise on addressed challenges, many organisations have invested heavily in robotics solutions, including advanced robotic arms, Automated Guided Vehicles (AGV) and Autonomous Mobile Robots (AMR), which optimally drive warehousing efficiencies, decrease labor hours and minimize processing time.

Throughout the projection period, the healthcare sector is expected to grow significantly. Hospitals and healthcare institutions are increasingly relying on automation to improve logistics, transportation of pharmaceuticals, lab samples, food, and medical waste. This transition allows for greater productivity, reduction in human error, and more time for clinicians to manage patient care. In addition, organizations are increasingly investing in automation to create leverage over the rapidly expanding costs of healthcare. Reducing manual labor while improving supply chain processes and increasing operational throughput can lead to significant savings for healthcare institutions.

Regional Insights

The Asia Pacific region had a market share of 35.4% in 2024, as it remained the market leader. These developments were due to expanding industrialization, the growth of e-commerce, and increasing investments in warehouse automation. Faced with rising labor costs, limitations on space, and consumer demand for speedy deliveries, the countries in the region accelerated the adoption of robotic technologies. China continued to lead the region due to its strong industrial base, aggressive digital transformation strategies, and government programs such as "Made in China 2025". It also had a broad network of suppliers, component manufactures, and system integrators in the region to facilitate the rapid deployment and economic expansion of the automation solution. Additionally, the increase of automobile production in the region supported the logistics robot 'market' dominance, as logistics robots supported internal material transportation, automating tasks in automobile manufacturing such as packaging, part feeding, and machine tending.

- The logistics robot sector in China is growing at a rapid pace, primarily due to the country's overall movement towards automation and intelligent manufacturing. Recent developments, such as the launch of the SA750U in 2024, an unmanned aeronautical vehicle that can carry 3.2 metric tons of cargo over 2,200 kilometers at high altitudes, have aided China's ambitions to grow its low-altitude economy at a projected value of USD 280 billion by 2030. The push for increased efficiency through the use of drones will drive future innovations in the logistics robot industry in China.

- The logistics robot market in India is also witnessing significant growth due to the growth of e-commerce, rising labor costs, favorable government intervention, and advancements in automation. Major e-commerce players in the market, such as Flipkart, Amazon, and Reliance Retail, are driving consumer demand for faster deliveries and efficient warehouse management. To meet demand, companies are turning to several technologies to automate warehouse management, such as automated mobile robots (AMRs), robotic sorting systems, and automated storage and retrieval systems (AS/RS).

North America Logistics Robot Industry Trends

In forecasted period, the North American logistics robot market will grow at a steady pace during the foreseen period. North America is where the most advanced robotics and artificial intelligence innovations are being produced. Companies like Boston Dynamics, Locus Robotics, and Fetch Robotics are now building sophisticated logistics robots that can move independently, mine real-time data, and respond to machine learning. AI, or artificial intelligence, driven robots have the potential to grow warehouse productivity by standardizing processes, minimizing errors, and enhancing inventory tracking. There is an increasing demand for agile, interoperable solutions that leverage robotics and plan for warehouse and corporate management systems. In addition, the region is stimulating businesses to utilize sophisticated logistics robots at transportation hubs and distribution centers because of favorable regulatory circumstances and a rising focus on supply chain resilience.

Europe Logistics Robot Industry Trends

Europe has a rapidly growing logistics robotics market with a strong focus on efficiency and automation. Businesses are investing in technology like autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) to improve supply chain performance, streamline warehouse processes, and manage inventories more effectively.

- One of the main driving forces behind logistics robotics in the UK is the growing e-commerce sector. Logistics companies have been at the forefront of adopting new technologies, such as delivery drones and self-driving vehicles, for final-mile delivery optimization, in response to global growth and customer demands for quick delivery.

- Germany's position as a leader in Industry and its strong industrial base are fuelling the fast growth of logistics robotics in the country. The logistics system in Germany is rapidly incorporating technologies and smart products into logistics systems that can work autonomously. The learning capabilities of robotics are being supported by AI and machine learning advances, allowing robots to forecast demand, productively organize operations, and improve decision-making in the supply chain.

Key Logistics Robot Companies:

The following are the leading companies in the logistics robot market. These companies collectively hold the largest market share and dictate industry trends.

- Swisslog Holding AG

- Kawasaki Heavy Industries, Ltd.

- Honeywell International Inc

- BEUMER Group

- GreyOrange

- SSI Schaefer

- KNAPP AG

- Dematic

- Locus Robotics

- Kion Group Ag

- Others

Recent Developments

- In February 2025, BITO Lagertechnik, a global innovator in state-of-the-art storage and order-picking systems, has formed a partnership with Locus Robotics, a worldwide leader in AI-driven warehouse automation, to provide complete, end-to-end solutions for automated order fulfillment. By integrating the advanced robotics automation technology from Locus Robotics with BITO's advanced storage solutions, this partnership provides clients in multiple industries with adaptive automation solutions with maximum flexibility and demonstrably improved productivity and efficiency

- In December 2024, Dematic, a leading provider of automated solutions in the Asia Pacific and around the globe, has announced the opening of a new office in Taiwan. This strategic growth further enhances Dematic's connection to Taiwan and the North Asian market, while demonstrating the company's commitment to delivering innovative solutions that meet regional needs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the logistics robot market based on the below-mentioned segments:

Global Logistics Robot Market, By Component

- Hardware

- Software

- Services

Global Logistics Robot Market, By Industry

- E-commerce

- Healthcare

- Retail

- Food & Beverages

- Automotive

- Others

Global Logistics Robot Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa