District Cooling Market Summary

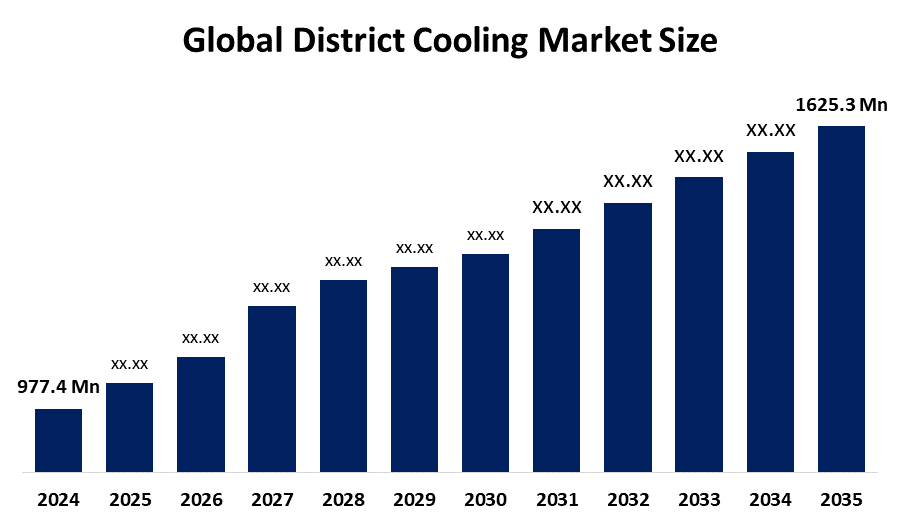

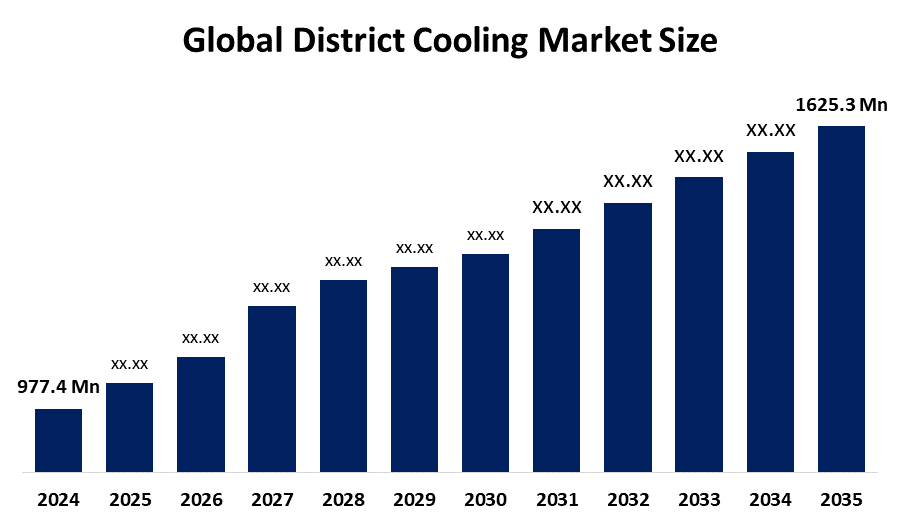

The Global District Cooling Market Size was Estimated at USD 977.4 Million in 2024, and is projected To Reach USD 1625.3 Million by 2035, Growing at a CAGR of 4.73% from 2025 to 2035. The district cooling market is expanding as a result of growing urbanization, an escalating demand for sustainable and energy-efficient cooling solutions, and the proliferation of smart city initiatives.

Key Regional and Segment-Wise Insights

- In 2024, the district cooling market in the Middle East & Africa accounted for 39.7% of the industry's revenue, making it the dominant market.

- In 2024, the UAE district cooling market led the Middle East & Africa district cooling industry, accounting for 34.7% of the revenue share.

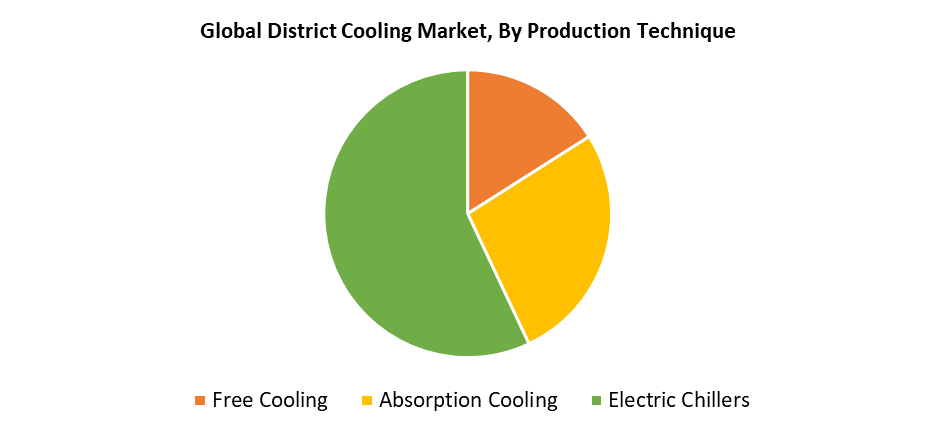

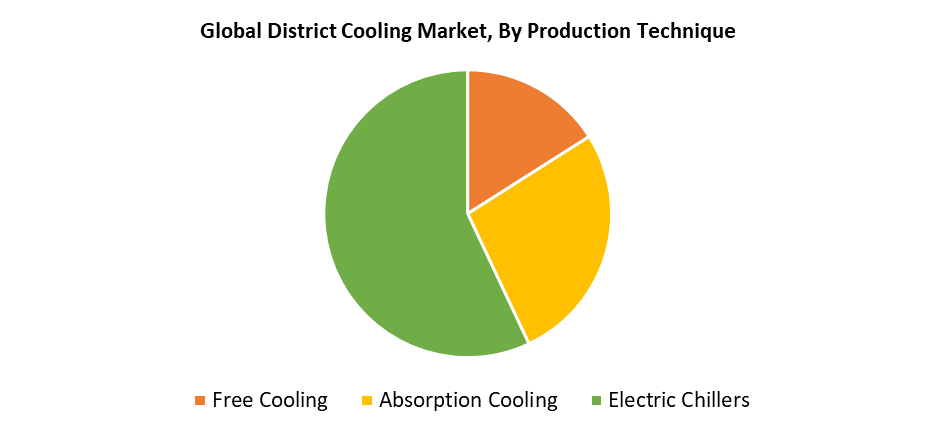

- In terms of production technique, the electric chillers segment represented the largest revenue share at 57.3% in 2024.

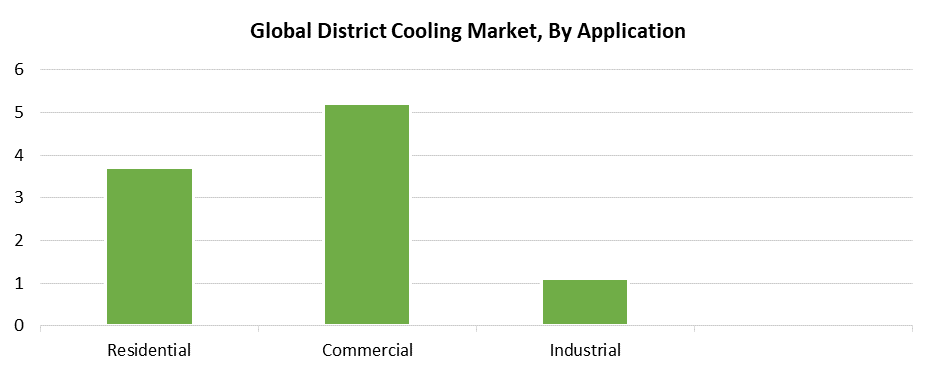

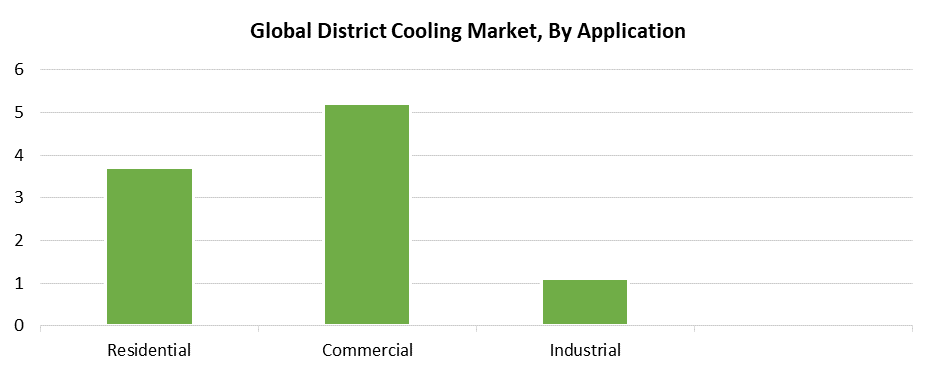

- The commercial segment represented the largest revenue share of 52.4% by application in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 977.4 Million

- 2035 Projected Market Size: USD 1625.3 Million

- CAGR (2025-2035): 4.73%

- Middle East & Africa: Largest market in 2024

The district cooling sector involves the centralized delivery and production of chilled water to multiple buildings or facilities within a designated area, such as a city, industrial park, or large-scale building development. Because of heavy urbanization and the requirement of cooling to be more energy efficient, district cooling systems are becoming more desirable. District cooling systems are significantly more sustainable than conventional air conditioning systems due to their minimal energy consumption and operational expenditures. In addition, there is consistent demand because of mega infrastructure projects, including airports, shopping centers, business developments, and others, especially in high-temperature locations like the Middle East. Policies and legislation for decreased carbon footprint in construction or energy consumption are also impacting the adoption of these cooling methods, including when they are used in new builds or retrofit developments.

The District Cooling (DC) Guidelines have been developed as part of the Energy Efficient Cooling (EE Cool) initiative that has been established by GIZ GmbH, on behalf of the German Federal Ministry for Economic Affairs and Climate Action (BMWK), and India's Bureau of Energy Efficiency (BEE). However, the upfront costs and complexity of establishing district cooling systems complicate implementation. Moreover, the necessity for infrastructure to distribute cooling energy can hinder the development of district cooling in certain regions. Although there are these challenges, there is a considerable amount of growth potential given the global focus on smart cities and sustainable development, and incorporating renewable energy sources such as solar and geothermal energy into district cooling systems provides real opportunities for both innovation and market expansion.

Production Technique Insights

In 2024, electric chillers represented the highest revenue share at 57.3%. Electric chillers are fundamental for the district cooling system; they provide a reliable and efficient method to produce chilled water. The systems produce chilled water through the use of electricity to drive the cooling operation, which enables the use of these systems in areas that have electric power available that is reliable and low-cost. Electric chillers are also considered flexible in the approach to mode operations that can be used for either small or large projects. Additionally, advancements in compressor technology and heat exchange material designs to developed a district cooling system explicitly for branded/approved usage, which has improved efficiency and decreased operating costs and even less environmental impact, contributing to the growth of the market.

The absorption cooling industry is estimated to grow at a CAGR of 2.7% from 2025 to 2035. The absorption cooling market is growing based on the increasing focus on energy efficiency and incorporating waste heat and renewable energy. Absorption cooling relies on using heat energy instead of electricity for cooling, making it an environmentally friendly and cost-effective option. Additionally, a chiller can use a heat source to rotate through the refrigeration cycle; they are becoming a popular choice in areas where options for waste heat sources are plentiful or electricity prices are too high to justify pulling energy from the grid. Overall, the ability of the technology to utilize alternate and waste heat sources lowers operational costs and carbon emissions, consistent with global sustainability targets.

Application Insights

In 2024, the commercial sector had the largest share of revenue at 52.4% attributed to the accelerating adoption of district cooling systems within office buildings, retail spaces, hotels and hospitality, and mixed-use facilities, all require efficient and economical cooling solutions. District cooling is a cost and energy-efficient solution for commercial buildings, because they have high, predictable cooling loads. By providing a centralized cooling service, district cooling systems can remove the need for independent air conditioning systems, leading to reduced maintenance costs and improved space efficiency. Furthermore, the combination of reliable, efficient, and cost-effective cooling options contributes to the comfort and productivity of commercial spaces and has led to the rapid uptake of district cooling. Commercial projects are increasingly adopting district cooling to achieve energy savings and operational efficiency, as the demand for increased urbanization and sustainability targets accelerates.

In the forecasted period, the residential segment is expected to grow with the highest CAGR of 3.7% due to the increasing acceptance of district cooling systems in multi-family housing and residential complexes. The use of district cooling in residential complexes is growing due to a better appreciation for its environmental benefits and the worldwide assault on energy consumption. The growth of the residential segment is also being driven by urbanization and the necessity of effective cooling in congested areas.

Regional Insights

In 2024, the Middle East and Africa accounted for the largest market share of 39.7% of total industry revenue in the district cooling market. This significant market share can be attributed to the extreme climate, as well as the large demand for cooling in nations like Saudi Arabia, the UAE, and Qatar. The UAE has widespread large-scale district cooling projects and leads the world in adoption and defines the regional market. The necessity of identifying sustainable and energy-efficient cooling options for residential and commercial properties adds to the demand for district cooling. Local governments are pursuing policies and incentives to support the growth of district cooling in their nations. Finally, as sustainable and smart city initiatives develop in the region, both are more frequently and successfully adopting district cooling projects.

UAE District Cooling Market Trends

The UAE district cooling market accounted for 34.7% of the revenue share in the Middle East & Africa district cooling sector in 2024. District cooling systems are being implemented by many businesses in the UAE due to the cost-effective and long-term effective services they provide. District cooling systems use 50% less energy than water-cooled or air-cooled air conditioners, and a decrease in upfront cost and regular maintenance is a significant component of price reductions. District cooling systems are a more environmentally friendly and sustainable way of providing cooling for buildings than independent air conditioning systems. Urbanization of population settlements in the UAE and the awareness of conservation and global issues are altering people's choices towards energy-efficient refrigeration technologies, and the demand for district cooling is increasing accordingly. Large-scale applications, including airports, business buildings, university campuses, and residential towers, present large savings and efficiency benefits with the use of a district cooling system.

North America District Cooling Market Trends

The North America district cooling market is projected to experience significant growth in the forecast time frame due to sustainability improvement, increased urban development, and energy-efficient infrastructure. Government developments for clean energy and carbon reduction continue to drive the implementation of district cooling systems in commercial or industrial spaces. If progress is made with smart cooling systems and connecting with renewable energy generation, then continued growth is predicted in the market. There is investment in smart city projects in the US, alongside the fact that urban centers are increasingly adopting sustainable cooling solutions. The area also benefits from sophisticated research and development resources available in North America, not to mention the key suppliers of district cooling systems available in the area. Those suppliers will also continue to drive innovation and growth in the North America district cooling market.

Asia Pacific District Cooling Market Trends

It is expected that the district cooling market in the Asia Pacific region will register a CAGR of 4.8% during the forecast period. The unprecedented urbanization rate in the region, along with increased investments aimed toward smart cities and the growing demand for energy-efficient cooling in both commercial and residential segments, is driving the growth of the region. China, India, and Singapore have already started taking necessary action to implement district cooling systems for sustainability and decreased electricity consumption. In response to climate change and decreased GHG emissions, regional governments are looking for opportunities to develop energy-efficient buildings, which could entail district cooling systems. Moreover, improvement in renewable energy generation also increases the usage of district cooling systems, making them an integral part of sustainable urban development in the region.

Key District Cooling Companies:

The following are the leading companies in the district cooling market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia

- Emirates Central Cooling Systems Corporation PJSC

- Danfoss

- ADC Energy Systems

- DAIKIN INDUSTRIES, Ltd.

- Emicool

- Stellar Energy International

- Tabreed

- AtkinsRéalis

- Keppel Ltd

- SHINRYO CORPORATION

- ALFA LAVAL

- Qatar District Cooling Company Private J.S.C

- ENGIE

- Others

Recent Developments

- In January 2025, Emicool, an established district cooling service provider and a joint venture between Dubai Investments and Actis, has unveiled a partnership with Quant Gulf, a leading provider of smart maintenance solutions, to enhance its operations using the Schaeffler OPTIME Ecosystem. Specifically, the purpose of the technology is to enhance Emicool's operational performance, environmental performance, and reliability. This novel technology is truly a leap in the company's digital transformation.

- In October 2024, Tata Power Trading Company Limited has partnered with Singapore's Keppel to deliver sustainable Cooling-as-a-Service (CaaS) solutions in India. The objective of this collaboration is to offer building owners and businesses energy-efficient cooling systems that can help them cut energy consumption by up to 40% and carbon emissions by 50% in line with India's Cooling Action Plan and Smart Cities Mission.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the district cooling market based on the below-mentioned segments:

Global District Cooling Market, By Production Technique

- Free Cooling

- Absorption Cooling

- Electric Chillers

Global District Cooling Market, By Application

- Residential

- Commercial

- Industrial

Global District Cooling Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa