Contract Logistics Market Summary

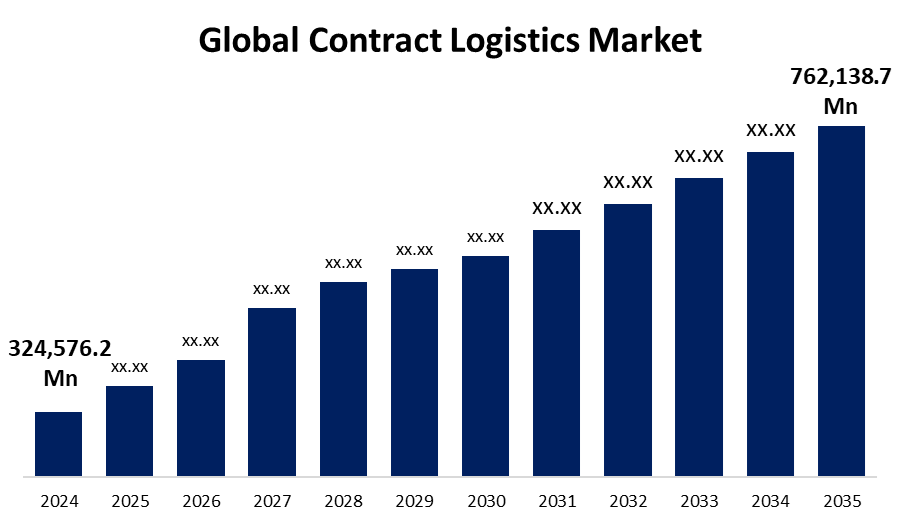

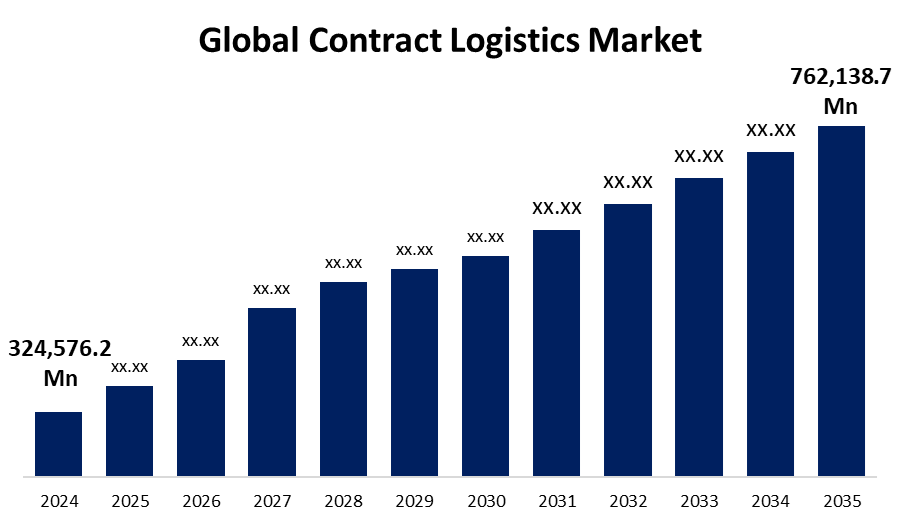

The Global Contract Logistics Market Size was Estimated at USD 324,576.2 Million in 2024 and is projected to Reach USD 762,138.7 Million by 2035, Growing at a CAGR of 8.07% from 2025 to 2035. The main factors propelling the contract logistics market are the emergence of automation and digital technology, the growth of e-commerce, and more outsourcing by businesses. This industry has grown as a result of e-commerce's requirement for effective supply chains and specialized logistical solutions.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific region dominated the market with the highest revenue of 33.4%.

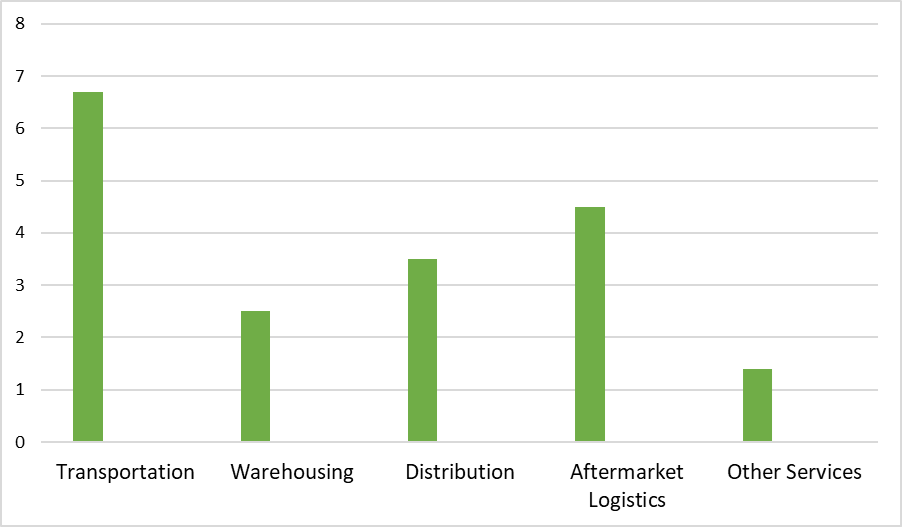

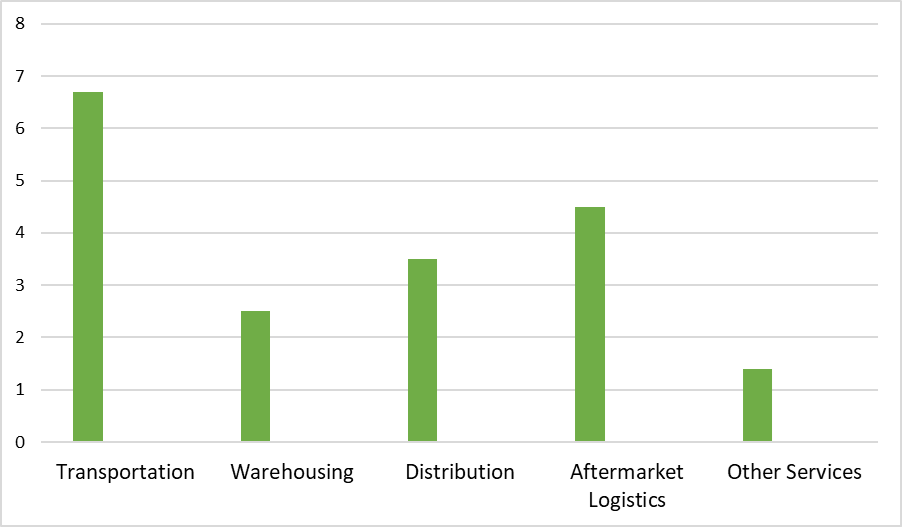

- In 2024, the transportation segment dominated the global market with the largest share of 34.4% based on service.

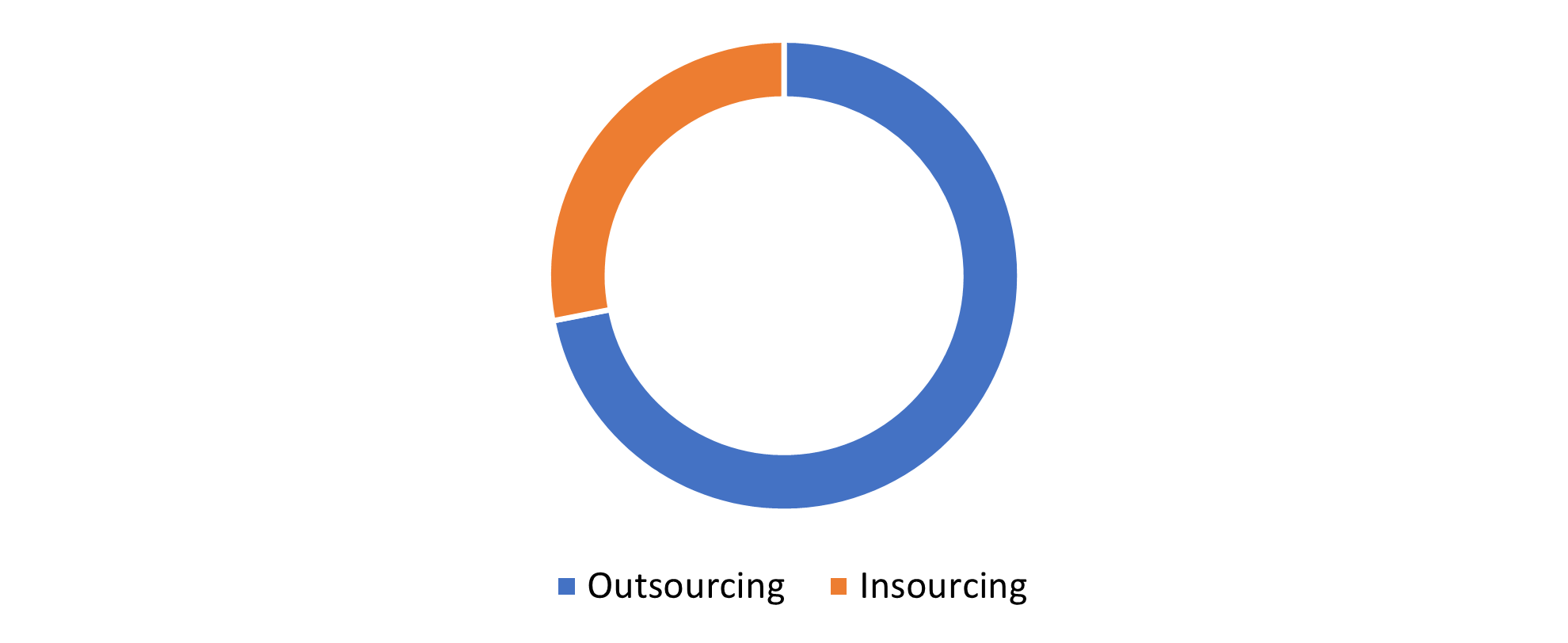

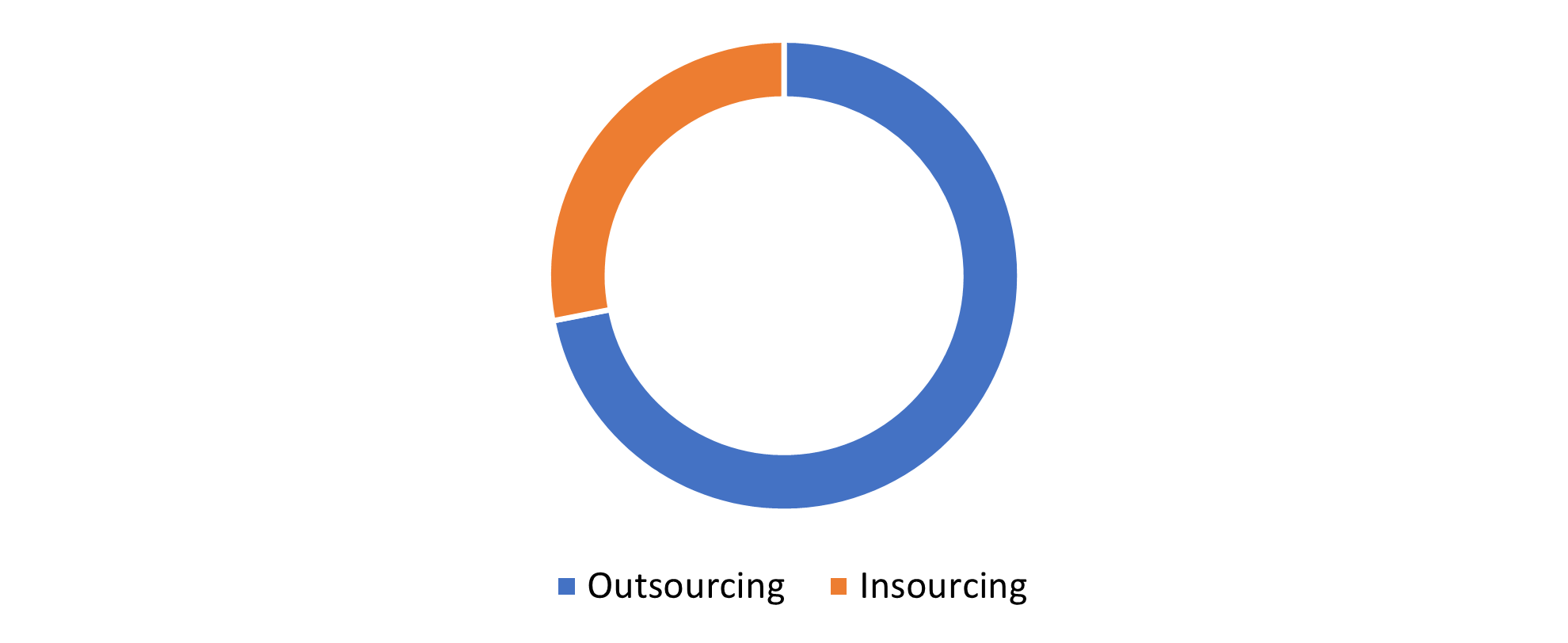

- In 2024, the outsourcing segment dominated the global market with the largest share based on type.

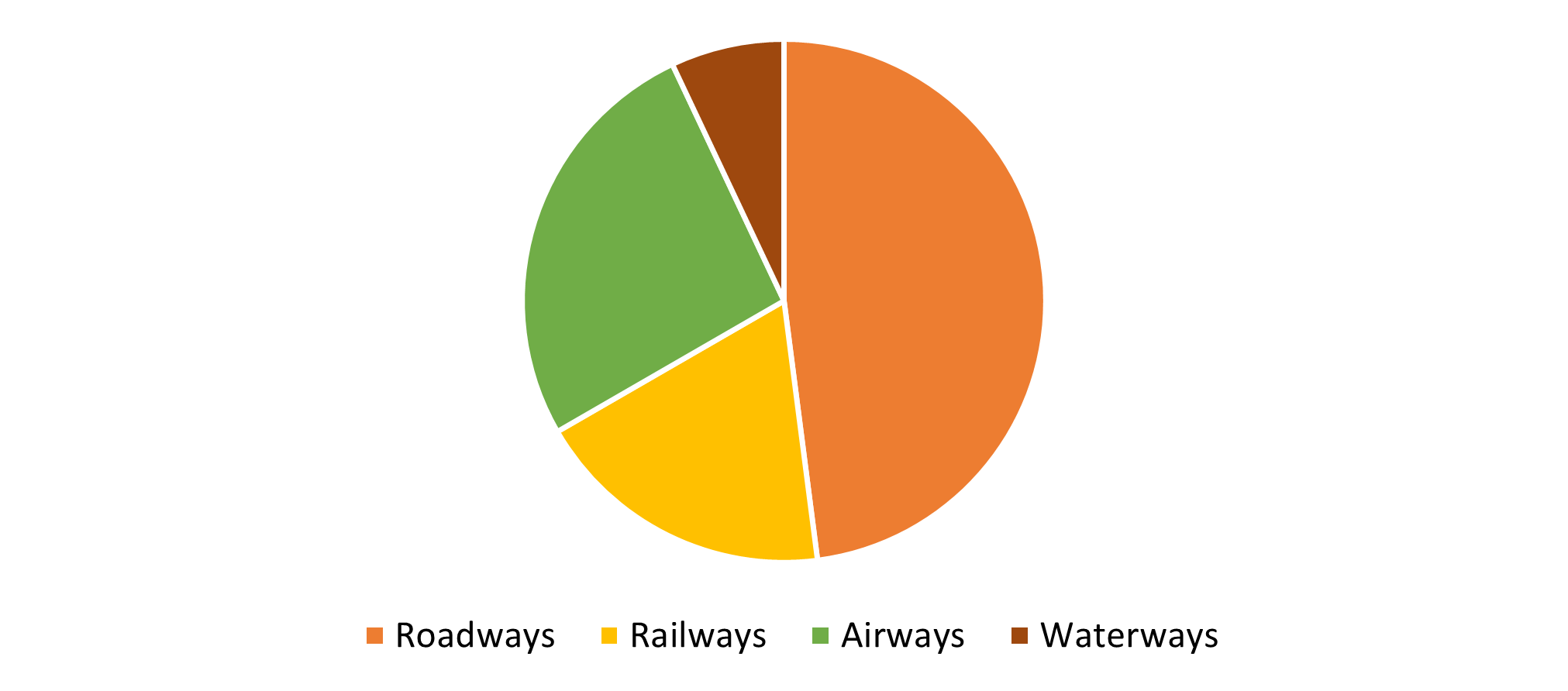

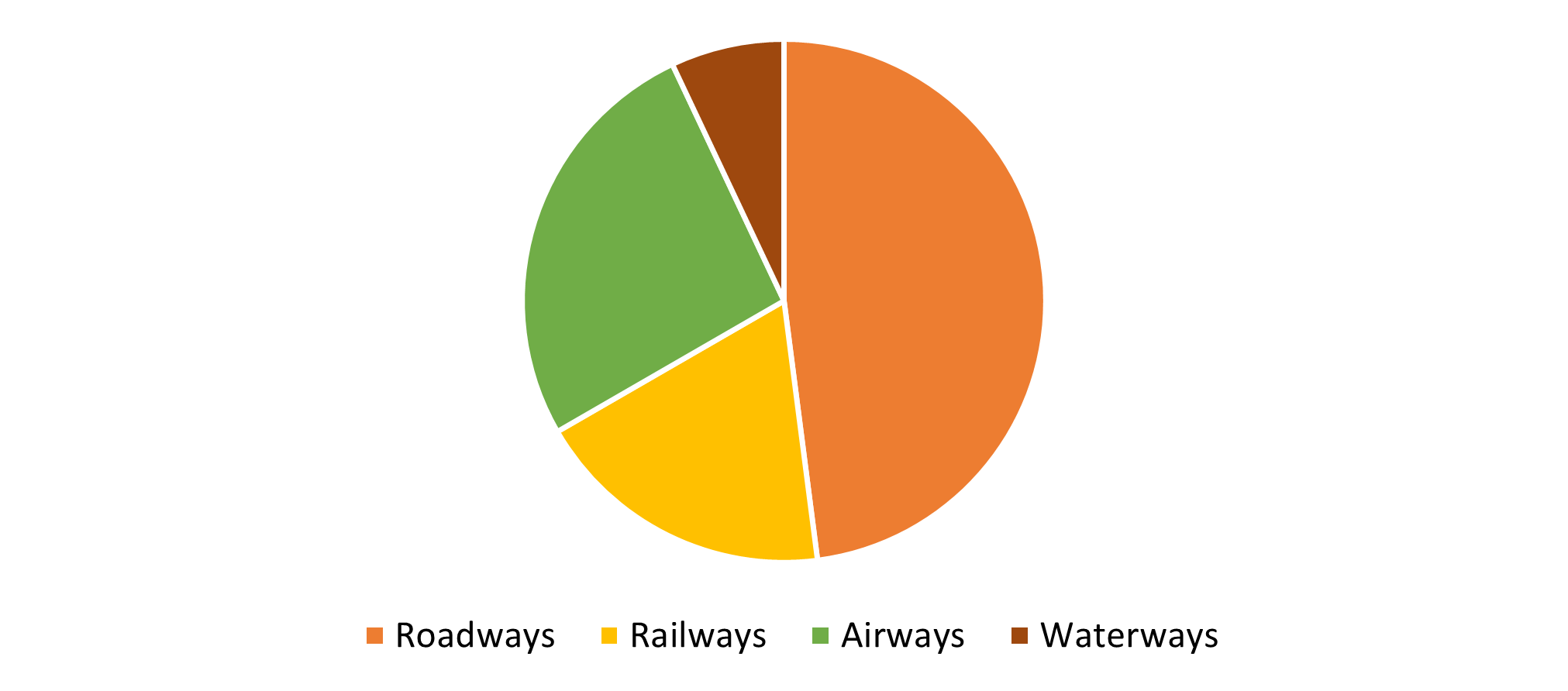

- In 2024, the roadways category dominated the global market with the largest share based on transportation mode.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 324,576.2 Million

- 2035 Projected Market Size: USD 762,138.7 Million

- CAGR (2025-2035): 8.07%

- Asia Pacific: Largest market in 2024

The phrase "contract logistics" describes the contracting out of a business's distribution, transportation, and warehousing operations to a third-party logistics provider (3PL) for an extended period of time. By using this strategy, a business may bolster its supply chain, leverage the resources and experience of the 3PL provider, and redirect its focus to its core competencies. Infrastructure development, digitalization, and industrialization can be attributed to an increase in government efforts to diversify economies. They are going to help make e-commerce and contract logistics increasingly popular, and will create an enormous demand for contract logistics. Increasing amounts of FDIs, rapid growth of the e-commerce sector, and supply chains that are focused on risk management are defining features that are attracting established businesses to compete with various non-asset providers.

The requirement for contract logistics is propelled by the globalised supply chain. Third-party suppliers are increasingly important for businesses sourcing and distributing internationally and managing complex multi-national functions. Ultimately a reliance on alternative logistics solutions facilitates the establishment of optimally integrated logistics solutions that enhance global trade resilience, mitigate compliance risk, and increase efficiency. Technology also helps businesses reduce costs, improve supply chain efficiency, and quickly adapt to changes in regulatory and geopolitical environments. Growth in the market is supported by the rapid growth in the manufacturing sector, focus on core competencies, increasing need for optimisation of workflows, efficiencies, and technological integration of supply chains. The logistics industry saw a significant and unprecedented transformation as a result of the COVID-19 pandemic. The contract logistics market was significantly impacted by company closures, supply chain interruptions, manpower and raw material shortages, and a stop in transportation operations. Nonetheless, as the e-commerce industry grew, so did the market.

Service Insights

In 2024, the transportation sector opened up with the largest percentage share of 34.4%. The growth of the segment is fueled by many factors, including the growing demand for fast, last-mile deliveries, the emergence of same-day delivery services, and expansions in the e-commerce networks in urban and rural environments. As they play an essential role in supply chain management and ensure smooth, time- and cost-effective, and flexible movement of products, transportation services are ubiquitous. Transportation is essential to global trade, and it provides the solutions to satisfy the increasing demand and complex operational requirements. Transportation services are the primary source of innovation in the global contract logistics market. The new and disruptive technologies, such as real-time tracking, IoT, and artificial intelligence, are used to create a better return on investment while improving efficiencies, all the while reducing costs. The expansion of smart routes and automated fleet management capabilities provide enhanced delivery accuracy.

The aftermarket logistics segment is expected to grow fastest in the forecast period as a result of developing trends related to reverse logistics, repair, and return services, and an increase in servicing goods and customer experience in industries such as automotive, electronics, and appliances. The aftermarket service segment pertains to logistics management after a product has been sold. It encompasses all the activities associated with aftermarket service, including spare parts distribution, warranty management, and repair services. The aftermarket service segment is crucial for various industries (automotive, appliances, and electronics) where customer satisfaction and product lifecycle management are essential. Also, aftermarket logistics are essential to ensuring customer satisfaction and brand loyalty. By managing these activities well after the sale of goods, companies can decrease downtime for customers, improve customer experience, and decrease resource utilization.

Type Insights

The outsourcing industry was the largest segment in 2024. Several forces are driving this trend which including the increasing demand for cost savings, better access to specialized logistics infrastructure, and an increasing reliance on third-party logistics companies for international operations. The main goal of third-party logistics or 3PL service providers is to achieve improvements in operational performance and cost-efficiencies while allowing firms to focus more on their core competencies. The scale advantages, professional and specialized expertise, and access to international networks are some of the reasons why outsourcing is still very attractive. The rise of e-commerce, sporadic product demand, and legislated international regulations are also fueling demand for outsourced logistics to ensure efficiency in flow, cost savings, and responsiveness. Therefore, the emphasis on outsourcing as a logistics strategy is becoming increasingly more critical for businesses when looking for an efficient logistics solution to ensure they are better positioned to become market leaders.

Throughout the forecast period, the insourcing segment is expected to grow at a remarkable CAGR. The growth is primarily due to large organizations bringing logistics functions in-house, to gain tighter operational control, secure data for compliance reasons, and to also provide service consistency in sensitive businesses such as aerospace and healthcare. Organizations are building internal logistics capabilities to reduce their reliance on external suppliers and are also trying to do so through automation, AI-driven analytics, and robotics. Concerns about service quality, cost transparency, and data security further strengthen this trend. Although many organizations are leaping the day to the outsourcing model only to consolidate operations and improve both customer service and flexibility to mitigate long-term costs. Insourcing is becoming increasingly more widely deployed as a core logistics strategy across industries in response to changing market dynamics.

Transportation Mode Insights

The roadways category had the highest share in 2024 because of the increasing demand for flexible last-mile delivery, a need for cheaper short to mid-haul transportation, and growth in infrastructure for road transport. The greater efficiency and reliability in road transport in the context of contract logistics are being enhanced by real-time mapping, telematics, and optimal routing. In addition, road transport is a feeder service, linking other transportation modes like rail and air with the ends of destinations in the last-mile delivery process.

The airways category is projected to grow at the greatest CAGR over the forecast period due to the increasing need for speed in the transport of time-sensitive products such as electronics and pharmaceutical products; an uptick in cross-border e-commerce; and an overall increase in digital solutions for air freight. While there is increased demand for time-critical delivery of products like devices and medications, we also have an increase in demand for cross-border e-commerce, and are relying on digital freight solutions.

Regional Insights

Booming cross-border trade, e-commerce, and mobile commerce contributed largely to Asia Pacific's 33.4% market share in 2024, resulting in regional dominance across the world. In India, the government is about to become a lot more logistical by making it easier for companies to modernize their logistics, such as via a USD 350 million loan from the Asian Development Bank for regional multimodal infrastructure investments to attract private capital. Given the growing demand for logistics, global logistics companies like CEVA Logistics are entering the supply chain with their recent acquisition of Stellar Value Chain. All these developments are improving the supply chain and speeding up the adoption of tech-driven, integrated logistics in the region.

China Contract Logistics Market Trends

China's huge market share in international contract logistics revenue in 2024 was spurred by the rapid growth of China's e-commerce sector and advances in digital commerce. A strong infrastructure and growing demand for last-mile delivery businesses contributed to this growth. Increasing cross-border trade, the proven success of mobile payments, and growing consumer demands for faster and reliable order fulfillment have generated even more demand for scalable and efficient logistics options for businesses. The growth in digital commerce is creating greater pressure on logistics companies to move larger volumes in a timely and efficient way. With such high expansion in the logistics industry in China, it is becoming a major source of innovation, and continued growth in the global logistics sector, particularly on demand for technology-enabled contract logistics services.

The contract logistics market in Japan held a significant share of the global market in 2024, driven by the continued growth of e-commerce and customer demands for reliable and on-time delivery. The market is characterized by an underlying focus on automation, high levels of service quality, and operational efficiency. Rapidly growing e-retail requires sophisticated, technology-driven logistics solutions that meet or exceed demanding expectations for speed, accuracy, and scale. As Japanese consumers increase their online purchases, there continues to be a growing need for streamlined and effective contract logistics services that position Japan as a major player in the Asia Pacific logistics market.

Europe Contract Logistics Market Trends

The rise in cross-border trade in the EU and the increasing demand for value-added services (e.g., reverse logistics, customized warehousing) made Europe an attractive place for the contract logistics industry in 2024. The market is also changing from the growing demands in specific industries, such as healthcare, which need temperature-sensitive transportation and compliance obligations. This trend was also seen in February 2024 with Bolloré Solutions Logistiques (BSL) acquiring STEF Logistique Santé (SLS), allowing for 13,000 m² of temperature-controlled space in Strasbourg; this extends BSL's capacity for pharmaceutical logistics. This marks how Europe is making a shift toward specialized contract logistics solutions with high value.

North America Contract Logistics Market Industry Trends

North America holds a significant position in the global contract logistics market due to a combination of innovative technologies and well-established infrastructure. The region is equipped with advanced warehouse and distribution facilities, as well as a robust and efficient transportation network that includes ports, airports, railways, and highways. This solid infrastructure makes for convenient and prompt logistics, even with complex and intricate supply chains. Another important factor contributing to North America's dominance in contract logistics is the enormous amount of money invested in logistics technology. Companies across North America are employing automation, artificial intelligence, data analytics, and real-time tracking technologies to enhance supply chain visibility, optimize inventory management, and improve delivery performance. Along with enhancing efficiency, these systems allow logistics firms to offer customers more personalized and faster services. Moreover, the area has a well-developed retail and e-commerce industry and is a major center for large international corporations. These companies require complex and scalable logistics systems to manage their extensive and often global supply chains. Together, these elements, strong infrastructure, technical innovation, and high demand from major corporations, firmly place North America as a leader in the contract logistics sector and set it up for future expansion.

Key Contract Logistics Companies:

The following are the leading companies in the contract logistics market. These companies collectively hold the largest market share and dictate industry trends.

- DHL Supply Chain (a division of Deutsche Post AG)

- Ryder System, Inc.

- GXO Logistics, Inc.

- DSV A/S

- GEODIS SA

- DB Schenker

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- United Parcel Service, Inc.

- CEVA Logistics

- Others

Recent Developments

- In November 2024, Amazon and IKEA, along with about 30 other companies that depend on ocean freight, have made a major step towards sustainable maritime practices by announcing plans to solicit bids from shipping companies to transport their cargo using vessels powered by e-fuels with near-zero emissions, like e-methanol. The Zero Emissions Maritime Buyers Alliance (ZEMBA) is leading this effort, which attempts to hasten the shipping sector's shift to net-zero greenhouse gas (GHG) emissions by 2050.

- In October 2024, as a top supplier of logistics services to the semiconductor sector, DB Schenker is growing even more. A new contract logistics facility will be opened by the company close to Amsterdam, Netherlands. A significant step towards bolstering Europe's semiconductor industry, the location will span 18,000 square meters.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the contract logistics market based on the below-mentioned segments:

Global Contract Logistics Market, By Service

- Transportation

- Warehousing

- Distribution

- Aftermarket Logistics

- Other Services

Global Contract Logistics Market, By Type

Global Contract Logistics Market, By Transportation Mode

- Roadways

- Railways

- Airways

- Waterways

Global Contract Logistics Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa